This article is part of a series that provides an ongoing analysis of the changes made to Kenneth Fisher’s 13F stock portfolio on a quarterly basis. It is based on Fisher Asset Management’s regulatory 13F Form filed on 05/01/2023. Please visit our Tracking Kenneth Fisher’s Fisher Asset Management Holdings article for an idea on his investment style and philosophy and our previous update highlighting the fund’s moves in Q4 2022.

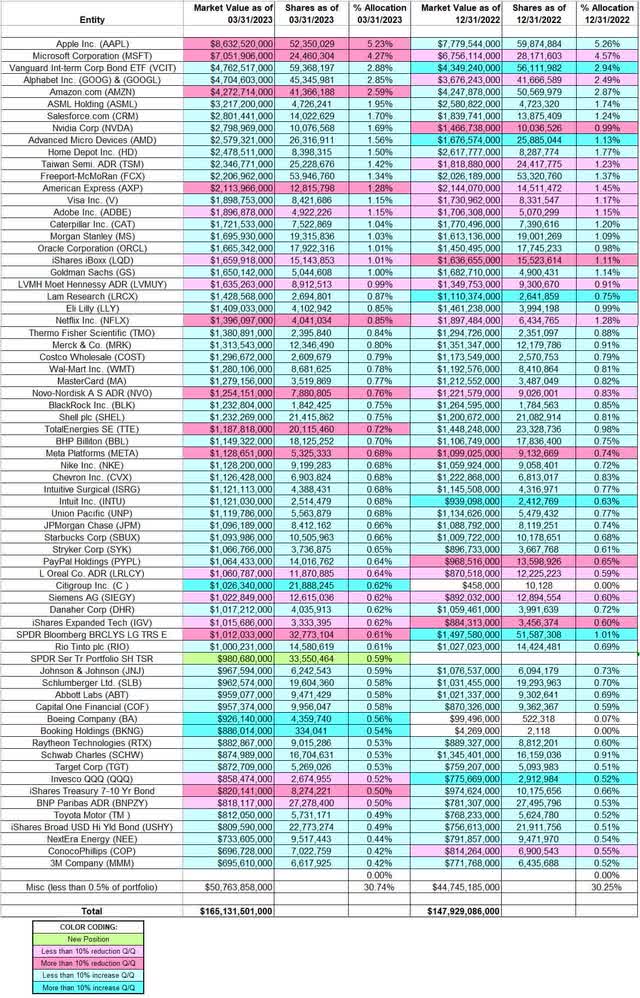

This quarter, Fisher’s 13F portfolio value increased ~12% from ~$148B to ~$165B. The number of holdings increased from 1025 to 1144. Significantly large positions increased from 66 to 69. The five largest individual stock positions are Apple, Microsoft, Alphabet, Amazon.com, and ASML Holding. Together, they account for ~17% of the 13F stock portfolio.

Note: Fisher manages ~100,000 client accounts with a total AUM of ~$210B. Each such portfolio is personalized to client requirements and beating the S&P is not the focus for many of them. “13F Portfolio performance” which would be the performance of the sum total of all such monies in 13F securities is unknown.

To know more about Ken Fisher, check out his Research Papers (most notably in Behavioral Finance) and investment books.

Stake Increases:

Alphabet Inc. (GOOG) (GOOGL): GOOG was a very small position that was built-up to a substantial 2% stake in 2011 at prices between ~$12 and ~$15. Recent activity follows. Q3 2020 saw a ~8% selling at prices between ~$71 and ~$86 while next quarter there was a ~17% stake increase at prices between ~$73 and ~$92. The seven quarters through Q3 2022 also saw minor increases. The stock is now at ~$106. The position stands at 2.85% of the portfolio. Last quarter saw a ~9% trimming while this quarter there was a similar increase.

ASML Holding (ASML): ASML became a significant part of the portfolio in Q1 2018 when there was a ~10% stake increase at prices between ~$175 and ~$215. Next major activity was in Q1 2020 when there was a roughly one-third stake increase at prices between ~$214 and ~$318. The stock currently trades at ~$634 and the stake is now at 1.95% of the portfolio. The last three years have seen a ~38% further increase. They are continuing to build their position.

Salesforce (CRM): The 1.70% CRM position saw a ~180% increase in Q4 2018 at prices between $121 and $160 and another ~55% increase next quarter at prices between $130 and $167. Q3 2019 also saw a ~30% stake increase at prices between $140 and $160. There was another ~50% stake increase in Q1 2020 at prices between $124 and $193. Q3 2022 saw a ~20% selling while last quarter there was a ~9% stake increase. The stock is now at ~$194. There was a marginal increase this quarter.

Nvidia Corp. (NVDA): NVDA is a 1.69% of the portfolio position built during Q3 2022 at prices between ~$121 and ~$192. There was a ~17% selling last quarter at prices between ~$112 and ~$181. The stock is now at ~$282. There was a marginal increase this quarter.

Advanced Micro Devices (AMD): AMD is currently a 1.56% of the portfolio stake. The original position is from Q1 2020 purchased at prices between $40 and $57. It saw a ~25% stake increase in Q4 2021 at prices between ~$100 and ~$162. That was followed with a ~22% increase next quarter at prices between ~$103 and ~$150. Q3 2022 saw a similar reduction at prices between ~$63 and ~$104. There was a roughly one-third stake increase last quarter at prices between ~$56 and ~$78. The stock currently trades at ~$90. There was a minor ~2% increase this quarter.

Note: they built this position while dropping Intel (INTC).

Home Depot (HD): HD is a 1.50% of the 13F portfolio position first purchased in 2012 at prices between $42 and $65. Q2 2017 saw a ~38% selling at prices between $146 and $159 and that was followed with another ~28% reduction in Q4 2017 at prices between $150 and $190. There was a reversal in the next quarter: ~14% stake increase at prices between $172 and $207. Q3 2019 saw a ~25% stake increase at prices between $202 and $234. The period since has also seen minor buying. The stock is now at ~$294.

Taiwan Semiconductor (TSM): TSM is a very long-term 1.42% of the 13F portfolio position. A large block was purchased in 2012 at prices between $12.50 and $16.50. The stake has wavered. Recent activity follows: The ten quarters through Q4 2018 saw periodic buying while the next seven quarters saw minor selling. The stock currently trades at ~$83. The last ten quarters have seen only minor adjustments.

Visa Inc. (V): The Visa position was first purchased in 2012 at much lower prices compared to the current price of ~$227. The size of the stake had more than tripled in the following eight years through incremental purchases almost every quarter. Q3 2021 saw an about turn: ~45% selling over the next three quarters at prices between ~$190 and ~$251. That was followed with a ~40% reduction during Q3 2022 at prices between ~$178 and ~$217. The position is now at 1.15% of the portfolio. The last two quarters have seen only minor adjustments.

Goldman Sachs (GS) and Morgan Stanley (MS): GS is a ~1% of the portfolio stake that saw a ~45% increase during Q3 2022 at prices between ~$282 and ~$356 and the stock currently trades at ~$333. The ~1% MS position was built during Q3 2022 at prices between ~$75 and ~$92 and it is now at $86.29. Both stakes saw minor increases in the last two quarters.

PayPal Holdings (PYPL): The 0.64% PYPL stake was built in H1 2020 at prices between ~$85 and ~$174. The stock currently trades below the low end of that range at $72.28. Q4 2021 saw a ~20% stake increase at prices between ~$179 and ~$272. That was followed with a ~16% increase next quarter at prices between ~$94 and ~$195. There was a ~23% selling last quarter at prices between ~$68 and ~$94. There was a minor ~3% stake increase this quarter.

Charles Schwab (SCHW): SCHW is a 0.53% of the portfolio stake built during Q3 2022 at prices between ~$61 and ~$77 and the stock currently trades below that range at ~$50. The last two quarters have seen minor increases.

3M Corp. (MMM), Abbott Labs (ABT), BHP (BHP), BlackRock, Inc. (BLK), Boeing Company (BA), Booking Holdings (BKNG), Capital One Financial (COF), Caterpillar (CAT), Citigroup (C), ConocoPhillips (COP), Costco Wholesale (COST), Chevron Corp. (CVX), Danaher Corp. (DHR), Eli Lilly (LLY), Freeport-McMoRan (FCX), Intuitive Surgical (ISRG), Intuit (INTU), iShares Broad USD High Yield Corporate Bond ETF (USHY), Johnson & Johnson (JNJ), JPMorgan Chase (JPM), Lam Research (LRCX), Mastercard Inc. (MA), Merck (MRK), NextEra Energy (NEE), Nike, Inc. (NKE), Oracle Corporation (ORCL), Rio Tinto (RIO), Raytheon Technologies (RTX), Schlumberger (SLB), Shell plc (SHEL), Starbucks (SBUX), Stryker Corp. (SYK), Target Corp. (TGT), Thermo Fisher Scientific (TMO), Toyota Motor (TM), Union Pacific (UNP), Vanguard Intermediate-Term Corporate Bond Index ETF (VCIT), and Walmart (WMT): These small (less than ~1.5% of the portfolio each) stakes were increased this quarter.

Stake Decreases:

Apple Inc. (AAPL): AAPL is currently the top position at 5.23% of the portfolio. It was built in 2012 at prices between $15 and $18. The original stake was increased by ~60% in Q2 2013 at around the same price range. The position has since been increased substantially through incremental buying. The stock currently trades at ~$169. Q3 2022 saw a ~10% trimming and that was followed with a ~13% selling this quarter.

Microsoft Corporation (MSFT): MSFT is a top-three 4.27% of the portfolio position. It is a very long-term stake that has been in the portfolio for well over a decade. The two years through Q2 2019 had seen a combined ~30% increase at prices between ~$69 and ~$137. The period through Q3 2022 saw another ~40% increase at prices between ~$135 and ~$343. The stock is now at ~$305. There was a ~13% trimming this quarter.

Amazon.com (AMZN): AMZN is a top five 2.59% of the portfolio position. The stake is from 2011 at a cost-basis of ~$10. Q2 2016 saw a ~20% selling at prices between ~$29 and ~$36. There was another ~16% selling in Q2 2017 at prices between ~$44 and ~$51. The three quarters through Q1 2018 had seen a ~15% increase at prices between ~$47 and ~$80 while the following quarter saw a similar reduction at prices between ~$69 and ~$88. There was a ~22% stake increase over the two quarters through Q1 2022 at prices between ~$136 and ~$185. The stock currently trades at ~$104. There was a ~18% reduction this quarter at prices between ~$82 and ~$113.

American Express (AXP): AXP has been in the portfolio since 2012. The original position was around 9M shares purchased at an average cost in the 50s and the current stake is 14.51M shares. The two years through Q2 2020 had seen a combined ~40% stake increase at prices between $74 and $138. The stock is now at ~$153 and the stake is at 1.28% of the portfolio. The last several quarters saw minor trimming and that was followed with a ~12% selling this quarter.

Adobe Inc. (ADBE): ADBE is a 1.15% portfolio stake that saw a ~300% increase in Q4 2018 at prices between $205 and $275 and another ~75% increase next quarter at prices between $216 and $272. Q3 2019 also saw a ~30% stake increase at prices between $272 and $311. Q1 2020 saw another ~25% stake increase at prices between $285 and $383. The stock is now at ~$369. The seven quarters through Q4 2021 saw minor buying while in the last five quarters there was a ~35% selling.

Netflix (NFLX): The 0.85% NFLX stake saw a ~50% stake increase in Q1 2020 at prices between ~$299 and ~$388. Q4 2021 saw a ~30% stake increase at prices between ~$587 and ~$692. That was followed with a ~17% increase next quarter at prices between ~$331 and ~$597. The stock currently trades at ~$318. The last two quarters through Q3 2022 saw minor increases while this quarter saw a ~35% selling at prices between ~$295 and ~$368.

Meta Platforms (META): The META stake was built in Q1 2020 at prices between ~$150 and ~$222. Q3 2021 saw a ~50% stake increase at prices between ~$337 and ~$382. That was followed with a ~25% stake increase next quarter at prices between ~$307 and ~$348. Q1 2022 also saw a ~17% increase at prices between ~$187 and ~$339. There was a ~23% selling last quarter at prices between ~$89 and ~$140. That was followed with a ~42% reduction this quarter at prices between ~$123 and ~$206. The stock is now at ~$239 and the stake is at 0.68% of the portfolio.

BNP Paribas (OTCQX:BNPQF), iShares iBoxx $ Investment Grade Corporate Bond ETF (LQD), iShares Expanded Tech-Software Sector ETF (IGV), iShares Treasury 7-10 Yr. Bond, Invesco QQQ (QQQ), L’Oreal ADR (OTCPK:LRLCY), LVMH Moet Hennessy ADR (OTCPK:LVMUY), Novo Nordisk A/S ADR (NVO), Siemens AG (OTCPK:SIEGY), SPDR Bloomberg BRCLYS LG TRS E, and TotalEnergies (TTE): These small (less than ~1% of the portfolio each) stakes were decreased this quarter.

The spreadsheet below highlights changes to Fisher’s 13F stock holdings (only positions that are over 0.5% of the 13F portfolio each are individually listed) in Q1 2023:

Ken Fisher – Fisher Asset Management’s Q1 2023 13F Portfolio Q/Q comparison (John Vincent (author))

Source: John Vincent. Data constructed from Fisher Asset Management’s 13F filings for Q4 2022 and Q1 2023.

Read the full article here