Peaking at an eye watering $69k a coin in late 2021 amidst a fever pitch of zero to hero success stories and a supposed wave of crypto millionaires and influencers, there was one key ingredient missing in Bitcoin’s (BTC-USD) rise, regulation. As crypto’s prodigal son looks to make a remarkable bullish turnaround backed by two SEC filings from both BlackRock (BLK) and Fidelity which is seen as an institutional adoption of crypto. One would imagine as these heavy weights pursue an ETF like model for Bitcoin, something will give way eventually.

According to Reuters, the SEC raised concerts with Nasdaq in a recent filing for a spot Bitcoin ETF from BlackRock. Over the past few years, the SEC has rejected dozens of spot Bitcoin ETF applications, noting the standards designed to prevent fraudulent and manipulative practices and protect investors. Subsequently, the ETF industry is trying to address these concerns.

Last Friday, CBOE refilled an application with the SEC for a Bitcoin ETF by Fidelity. That filing named Coinbase (COIN) as the platform that would assist the policing manipulation in the proposed ETF.

Over the past year alone, Bitcoin has seen a 100% rise from the $15k low, navigating its way through several banking collapses and of course the demise of the cryptocurrency exchange FTX technically and has now technically posted a higher high to launch a bullish third wave past a rejection on the monthly chart directly towards the $40k price region.

So can this bullish move be taken seriously, or is it perhaps a bull trap?

From a technical point of view a three wave structure can break out giving a probable target which you can see that I have identified within the structures of various different major US equities of which I have documented with Seeking Alpha, however as the old saying goes, we don’t have a crystal ball, but we can imagine as the press for some form of regulation intensifies, positive news on this front will render this bullish breakout for real.

To give a short backstory for Bitcoin, as mentioned at the top of the article, this cryptocurrency topped at $69k in October of 2021. Creating a bearish three wave structure, I was able to identify that the break below $32k would first lead to a target of $14.9k and then $10k should there be no sign of a turnaround at the former. Bitcoin did reach the mid $15k region before showing a three wave pattern on the weekly chart early in 2023 which has now developed into the three wave pattern we will go on to look at in this article.

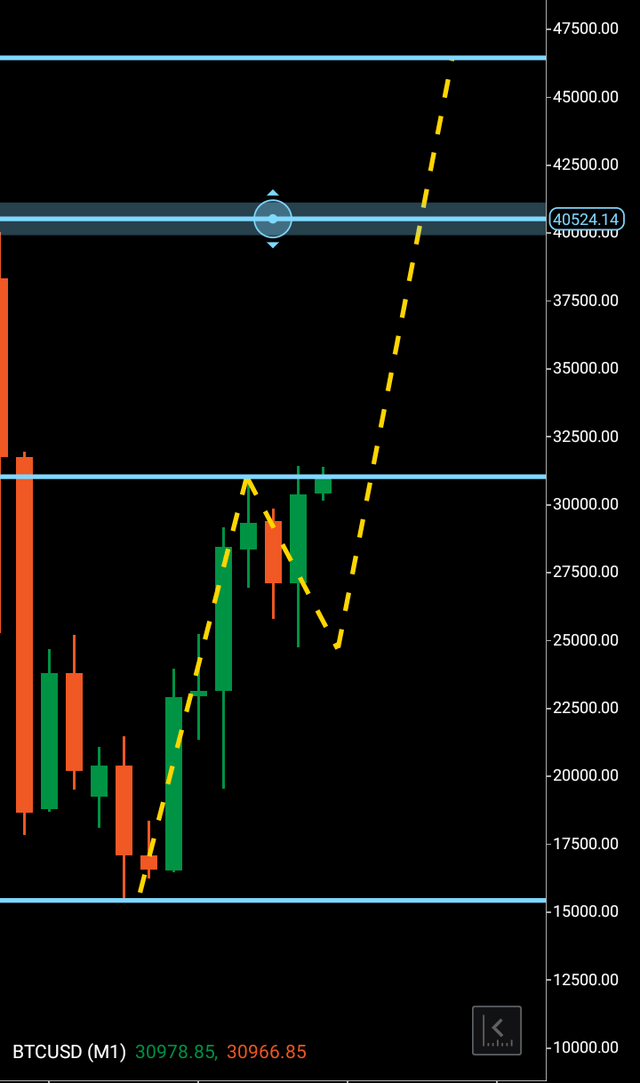

If we look at the chart below we can see the bottoming circa the mid $15k region with quite a bullish move upwards, it wasn’t until several months later that the bearish rejection candle was printed which gives way to the possibility of a third wave north should this now wave one two structure be broken above.

Bitcoin Monthly Chart (C Trader)

Additionally, we can then see the attempt at launching the third wave so far by the piercing of the rejection line at $30.5k. Should this move hold, we can expect firstly $40k and then $46k before we would see the $15k region again.

To finalize, I am issuing a buy signal for Bitcoin on the basis that it has technically broken above the $30k rejection, but am mindful that a positive regulatory step could be a factor in both the wave holding and also how quickly it could go to target. I would expect Bitcoin to achieve firstly $40k within the next 30–120 days.

About the Three Wave Theory

The three wave theory was designed to be able to identify the exact probable price action of a financial instrument. A financial market cannot navigate its way significantly higher or lower without making waves. Waves are essentially a mismatch between buyers and sellers and print a picture of a probable direction and target for a financial instrument. When waves one and two have been formed, it is the point of higher high/lower low that gives the technical indication of the future direction. A wave one will continue from a low to a high point before it finds significant enough rejection to then form the wave two. When a third wave breaks into a higher high/lower low, the only probable numerical target bearing available on a financial chart is the equivalent of the wave one low to high point. It is highly probable that the wave three will look to numerically replicate wave one before it makes its future directional decision. It may continue past its third wave target, but it is only the wave one evidence that a price was able to continue before rejection that is available to look to as a probable target for a third wave. The link to the Ward Three Wave Theory can be found in my bio.

Read the full article here