Thesis Summary

Since the start of the year, analysts have been calling for a recession to start in 2023; so far, though, we have experienced immaculate disinflation, a strong economy, and rallying stocks.

But no matter what you do, a recession always comes, and as we approach all-time highs again, now is the time to begin thinking about when the other shoe will drop. Because yes, the shoe will drop, and it’ll be heavier than investors think.

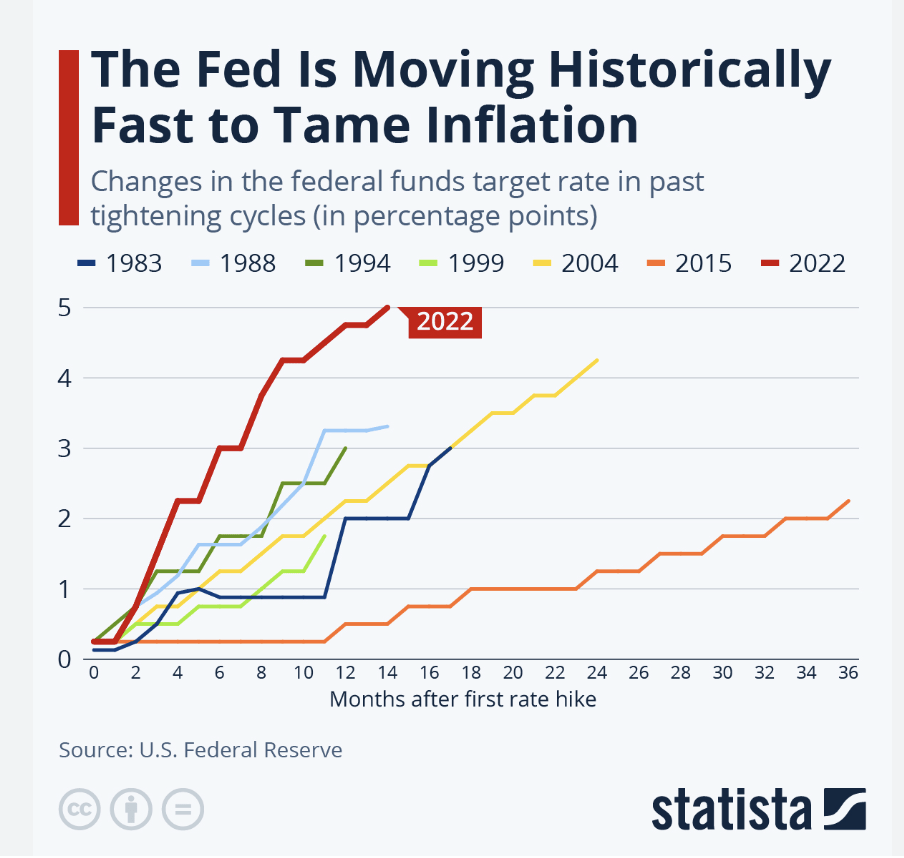

The Fed has carried out the fastest rate of monetary tightening ever witnessed, and it would be naive to believe that an economy, and financial markets, that for the last 20 years have been addicted to debt and zero interest rates will be able to get out of this unscathed.

So, today let’s try to assess how this economic downturn will take place, what its effects will be on markets, and how we can prepare for it.

The Bears Give In

This rally has legs. That is undeniable, and it has been my position for some time. Since stocks started turning up in October, there has been no shortage of reasons as to why this rally was unsustainable.

First, it was, the “inflation will be stubborn” narrative. The way I see it, Wednesday’s CPI data was the nail in the coffin of this thesis. I still think we could see resilient disinflation, but the path now is clear, and it should eventually lead to deflation.

Then it was the “only mega caps are rallying, we have no market breadth” argument. Funny how articles are now coming out pointing out the rotation from Nasdaq (NDX) into smaller caps names in the Russell 2000 Index (IWM). This is in fact, a move I called, quite accurately, back in May.

It looks like the bears are giving in, so now might be the time actually to start worrying.

The Fed Has Really Tightened The Screws

A lot of investors seem surprised that the US economy has thrived so well in the face of the fastest monetary tightenings in history.

Fed tightening (Statista)

Instead of a recession, we got surprisingly good earnings on the back of a strong consumer and a tight labour market.

One explanation for this could be that real earnings have actually been increasing in recent months. As inflation has been coming down, wages have been catching up, meaning that there is, in fact, more purchasing power available to consumers.

Although it seems like everything is under control, it was only a few months ago that regional banks were on the brink of collapse. What will the next black swan be? It’s hard to say, but we can do our best to predict it.

The Pain Has Yet To Come

The way I see it, we have a confluence of factors coming into 2024 and beyond that could really shake up markets.

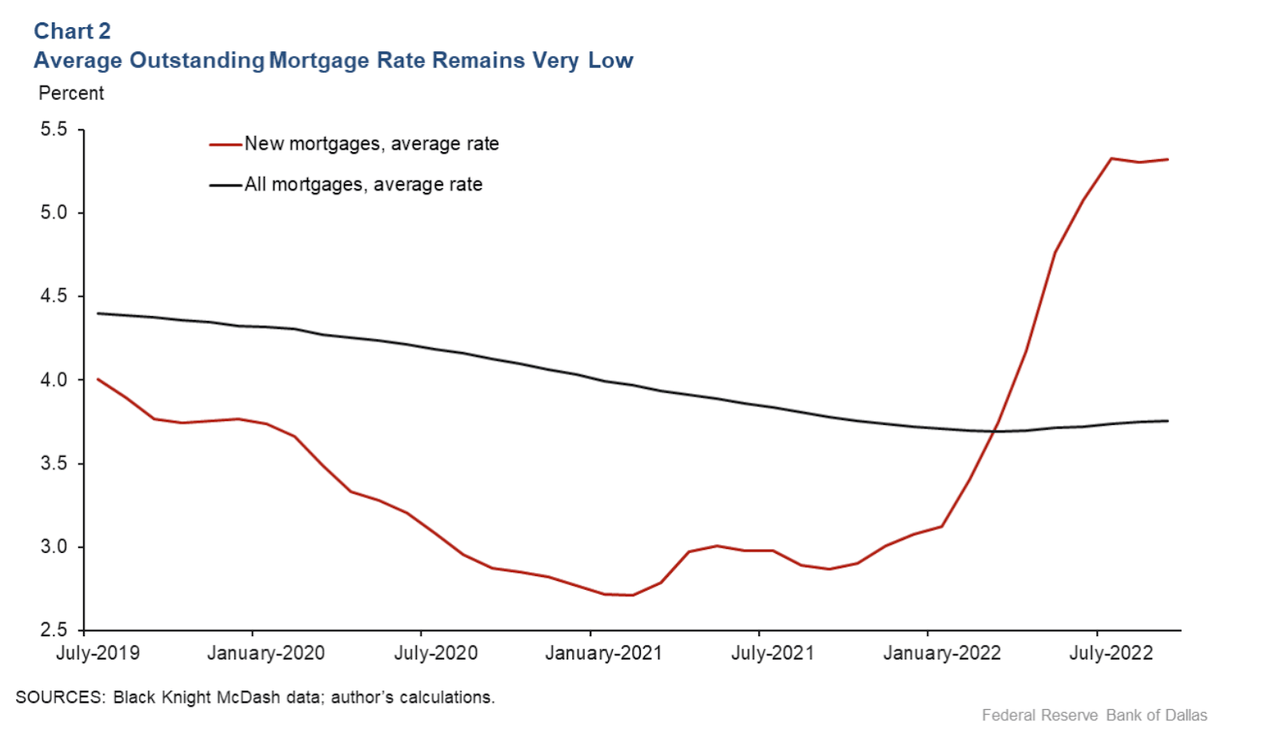

For starters, the economy has yet to feel the real effects of monetary policy, which has a lagged effect. This is clear when we look at how the effective mortgage rate has yet to catch up with current mortgage rates.

Mortgage rates (Black Knight McDeam)

While yes, current mortgage rates today are nearing 7%, the effective rate of mortgages is much closer to 4%. Most consumers are trying to hold off from buying/selling their house as they wait for more favourable interest rate conditions. However, the Fed has made it clear that it wants to keep rates near these levels for some time, and it is just a matter of time before effective mortgage rates catch up to the levels of new mortgages.

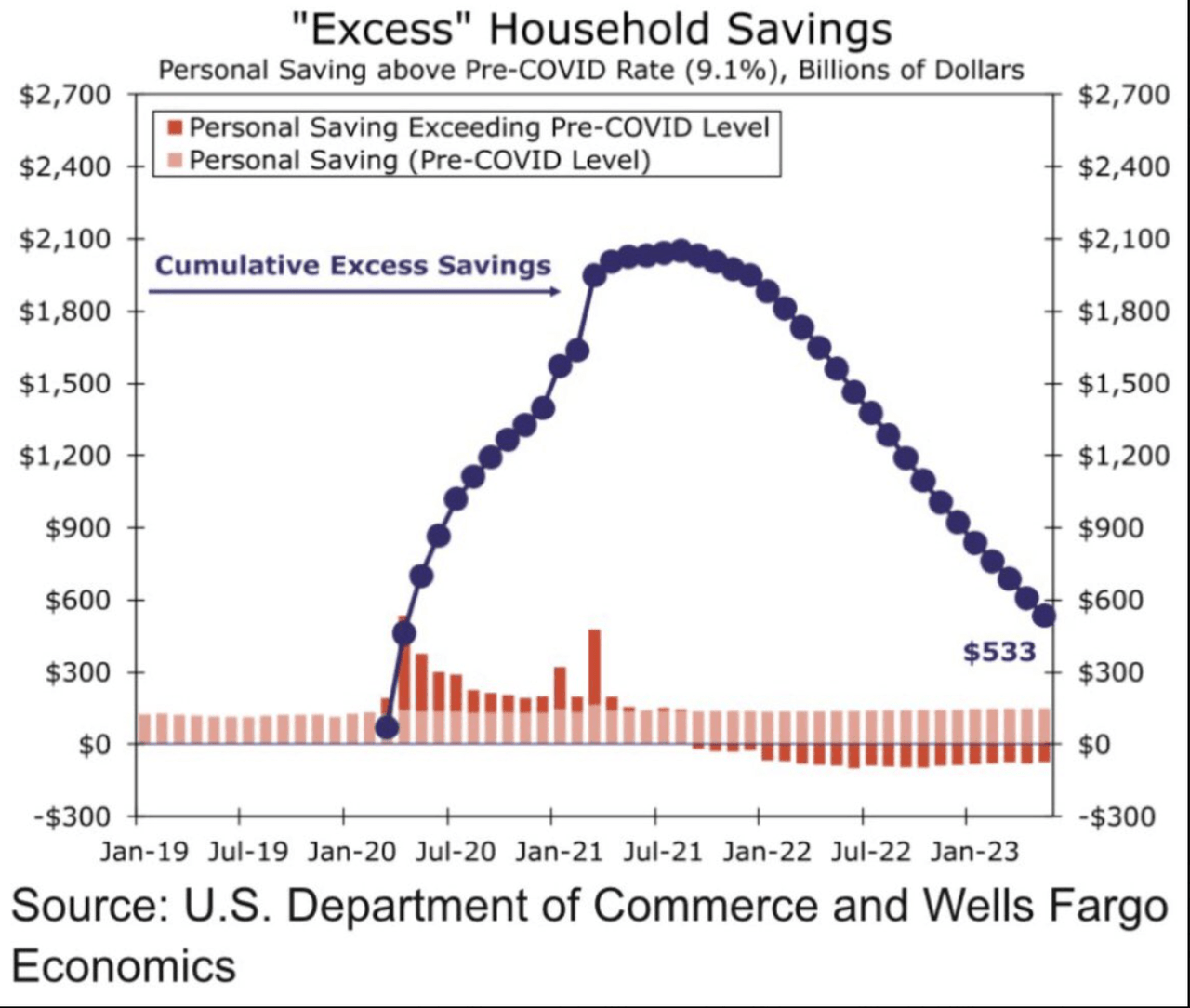

This is not great news for the US consumer, and that’s not all. By the looks of it, US consumers will be running out of excess savings by late 2023 or early 2024.

Excess savings (Wells Fargo)

We should expect consumers to begin to tighten their belts, which will be reflected in company earnings moving forward.

Speaking of companies, this will likely also be another key factor in sparking a deflationary recession. The dynamics pointed out above for consumers and mortgages will also play out with companies.

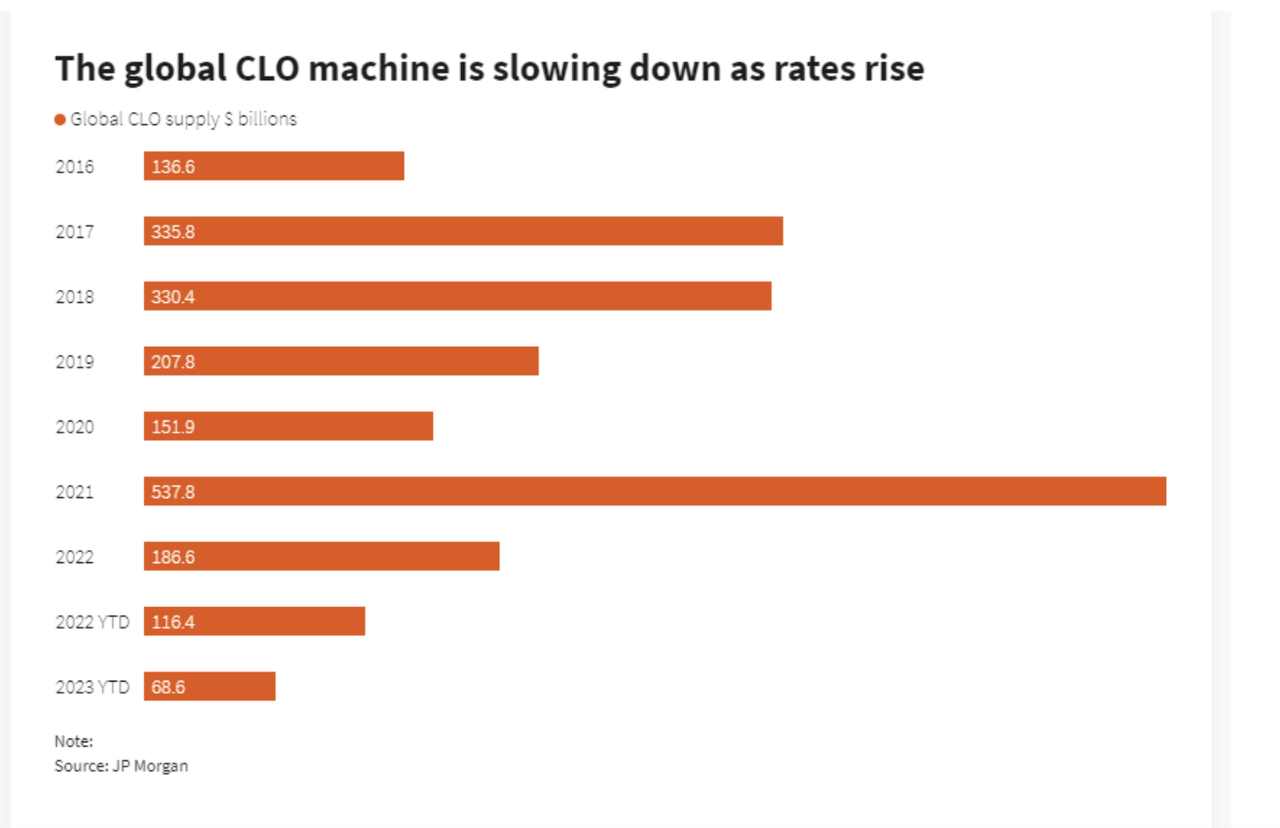

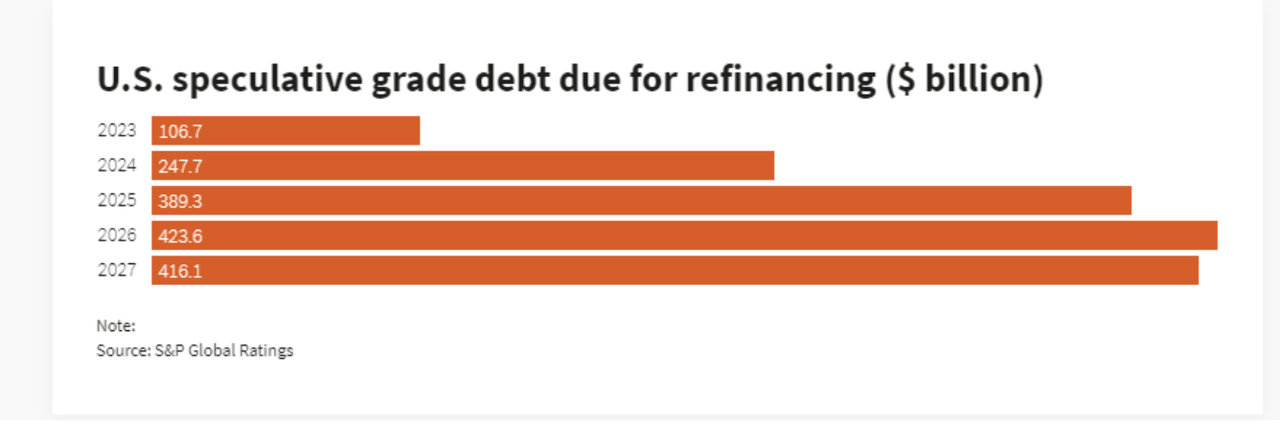

Following the COVID pandemic, everyone was flush with cash and low interest debt, but this debt will have to be rolled over soon, and this could lead to a $1.5 trillion problem. This is the amount of collateralized loan obligations issued by high-risk companies.

“There haven’t been large credit losses yet, but the expectation is that bankruptcy rates [for corporate loans] will go up,” said Rob Shrekgast, a director at KopenTech, an electronic trading and analytics platform for CLOs.

CLO market (JPMorgan)

As we can see, investors were more than happy to lend to high-risk borrowers in 2021, but the market is drying up, and loans are due.

CLO debt maturity (JPMorgan)

2025, in particular will be rough, with $389.3 billion in need of refinancing.

To sum up, we have effective mortgage rates catching up to the actual rates of new mortgages, consumers running out of savings and companies having to refinance junk debt at much higher rates in the coming two years.

How This Plays Out

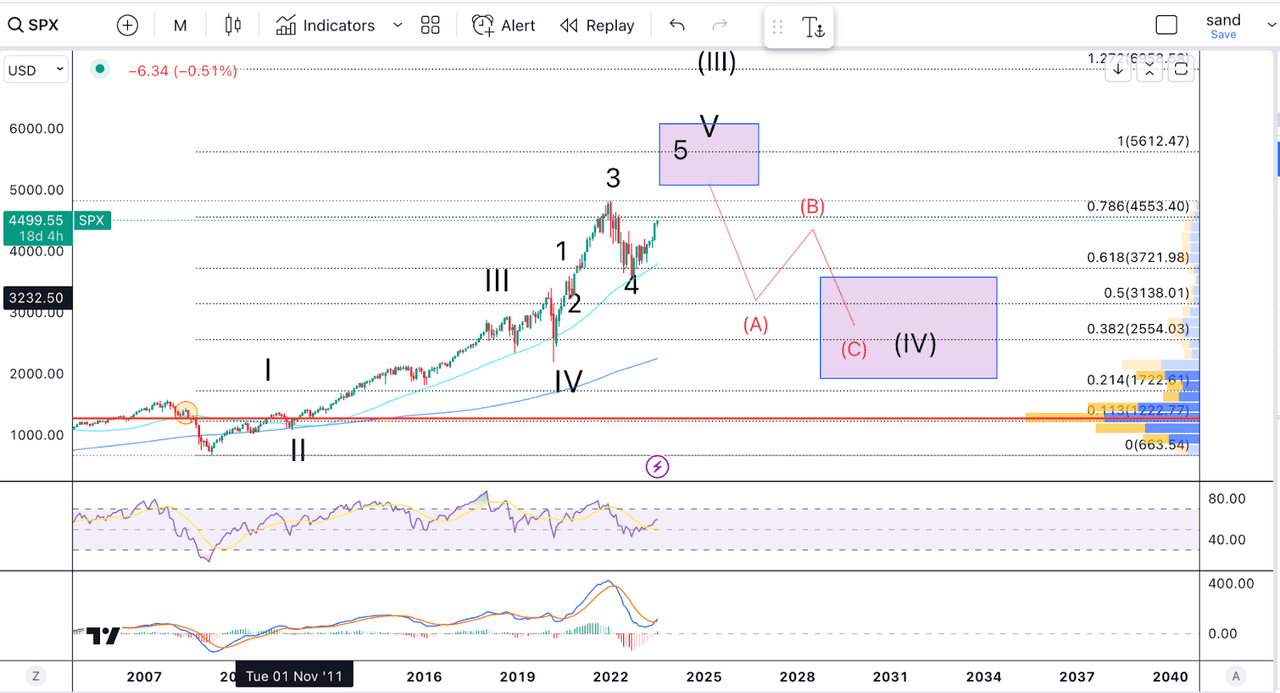

The way I see it, this is setting us up for a massive deflationary recession. I’d expect both the housing and the corporate debt market to begin to weaken, which will slowly percolate through the real economy. Demand will weaken further, and eventually, so will the labour market. Many of the banks that are already struggling with their bond portfolios will find themselves in trouble again, and yes, stocks will likely come down, but only after we get one more high into the 5500 point region in SPX.

SPX (Author’s work)

This target is based on my long-term Elliott Wave count. I believe that since 2009 we have been forming a five wave structure within a large degree wave (III). This would mean right now we are in wave 5 of V of (III). In other words, the last legs of a decade-long bull market, which could be followed by a decade-long bear market.

Assuming we reach a market top around 5500 points, then the retracement in wave (IV) could take us all the way down to 2550 points, which is where we have the 61.8% retracement.

At this point, we will likely get another round of unprecedented monetary and fiscal stimulus, which will probably set us up for yet another wave of inflation.

Final Thoughts

In conclusion, though I am still long equities, the long-term picture doesn’t look great for US stocks. This is why I am building a highly diversified portfolio of international equities, cryptocurrencies, precious metals and commodities. I think these asset classes could perform much better in the next 20 years.

Read the full article here