Thesis

This article provides an overview of Northern Technologies International Corporation (NASDAQ:NTIC) and highlights its recent financial performance in the third quarter of fiscal 2023. Despite missing EPS estimates by $0.02, NTIC achieved a revenue of $20.97 million, surpassing expectations by $369.73K. I argue that while NTIC’s historical stock performance has been modest, its solid earnings growth, expanding product offerings, and dividend growth make it an intriguing investment opportunity.

Company Overview

Established back in 1970 with headquarters nestled in Circle Pines, Minnesota, Northern Technologies International Corporation is a key player in the fight against rust and corrosion. With operations spanning the globe, from North America to Asia and the Middle East, this company’s influence is decidedly international. It’s noteworthy to mention their primary line of products-ZERUST. This includes an array of anti-corrosion solutions like packaging materials, liquids, coatings, rust removers, and even custom-tailored products specifically for the oil and gas industry.

However, Northern Technologies is far from being a mono-product entity. They’ve strategically broadened their portfolio with the introduction of the Natur-Tec brand, encompassing a suite of bio-based and compostable polymer resin compounds. This expansion not only augments their revenue sources but also puts them in alignment with the escalating eco-awareness trends prevalent among consumers and industries.

Overall, the company’s reach is impressive, servicing a broad spectrum of industries from automotive and electronics to retail and military.

NTIC’s Bullish Q3 2023 Earnings Highlights

The third quarter of fiscal 2023 saw Northern Technologies International riding high on a tide of record sales, fueled by its Zerust industrial, Zerust oil and gas, and Natur-Tec units. The booming sales not only underline the efficacy of the company’s long-term growth strategy, but also vouch for the value of its corrosion inhibitors and bio-plastic offerings.

To the credit of its financial management, NTIC revved up its gross margins to an impressive 36.7%, a significant year-over-year and sequential leap. This boost owes much to the company’s successful efforts to rein in operating costs and successfully navigate the tricky terrains of supply chain snags, escalating raw material costs, and European and Asian market challenges.

Drilling down into individual business units, the Zerust oil and gas segment reported a notable 32.7% surge in sales, while the Zerust industrial and Natur-Tec units saw a solid 9% and 7.8% sales escalation, respectively. On the flip side, the company’s joint ventures were slightly dented by a 1.1% drop (which I’ll weigh in on below in “Risks & Headwinds”) in sales, attributed to decreased demand across the regions they operate in and foreign exchange shifts.

Despite an 8.4% contraction in sales from NTIC China, the company remains optimistic about a revival in the fourth quarter and into fiscal 2024, as the Chinese economy shows signs of shaking off its pandemic-induced slumber. The company is also banking on the buoyancy of new customer connections and supplementary orders for its Zerust oil and gas and Natur-Tec segments to fuel growth.

The company’s third quarter of fiscal 2023 saw consolidated net sales rally by 10.6% to hit a new record at $21 million, with the Zerust oil and gas division turning in its best quarter ever. Despite a marginal uptick in operating expenses, NTIC’s gross profit as a percentage of net sales skyrocketed by 36.7% relative to the corresponding period in the previous fiscal year. This was made possible by the company’s adept handling of inflation and a surge in sales from its high-margin Zerust oil and gas solutions.

NTIC’s net income saw an encouraging 52.5% surge to $1.5 million or $0.16 per diluted share in its third fiscal quarter 2023 versus 1 million or $0.11 in fiscal 2022. In a nutshell, the fiscal 2023 third quarter financials depict NTIC as a company that’s not only growing but also generating robust profitability and shareholder value.

Expectations

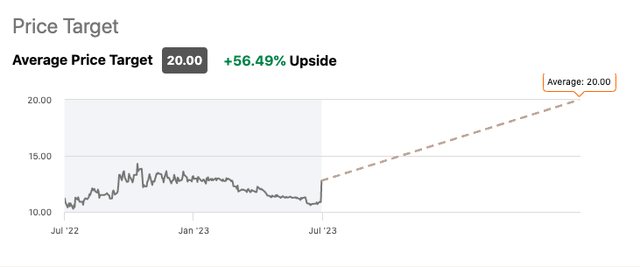

NTIC is covered by only one Wall Street analyst with a decisively “Strong Buy” rating and +56% upside price target.

Seeking Alpha

Performance

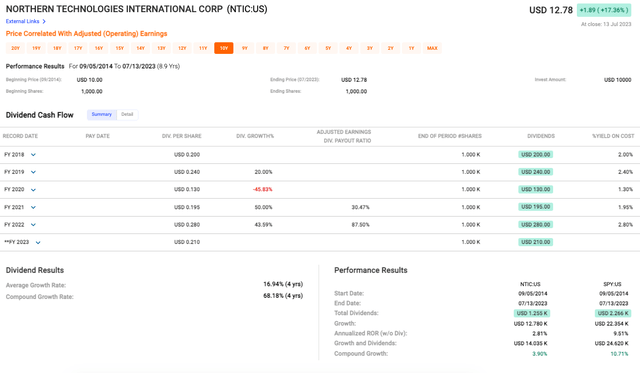

Over the past 8.9 years, NTIC’s stock price has seen modest growth, increasing from $10 in 2014 to $12.78 as of yesterday’s close. That gives us a compounded annual return of just 2.81% excluding dividends, which honestly, is pretty lackluster when you stack it against the broader market index, the S&P 500 Index, clocking in at 9.51%. On a total return basis, including dividends, we’ve got a compound growth of 3.9% for NTIC, still significantly trailing the S&P’s 10.71%. So for the buy and hold investor, NTIC hasn’t exactly been the golden goose.

Fast Graphs

Yet despite the tumultuous dividend history, NTIC’s compound growth rate in dividends over the past four years comes out to an eye-popping 68.18% which might appeal to some income investors, but from this perspective, it doesn’t seem to leave much for reinvestment back into the company.

Valuation

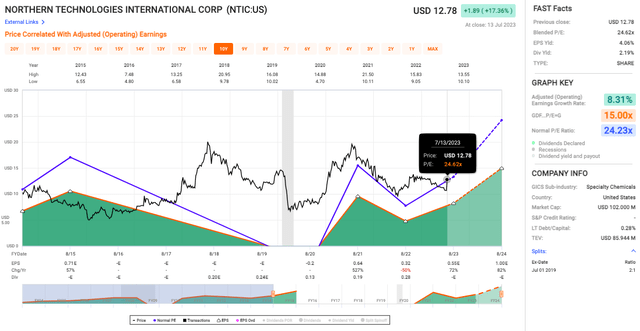

Fast Graphs

Taking a look at the fundamentals (see chart above), the Blended P/E of 24.62x is slightly above the Normal P/E Ratio of 24.23x suggesting that the market might be pricing in a bit more optimism about NTIC’s future earnings potential than usual. Generally, high P/E ratios can indicate overvaluation, but when you take into account the firm’s operating earnings growth rate of 8.31%, it becomes clear that the premium might be warranted.

Risks & Headwinds

Diving first into the company’s joint ventures, we see a modest contraction in their total net sales, which slid down by 1.1% year-over-year. This decline, albeit marginal, could be signaling a softer demand in the markets that these joint ventures serve. Alternatively, it may hint towards operational inefficiencies creeping into the otherwise well-oiled mechanism of these joint ventures.

Shifting the lens towards NTIC China, an 8.4% decrease in sales paints a concerning picture. It exposes the subsidiary’s vulnerability to the adverse macroeconomic conditions in the highly potent Chinese market. With the economic headwinds in China not abating as fast as anticipated, NTIC China’s performance underscores a tangible risk. It’s clear that its fortunes are entwined with the health of the Chinese economy, raising questions about its resilience in navigating through the tough Chinese economic landscape.

Another point that I find somewhat concerning is the significant uptick in operating expenses by 12.8% compared to the prior fiscal year. This surge is primarily attributed to increased personnel expenses and the costs associated with kick-starting a new subsidiary in Taiwan. Operating efficiency is a key determinant of profitability, and this upward trend in expenses may potentially gnaw at NTIC’s bottom line if left unchecked.

Final Takeaway

I rate NTIC as a “Buy”. NTIC’s robust Q3 2023 earnings, strong gross margins, and the significant growth in its Zerust oil and gas, and Natur-Tec units underscore its successful long-term growth strategy and financial strength. I believe that he company’s positive outlook for fiscal 2024 outweigh the minor concerns surrounding joint venture sales and the Chinese market performance. And despite a somewhat lackluster historical stock price performance and slightly elevated P/E ratio, the company’s accelerating earnings growth and proactive expansion into eco-conscious products, coupled with substantial dividend growth, make it an intriguing investment opportunity. With that noted, taking into account the stock’s +17% surge yesterday (and +2% premarket bump at the time of this analysis), the market also agrees with me.

Read the full article here