The Vanguard FTSE Emerging Markets Index Fund ETF (NYSEARCA:VWO) has reacted positively to the recent drop in US inflation and declining interest rate expectations. Having significantly underperformed developed market indices, EM stocks have a lot of room to catch up. However, I am shifting my position on the VWO since my last article in February to a hold from a buy as the outlook relative to bonds continues to deteriorate following recent gains and rising short-term bond yields.

The VWO ETF

The VWO tracks the performance of the FTSE Emerging Markets index and offers exposure to large-cap EM stocks with a very low expense ratio of 0.1%, which compares favorably to the 0.7% charge for the iShares MSCI Emerging Markets ETF (EEM). China has a higher weighting in the VWO, comprising 28%, although this has fallen from around one third in February due to its underperformance. This largely reflects the absence of Korean stocks in the index, which contrasts with the EEM’s 12% weighting. The absence of Korean tech giant Samsung also means a slightly lower weighting towards Technology. The VWO pays a dividend yield of 3.4%, which is slightly higher than the trailing yield on the underlying index of 3.1%

Falling CPI May Allow EM To Play Catch Up

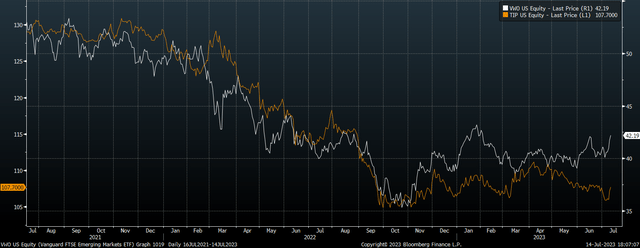

The drop in US headline and core inflation in June has provided the trigger for a recovery in the VOO. Emerging market stocks tend to be more sensitive to changes in bond yields compared with US stocks, and have been particularly sensitive to inflation-linked bonds over the past two years. The fall in real bond yields has helped drive a strong recovery in the VWO and a rare period of outperformance relative to DM stocks.

VWO Vs TIP ETF (Bloomberg)

There is significant further upside to come from a valuation perspective. The FTSE EM Index trades at a 27% discount to the MSCI World on a forward PE ratio basis, which is below the long-term average discount going back to 2008 of 20%.

VWO Increasingly Inferior To Cash And Bonds

However, at 13.5x, the forward PE on the FTSE EM index is not particularly cheap considering that profit margins are elevated and the fact that earnings per share have grown by precisely zero over the past decade. We have also seen the forward dividend yield come down significantly over the past few months, and it now sits 75bps below the yield on the 10-year US Treasury. The last time the yield difference was this far in favor of USTs was in mid-2011, following which the VWO underperformed bonds for a full decade.

VWO Dividend Yield Vs 10-Year UST Yield (Bloomberg)

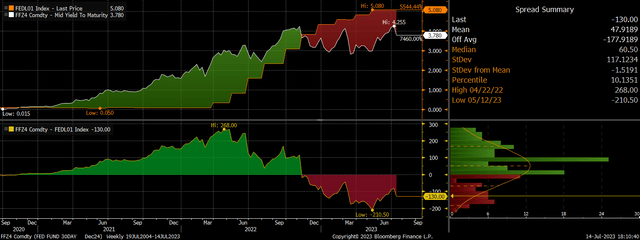

Furthermore, while I believe that real bond yields will continue to decline over the coming years, this should not be seen as a bullish factor for EM stocks as it will reflect weak US and global real GDP growth prospects. Moreover, the ongoing inversion of the yield curve suggests bond investors may be overestimating the prospects for rate cuts over the next 18 months. Markets are pricing in 130bps of rate cuts by end-2024, which in my view is only likely if we see a large stock market decline.

Fed Funds Rate Vs Dec 2024 Futures Yield (Bloomberg)

In the meantime, with cash earning in excess of 5% and EM bond funds such as the iShares J.P. Morgan USD Emerging Markets Bond ETF (EMB) earnings in excess of 7%, the case for the VWO is not particularly attractive, bond a short-term momentum trade.

Conclusion

The VWO has reacted positively to the fall in real US bond yields following the low June CPI print, which may provide the trigger for further gains. However, the fundamental case has weakened due to rising valuations and the widening gap between UST yields and the VWO’s dividend yield. The VWO is also at risk from a reversal of the aggressive rate cut expectations priced into US rate markets, suggesting cash and bonds are a better bet.

Read the full article here