Thesis

In this article, I delve into the performance and future outlook of UWM Holdings Corporation (NYSE:UWMC) an entity in the U.S. residential mortgage lending industry. Notwithstanding impressive loan production volumes and gain margins amidst a softening mortgage market, UWM’s vulnerability to interest rate fluctuations, a notable net loss, and earnings shrinkage pose pertinent challenges. My analysis discusses the nuances of the company’s financial health, operational resilience, market perception, and stock performance, thereby substantiating a cautious stance.

Company Overview

UWM Holdings Corporation is self-described as the “The Nation’s #1 Mortgage Lender” in the U.S. residential mortgage lending scene. The company’s primary route of operation is through wholesale channels, underscoring a strategic approach that effectively bypasses the retail noise.

Pivotally, UWM primarily focuses on the origination of conforming and government loans. This targeted specialization has undoubtedly carved out a unique niche for the firm, minimizing exposure to the volatility associated with non-conforming loan markets.

Established in 1986, UWM has demonstrated longevity in a competitive industry, pointing towards sound management practices and consistent performance.

Riding the Tides of a Softening Mortgage Market

In a seemingly upbeat financial narrative, mortgage lending powerhouse UWM Holdings showcased a sturdy performance in their recent earnings disclosure. In the face of a softening mortgage landscape, the company managed to chart a staggering production of $22.3 billion, breaking its own record with a purchase volume of $19.2 billion – both figures hitting the upper end of their forecast.

UWM’s gain margin took an impressive leap from 51 basis points in Q4 to 92 basis points in Q1, a sign of their growing strength in an uncertain market. However, it wasn’t all rosy; a net loss of $139 million was reported, largely attributed to a substantial mark down of over $337 million impacting their Mortgage Servicing Rights (MSR) portfolio. Nevertheless, higher margins and volume helped UWM keep its operational profitability afloat.

The company, mirroring an unwavering optimism on their latest conference call, was quick to emphasize its robust position for future growth and expansion. Comparing their present standing to their 2020 stature, they underscored advancements across various fronts including capital, liquidity, technology, customer relations, and infrastructure.

In the realm of Q1 2023, UWM put up a commendable show with strong mortgage loan production volume and an elevated gain margin. By reigning in their expenses by a significant 19% or nearly $50 million, compared to Q1 2022, they demonstrated admirable fiscal discipline. Furthermore, their liquidity reserves got a substantial boost to an estimated $2.9 billion as of March 31, 2023, a sizable leap from year-end numbers, thanks to deliberate moves to buttress their balance sheet and enhance liquidity. Notably, this includes a line of credit, securing up to $500 million in borrowing capacity, only half of which had been drawn at the quarter’s end.

Regarding UWMC’s outlook moving forward, something we’ll get more color on in their next report on August 11, a downward shift in interest rates of a full percentage point (or 100 basis points) could yield a substantial tailwind for their business operations. This scenario is strictly coming from management, however, with a vision of the coming years in which the potential for raking in billions is anticipated, although the exact schedule remains contingent on the timing of this interest rate decline.

CEO Mat Ishbia highlighted this by stating in the most recent conference call:

So, just realize that when that happens when rates dropped 100 basis points, volume could double, margins could go up. And we’d make exceedingly amount of money, excessive amount of money in a really profitable for our shareholders and do some great things…

And actually, yes, it will help us, it will help a lot of other lenders even more, because they’re actually losing money right now and actually laying off people right now, we’re hiring. And we’re actually winning. And as you saw, I’m guiding even to do more volume in the second quarter than the first quarter.

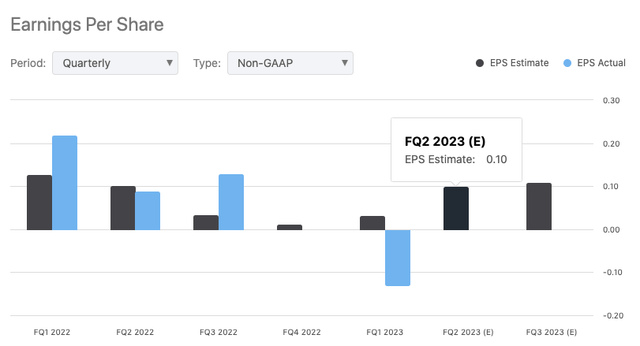

Seeking Alpha

However, considering that the company missed EPS expectations this past quarter, and considering that the stock has surged +75% YTD alone, there is the possibility to consider that that positive outlook/sentiment has already been baked into the price.

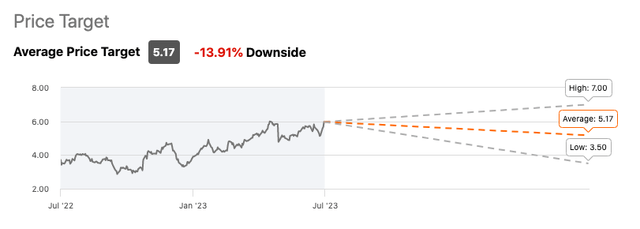

Wall Street Expectations

UWM Holdings is covered by 11 Wall Street analysts who have a weighted “Hold” rating on the stock and a somewhat bleak, negative outlook for the stock by projecting an average -13.91% downside target on its price.

Seeking Alpha

Performance

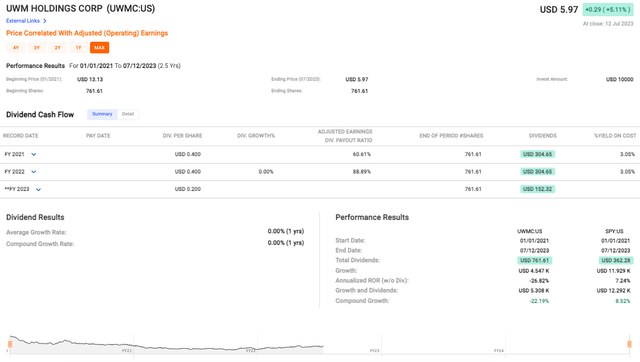

The company’s short term (2.5 years) share price has seen a significant reduction, falling from USD 13.13 at the beginning of 2021 to USD 5.97 in July 2023, a drop of over 54% which translates into a negative annualized rate of return (ROR) of -26.82% excluding dividends.

Fast Graphs

UWMC’s growth and dividends only amounted to USD 5.308K on a hypothetical $10 initial investment, a stark contrast when compared to the S&P 500 Index which reported a much healthier USD 12.292K during the same period. At this point in my analysis, such disparity in performance could further deter investors from allocating capital towards UWMC, and rather seek refuge in a more consistent performer like the broader index.

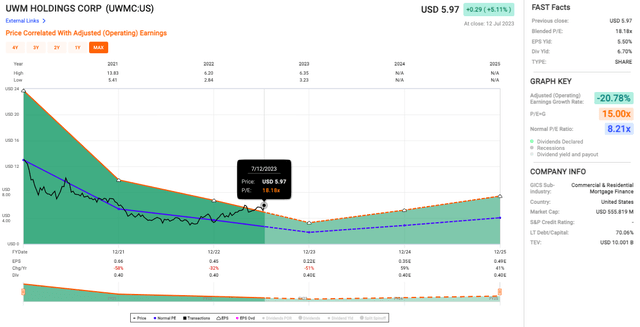

Valuation

UWM’s blended P/E ratio is soaring at 18.18x, standing in stark contrast to a normal P/E ratio modestly sitting at 8.21x. This suggests a significant premium, prompting us to ask – what’s going on here?

Fast Graphs

UWM’s adjusted earnings growth rate is in the red, tumbling at -20.78%. Far from growth, we’re seeing a shrinkage in earnings.

And then there’s a hearty dividend yield of 6.70%, while the earnings yield hovers at a lower 5.50%. This imbalance creates a conundrum. On the surface, who doesn’t love a hefty dividend? But dig a little deeper and it seems obvious they’re paying out more in dividends than they’re earning.

Risks & Headwinds

A key area of concern for me is the reported net loss of $139 million, a stark contrast to the strong operational gains that the company achieved. This discrepancy can be largely attributed to a significant markdown in the fair value of Mortgage Servicing Rights (MSR), an element predominantly dictated by market forces that lie beyond UWM’s sphere of control. Thus, even while the firm posts strong operational performance, the shadows of these uncontrollable externalities may continue to obscure the bottom line.

The relationship between UWM’s performance and the interest rate environment serves as another point of my analysis. As interest rates shift, so does the value of MSRs, introducing a degree of volatility to UWM’s financial outlook. Contrary to the potential scenario that management envisioned that I pointed out earlier in my article of possible interest rate declines, they could trigger MSR write-downs, which would, in turn, exert downward pressure on the company’s financial performance via lower returns or an increase in prepayments (from refinancing activity). Therefore, UWM’s fortunes are, to a significant extent, hitched to the whims of the macroeconomic environment, particularly the trajectory of interest rates, a situation that is far from ideal.

Lastly, turning our focus to profit margins, a sense of apprehension creeps in. UWM is forecasting a contraction in gain margins for the upcoming second quarter. While this projection is not an uncommon occurrence in the cyclical nature of the business, it nonetheless portends a potential dip in profitability. This anticipated compression in margins could suggest that the company’s profitability growth may not maintain the same tempo as it has recently demonstrated.

Final Takeaway

Based on the provided information, I would rate UWM Holdings Corporation as a “Hold”. Despite robust production and promising growth strategies, the company’s severe markdown of assets and the sizable net loss reported in Q1 2023 expose significant vulnerabilities. Coupled with a negative growth in earnings and a high dividend payout that exceeds earnings, there’s a clear indication of financial strain. In addition, the downside target projection by Wall Street analysts and the stock’s sensitivity to interest rate fluctuations add to this uncertainty. Therefore, until these factors stabilize and the company demonstrates more consistent profitability, a “Hold” rating seems prudent.

Read the full article here