Investment Thesis

In 1931, the economy struggled because of the Great Depression. The tight credit situation, much worse than today, hit the founder of the Hilton Group, Conrad Hilton. A loan from the bellhop kept the hotelier, Conrad Hilton, afloat. Citing below from Propeacher:

In retrospect, Hilton observed that 1931 was “an outrageous time to dream.

Today, regional banks are failing one after another, but Hilton Worldwide Holdings Inc. (NYSE: HLT), which built an empire across 127 nations, is prepared to grow with the support of big banks.

Hilton’s Q1 2023 earnings showed strong growth in RevPAR and adjusted EBITDA, exceeding guidance, driven by demand in APAC, leisure, and a recovery in business and group travel. While the company had a strong performance and the stock market was celebrating, we spotted a couple of areas that might harm its stock valuation. We decided to calm the investors down and rate the stock as neutral.

Company Profile

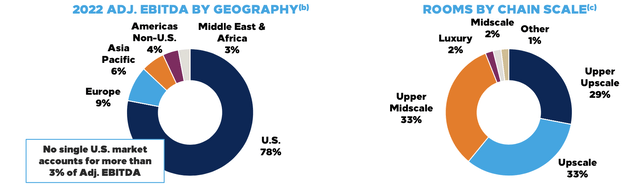

Hilton Worldwide Holdings Inc. is a multinational hospitality company that operates a portfolio of hotels and resorts, with 7,200 properties, 1,127,000 rooms. Its operations are mainly in the U.S. and focus on mid- to upper-scale hotels.

Earnings and Room Breakdown (HLT)

Key Takeaways from Q1 2023 Earnings:

- System-wide RevPAR grew 30% YoY on a comparable and currency-neutral basis and increased 8% compared to 2019, driven by strong demand in APAC, leisure, and a steady recovery in business transient and group travel.

- Adjusted EBITDA was $641 million in the first quarter, up 43% YoY and exceeding the high end of the guidance range, driven by better-than-expected fee growth and strong performance in Europe and Japan.

- Management and franchise fees grew 30% YoY, driven by continued RevPAR improvement and good cost discipline.

- Pipeline grew YoY and sequentially, now totaling 428,000 rooms, with nearly 60% located outside the U.S. and over half under construction, with net unit growth expected between 5% and 5.5% for the full year.

- Raised full-year 2023 guidance: RevPAR growth is expected between 8% and 11%, adjusted EBITDA between $2.875 billion and $2.95 billion, and diluted EPS adjusted for special items between $5.68 and $5.88.

- The full-year 2023 capital return is projected to be between $1.8 billion and $2.2 billion.

Growth Drivers

According to the management, the company focuses on the following areas of growth:

Acquisition

According to the management, demand for independent hotels to convert to brands had increased as people tended to seek out stronger brands in an environment where demand was expected to soften. Thus, the company can expand by acquiring independent hotels. Acquiring a cash-flowing hotel is easier to finance than new construction in an environment where credit is tighter.

We believe the benefit from this trend may be limited and short-term, as it is primarily transaction-driven. It takes time and luck to find the right one, and it might not be able to sustain its growth over the long term.

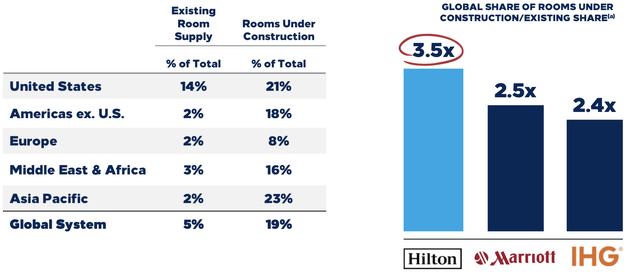

Existing pipeline

The management highlighted that the company’s pipeline of hotel rooms has grown YoY and sequentially, with a significant proportion located outside the U.S. and under construction. The company expected to take more shares than other peers through existing projects, as shown in the below chart.

However, we believe that the earnings impact from this expansion may be limited due to the company’s core network strength being primarily in the U.S. As a result, the lack of network effects in overseas markets may make it challenging to achieve the desired profitability and sustain growth in these regions.

Construction in the pipeline (HLT)

Target work from home population

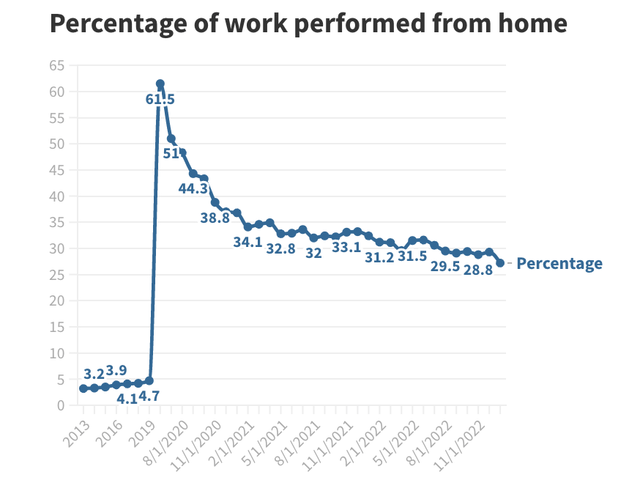

Hilton is launching a new brand in the extended-stay market with efficient build costs that are expected to generate high margins. This move was in response to the high demand for extended-stay products due to workforce housing needs, increased mobility, and the desire to work from different places. COVID-19 has accelerated the need for flexible housing options as more people work remotely. The new product will be a hybrid of an apartment and a hotel, designed to meet the workforce housing needs of those staying for 30-120 days. Hilton expected this new brand to be successful, given the high demand for similar products during the pandemic.

Hilton’s plan to launch a new brand in the extended-stay space is aimed at meeting the demand for flexible housing options, particularly for those who require workforce housing for extended periods. However, the growth prospects of this new brand may be limited due to several factors.

While the pandemic has resulted in more people working remotely, according to a National Bureau of Economic Research report, the percentage of work performed from home is declining, and among those who work from home, only a portion of it is high-paying work.

Percentage of job work from home (National Bureau of Economic Research Working Paper)

According to flexjobs.com, many people who work from home, such as accountants, teachers, and writers, may not command a high salary and are not able to afford the luxury of staying at an extended-stay hotel, which is still more expensive than a monthly rental.

| Job Title | Average Salary |

|---|---|

| Accountant | $52,286 |

| Engineer | $88,237 |

| Teacher/Faculty/Tutor/Instructor | $47,580 |

| Writer | $51,867 |

| Consultant | $89,780 |

| Program Manager | $54,015 |

| Project Manager | $75,568 |

| Customer service representative | $40,065 |

| Business Development Manager | $75,109 |

| Account Manager/Account Executive | $56,492 |

Therefore, while Hilton’s new brand may be successful in meeting the needs of a certain niche market, its growth prospects may be limited due to its price point and the declining trend of remote work.

Entry into the economy market through acquisition

According to the management, Hilton’s Spark brand, which offers affordable accommodation and targets young budget travelers, is expected to drive unit growth mostly through acquiring independent hotels, with potential for earnings growth similar to that of the Hampton brand, while international expansion is also expected to contribute to achieving the target.

It’s noteworthy that budget hotel Wyndham (WH) was doing the opposite of Hilton. In its Q1 earnings, Wyndham mentioned its new projects were more positioned at the mid- to high-end. We have a piece discussing Wyndham in detail. “Wyndham Q1 Earnings: No Signs Of Slowdown”

So, what’s our take from this situation? We believe that (1) the conglomerate hotel groups are undoubtedly gaining market share in this environment because they have the liquidity and support from creditors to expand, and (2) the period of strong organic growth may be coming to an end, which is why both companies are attempting to enter each other’s territories.

In addition, Hilton mentioned that it expected Spark to function more as a traffic acquisition tool to grow its reward program member base, which may also limit its margin potential. Moreover, the growth of the brand depends on acquiring independent budget hotels, which are scarce targets in the current market. Hence, we think the growth prospects from this initiatives are limited.

Risks

Macro risk

The company believes that while inflation is a concern, it is being managed and is expected to slow down. Despite an anticipated modest slowdown, the company views the economy as resilient and has confidence in the Fed’s ability to manage inflation. Small and medium-sized enterprises continue to perform well in business travel, representing 85% of the business. However, demand from large corporations has been flat, primarily due to challenges in the technology and financial services sectors. Overall, the company appears to be cautiously optimistic about the current economic environment.

Although inflation can have a negative impact on businesses, we believe that the company’s ability to maintain above-inflation RevPAR growth suggests that the inflation impact on the company may be limited and manageable.

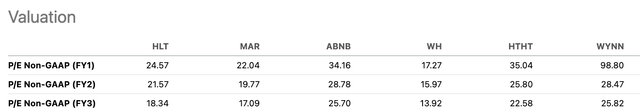

Valuation

The company’s FWD P/E ratios for 2024 and 2025 are in the range of 18–21x, suggesting that the market is anticipating a high-growth scenario for the company.

Valuation comparison (Seeking Alpha)

However, based on our discussion of growth factors above, we believe it is challenging for the company to maintain strong growth because of the constrained development potential, historical lows in capacity expansion, and tight financial conditions.

Furthermore, RevPAR growth seems to be slowing down to single digits based on its guidance, indicating that there may be limited opportunities for margin expansion.

As a result, we think that the lack of sizable untapped growth potential and absence of margin expansion opportunities can limit the upside potential of the stock.

The company anticipates returning $1.8–$2.2 billion to shareholders in 2023, primarily through share repurchases. This can result in a 5.6% decrease in the number of outstanding shares.

Summary

The company announced solid Q1 2023 results and raised its 2023 forecast. However, we believe that the company can’t sustain its strong growth momentum as there aren’t as many opportunities for long-term growth. The stock’s valuation is based on high growth expectations, so the limited growth potential and margin expansion opportunities may constrain its upside. We rate the stock as Neutral.

Read the full article here