Verizon: Best-In-Class

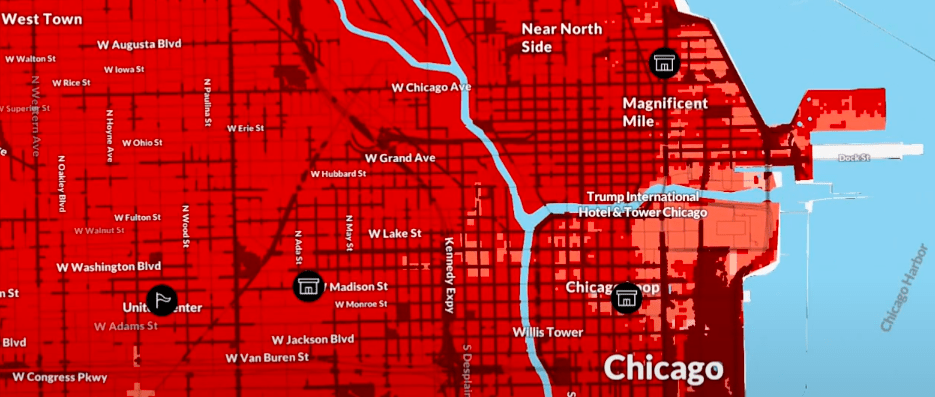

In my last article on Verizon (NYSE:VZ), “Verizon: Blazing-Fast 5G Is A Buy Signal,” I explained why Verizon’s network is in a position of competitive strength. Verizon’s the leader in 5G home internet and has also blanketed major cities with award-winning mmWave (Dark red) and C-Band 5G (Red):

Sample Of Verizon’s mmWave (Verizon)

Now, I will discuss Verizon’s value spread, position vs. MVNOs, inelastic products, and Metaverse tailwinds. Also on the menu: Why I think Verizon will outperform mega-cap tech in a recession, and why Verizon is in a better financial position than T-Mobile (TMUS) and AT&T (T). Let’s begin.

The Value Spread Is Huge

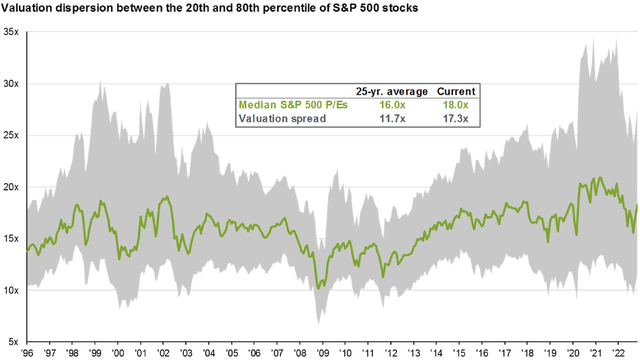

Value stocks have been beaten dow over the past five years. The spread between growth and value is now as wide as it was during the dot-com bubble of 2000:

S&P 500 Value Dispersion (J.P. Morgan Asset Management )

Note: The above graph shows the “dispersion of P/E ratios in the S&P 500 index.”

In fact, the only time the value spread was wider was in 2021 when tech stocks with zero earnings were soaring and digital pictures of monkeys A.K.A. NFT’s were selling for millions of dollars.

So what does this mean? It means now is not the time to own expensive growth stocks, now is the time to own cheap value stocks (In my opinion). Enter Verizon Communications (VZ), which has a PE ratio of 6.8x, compared to the SPDR S&P 500 ETF Trust (SPY)’s PE ratio of 26x. That’s the kind of value spread I can bet against.

Potential For Recession Outperformance

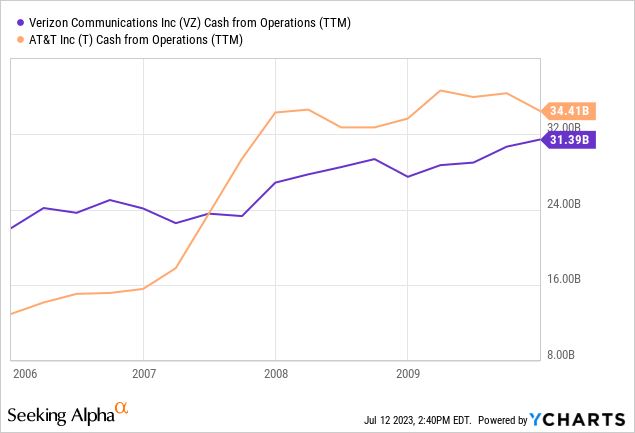

Telecom cash flows have historically held up extremely well in recessions. Through the horrendous recession of 2008/09, Verizon’s cash flows actually grew:

AT&T (T) did alright as well. You see, phone plans and home internet plans enjoy what is called “inelastic demand.” This is because they are essential services. That is, they’re typically the last thing businesses and consumers cut spending on during a recession. And, if the likes of Verizon, AT&T, and T-Mobile (TMUS) should choose to raise prices in unison, consumers will have no choice but to pay up.

Verizon Vs. MVNOs

Even the third party MVNOs like Mint Mobile, Consumer Cellular, and Google Fi are at the whims of the big telecom players because these MVNOs don’t own any infrastructure. Instead, they lease the network capacity from the likes of Verizon, AT&T, and T-Mobile (The companies who actually own the network). In other words, the big telecom players like Verizon have all the pricing power and the little MVNOs have none. Also, Verizon and others tend to give their own subscribers priority over MVNO subscribers ~ this is especially true in congested areas and cities, where Verizon’s subscribers typically get the priority in terms of data speeds.

The Metaverse Opportunity

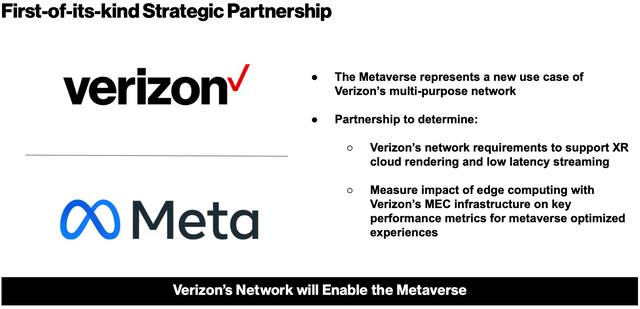

Verizon claims to be well-positioned to capitalize on the Metaverse:

Verizon And Meta Partnership (Verizon)

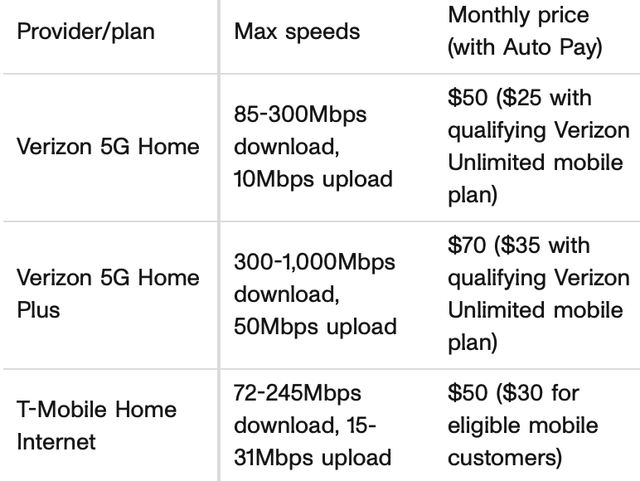

Fortune Business Insights has the Metaverse growing at a CAGR of 48% per annum through to 2029, and Verizon could capitalize on this with its leading position in 5G home internet:

Home Internet Speeds And Prices (CNET)

Industry-Leading Financial Fortitude

Among its peers, Verizon has the best interest coverage (By far) and the best credit rating. This is part of why I prefer Verizon over a company like T-Mobile:

| _____________________ | Verizon | AT&T | T-Mobile |

| Interest Coverage | 7.9x | 3.8x | 2.9x |

| Credit Rating (Fitch) | A- | BBB+ | BBB+ |

| Credit Rating (S&P Global) | BBB+ | BBB | BBB- |

A Beneficiary Of Low Interest Rates

With inflation cooling, many expect a Fed pivot to lower interest rates. So you have tech investors bidding up the prices of the flashiest growth stocks. But, remember that the Fed has two mandates: Stable prices (Low inflation) and maximum employment. I don’t think the Fed is going to attempt to lower rates until unemployment begins to spike up. In other words, until we are in a recession.

As we discussed earlier, Verizon and AT&T’s businesses and cash flows tend to be recession resilient. I would say even more so than the likes of Apple (AAPL), Meta (META), Tesla (TSLA), and Amazon (AMZN) because people can choose to delay buying a new iPhone [Apple], cut spending on advertisements [Meta], postpone the purchase of a luxury vehicle [Tesla], and cancel their prime membership or scale back cloud spending [Amazon]. But, people need their phone and internet connection.

Meanwhile, I think Verizon’s nearly 7.5% dividend will become very attractive with lower interest rates. And, it should be well covered:

| ______________ | 2022 | 2023 | 2024 |

| Operating Cash Flow | $37 Billion | $38 Billion | $39 Billion |

| Capital Expenditures | $23 Billion | $19 Billion | $17 Billion |

| Free Cash Flow | $14 Billion | $19 Billion | $22 Billion |

| Cash Dividends Paid | $11 Billion | $11 Billion | $11 Billion |

Source: Forward estimate by author using Verizon’s CapEx guidance.

Also, lower interest rates are also a positive for Verizon, T-Mobile, and AT&T’s interest expense. You want the debt to roll-over at low interest rates, not high.

Even if interest rates stay elevated, I think Verizon will have the pricing power necessary to offset increasing interest expense. Also, it helps that Verizon’s interest expense is covered nearly 8x over by its operating income.

Potential For Outsized Returns

In the decade ahead, I estimate compound annual returns of 15.5% per annum for Verizon:

| Current EPS | $5.14 |

| Current Dividend | $2.60 |

| Compound Annual Growth Rate | 3.5% |

| Year 10 EPS | $7.25 |

| Terminal Multiple | 11.5x |

| Year 10 Share Price | $83 |

| Annualized Returns (Dividends Reinvested) | 15.5% |

Note: This is a base-case estimate. The compound annual growth rate is for dividends and earnings.

Risks

If I had to dream up a worst-case scenario for Verizon, this would be it:

- Verizon’s marketing team fails to get consumers to see the company’s value proposition and loses a huge chunk of its customers to T-Mobile, reducing cash flows.

- Verizon’s CapEx guidance falls through, and the company has to continue spending around $23 billion in CapEx over the next few years to maintain its competitive position.

- Interest rates and, therefore, interest expense continue to creep higher.

- The telecom industry is unable to raise prices to consumers.

- This combination squeezes Verizon’s free cash flow and causes the company to cut its dividend and pay down debt.

I’ve factored this outcome into my forecast returns of 15.5% per annum, but assigned it a low probability because I think the company’s value proposition is rock solid. If it were to play out, Verizon appears priced to merely match the returns of the S&P 500 going forward, rather than achieve the outsized returns I expect.

Best-In-Class

With the value spread as wide as the 2000 Dot-com bubble, Verizon’s stock has plummeted, and I have a “pounding-the-table” Strong-Buy rating on it. I think Verizon will outperform dramatically in a recession because its products are close to essential. The company trades at just 6.8x earnings despite having a best-in-class position in major cities and 5G home internet, as well as best-in-class financial fortitude. I also like its potential for Metaverse tailwinds and its position against MVNOs. Is Verizon destined to crush the market? Time will tell.

Until next time, happy investing!

Read the full article here