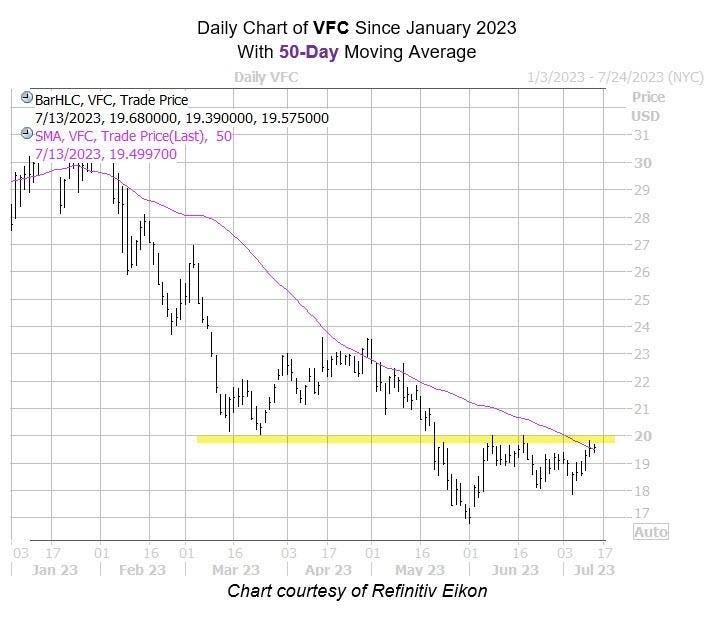

Shares of VF Corp (VFC) have struggled on the charts, but from a technical point of view, there seems to be two clear culprits of its recent bout of bad luck. A surefire contributor to the equity’s 28% year-to-date deficit, the $20 mark moved in as a ceiling in mid-May. In fact, this level of resistance once acted as support for the security. The stock is also facing off with a historically bearish trendline, suggesting now may be the ideal time to buy more puts on VFC.

VF Corp stock is running into its 50-day moving average. Per Schaeffer’s Senior Quantitative Analyst Rocky White’s last study, the stock saw seven similar signals in the past three years. One month later the stock was lower 57% of the time, averaging a 2.8% loss. Last seen trading flat at $19.59, a move of similar magnitude would send VFC back toward its early June lows.

There is still some room for downgrades, which would generate additional headwinds for the shares. Heading into today, nine of the 23 covering brokerage firms sport a “buy” or better recommendation.

Options look relatively cheap, too, per the equity’s Schaeffer’s Volatility Index (SVI). VF Corp stock’s SVI of 46% sits in the low 33rd percentile of its 12-month range. In other words, options traders are pricing in low volatility expectations right now.

Read the full article here