Intuitive Surgical (NASDAQ: ISRG) will report its Q2 2023 results on Thursday, July 20. We expect the company’s revenues to come in at $1.7 billion, aligning with the consensus estimate. This would mark year-over-year growth of about 12%. Earnings are likely to come in at about $1.32 on a per-share and adjusted basis, in line with the consensus estimate. See our interactive dashboard analysis on Intuitive Surgical Earnings Preview for more details on how the company’s revenues and earnings will likely trend for the quarter. So, what are some of the trends that are likely to drive Intuitive Surgical’s

ISRG

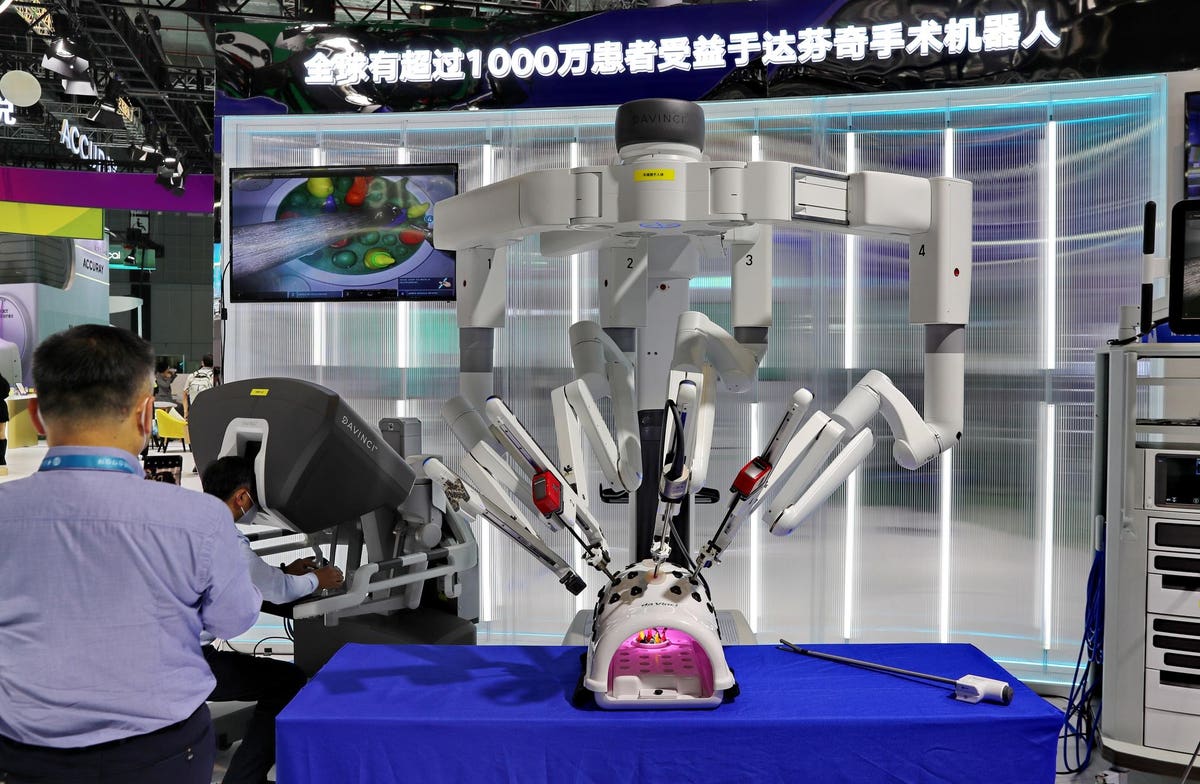

The company will likely continue to benefit from a rise in total procedure volume. The company continues to expand its installed base, which results in the growth of recurring revenues, such as consumables. Intuitive Surgical’s revenue of $1.7 billion in Q1’23 reflected a 14% y-o-y rise, with instruments and accessories seeing 22% growth, services up 14%, and the systems segment seeing no growth. Overall procedure volume was up a solid 26%, and the company’s installed base grew 12% to 7,779 systems.

Intuitive Surgical reported a 6% rise in adjusted net income to $437 million in Q1, as the 14% sales growth was partly offset by over 400 bps fall in operating margin. This can primarily be attributed to higher fixed and component costs. With elevated inflation, the costs may remain high for the company in the near term. Our Intuitive Surgical Operating Income Comparison dashboard has more details.

Not only do we expect Intuitive Surgical to post an in-line Q2, we believe its stock is fully valued. We estimate Intuitive Surgical’s Valuation to be around $313 per share, which is 8% below the current market price of $339. This represents a 57x P/E multiple based on our forward adjusted earnings expectation of $5.48. ISRG stock enjoys a higher valuation multiple, given the substantial revenue and earnings growth over the past years.

Note: P/E Multiples are based on Share Price at the end of the year and reported (or expected) Adjusted Earnings for the full year

While ISRG stock looks appropriately priced, it is helpful to see how Intuitive Surgical’s Peers fare on metrics that matter. You will find other valuable comparisons for companies across industries at Peer Comparisons.

What if you’re looking for a more balanced portfolio instead? Here’s a high-quality portfolio that’s beaten the market consistently since 2016.

Invest with Trefis Market Beating Portfolios

See all Trefis Price Estimates

Read the full article here