The fixed to floating preferred dislocation continues and has actually increased. Specifically, floating rate preferreds are being traded down along with fixed income securities as interest rates rise. Mathematically they should not, so the discount to par is mispricing and represents substantial capital gains potential.

On 7/6/23, a strong ADP jobs report came out indicating a gain of +497K jobs vs. a +228K consensus number. It sent the market into a fit. Intraday, my streamer showed basically everything in red ink.

E*Trade streamer intraday 7/6/23

I suppose I understand why most stocks were down as it renewed fears of more Fed hikes and interest rates across the board spiked up. However, one thing is clearly wrong in the screenshot above – the variable rate preferreds dropped along with everything else.

Variable rate income instruments increase their payouts when interest rates rise. So why were they down on a day in which interest rates were spiking?

The market seems entirely unaware that the fixed to floating preferreds are variable rate securities. We have been observing this phenomenon for the better part of a year as the fixed to floating preferreds are traded in unison with fixed income securities.

With the crescendo on 7/6/23, the mispricing has gotten rather extreme. These are preferreds that will convert to floating as soon as a few months from now and the dividend yield upon conversion will be in the 10%-16% range.

The market is only observing the current yield and is trading the current yield in parallel with interest rates. As such, these preferreds are trading at massive discounts to par on securities that are not interest rate sensitive. They should be trading at par for most issues and close to par for others.

At a broad level it is opportunistic, but this article will be about fine-tuning one’s stock selection within the group.

There are dozens of fixed to floating REIT preferreds with an aggregate issue size in excess of $7B.

That is a rather large landscape of opportunity. Some of the preferreds are significantly better than others and the focus of this article will be on determining which are the most opportunistic.

- Time until conversion – shorter is better

- Spread over SOFR

- Discount to par

- Size of common equity

- Business model of issuer

- Stability of cashflows supporting preferred dividend

- Leverage and sensitivity to factors

Notably not on this list is the current fixed coupon. It is a minor factor as the dividend level is only determined by this rate until the point of conversion to floating which for most of these issues is 2 years or less. Thus, even a substantial difference in the current coupon should only affect price by a couple percentage points.

This is where the market is getting it the most wrong as it is trading these issues based on current yield rather than converted yield.

Time Until Conversion and Discount to Par

Once the variable rate date hits, the preferreds start paying their dividends based on SOFR plus a spread plus the SOFR adjustment.

The Alternative Reference Rate Committee has declared the adjustment rates for securities that used to be based on LIBOR to get them to the proper SOFR terms. For 90 day LIBOR it will be 90 day SOFR + 26.161 basis points.

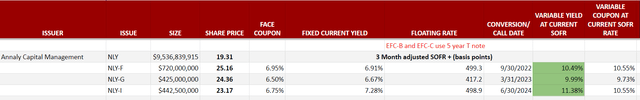

Given where SOFR is now, (in the mid 5s) and the spreads on these issues, the dividends are almost universally larger upon conversion. When these actually convert and start paying the huge yield seems to be the time the market realizes they are variable rate securities. We have seen at least 6 issues trade up to around par value of $25 as the conversion date hits. Annaly Capital (NLY) Preferred F (NLY-F) converted on 9/30/22 and now trades at $25.16.

Portfolio Income Solutions fixed to floating preferred tracker

You can see above that the not yet converted NLY-I trades at a nearly $2 per share discount to NLY-F even though starting on 6/30/24 they will have basically identical dividends.

I can say with near certainty that the 11 months of higher dividend from NLY-F is nowhere close to $2 in difference. Using today’s rates, the difference in dividend between NLY-F and NLY-I is about $0.95.

These trading prices are just mathematically wrong.

One could buy NLY-I and collect the discount to par. As it is only 11 months until conversion to variable that is not a long time to wait. In my opinion, the most likely outcome over those 11 months would be roughly $2 of capital appreciation as it trades in line with the F and 11 months of the 7.28% current yield.

Discount to par is a large portion of the total return as that is what is likely to be realized upon conversion. I tend to lean toward issues with bigger discounts to par.

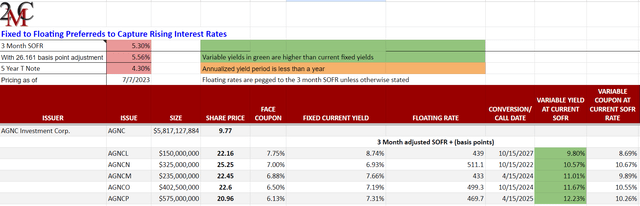

AGNC Investment (AGNC) Preferred E (AGNCO) has a slightly larger discount to par as it trades at $22.60 which portends a full 10% in capital appreciation.

An even larger discount to par exists in AGNCP which trades at $20.96. The tradeoff here is that it converts on 4/15/25 instead of 10/15/24 like AGNCO.

Portfolio Income Solutions fixed to floating preferred tracker

Thus in trading these fixed to floating preferred issues one must juggle the tradeoffs.

We want as much discount to par as possible but also as soon of conversion as possible. I believe there is an opportunity to chain them in that owning the one that converts sooner might allow one to get that pop upon conversion and then you can swap into the later conversion date security and get that pop also.

The third factor to consider is spread over SOFR.

Spread over SOFR

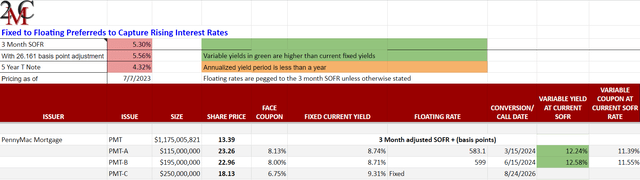

Ultimately it is the spread over SOFR that determines the dividends over the long haul. Not all of these issues will be redeemed so it behooves investors to make sure they are getting a healthy spread such that the yield will be ample regardless of the interest rate environment. This parameter is where something like the PennyMac (PMT) preferreds are interesting.

Portfolio Income Solutions fixed to floating preferred tracker

The discount to par here is not huge, but the spread is excellent. PMT-A, starting on 3/15/24 will yield 3 month SOFR + 583.1 basis points. PMY-B has an even higher spread at 3 month SOFR + 599.

It is the spread that should govern the price at which these stabilize. A great spread should result in the security trading slightly above par, whereas a weak spread could result in a stabilized price well below par. It is a matter of comparing the variable coupon to prevailing interest rates.

With a spread of 599 basis points, PMT-B provides ample yield in any interest environment. If interest rates remain high where they are today it yields 12.58%, but even if we return to a zero interest rate environment and adjusted SOFR collapses to 1%, it still yields over 7% against today’s price.

The dividend demanded by the market should be proportional to the environment. Thus, by having a large spread to the environment, this dividend is desirable regardless of where rates move and I suspect PMT-B will trade north of par.

As we trade opportunistically we are looking for:

- Bigger discount to par

- Earlier conversion date

- Bigger spread over SOFR

Looking at these parameters will find very high potential return preferreds, but it doesn’t yet factor in risk. To factor in risks we look at the following.

- Size of common equity

- Business model of issuer

- Stability of cashflows supporting preferred dividend

- Leverage and sensitivity to factors

When analyzing the fundamentals of a company with regard to common stock, investment size isn’t really a major fundamental factor. Being a mega-cap can help with economies of scale, but generally speaking small caps can have great fundamentals too.

With preferreds it is a bit different. Due to preferreds being senior to common in the waterfall, the size of common equity underneath the preferred is a major factor. If there are billions underneath the preferred, it is much safer.

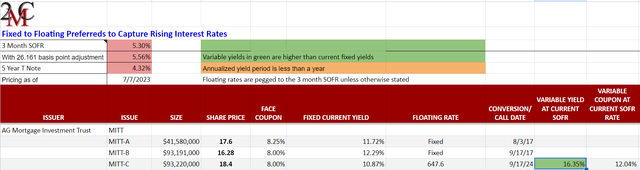

For instance, take a look at AG Mortgage Investment Trust (MITT).

Portfolio Income Solutions fixed to floating preferred tracker

At first glance, the variable rate preferred C (MITT-C) looks fantastic. It has all the things we were just talking about. It trades at a huge discount to par, has a near term conversion date and a whopping spread of 647.6 basis points over SOFR. Upon conversion this thing yields 16.35%

However, once we dig deeper into the fundamentals it comes with quite a bit of risk. Its business model seems fine to me and its sensitivity to macro factors is roughly in-line with other mREITs, but there is a big red flag – MITT has a market cap of only $123 million.

That is smaller than the preferred issues and much smaller than the debt. With this sort of upside down pyramid capital structure, all it takes is a few things going wrong and the equity cushion under the preferreds is wiped out.

I’m not saying it can’t work. There are plenty of scenarios in which MITT-C delivers a great total return, but it is high risk. I don’t feel a strong incentive to move that far out on the risk curve when there are so many other fixed to floating preferreds that also offer great return potential but with much lower risk.

With seasoned and large issuers like AGNC, NLY, and Rithm Capital (RITM) having preferreds with total return potential in the 15%-45% range upon conversion within the next 2 years, that is where I want to be.

Atypically opportunistic

In looking at all these fixed to floating opportunities, I find it baffling. These opportunities should not exist and I have never seen an environment like this before.

I can understand how equities with completely unknown futures can be wildly mispriced, but for preferreds whose fair values can be accurately determined by math, this magnitude of mispricing is just strange.

It truly feels like the market’s price discovery mechanism is broken.

I suppose it is a great time to be involved in this area. The opportunity to double dip by buying one preferred, waiting for the conversion pop and recycling into the next is quite exciting.

Read the full article here