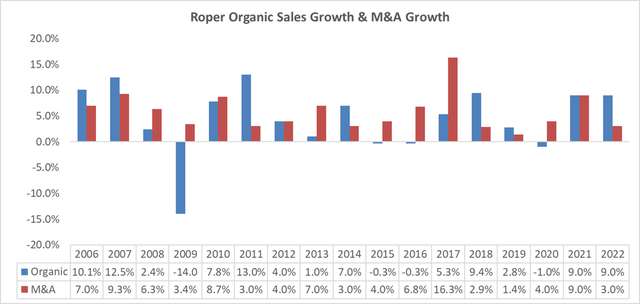

Roper Technologies (NASDAQ:ROP) owns a high-quality set of highly recurring revenues from its software portfolios. They have a very broad range of end markets, and Roper is either the top or the second-ranked player in most of these small niche industries. Roper’s decentralized operating structure and multi-year portfolio optimization enable them to achieve double-digit sales growth and mid-teens free cash flow growth.

Investment Thesis

Decentralized Operating Structure: In my article on Amphenol (APH) titled ‘Decentralized Organization With Structural Growth Potential’, I discussed the decentralized nature of the organization, with standalone entrepreneurial business units led by local general managers and teams. Each business unit manages its own budgets and implements independent strategies for product development, sales, marketing, and procurement. I believe Roper is also a highly decentralized organization, with local resource allocation and nimble execution. The local management supports organic business development and manages their own P&L.

Roper 10Ks, Author’s Calculation

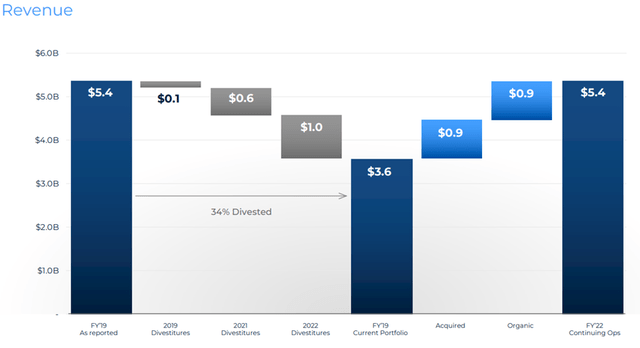

Multi-Year Portfolio Optimization: Roper has actively managed its portfolios. Interestingly, its revenue in FY22 was approximately at the same level as FY19. They have divested 34% of their FY19 sales while upgrading their portfolio with more recurring revenue and higher-margin software businesses. Specifically, in FY19, 34% of their sales came from the industrial and project-oriented business, which was highly cyclical and non-recurring. In FY22, 75% of Roper’s sales came from vertical software with a much higher-margin profile, while 25% of sales were from medical and water products, which are more recurring in nature. In 2022, Roper sold the majority stake in its industrial business for $2.6 billion. As a result, their EBITDA margin improved from 36% in FY19 to 40% in FY22, which is quite remarkable.

In July 2023, Roper transferred its stock exchange listing to Nasdaq from NYSE and continues its journey to becoming a vertical software company.

Roper 2023 Capital Market Day

Broad Market-Leading Portfolios in Defensible Niches: Roper’s vertical software covers a broad range of end markets, including healthcare, education, government, legal, insurance, utilities, construction, supply chain, and media. In each industry where Roper operates, the end market has relatively few competitors and a small total addressable market size. Moreover, customers in these industries are less sensitive to price as the products provided by Roper are mission-critical, and Roper is the leader in those specific industries. The company’s broad market-leading portfolio in these niches enables Roper to enjoy a very high operating margin and sustainable growth rate.

Downside Risks

M&A Diligence and Integration Risks: Roper’s success relies on disciplined acquisition deals. They have a large universe of M&A pipelines, including 1,200 annual software targets. Prudent and careful diligence is necessary, as integration risks exist post-acquisition. Since Roper tends to acquire vertical software players, the deal multiple is normally very high.

Roper’s net debt to EBITDA, or net leverage, stood at 2.7x. While this leverage might be considered high compared to other software companies, Roper has successfully deleveraged from 4.7x in Q4 FY20 to 2.7x in Q4 FY22. Currently, they have $4 billion of available M&A firepower.

I believe Roper has a solid track record for acquisitions. Their deals with DAT, NDI, and FOUNDRY were well-executed and integrated. These deals align with Roper’s multi-year portfolio transformation strategy, making the company more focused on higher recurring revenue and higher margins.

Some Slower Customer Demands at Deltek: Deltek generated $800 million in revenue in FY22, representing around 15% of the group’s sales. Deltek provides software for project intelligence, management, and collaboration. Due to the weak macroeconomic conditions, Deltek experienced slower customer demand in Q4 FY22. However, in Q1 FY23, Deltek saw double-digit bookings growth, with strength across both enterprise-class and SMB-sized customers, as well as government contracting and private sector solutions.

I believe Deltek’s small business segment could continue to face challenges in the coming quarters due to macro uncertainties. However, it’s important to note that 82% of Deltek’s business is recurring in nature. Therefore, I believe the negative impact on Roper will be relatively limited.

Outlook and Valuation

Roper is targeting double-digit sales growth, with a 50/50 split between organic growth and growth through M&A. They expect their free cash flow to grow at a mid-teen rate, with a free cash flow margin exceeding 30% due to their operating margin.

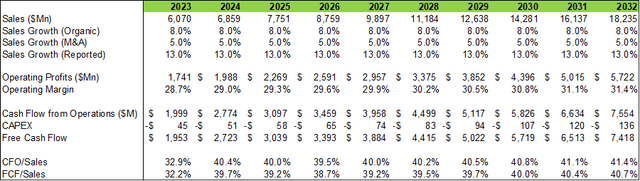

I believe their target for organic sales growth is too conservative, especially considering the mission-critical nature of their vertical software offerings. Over the past two years, they have achieved 9% organic growth, aided by some pricing increases due to inflation. In my DCF model, I assume 8% organic sales growth, 5% growth through M&A, and an annual expansion of the operating margin by 30 basis points due to a greater shift towards software and operating leverage.

Roper DCF Model – Author’s Calculation

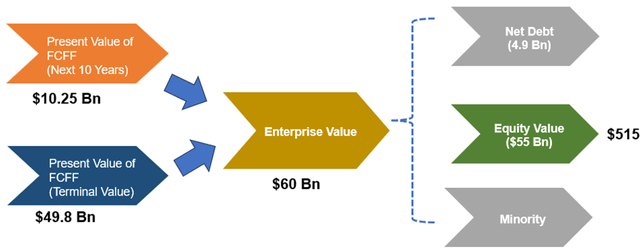

The model also assumes 10% of WACC and 4% of terminal growth rate. With all these assumptions, the FCF margin is projected to be 40.7% in FY32 as per my estimate. The present values of FCFF over the next 10 years and terminal are calculated to be $10.25 billion and $49.8 billion, respectively. Adjusting the debt and cash, the fair value is $515 per share as per my estimates.

Roper DCF Model, Author’s Calculation

End Note

With an increasing software component in Roper’s portfolio, we should expect a higher operating margin, improved free cash flow conversion, a lower percentage of capital expenditure, and greater resilience in their business. Overall, I appreciate their mid-teen free cash flow growth, recurring business model, and leading position in niche defensive markets. I recommend a “Buy” rating for Roper Technologies.

Read the full article here