Research Brief

In today’s equity research analysis we are going back to the world of cybersecurity again and rating Check Point Software Technologies (NASDAQ:CHKP), which has its next earnings release in a few weeks on July 26th.

I have to admit I am a fan of subscription-driven, recurring revenue business models, and this firm seems to have grasped that model quite well. Although years ago I tried a free version of one of their endpoint antivirus products for my laptop, today’s company has come long past that level of solution and appears to be a major player in this space.

Some notable items to mention from this company’s website are: over 3,500 security experts, solutions for all industries in 88 countries, and the Check Point Incident Response Team (CPIRT) that “offers 24/7, data(intelligence)-driven, and vendor-agnostic incident response services.”

Our Rating Methodology

Our goal is to find value buying opportunities for stocks in the financial & tech sectors, for companies that otherwise have strong financial fundamentals.

We individually rate 5 categories: share price trend, valuation, dividends, financial condition of company, macro factors affecting company.

If we recommend a stock on at least 4 of the 5 categories it gets a buy rating, 3 out of 5 is a hold rating, and less than that is a sell rating.

Waiting on Next Price Dip Before Buying

Now, let’s talk about buying opportunities with this stock. As of the writing of this analysis, the stock is trading around $127.52 early in the trading day on Tuesday July 11th:

Current share price on July 11 (StreetSmartEdge trading platform)

I created the chart above to track the price (mountain pattern) vs the 50 day SMA (blue line) and 200 day SMA (red line).

As someone whose strategy is buying dips below the moving averages, this stock currently seems to have broken through the 200 day SMA resistance back in June and now trading above it. My own targeted buy range, as highlighted in yellow, is actually $120 – $124, with a timeframe horizon of holding the shares for 1 year and getting out with at least an 8% capital gain, targeting an exit price at around $130 and above in a year’s time.

With that said, I would not recommend this stock at this time as a buying opportunity, however perhaps after it takes another dip into my preferred buying range. It being a non-dividend paying stock, it adds an extra risk to my portfolio strategy which is primarily dividend-income oriented, as mentioned in my other articles.

P/E Ratio Better than Sector Average

In this section, we will discuss the valuation metrics for this company using Seeking Alpha data on GAAP-based forward P/E and forward P/B ratios. The benchmark I will use to compare to is the sector median.

As of July 11th, this stock has a P/E of 18.21, over 28% less than its sector median and over 11% lower than its own 5 year average P/E. Its P/B, however, is 5.52, almost 25% above its sector median and about 12% higher than its own 5 year average.

To compare with a peer, I want to use another cybersecurity-focused tech stock, Akamai Technologies (AKAM). Its forward P/E of 25.18 is just over 1% less than the sector median, so Check Point beats it on that metric. Its forward P/B, though, is just 2.99, over 32% less than the sector median, so Akamai beats in this metric.

In terms of valuation, then I would recommend Check Point because it is undervalued in at least one of the two ratios I use, and on P/E it is more undervalued than another major IT security vendor, Akamai.

Lack of Dividend Payments

This is one of the few stocks I have covered that does not offer a dividend, as shown by Seeking Alpha dividend data. In comparison to a peer in the cybersecurity space which I also covered some time ago, Akamai, that stock too also does not offer any dividend, and I have noticed this often when researching stocks in the tech sector, unlike the banking sector.

However, if you are building a tech stocks portfolio, though not necessarily cybersecurity specific, you could opt for Dell Technologies (DELL) which offers a dividend yield of 2.48%, HP (HPQ) which offers a yield of 3.33%, or Xerox (XRX) whose yield is 6.47%. All of these I have covered in recent articles.

Therefore, I would not recommend this stock in the category of dividends since it does not offer any, particularly since I am a dividend-income investor myself and usually try to find good dividend opportunities here for my readers, and have done so.

Financial Condition of Company is Strong

The company is in overall strong financial condition, and here some notable takeaways to mention from their most recent Q1 earnings results, since we are still waiting on Q2 figures in a few weeks.

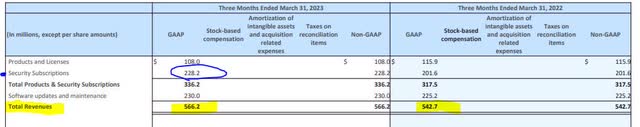

First, as mentioned earlier, I like the subscription-driven recurring revenue model, and this company has had YoY growth in that segment as well as YoY growth in overall revenue:

Check Point – Q1 revenue (Check Point – quarterly presentation)

Looking forward, I think for Q2 and Q3 the recurring subscription revenue will continue to provide a strong foundation to rely on, unless of course there is a massive outflow of clients. This segment seems to be a counterweight to the YoY decrease in their products & licenses segment.

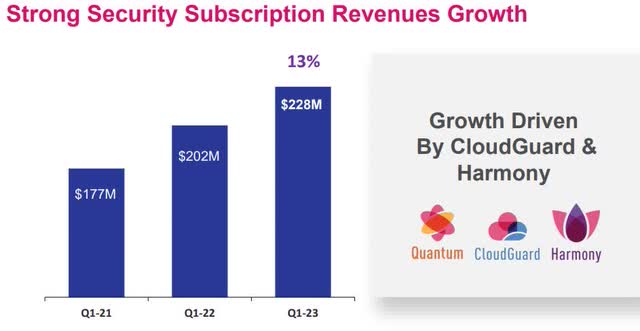

Supporting my positive view of their subscription-driven model is their own chart which shows continued growth of this revenue driver:

Check Point – subscription revenue (Check Point – quarterly presentation)

If this growth trajectory continues, I would say we can expect a similar trend for Q2 when those results are released on June 26.

In terms of profitability, their Q1 net income was $204MM, a good 7% YoY increase, along with an EPS growth of 15% YoY, which is quite impressive.

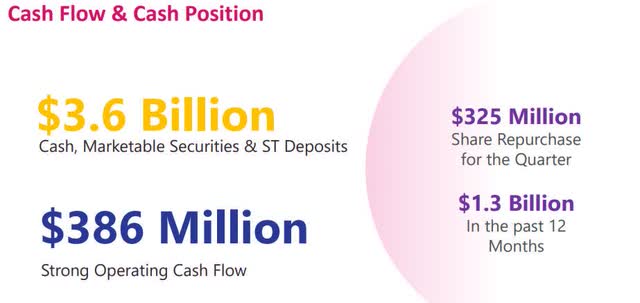

Lastly, their cash situation is a positive one:

Check Point – Cashflow situation (Check Point – quarterly presentation)

With $386MM in operating cashflow, the ability to repurchase shares, and $3.6MM in cash & securities it can tap into, I would say its financial position is a healthy one.

Therefore, in this category I would recommend this stock.

Macro Effect on this Company is Positive

The larger macro environment has been very cybersecurity-focused for a while now, and I will show why this will continue to benefit firms like Check Point who can fill the existing and growing market need for security solutions.

Consider the positive forward-looking sentiment for this industry in a March 2023 study by market intelligence firm IDC:

Investments in hardware, software, and services related to cybersecurity are expected to reach nearly $300 billion in 2026, driven by the ongoing threat of cyberattacks, the demands of providing a secure hybrid work environment, and the need to meet data privacy and governance requirements.

Additionally, a 2022 research study by consulting firm McKinsey pointed to a major untapped market opportunity for security vendors:

the gap today between the $150B vended market and a fully addressable market is huge. At approximately 10% penetration of security solutions today, the total opportunity amounts to a staggering $1.5T to $2.0T addressable market.

My positive sentiment was also shared by SA analyst Insight Analytics who commented in their February analysis & buy rating of this stock:

Check Point is well positioned to capitalize on the strong demand for cyber solutions and profit from cloud storage and IoT segments growth. The advantage of Check Point is the wide range of solutions offered, which cover almost all segments of the cybersecurity market.

Hence, in this category I am bullish on this stock and recommend it.

Rating Score

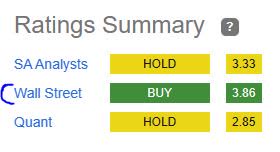

As I recommended this stock in 3 of 5 categories, it gets a hold rating today.

This rating is in line with the consensus from both SA analysts as well as the SA quant system, but less bullish than the Wall Street consensus, as shown below:

Ratings Consensus (Seeking Alpha)

Risks to our Outlook

A risk I can identify to my neutral / hold rating on this stock is that it is overly positive, as the cybersecurity space despite having lots of demand as I have shown earlier also is crowded with several players, combined with client IT executives pressured to optimally manage their budgets and which vendors will get chosen, even in multi-vendor environments. This can impact growth of this company vs its peers which have shown stronger revenue growth.

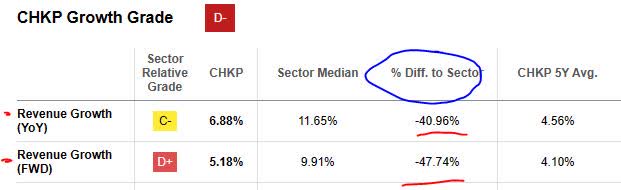

Consider that Seeking Alpha in its growth grade for this stock has given it a grade of below C.

Check Point – growth vs sector (Seeking Alpha)

What concerns me as a risk is that although it has over 4% avg 5 year growth it also is over 40% below its sector average for revenue growth.

I believe this could make certain investors shy away from buying this stock, when they can pick the higher growth companies instead.

What I am looking for, and I think will occur, in the Q2 results call is more confident commentary from company management that speaks to their growth projections in relation to peers and the larger sector. So although I have shown they are doing well with subscriptions revenue, for example, which they are, I expect them to provide guidance on improving growth vs their sector, and get to a point where revenue growth is beating the sector median.

Analysis Wrapup

To wrap up this discussion today, I am reiterating my hold rating on this stock. Its positives are nice P/E valuation, strong financial condition, and being in a sector that benefits from the macro environment of cybersecurity spending growth. Its headwinds are that it is not a dividend payer, and its current price is trending above the 200 day average, so I think you can get a better price. A risk identified as well is it lags behind its sector in revenue growth.

Nevertheless, as earnings season heats up this month, eyes will be on the big tech names of course but let’s not forget the lesser covered cybersecurity-focused brands like this one, since IT security is such a vital component to our critical infrastructure despite often being something that simply operates “behind the scenes” at most organizations, including companies I have worked at as well. For this reason, will add this stock to my tech watchlist for 2023 and keep an eye on it, since tech is not just social media & hardware but also the solutions providers that help secure both of those effectively.

Read the full article here