Introduction

As a dividend growth investor, I seek new investment opportunities in income-producing assets. I often add to my existing positions when I find them attractive. I also use market volatility to my advantage by starting new positions to diversify my holdings and increase my dividend income for less capital.

The financial sector is compelling nowadays, with different companies trading below book value, such as major banks like Goldman Sachs (GS) and Citi (C). Therefore, we have an opportunity to try and find well-performing companies that suffer from bad sentiment in the financial sector. The sentiment is associated with commercial real estate risks and several regional banks’ collapse. I will analyze Blackstone (NYSE:BX), a leading alternative assets asset manager, in this article.

I will analyze Blackstone using my methodology for analyzing dividend growth stocks. I am using the same method to make it easier to compare researched companies. I will examine the company’s fundamentals, valuation, growth opportunities, and risks. I will then try to determine if it’s a good investment.

Seeking Alpha’s company overview shows that:

Blackstone is an alternative asset management firm specializing in real estate, private equity, hedge fund solutions, credit, secondary funds of funds, public debt and equity, and multi-asset class strategies. The firm typically invests in early-stage companies. It also provides capital markets services. The real estate segment specializes in opportunistic, core+ investments and debt investment opportunities collateralized by commercial real estate and stabilized income-oriented commercial real estate across North America, Europe, and Asia. The firm’s corporate private equity business pursues transactions worldwide across various transaction types, including large buyouts, special situations, distressed mortgage loans, mid-cap buyouts, and buy and build platforms, which involve multiple acquisitions behind a single management team and platform.

Fundamentals

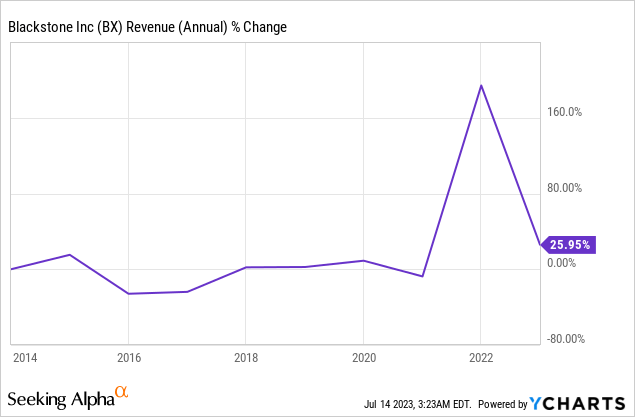

The revenues of Blackstone have increased by close to 200% until 2022, only to decline significantly in the past 18 months. The company’s revenues are made up of management fees and investment income. While the first one increased even in 2023, the investment income declined significantly as the assets’ prices and performance were not as good as in 2022, reducing the total revenues by almost 75%. In the future, as seen on Seeking Alpha, the analyst consensus expects Blackstone to keep growing sales at an annual rate of ~12% in the medium term.

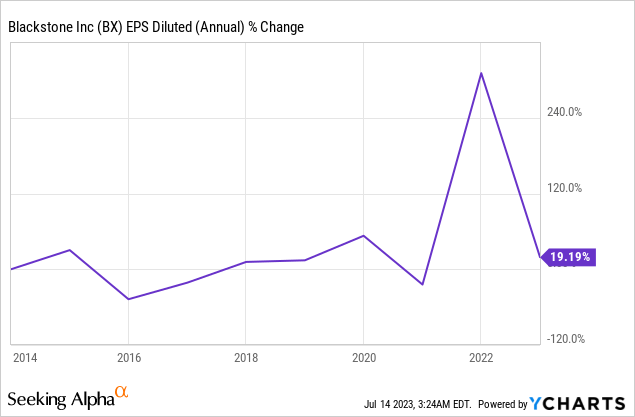

The EPS (earnings per share) has declined sharply for the same reasons the total revenues have declined. Over the last decade, the EPS was affected by sales growth, which is very volatile today. It was also affected by the share issuance that the company commences to raise more capital. In the future, as seen on Seeking Alpha, the analyst consensus expects Blackstone to keep growing EPS at an annual rate of ~11% in the medium term.

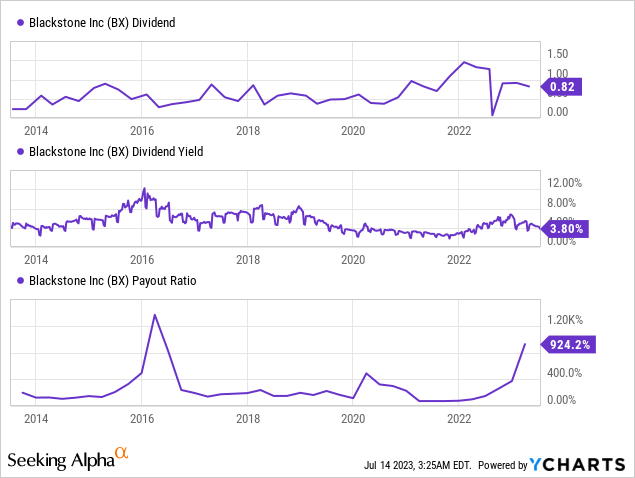

The company is paying a consistent dividend, but not one that grows annually. The dividend has been paid since 2007, and the long-term trajectory is upward. However, there are only four consecutive years of dividend growth. Therefore, investors who seek stable, growing dividend income will not be satisfied with this investment. Moreover, the current payout ratio is extremely high yet still covered by the free cash flow and the non-GAAP EPS. Investors should expect the 3.8% yield to grow in the long term but with higher volatility.

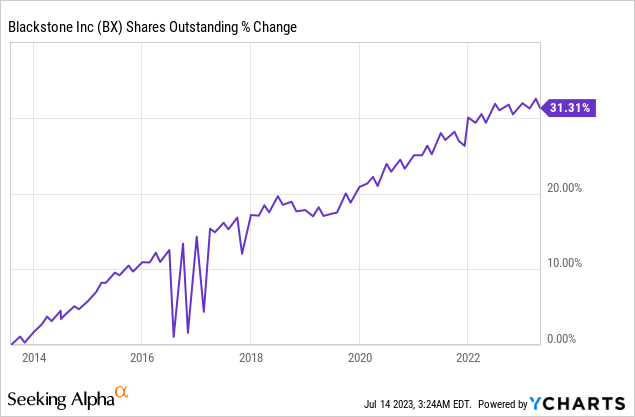

In addition to dividends, companies return capital to shareholders via buybacks. Buybacks support EPS growth as they lower the number of shares outstanding. Moreover, they’re highly effective when the share price is low and the valuation is attractive. Over the last decade, the number of Blackstone shares has increased by 31%. Shareholders were diluted significantly, forcing the company to be a great capital allocator to maintain the EPS growth despite the higher number of shares.

Valuation

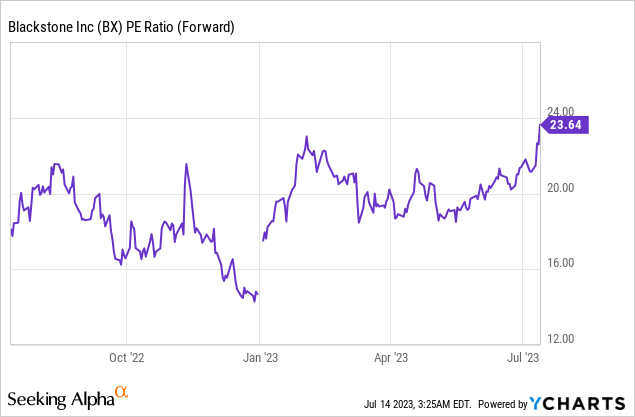

Blackstone’s P/E (price to earnings) ratio stands at 23.64 when using the 2023 EPS estimates. This is the highest valuation we have seen for Blackstone over the last twelve months. It represents that the market believes the downward revisions in assets valuation are close to an end, and that the company is poised to grow quickly. I am uncomfortable with the current valuation and believe the shares are trading for some premium.

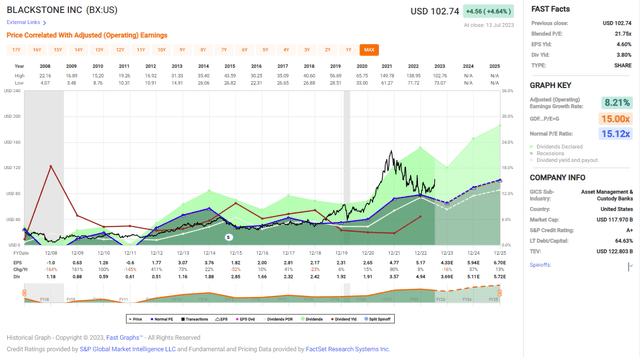

The graph below from Fast Graphs also implies that the current valuation of Blackstone is slightly higher than it should be to become compelling. Over the last two decades, the average P/E ratio stood at 15.12. The current P/E ratio is significantly higher compared to the average. While the projected growth rate is also higher due to the high volatility associated with asset managers, I don’t feel comfortable with the valuation, even if the premium is not too high.

Fast Graphs

Opportunities

Alternative assets are becoming extremely popular nowadays with investors. More long-term investors are willing to forfeit liquidity to gain higher returns. Therefore, leading institutions like Goldman Sachs are eager to shift more strategic focus toward this segment. Investors cannot buy exposure to the entire alternative market, so the fees can be higher when it comes to alternative assets.

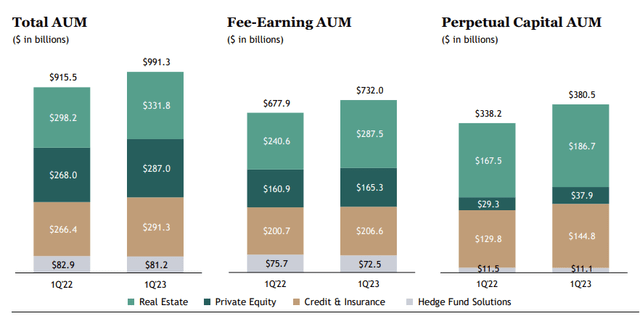

Not only that the segment is becoming more compelling, but Blackstone also has a great position within the segment. The company has been managing alternative assets for almost four decades now. It gives it a vast portfolio and great experience. Both can be leveraged to raise investors’ capital and achieve higher returns. In the long run, these higher returns are translated into higher fees. Therefore, today, the company manages almost $1T of alternative assets.

Blackstone

The Blackstone portfolio is also very diversified due to its massive size. Managing almost $1T in assets allows Blackstone to diversify it significantly. Real estate is still the leading asset, but credit and private equity are just behind. Moreover, the company is operating worldwide, which means that if one market is weaker, it can focus its effort on other growing segments in the growing markets.

Risks

Higher rates are the first risk for Blackstone as an asset manager. It is risky for two reasons. Firstly, the company suddenly faces another competition- the risk-free interest rate. Investors can once again gain a 5% return without any risk. Moreover, the higher rates make it harder for the company to fund its growth and acquisitions. Higher rates mean that the company will have to find enough high-quality projects that will yield enough to be worthy even when the financing is much more expensive.

Moreover, commercial real estate is in distress in the United States. The continuous trend since the pandemic of workers working from home instead of their offices leads to high vacancies in office buildings. The real estate owners then struggle to pay the lenders, and the higher rates lower the real estate value despite higher financing costs. As a landlord, Blackstone has to deal with lower revenues due to higher vacancies together with higher interest payments, and it will erode its revenues and EPS.

The third risk is an execution risk, as there are significant challenges in the business environment. A year ago, I wrote about Blackstone and rated it a HOLD. Back then, the expectations for an EPS of $6, while today, the expectations are $4.35. In less than two years, the expectations declined by 28%. With the current rates and challenges in office real estate, investors must consider the possibility of another downward revision that might be challenging at the current valuation.

Conclusions

To conclude, Blackstone is one of the leading asset managers regarding alternative assets. Therefore, the company can grow its sales and income over the long run and reward its shareholders with dividends. The company has several growth opportunities as alternative assets become more attractive for long-term investors, and they cannot be copied using a low-fee ETF or fund.

On the other hand, there are several risks to the investment thesis. The higher rates make it harder to finance deals, and the weakness in commercial real estate increases the chances of an execution failure. The company may not meet its EPS expectations. At 24 times earnings, I do not feel comfortable with the current offer for investors, and I believe that shares are still a HOLD.

Read the full article here