Dear readers/followers,

A company like RELX (NYSE:RELX) is actually a very interesting potential investment. Decision-making tools and the services associated with them provided it’s not something “new, innovative, and tech-based”, is something I’m interested in investing in. Anyone who at any time has worked for a large organization, you’ll likely know that efficient decision-making equals profitability and productivity. So the theoretical appeal of a company such as this is absolutely massive – and that is also why RELX has been a common name for companies for over 100 years.

In my last article, I made a case for why this business was overvalued and why investors should exercise caution for this name. Since that time, which has now been almost 2.5 months, the company has only gained 0.69% to the S&P500 which has gone up 7.5%. Not a huge underperformance, but underperformance nonetheless.

Let’s look at the continued case for RELX we do have here.

RELX – Plenty to like fundamentally

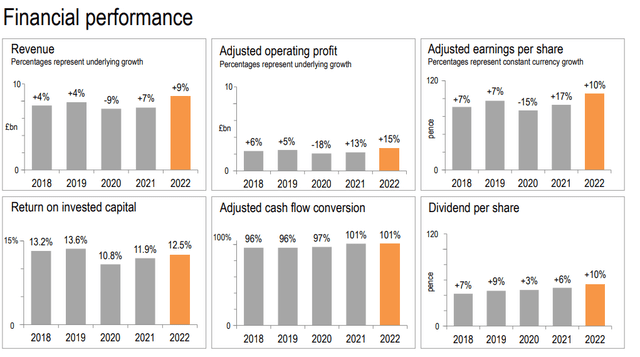

Decision-making tools are a billion-dollar business. The company manages revenues of over £8.5B, and operating margins on those revenues of more than 31%, with a cash flow conversion of over 100% and a net debt/EBITDA of below 2.2x. This is one of the most conservatively-leveraged businesses in this entire field – and it represents 180,000 employees in over 180 countries, with native listings on 3 stock markets and a market cap, in dollars, of over $60B.

The company manages to maintain a close-to or above double-digit revenue and profit growth rate over time – which also flows to its dividend growth rate, also growing at impressive overall levels.

The company has a very attractive business model – over 50% of sales are subscription-based, and 46% are transactional, which by the way include contracts with what are known as volumetric elements. Over 55% of sales are NA, 21% EU and the rest are 19%. The company, therefore, is primarily NA-based in terms of its revenues.

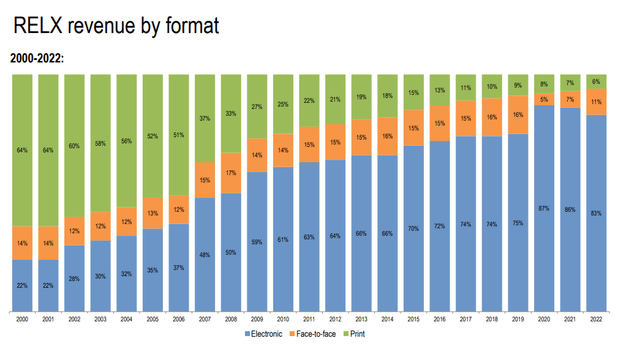

It used to be that this was a predominantly traditional face-to-face and print-based business -that has switched in the past 15 years, and it’s now 83% electronic, though print and face-to-face still do play a role in the company. The evolution of this revenue mix can be seen here.

RELX IR (RELX IR)

What the company continues to do is develop information-based analytics and decision tools that deliver value to customers regardless of market. Basic financial performance metrics confirm this company’s overall timeless appeal.

RELX IR (RELX IR)

Primarily, the company focuses on four attractive markets – namely the Risk, the Scientific/Tech/Med, the Legal and the Exhibitions markets, each of them making up one of the company’s market segments. The segments are relatively self-explanatory, but here is a quick run-down of each business segment.

RELX Brochure (RELX Brochure)

The mix provides a mixed, pardon the pun, growth picture. You might consider what happened to the “exhibitions” portion of the business during COVID-19 for instance – the segment fell by almost 70% – only to bounce back up 44% in 2021, and 64% in 2022, while the legal, science, and Risk segments never really went below 1-3% in annual revenue growth even during the worst of the trends of COVID-19.

RELX is one of those businesses you don’t really hear about, but it’s a business that’s in the “background” of most other businesses in certain fields, providing those with the tools to do things accurately and efficiently/better. As long as the modern world and things are developing as we’ve been seeing for the past century, I consider it more than likely that RELX will continue to see a place and demand for its services.

What sort of trends should we be looking at when we try to determine the appeal of RELX here?

KPIs I look at for this company is the submission number for the STM segment, given RELX divisions with operations in the journal field/physical field. There is an overall growth in submissions not necessarily due to a growing amount of research, but rather due to a growing number of researchers having access to more powerful tools than at any time in the past – so that’s what’s driving growth in key segments like STM (Science, Tech, Med). We want to look at those submission growth rates to make sure this continues, and for the company to continue to scale up operations and expand its network with researchers across the world. During 2022, the company published 600,000 articles, about 25% of which are so-called open access. This is about on par with the 2021 numbers.

Also, the company is one of the very few businesses I’m aware of in this size that hasn’t pushed an inflationary price increase for its sub-renewals. The company’s renewal rates are currently very strong – and the question becomes how customers would react to price increases in terms of pushback – what sort of renewal impact would we see from a 3%, 5%, or 10% price increase?

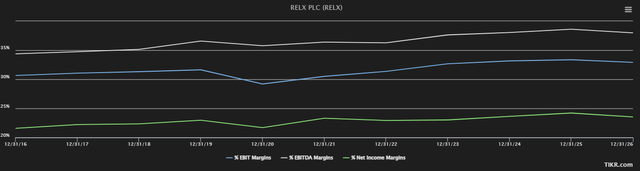

In essence, the company is accepting a potential margin impact in order to safeguard volume and momentum – management confirms this more or less in the latest 2022 earnings call. This is something we need to keep an eye on. As of the current forecast levels, EBIT margins are actually expected to grow, not decline – the same is true for Net and EBITDA margins.

RELX trends (TIKR.com)

If this is what we get, then there is no issue – but we’ll want to keep an eye on those margins, those renewal rates, and the way the company adjusts – or doesn’t adjust – pricing levels.

The big elephant in the room – number 3 – is AI. How would something like ChatGPT influence a company like this? I can say that for myself, having viewed many of the results that come from ChatGPT, the room for error is still unacceptably high (and massively so) for anyone in any serious field that requires technical or legal expertise to rely on it. If the platform/AI makes simple errors or can’t tell 100-year differences from the present (which in concrete cases where I have tried it out, it cannot), then I don’t see the current appeal as a replacement or alternative. But it’s certainly something to “build upon”.

RELX already uses a fair share of AI – and they have been one of the first movers behind generative AI tech (such as ChatGPT). The company characterizes the platform and the technology as only one small step – and I believe that this is the right way to view it. RELX will continue to stay at the forefront of this development – but I don’t see it replacing anything in the company at the near-term. Especially when it comes to incredibly technical or legal contexts, the margin of error for this sort of generative technology is still, simply put, far too high.

Simply put, the company manages global tools that you probably have never heard of, but that people in those industries are relying on daily. I’m talking about things like LexisAdvance, LexisNexis, ICIS, Cirium, Mendeley, ClinicalKey, Scopus, SciVal, and ScienceDirect. The only part of the operations that I have ever come into contact with is ClinicalKey – but I’ve heard of several others. Nonetheless – realize as an investor, these platforms are not only market-leading but for many absolutely crucial – and this is why the company both has appeal and why it will continue to have appeal.

Let me showcase, however, why the valuation for RELX remains problematic.

RELX – The problem is still clear – valuation

When there is an issue in valuation, that’s when you need to be very careful overall. The company currently trades at 24.5x normalized P/E, based on an average 5-year EPS growth rate of around 6% – which is below the longer-term average. The company’s 10-year premium is around 22x P/E, which means the company is currently clearly above this premium level, despite developing relatively flat since my last article.

Fundamentals are solid. BBB+ credit, a yield that’s now 2%, and unlikely to become a high yielder. The last time RELX was clearly buyable was last fall, when the native share price fell to around $24/share or below. Now we’re at $32/share.

Street targets for the company are as volatile as you might expect analysts to be – though only 2 analysts actually follow RELX as a native NYSE ticker. They give the company a target range of $35-$38 with an average of $36.70, implying a 14% upside here.

I call this way too optimistic, especially in the light of a PT of $27 only a year ago or so, when the company could be considered attractive.

Based on the company’s 5-year average P/E, the current annualized RoR upside to around 21-22x P/E is 7%. I would be uncomfortable going higher than this in my forecasts, and 7% isn’t enough to interest me in this environment. I would rather do a combination of savings and options trading, resulting in potential annualized yields of 9-12% than try to eke out a gain from what is an overvalued, great business.

In my last article, I gave the company a $24/share PT. You’ll know that my price targets are not subject to change easily, and I guided for a buying of the stock at below 20x P/E. As of this article, I’m slightly bumping this to a 20-21x P/E range, averaging it out at $25.5/share, due to the company’s better-than-expected growth profile and potential renewals.

I don’t want you to look at the S&P global targets as being massively realistic – because this is not my stance. If you look at a fundamental mix of NAV, book values, FCF potential, and DCF, there’s not a massive upside to this company unless you start allowing for beyond-normal premiums, and this is not something I do or would want any of my readers to do.

I’m perfectly willing to pay a premium for a great business, and RELX is a great business. But I’m not willing to pay this premium.

So while I’m shifting my target, I’m recommending caution here – and my RELX thesis is as follows.

Thesis

- RELX is a class-leading company in research and consulting – and it’s a convincing investment at a good price. My ambition is to own RELX in my portfolio once the price drops down. I view the company as a relatively simple and stable play on attractive business segments. That is still my ambition, but for the time being, it’s less than likely in the near-term.

- If bought at below 20x P/E, and trimmed at above 25-26x P/E, this company has the potential to give you excellent returns over time while paying you a relatively attractive and well-covered dividend of above 2%.

- I would consider RELX a “BUY” at around $25.5/share for the ADR. The ADR is relatively liquid, meaning you can either go native or buy the RELX US ticker here. This represents an increase in my overall PT for the company as of July 2023.

- I’m on a “HOLD” for RELX here.

Remember, I’m all about:

- Buying undervalued – even if that undervaluation is slight and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn’t go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside that is high enough, based on earnings growth or multiple expansion/reversion.

The company is excellent but does not fulfill my valuation-based criteria, making it a “HOLD” here.

Read the full article here