Investment Outline

Community Health Systems Inc (NYSE:CYH), has seen a very significant drop in its bottom line from the results posted in 2022. The EPS landed at negative $0.4 for Q1 in 2023, down from a negative $0.01 in Q1 of 2022. The net operating revenues stayed pretty much equal on a YoY basis but costs seem to have been biting into the earnings and resulting in the company posting such a big decrease.

For the moment I find it very risky to be putting money into the company, besides negative cash flows the last two years, there seems to be a trend of diluting shares that I am not very fond of. In all honesty, I think there is too much risk in holding shares as well right now. Until a positive EPS can be posted consistently, I wouldn’t view CYH as anything else than a sell rating, unfortunately.

Recent Developments

Some developments that happen back in February that I reacted to was that CYH is selling two of its Hospitals in North Carolina to Novant Health. This transaction is set to be valued at $320 million and will bring in some much-needed capital into CYH as the long. term debts are alarmingly high at over $11 billion.

I think that if we are seeing more news like this of CYH selling off assets to raise capital then I would be worried as an investor. Community Health Systems operates as an owner and leaser of general acute hospitals in the United States. They experienced rapid revenue growth as the Covid-19 pandemic hit and placed a lot of demand on hospitals and the facilities related to them. Within these acute hospitals, the company offers emergency rooms, general and specialty surgery but also critical care and diagnostics. Founded back in 1985 the company has grown its asset base immensely and now has over $14 billion in total assets. This could value CYH at a very long p/b multiple, but the fact they hold over $11 billion in long-term debt and has other liabilities means it has a negative total equity value of $791 million. In terms of valuation, which I will cover below, this is a major factor for the volatile share price and what I think is a fair undervaluation to the rest of the sector.

Margins

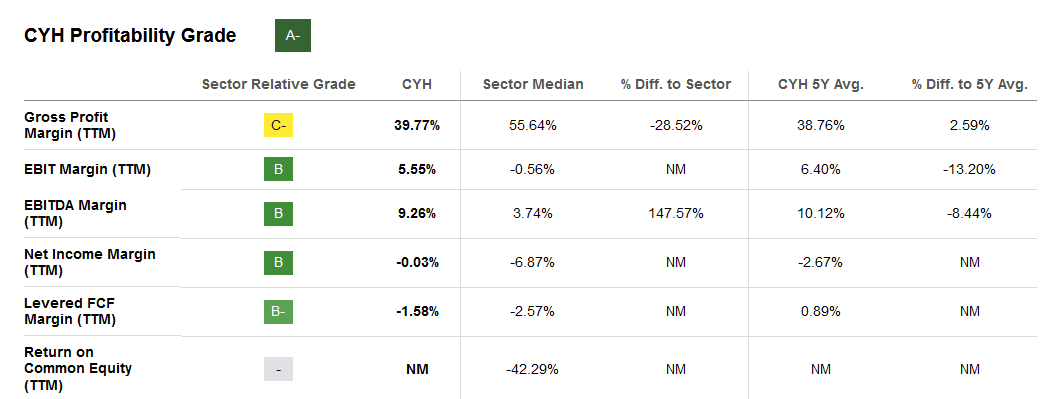

The margin profile of CYH has some good parts and some other not-so-good parts. Looking decent on paper I fear more difficulties lie ahead.

Margin Profile (Seeking Alpha)

The gross margins for the company aren’t necessarily that bad, but looking at the bottom line we can see that there are some issues that CYH needs to deal with. With a negative net margin of 0.03% in the last 12 months, it beast the sector. But for me, I care about a company having positive net margins, not negative but still beating a sector’s negative average. As posted in the Q1 2023 report from CYH they generated pretty much the same revenues as in 2022 but the bottom line saw a significant decrease.

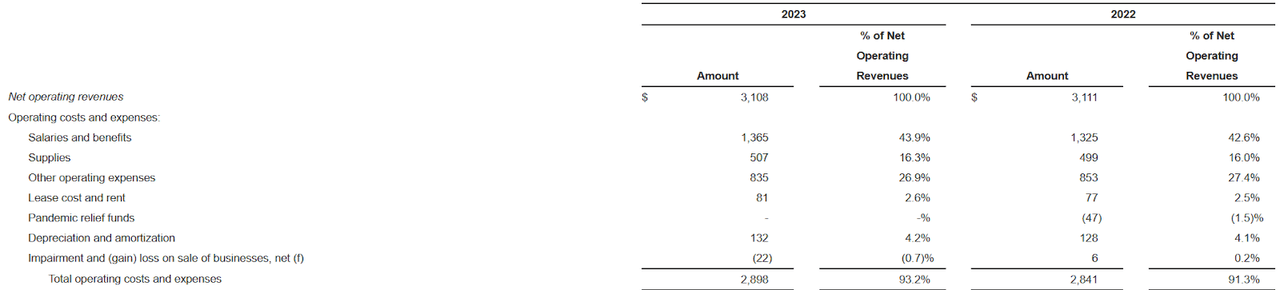

Operating Expenses (Earnings Report)

As operating expenses increase with lower revenues the results speak for themselves that CYH posted a YoY decline in EPS. Looking closer at the operating expenses we see that “Salaries and Benefits” made up a larger portion of operating expenses, at 43.9%. But in 2022 the company also received $47 million in pandemic relief funds which helped improve the bottom line, but in 2023 that wasn’t the case. The $47 million seems to have made enough of a difference here to have yielded the company such different results YoY.

Valuation

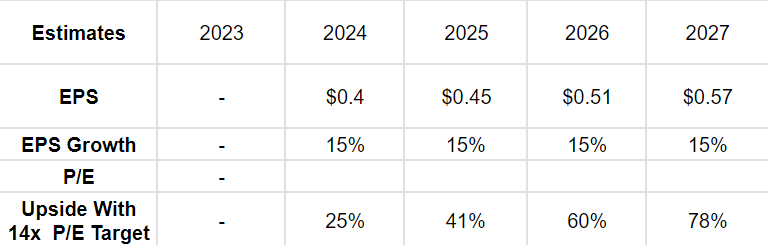

CYH has a poor track record of a positive bottom line. What was a one-off was in 2021 when EPS came in at $2.45 which beat estimates of $1.77 per share. But I think as with many pandemic-related revenue growths, they dribbled down, and now we are left with a company that has a poor bottom line and large amounts of debt. Estimates however suggest that profitability might be achieved in 2024, below is a model looking at what those projections say about today’s prices and whether it makes CYH more appealing or not.

EPS Estimates (Author)

According to some estimates, in 2024 CYH will post an EPS of $0.4 per share, up from a negative $0.56 which is expected in 2023. I find this quite unlikely and rising costs and sticky prices seem to remain. For more risk-averse investors, they might view CYH as a potential growth opportunity, but I think those who are more concerned about the volatility and safety of their portfolio should still view CYH as anything but an investment opportunity right now. Without a positive EPS posted consistently, you aren’t investing based on fundamentals, which exposed you to a lot of downside potential once earnings disappoint and the valuation is adjusted. I have put a 14x P/E multiple as I view the balance sheet to be in quite a rough shape with so much debt and lacking positive equity. This should in my opinion result in a lower multiple to reflect the potential risk associated.

Investor Takeaway

CYH does not right now offer any form of solid investment opportunity in my opinion. Despite generating revenues far above their current market cap of around $550 million I think the risks associated with the business are too much. Besides that, share dilution has been continuously happening, even through times of strong growth and a positive bottom line.

A low multiple should be applied for the business and there are better options in the healthcare industry for investors to look at, with both stronger margins and better balance sheets. As for now, I am viewing CYH as a sell.

Read the full article here