Investment Summary

When looking over the transportation industry there seems to have been a lot of disappointing earnings across many companies, but XPO Inc (NYSE:XPO) is a shining light that showcases its resilience and ability to hedge downturns in the cycle and outperform. Even though the YoY revenue growth might have been small, the EPS grew by 22% which is very impressive as fuel prices have increased and margins squeezed for many companies. But with the international presence that XPO holds they seem to have managed very fine nonetheless.

After the report came out on May 4 the share price has been in a strong uptrend and XPO now boasts a FWD P/E of 25. The shares are up nearly 100% in the last 12 months and I think there is a strong possibility of a correction as XPO is trading 47% above the sector and its 5-year average p/e of 16. Despite growth being impressive and XPO noting they are gaining more market share I can help but to think we might see better entry prices in the short term for investors seeking to start a position. Right now I am rating XPO stock a hold.

Company Overview

XPO has its history dating back to 2000 when it was founded. Since then the company has grown into a major player in the ground cargo transportation industry and boasts a significant market share.

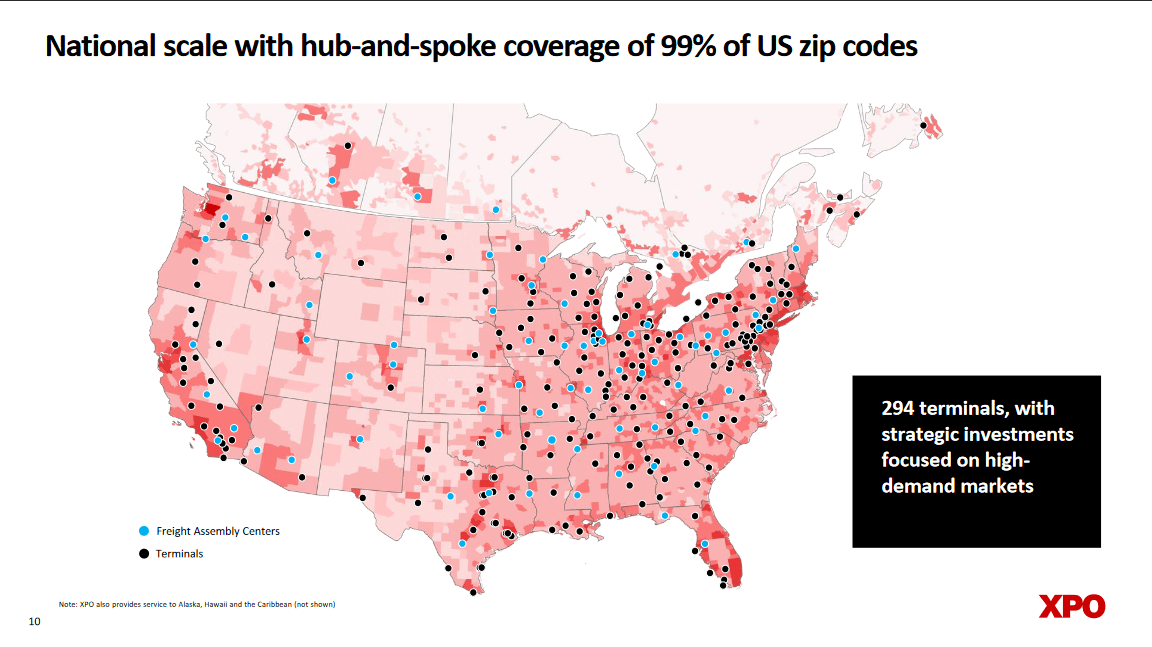

Market Footprint (Investor Presentation)

With 294 terminals across the US, XPO can cover 99% of all US zip codes which presents them as a very intriguing option for customers in my opinion. Where XPO has been very successful is in establishing strong and lasting relationships with companies that need consistent transportation and ones that make deliveries regularly. Some of the major names include Caterpillar Inc (CAT) and Deere & Company (DE).

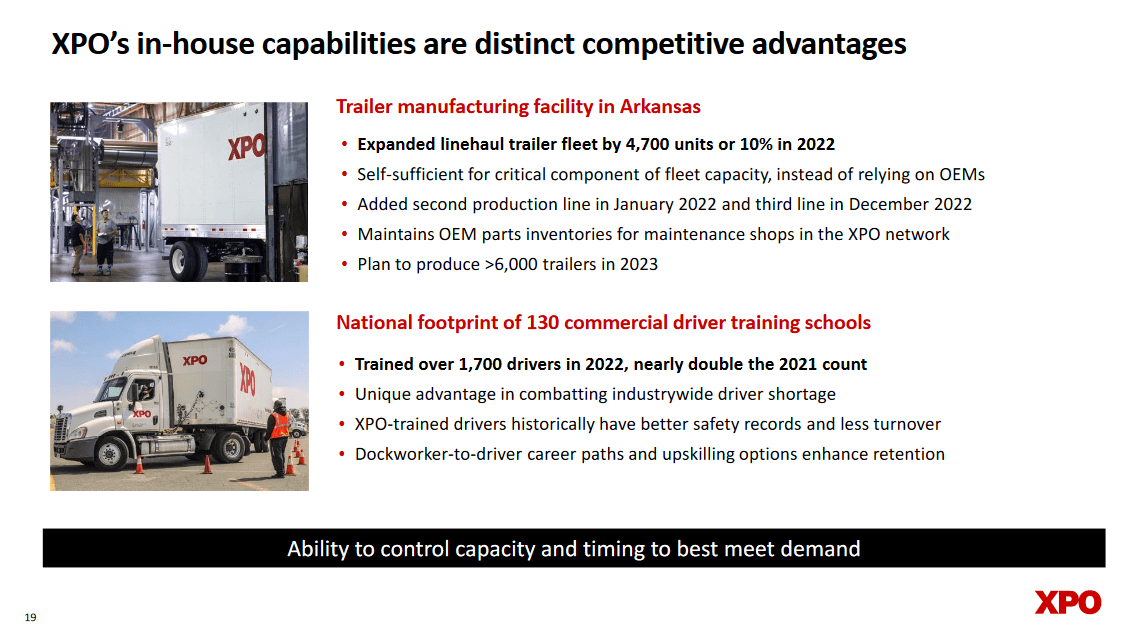

XPO Overview (Investor Presentation)

As the employees of the company are the driving force behind expansion XPO prioritizes maintaining a strong retention rate and keeping them happy. They have pushed heavily in growing their employees and in 2022 alone they trained over 1.700 drivers and expanded the fleet by 4.700 units. The company structures its business into two primary segments, the North American LTL and European Transportation. The North American segment makes up the majority of the revenues, around 70% in the last quarter. The North American segment provides customers with less-then-truckload shipments but also cross-border deliveries to Mexico, Canada, and the Caribbean.

Market Footprint

The transportation and freight market is a difficult one to operate in as it is heavily dependent on strong economic activity which increases demand for deliveries and shipments. But they also need to efficiently battle higher fuel expenses in certain periods. Currently, the outlook seems to be that demand will be somewhat consistent in the US as production and sales remain stable, but lower freight rates are placing pressure on margins for companies like XPO and others.

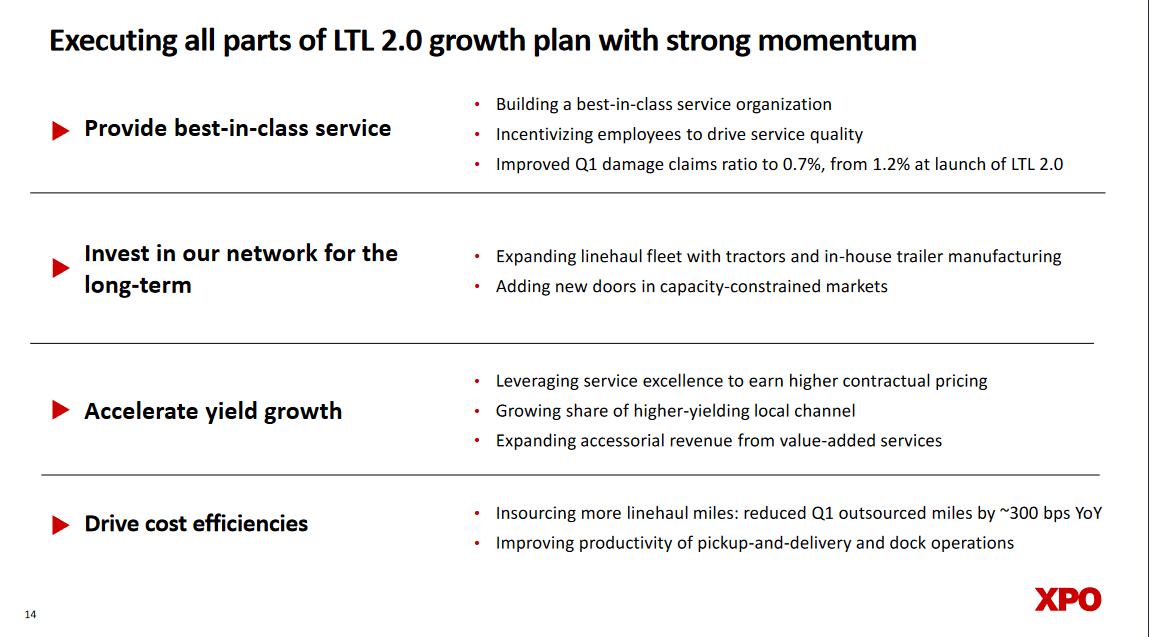

Growth Plan (Earnings Presentation)

To accelerate the growth of the business XPO is ensuring they are in a strong position when the cycle comes around again. Right now I think we are in the bottom part of the cycle as some important key notifications of that are equipment orders rising and rates beginning to rise somewhat. Right now the rates aren’t where they were in 2022 when we experienced the late part of the cycle or the euphoric state. What XPO is doing to set itself up is expanding the fleet to capture even more revenue growth and secure market share.

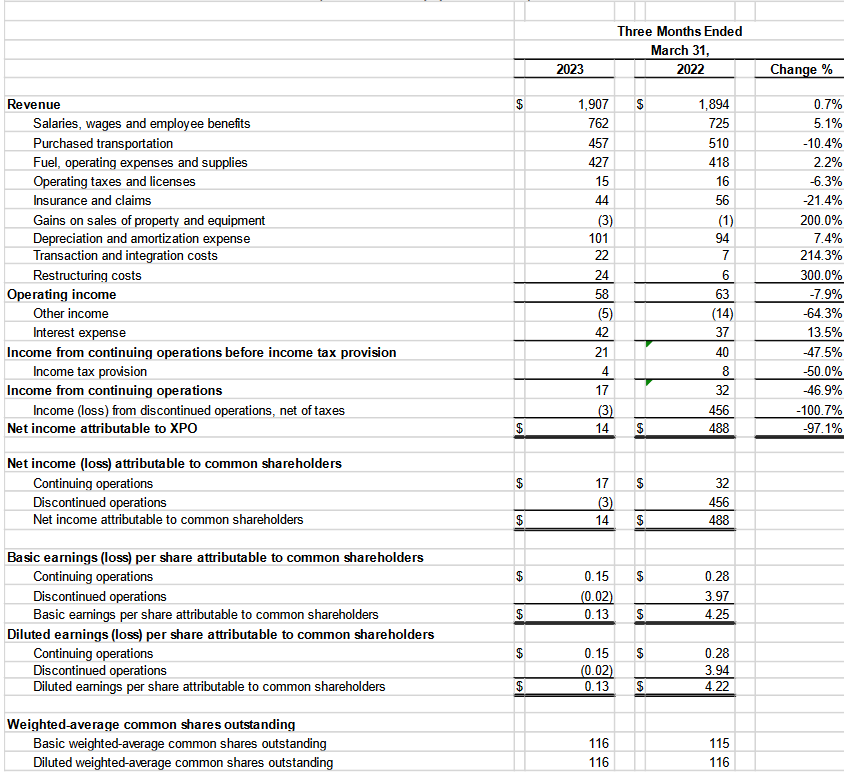

Quarterly Results

Looking at the last earnings report from XPO it was a real success in my opinion. They were despite the better rates last year able to increase the EPS by 22% YoY, and the revenues also.

Income Statement (Q1 Report)

The company is still spending capital on purchased transportation, but it is down 10% YoY, which helped offset some more bottom-line growth. What makes me optimistic about the coming quarters is the fact that XPO has hedged very well against fuel expenses and the Q1 FY2023 report only showed this part growing 2.2% YoY. The management comments on the quarter were interesting to read, CEO Mario Harik said the following, “Demand remains soft, with a negative impact on tonnage, but we’re actively reducing our operating costs while continuing to invest capital to meet the long-term needs of our customers. Importantly, we’re gaining profitable market share, propelled by our highest service quality in over a decade.” This comment speaks volumes about what the current industry situation is, a time to establish more revenue streams and build out what is working, and invest in that. Seeing XPO able to efficiently mitigate high operating costs is also reassuring and a reason for a perhaps slightly richer valuation than the sectors.

Risks

The primary risks facing any company in the transportation industry seem to be about managing high fuel costs and hedging against that efficiently. As seen with XPO they have been able to drag down operating expenses and post a 22% YoY growth of EPS despite many other companies like Werner Enterprises (WERN) for example seeing both the top and bottom line decreasing as the market softens. Some of the worries I have just regarding the share price is that a pullback seems quite likely seeing as the price has run up so quickly recently. XPO is trading above its 5-year historical p/e of 16 – 17 and nothing fundamental has changed around the business model. They were just very good at managing low operating costs despite lower rates and high fuel prices. That seems to have equated to a share price increase of over 30%.

Valuation & Wrap Up

XPO is a major company in the transportation sector in the US, particularly with ground transportation. The last quarter showed the company’s ability to grow through downturns and a softer market environment. This has caused the share price to increase at a very fast rate in just the last few months, and it’s now trading above historical averages.

Stock Chart (Seeking Alpha)

I think the financial state of the business is strong and debt doesn’t seem to be a major task for them to handle. The market seems to be in the bottom part of the cycle but on the rise. When that happens growth could come quickly and could potentially justify the current valuation of the business. But for me, I think it’s far more likely we see a short-term pullback, and perhaps an entry point around $50 per share opens up. In the meantime, I am rating XPO a hold.

Read the full article here