In my view, the market is fundamentally mispricing the value proposition of real estate investment trust W. P. Carey Inc. (NYSE:WPC).

The REIT is well-diversified and maintained strong portfolio characteristics throughout the first (and probably second) quarter. W. P. Carey’s office exposure has hurt the REIT’s valuation in the last couple of month, in addition to the banking crisis, but the REIT’s strong portfolio and pay-out metrics make WPC a rather low risk bet in the REIT market, in my view.

I think passive income investors have grown too fearful of commercial REITs, largely because of concerns over the state over the U.S. office real estate market.

Why The Market Is Wrong

In my article about Alexandria Real Estate Equities Inc. (ARE), I mentioned how the market falsely associated the trust with other office REITs (despite owning mostly life science real estate) which has resulted in a mispricing that passive income investors can exploit.

The same is true for W. P. Carey.

Office real estate has been pummeled in 2023 due to the central bank’s rate hikes, the growing popularity of remote work (leading to higher office vacancies) and growing pressure on office valuations.

Furthermore, delinquencies in the sector are on the rise which has spooked investors. These fears combined have resulted in a valuation haircut of 18% since February for W. P. Carey.

Just with Alexandria Real Estate Equities, I think that the market unjustly punishes W. P. Carey for its office exposure, even though the commercial REIT owns only a moderate amount of such real estate. With that said, W. P. Carey offers a very safe dividend for passive income investors, in my view.

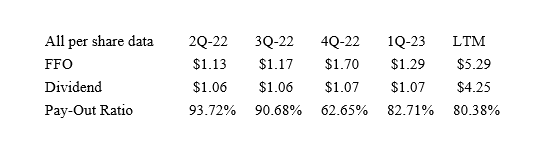

The REIT earned a total of $5.29 per share in the last year in funds from operations while paying out only $4.25 per share which means that the dividend is both well supported and sustainable.

W. P. Carey’s dividend pay-out ratio in the last twelve months (the period between 2Q-22 and 1Q-23) was only 80% and the trust raised its dividend by ~1% as well.

Dividend (Author Created Table Using Trust Information)

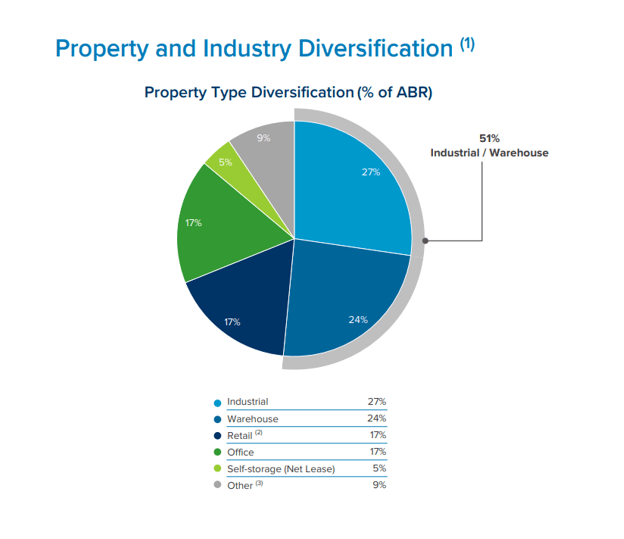

But more important for passive income investors than just looking at the pay-out ratio is the fact that the trust has a moderate allocation of funds to the troubled U.S. office real estate market. Now, W. P. Carey does have exposure to office real estate and has approximately 17% of its revenues tied to the sector.

It is, however, not the biggest sector. Industrial properties account for 27% of annual base rent while warehouses produce 24% of the REIT’s rent. In short, the office exposure of W. P. Carey is rather limited and the REIT offers a rather well-diversified portfolio as a whole.

Property And Industry Diversification (W. P. Carey Inc)

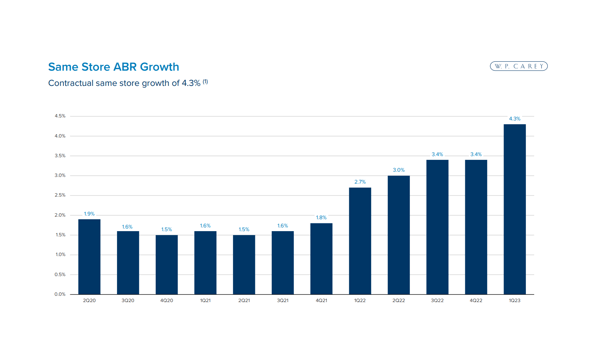

What I think helps make the case for the robustness of W. P. Carey as an investment is that the REIT is experiencing robust demand for its real estate, resulting in higher rents. W. P. Carey’s same-store rental growth in 1Q-23 was 4.3%, reflecting a 0.9 percentage point increase QoQ. Rents rise when landlords have pricing power and certain real estate types, like industrial, warehouse and retail, are in high demand.

ABR Growth (W. P. Carey Inc)

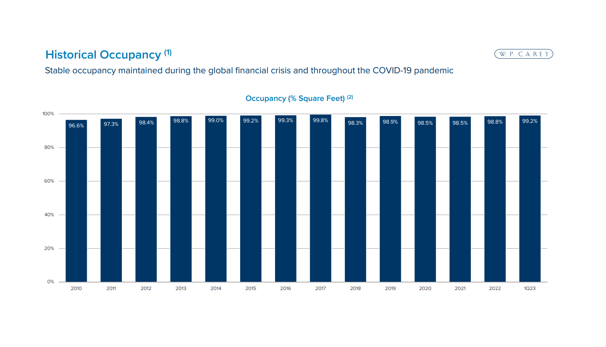

Taking into account that the REIT’s valuation has declined by 18% since February, one would think that the trust has major portfolio issues, such as high vacancies or rent collection problems. However, neither is the case, and the portfolio is as strong as it has ever been. W. P. Carey’s portfolio has been well-leased in the past and the trust’s occupancy actually went up by 0.4 percentage points in 1Q-23 to 99.2%.

Historical Occupancy (W. P. Carey Inc)

Low AFFO Multiple Indicates WPC Is A Bargain

W. P. Carey reaffirmed its guidance for 2023 in the first quarter and continues to see $5.30 to $5.40 per share in adjusted funds from operations.

The REIT’s stock has fallen to $69.09 which translates into an AFFO multiple of 12.9x.

Earlier this year, W. P. Carey’s stock traded at a 15.7x AFFO multiple. The implied AFFO yield for WPC is 7.7% today compared to 6.4% in February which, I think, makes the commercial REIT a bargain.

W. P. Carey Has Office Risks, But Investors Are Too Fearful

Obviously, W. P. Carey has exposure to the troubled office real estate market, but it is not a dominating real estate category in the trust’s portfolio.

Moreover, W. P. Carey had great portfolio metrics at the end of the first quarter including 99% portfolio occupancy (which includes office real estate), maintained its overall diversification and paid out just about 80% of its funds from operations.

A downturn in the U.S. office real estate market is a risk, but it is none, I think, that should preclude passive income investors from investing into W. P. Carey. Investors have become too fearful of REITs in general, creating a number of bargains in the sector, WPC being one of them.

My Conclusion

I think that the market makes the same mistake with W. P. Carey that it makes with Alexandria Real Estate Equities which is to punish them for office real estate exposure even though the portfolio fundamentals are robust.

Alexandria Real Estate Equities is more focused on life science real estate while W. P. Carey has broad commercial real estate exposure and only a moderate degree of office real estate investments. Yet, both REITs have seen large valuation declines since February.

W. P. Carey’s portfolio is performing very well as it has robust occupancy and rents are growing. In my view, these facts don’t justify the application of an 18% valuation haircut and I think passive income investors have an opportunity here to exploit W. P. Carey’s low AFFO valuation for their benefit.

Read the full article here