Background

Despite rising interest rates, which typically squeeze the budgets of potential borrowers, single family new-build homes are currently in high demand. Over the past year, but during 2023 especially, the market has suddenly taken a shine to homebuilders as a result.

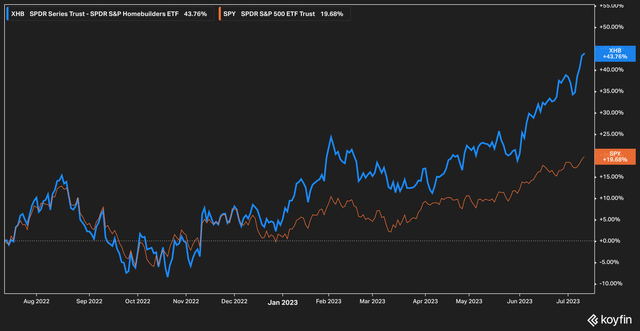

Koyfin

With the beginning of the breakaway occurring in January 2023, the SPDR Homebuilders ETF (XHB) has far and away beaten the broader S&P 500 (SPY) on a total return basis, delivering 43% on a one year basis against SPY’s 19%.

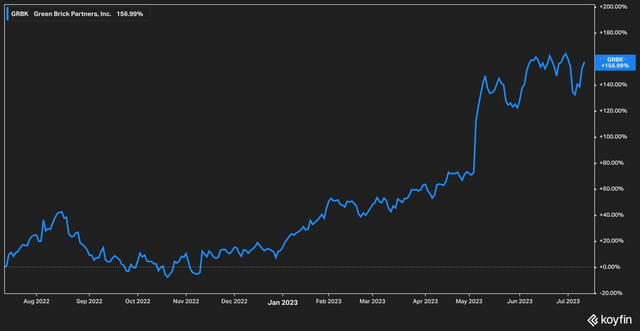

For investors, then, the question is whether or not this run up can continue. Today we turn to Green Brick Partners, Inc (NYSE:GRBK), a regional homebuilder that has enjoyed an excellent 2023 thus far, rallying over 150% in the past year.

Koyfin

Today we’ll assess whether Green Brick’s rally still has legs, or whether investors should cool on its prospects. Let’s dive in.

The Business

Green Brick is a full-service home builder and developer. Unlike many builders which simply purchase lots, build, and move on, Green Brick through its several subsidiary builder names takes part throughout the entire development and purchase lifecycle of new home construction. The company purchases and develops land, conducts the actual build, and even offers referrals to mortgage financing its joint venture mortgage venture BHome Mortgage (of which it owns 49%), and titling services through Green Brick Title which is wholly owned by the parent company.

The company focuses on the mid-to-upscale home market, building primarily in the Dallas-Fort Worth metroplex and Atlanta. In the most recent conference call, company executives announced that the company would be expanding into the Austin market as well with a focus on offering a more affordable price point with homes starting under $300,000.

The geographic locales in which the company operates is important. With Texas leading the overall list, more Americans are moving to the Southeast United States than anywhere else. Bloomberg recently reported that much of the nation’s economic center of gravity is migrating to the south overall due to a plethora of jobs and companies moving headquarters and operations centers. While we don’t typically look for macro reasons to like a company, large trends are difficult to ignore, and this particular one seems to have legs.

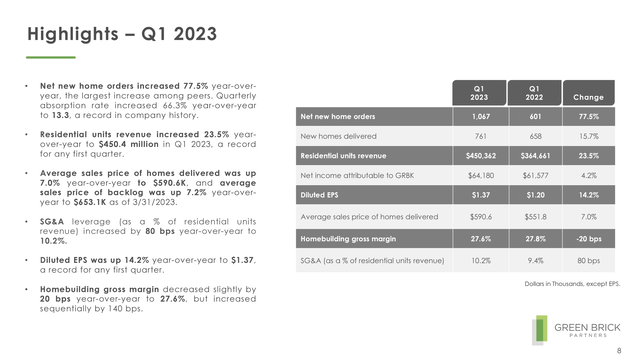

The company also posted a stellar first quarter to start 2023, with net new home order coming in up 77% year over year.

Company Presentation

Backlogs at the company remained healthy, a good sign for a builder of primarily higher-end homes, and management boasts that their company has some of the lowest cancellation rates (6% in the last quarter) among their peers. Importantly, management stated that they had eased on offering buyer incentives for new homes in the first quarter, another sign of resilience in the market.

The Run Up & The Future

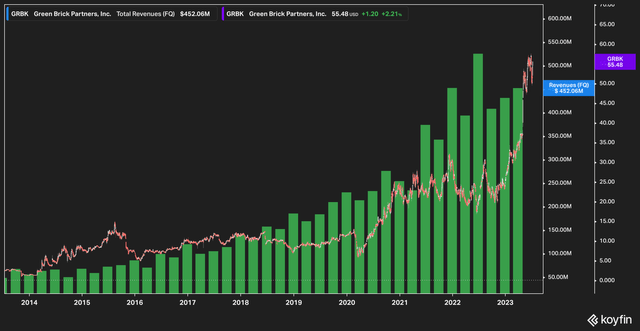

Of course, all of that is in the past. What matters for investors most is whether or not the company presents a decent opportunity today and in the future. One thing that caught our eye about Green Brick was that when the stock’s rally in 2023 is compared with sales, it appears that the run-up is less hype-driven than perhaps a market taking notice of a home builder with exceptionally strong sales growth.

Koyfin

When we look back ten years and overlay the company’s quarterly sales against its stock price, we see an interesting development. Prior to 2018, the stock and sales moved rather comparably with each other. It wasn’t until after that time that sales began to grow at a rapid clip and left the stock’s price behind.

As the company began to post record quarterly revenues in 2021 and most of 2022, the market still seemed to pay the stock little mind as it ranged mostly between $20 and $30 per share. Only recently, then, has the market realized that Green Brick has become something more than it once was in terms of sales, and the stock re-rated to its levels today.

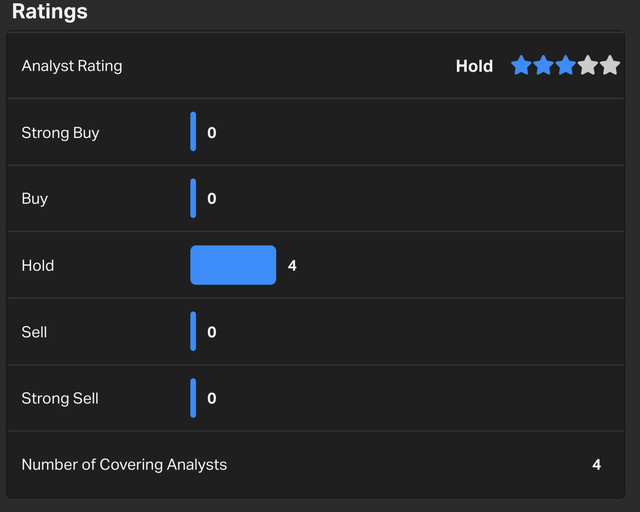

This could be for a number of reasons. With a market capitalization under $3 billion, the company is not particularly large. It also pays no dividend, and is currently covered by only four analysts–all of which, according to Koyfin data, have a hold rating on the stock.

Koyfin

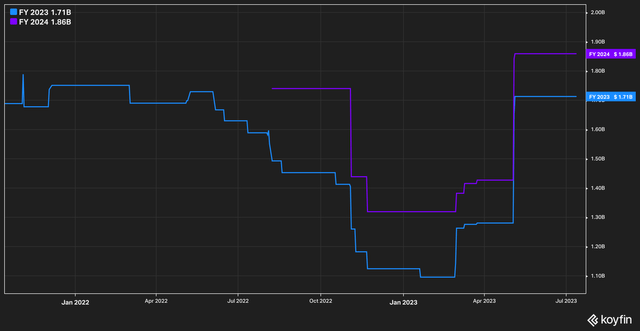

This hold rating, however, seems to belie the covering analysts’ assumption that revenue will continue to grow. Looking out one and two years, revenue estimates for Green Brick have been revised above their prior highs after having been lowered for a time.

Koyfin

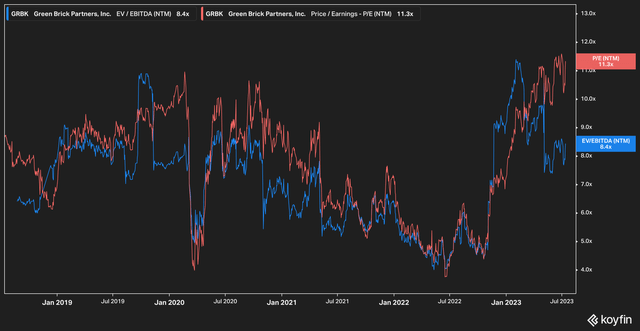

These upward estimate revisions, however, have not been enough to keep forward multiples from expanding.

Koyfin

From the chart above we can see that Green Brick is indeed more expensive today using forward multiples than it was in 2022 with the stock currently trading hands at 11x earnings and a little more than 8x EV/EBITDA. We point out however, that these levels are not without precedent–the stock is now trading in the upper bound of a range of valuation last visited in 2020.

The Bottom Line

There is a lot to like about Green Brick–the company runs an efficient operation and has a geographical and economic tailwind at its back. However, given the dual facts that the stock has re-rated upwards to match its historic trend versus sales and that valuations are currently stretching historic norms, we think that without a continued surge in growth or other catalyst (such as a large-scale stock buyback or declaration of a dividend), that any further move upward is likely fraught. As much as we wish it weren’t so, today we sit on the sidelines when it comes to Green Brick.

Read the full article here