For family business owners, the decision to sell all or part of their business is often one of the most difficult moments of their lives. One or several generations’ work and legacy are being put on the block, with expectations and emotions running high. How do you know you’re getting the right price? What do you need to do to attract the right buyers? To what extent can the family, including the next generation, remain involved with the business?

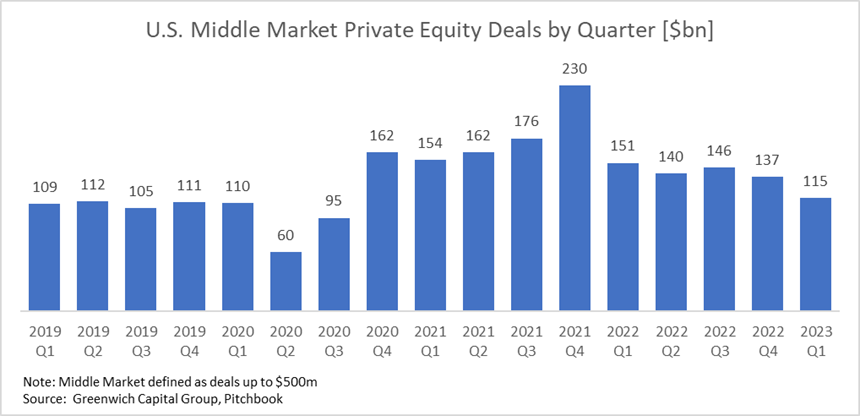

The immediate temptation, often reinforced by advisors, will be to focus on optimizing financial considerations. But the reality is that trying to “time the market” is extremely difficult. Looking at the past few years with perfect hindsight, an owner “should have” sold their business in the last quarter of 2021, when buyer interest and multiples reached a historic peak. As the graph below illustrates, that peak was short lived.

For full-year 2022, middle market M&A declined 21% in value and 10% in volume from the prior year, and almost two-thirds of PE firms expect M&A volumes in 2023 to be lower or flat compared to 2022. Since even a smooth sales process takes two or three quarters, and most processes have significant twists and turns, a business timing the peak would have been the equivalent of a surfer trying to catch waves running at several times their speed.

So, if optimizing financial considerations is already so difficult, what about the other considerations and complexities affecting the sale of a family business – legacy, expectations, and satisfying a multitude of stakeholders? In our experience, correctly prioritizing and navigating through those issues, more than optimizing the timing of any transaction, often simplifies the process. The result can be that the owner feels confident that she made the right decision about a sale, her future, and the future of the business.

Do You Hate Mondays?

At Brightstar Capital Partners, we frequently speak with family business owners who are contemplating a sale but aren’t sure that they’re ready to make that big leap. Before getting into the financial and valuation aspects, we ask them a series of simple questions, such as:

- Do you hate Mondays?

- What makes you excited about the business?

- Is there something you’d rather be doing with your life post-sale?

- What are the goals and aspirations of the next generation?

“Do you hate Mondays” is our metaphor for, “do you no longer enjoy the thought of an intense five days ahead, running and operating your business?” It opens the door to a conversation about what sort of hands-on partnership with a new investor might work – and restores a love of Mondays.

All those questions aim to get the owner focused on those elements of the sale decision that go beyond pure economics. We believe those elements will help the owners choose the right partner for a potential transaction, where the family can be confident their business is in the right hands for the next phase of growth. And with the right partnership, financial considerations can be optimized over a long period rather than just one sale event – the equivalent of a surfer being towed back out to catch the next big wave.

Considering the aspirations and readiness of the next generation is also a vital part of the sale decision. The North America Family Business Report 2023, recently published by Brightstar Capital Partners and Campden Wealth, found that the overarching goal of “Next Gen” family members is to protect and sustain the family business, according to 81% of survey respondents. That said, 22% of the family business owners surveyed felt there were no next generation members either willing or sufficiently qualified to take over. Taking the time to potentially train the next generation is a far more important call than trying to optimize market timing.

It is also critical for owners to evaluate if the business is truly ready for a sale. We tell owners that it can take up to 18 months to get a business into sale-ready shape. Potential buyers will conduct an intensive due diligence process, and will require (among other things):

- Up-to-date, audited business records, contracts, supplier agreements

- Audited financial statements

- Evidence of solid infrastructure, particularly on the technology and cyber side

- Well-established leadership structures and risk management processes

The good news is that all those diligence steps ultimately make the business stronger – so they are valuable whether or not a sale takes place. And in the case of a sale, they can help find a better partner, positioning the business and family legacy for long-term success. Our experience is very clear – long-term vision and patience have made so many family businesses into the powerhouses they are. We are confident that it is also the right approach when looking at the sale of the business – owners should stay in control of timing until the day the sales documents are signed.

Read the full article here