Thesis

This article examines the potential risks and headwinds that could affect StepStone Group’s (NASDAQ:STEP) financial health and growth prospects, including market volatility, competition in the private markets space, a slowdown in venture fundraising, geopolitical risks associated with its international expansion plans, and the efficacy of its data and technology capabilities. Ultimately, I believe that my analysis will provide investors with an informed opinion on whether or not they should consider selling the stock to avoid potential losses.

What does the company do?

According to Seeking Alpha’s company profile, the StepStone Group is renowned for its extensive array of investment strategies, as it allocates funds to direct investments, funds of funds, secondary direct and secondary indirect investments alike. STEP boasts an expansive portfolio, comprising natural resources, technology, healthcare services, materials manufacturing, consumer goods hospitality media retail finance telecom energy infrastructure real estate real assets among others.

The scale of their investments ranges with allocations from $15 million to $200 million in companies with enterprise values between $150 million and $25,000 million. STEP also places significant emphasis on emerging markets, with investment percentages extending from 5% to 40%. Furthermore, the firm’s fund of fund investments is also well-rounded, as it encompasses private equity funds, venture capital funds, special situation funds, real estate funds, infrastructure funds, mezzanine funds, and turnaround/distressed funds.

A Review of Expectations, Performance, and Valuation

Overall, Wall Street’s six analysts that cover the stock appear to be very optimistic on StepStone’s share price trajectory with an average price target of around $29 which represents a substantial 33% upside from the time of this writing. Although, only one analyst has a “strong buy” rating, all others are in the “hold” camp.

Seeking Alpha

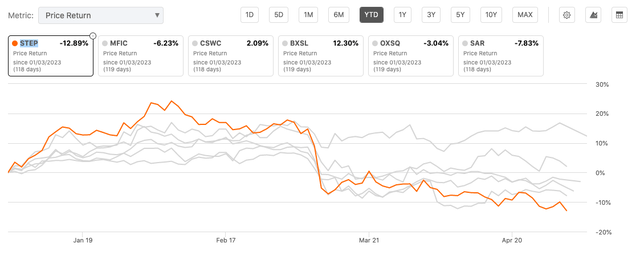

Performance wise, unfortunately, STEP is on the bottom step, if you will, taking last place against its peers with BXSL the clear winner in the group overall.

Seeking Alpha

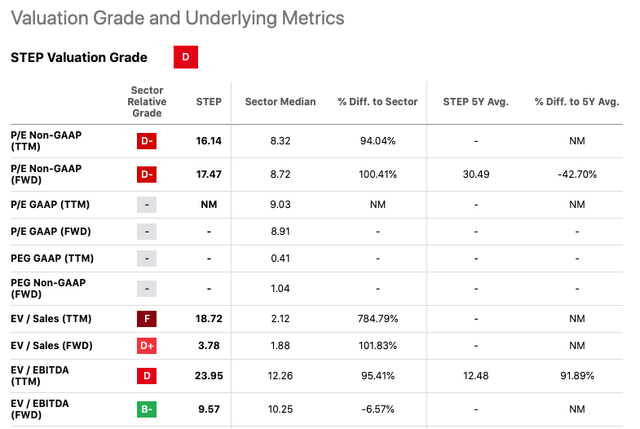

On the valuation front, I see several red flags that warrant caution for investors. The firm’s valuation grades are consistently below average, and its relative performance in the sector is also disappointing, so at this point, I’m beginning to wonder about all that Wall Street optimism I just talked about. Perhaps, as we dive deeper into their last earnings report and some fundamentals we’ll get some better insights.

Seeking Alpha

Okay, so starting with the P/E Non-GAAP (TTM) ratio, StepStone is at a staggering 16.14, which is 94.04% higher than the sector median of 8.32. This indicates that the company is significantly overvalued compared to its peers, and investors may not be receiving sufficient value for their investment. The P/E Non-GAAP (FWD) ratio tells a similar story, with StepStone trading at a premium of 100.41% compared to the sector median.

Regarding the EV/Sales (TTM) ratio, StepStone’s figure of 18.72 represents a 784.79% premium compared to the sector median of 2.12 which earns it a big fat “F” grade from Seeking Alpha. This is a concerning statistic for investors, as it suggests that the company’s stock is significantly overvalued relative to its sales. Additionally, the EV/EBITDA (TTM) ratio at 23.95 is 95.41% higher than the sector median, further confirming the overvaluation concerns.

On the positive side, the EV/EBITDA (FWD) ratio is slightly below the sector median, indicating that the company may be more fairly valued on a forward-looking basis. The EV/EBIT (FWD) ratio also indicates a slight undervaluation compared to the sector median.

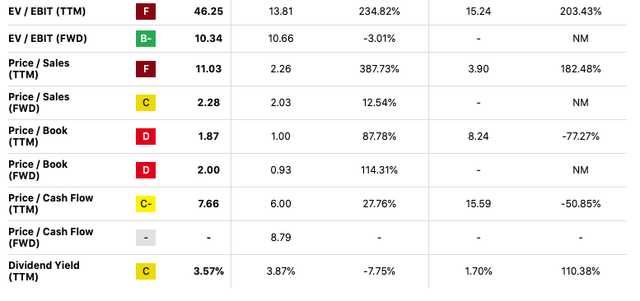

Seeking Alpha

However, the Price/Sales (TTM) ratio of 11.03 is 387.73% higher than the sector median, implying that the stock is significantly overpriced relative to its sales. The Price/Book (TTM) ratio is also concerning, with a value of 1.87, representing an 87.78% premium compared to the sector median of 1.00.

And finally, on the sacred dividend front for many fixed income investors, StepStone’s TTM dividend yield of 3.57% is slightly below the sector median of 3.87%. While this may be a small positive for income-oriented investors, the overall valuation concerns outweigh this minor advantage.

Q3 2023 Bullish Bullet Points

(source: Seeking Alpha)

- SPRIM and SPRING have demonstrated remarkable investment prowess, boasting a 30% annualized return since their inception.

- Over the past year, fee-earning assets have swelled by $12 billion, a 16% increase. A substantial $14 billion in undeployed fee-earning capital presents the firm with a lucrative opportunity to capitalize on judicious and disciplined investments in down markets.

- The company’s blended management fee rate has risen to 54 basis points, exceeding previous years as a result of a shift toward commingled funds, spurred by the contributions from their burgeoning venture capital platform.

- Shareholders will be rewarded with a quarterly dividend linked to fee-related earnings, supplemented by an annual recurring supplemental dividend, which is contingent upon realized performance-based earnings and subject to board approval.

- The potential within the market for secondaries appears quite promising, given that private market fundraising has averaged a robust sum of over $1 trillion per annum since 2016. Furthermore, unrealized private asset value now hovers around an impressive $10 trillion.

Q3 2023 Bearish Bullet Points

(source: Seeking Alpha)

- During the quarter, the gross realized performance and incentive fees amounted to $19 million, exhibiting a decline in comparison to previous periods.

- The annualized net income (ANI) per share experienced a decrease relative to the previous year, despite witnessing a long-term growth rate of 33% annually.

- The quarter concluded with gross accrued carry standing at approximately $1.1 billion, which is about $60 million less than the preceding quarter.

- The realized net performance fees per share have undergone a 37% reduction since the fiscal year of 2018, counterbalancing the 24% growth in per share management and advisory fees.

- An adjusted net loss was reported at $13.6 million while adjusted net income reached $31.2 million, leading to an adjusted net income per share figure of $0.27 and both reflecting a reduction from previous years.

- Fundraising activities have experienced a decrease in activity levels relative to those witnessed over recent years.

StepStone’s Strong Performance and Expansion Strategy

On the surface, StepStone demonstrated strong performance, fueled by increasing demand from both domestic and international clients. This growth supports the firm’s total capital responsibility of $602 billion and $134 billion in assets under management whereby management attributes this success to the effective expansion of the company’s retail platform in the Asian and Australian markets that is expected to continue, potentially boosting market share and revenue. In the conference call, CEO Scott Hall noted how those regions function “differently”:

So, the markets are structured slightly differently, right, market-to-market in terms of who the major players are and how they function. Europe doesn’t really have the IBD kind of platforms. It tends to be private bank driven, although there are a couple of bold bracket versions of that, that look a bit more like the wires as well. Asia, larger institutions, not a lot of the independent RIA type market and then Australia, a little bit of a mix. In terms of how we prosecute that from a go-to-market perspective, we can probably get by with a little bit less density on the private wealth team to cover those markets just due to a smaller number of players that are active in the private markets or expect to be active in the private markets. That would probably be the biggest difference, I would say.

Seemingly, StepStone’s results appear to underscore an efficacy in its strategy and investments, as evidenced by consistent inflows of funds from Limited Partners and General Partners whereby the firm is emerging as a dominant player in the secondaries market. Echoing that, CEO Hart commented:

Furthermore, the venture capital secondaries market is becoming much more active. There are well over $1 trillion of unrealized venture assets and vintages from 2018 and earlier, which we anticipate will spur an acceleration in BC secondary deal flow. We have the largest venture secondaries fund in the market today and we believe we are well positioned to continue to benefit with future funds. This interest in venture and growth equity is shared by our clients

However, the company faces stiff competition in a market consisting of approximately 4,500 private equity firms in the United States and 16,000 private equity-backed companies.

Active Pursuit of a Global, Diversified Platform

As far as its pursuit of a global, diversified platform, StepStone has actively expanded its private wealth channel through SPRIM and SPRING which I highlighted in the bullet points, aiming to capture the anticipated growth in the Global Private Equity Market that is predicted to grow at a CAGR of over 10% in the coming years.

Regarding the firm’s corporate expansion, StepStone has also demonstrated a propensity for acquiring and integrating large senior teams, as exemplified by the recent acquisition of the boutique-sized Greenspring. Elaborating on Greenspring, Mike McCabe, Head of Strategy said:

…I think it was a good case study and a working example of how we augmented our existing venture capital base and accelerated our growth to $22 billion of AUM with that transaction with a deep team that had a 20-year track record.

Moving on to the company’s Fee Related Earnings (FRE) margin of 33%, it’s seen significant growth since going public, with management optimistically boasting predictions of achieving a mid-30s margin over the medium to long term. If it bears fruit, it would further showcase StepStone’s ability to balance growth and profitability while investing in its team and acquisitions like Greenspring to fuel future growth prospects.

Retail Segment Growth and Low Redemptions

STEP’s retail segment has enjoyed sustained growth without a notable increase in redemptions (only just over 1% for the quarter). Management said that it’s likely due to the company’s private wealth team effectively educating and conducting diligence sessions with financial advisors, who in turn appease their clients, particularly during tumultuous market conditions like we’ve recently seen, and most likely, will see again. How soon? Only time will tell.

Capitalizing on Shifts in the Venture Business

Moreover, StepStone’s venture business seems to be well-positioned to capitalize on the shift towards sustainable and profitable growth among portfolio companies. CEO Hart added more color to that by stating:

Furthermore, the venture capital secondaries market is becoming much more active. There are well over $1 trillion of unrealized venture assets and vintages from 2018 and earlier, which we anticipate will spur an acceleration in BC secondary deal flow. We have the largest venture secondaries fund in the market today and we believe we are well positioned to continue to benefit with future funds. This interest in venture and growth equity is shared by our clients. Last week, we hosted our Venture Capital Annual Meeting, where we had nearly 400 clients attend. While venture portfolios have been impacted, there is growing optimism about the go-forward investment opportunity.

So despite a 35% decline in global venture funding from $681 billion in 2021 to $445 billion in 2022, this could very well present opportunities within the venture asset class.

Balanced Client Sentiment and Allocation

And finally, overall, management reports that client sentiment appears balanced, with some clients slightly reducing allocations entering 2023, while an equal number maintain or marginally increase allocations. CEO Hart noted,

Look, I would say sentiment continues to be pretty balanced, hard to generalize in some cases because for every client that we have today that may be slightly decreasing their allocations coming into 2023, there are a similar number that are maintaining flat or slightly increasing allocations.

In other words, the prevailing sentiment from management is that current vintage years offer opportunities that should not be missed, and clients recognize that commitments made now will influence allocations in the years to come. So, for the sake of STEP’s reputation, let’s hope its clients and managers make the right moves today.

Risks and Headwinds

Firstly, and probably the most obvious, market volatility could have an adverse impact on StepStone’s financial health. If we’re on the cusp of a minor, or worse, a major downtown, investors will certainly adopt a more conservative stance, or need to withdraw funds, which would potentially lead to reduced demand for the firm’s services and a decline in its profitability.

Secondly, the aforementioned competition in the private markets space is another factor that could curtail StepStone’s growth. As new entrants and existing rivals strive for market share, they may deploy aggressive strategies and offer competitive pricing, compelling StepStone to adapt its approach or face stagnation.

Furthermore, a slowdown in venture fundraising could directly impact StepStone’s core business. A potential drop in available capital might result in fewer investment opportunities and lower overall deal flow, which would, in turn, translate into diminished returns and erode the firm’s growth prospects.

Additionally, StepStone’s ongoing expansion into international markets is not without its unique challenges either. These ventures expose the firm to geopolitical risks, currency fluctuations, and regulatory hurdles, all of which could hinder its global growth plans.

Finally, the efficacy of StepStone’s data and technology capabilities may not necessarily translate into consistent returns. While advanced analytics and data-driven insights can contribute to better decision-making, the unpredictable nature of financial markets could still yield suboptimal outcomes.

Final Takeaway

Despite StepStone’s strong performance and expansion strategy, several valuation red flags indicated to me that the stock may be significantly overvalued compared to its peers. And as competition in the private markets space intensifies and various risks persist, I think that investors should consider selling the stock to avoid potential losses.

Read the full article here