Investment Rundown

The solar sector seems to have gone a little out of favor as many of the largest companies have seen their share prices go down over the last few months, as seen with SolarEdge Technologies, Inc. (NASDAQ:SEDG). The forward p/e for the company is just around 23 right now, and for a growth company like SEDG which has had revenues grow 35% YoY between 2018 and 2022, this seems like a good opportunity to get in.

As demand for solar is only increasing it’s making up a larger and larger part of our energy generation and there doesn’t seem to be any significant worry as to oppose this momentum. The push for greener energy sources and lower emissions is strong, especially among the younger generations, which eventually will be the deciders in our societies. Paying a 23x p/e for a growing company like SEDG seems quite fair. SolarEdge continues to innovate and diversify its revenue streams and quite recently revealed they are pushing more toward energy storage systems, which I find to be a massive market opportunity, but still in its infancy. In conclusion, SEDG is rated a buy from me.

Company Segments

SolarEdge is a company focusing on renewables and particularly solar. Since its founding in 2006, the company has managed very well in securing a significant portion of the market share and can be described as a leader in the space. The company designs and develops its own direct current-optimized converter systems for solar photovoltaic installations. Its operations span worldwide.

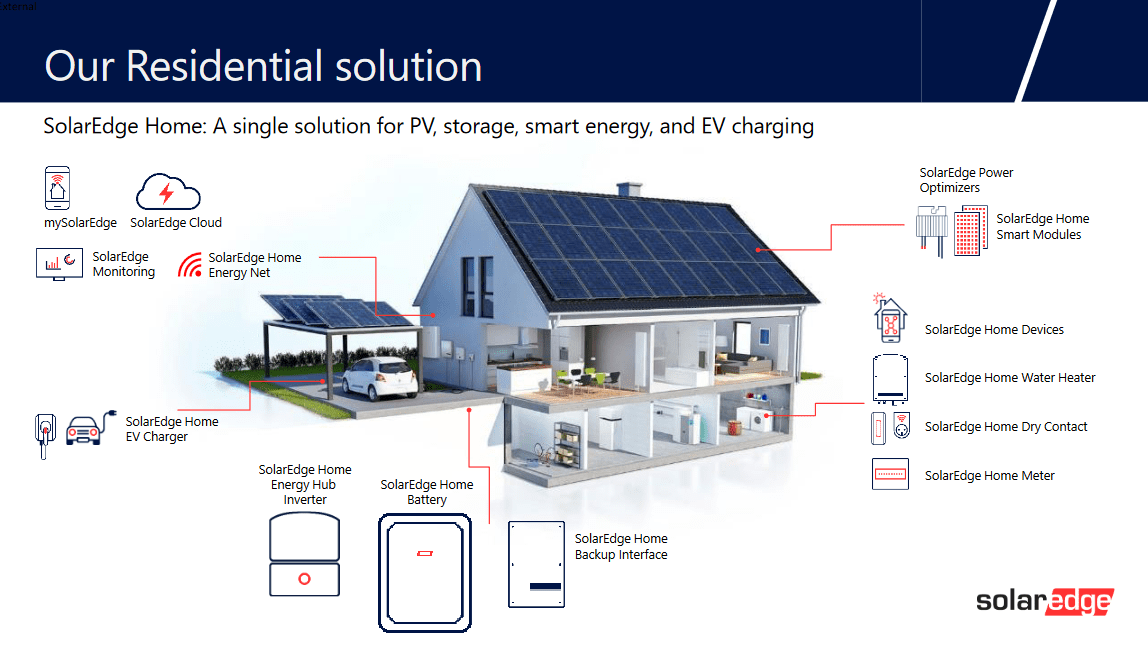

Residential Offering (Investor Presentation)

The company offers both residential and commercial solutions for solar. The company aims to almost create an ecosystem with its products as they offer EV chargers and home batteries but also cloud-based systems. I think this type of approach makes customers likely to stay with the company if the products and services are good of course. But with an ecosystem like this sticky customers seems more likely.

CCS Product (Investor Presentation)

Quite recently the company announced its Commercial Storage Systems (CCS). The availability is expected to be somewhere in the second half of 2024. The revenues for no-solar have been climbing over the years, faster than the solar revenues if you are looking at just the percentage growth. What this new product offering can help benefit with is securing a more diversified stream of revenues, still related to solar and power generation, but perhaps with better margin potential overall. The CCS system has a capacity of 58kWh and will be able to connect up to eight batteries and 460 kWh storage capacity. The technology helps eliminate the “triple-conversion penalty” and also offers site-level energy management for customers.

Markets They Are In

I don’t think it’s heavily disputed that solar will become a major source of future energy. The sector is growing very fast as more and more people see the benefit of installing and generating their electricity.

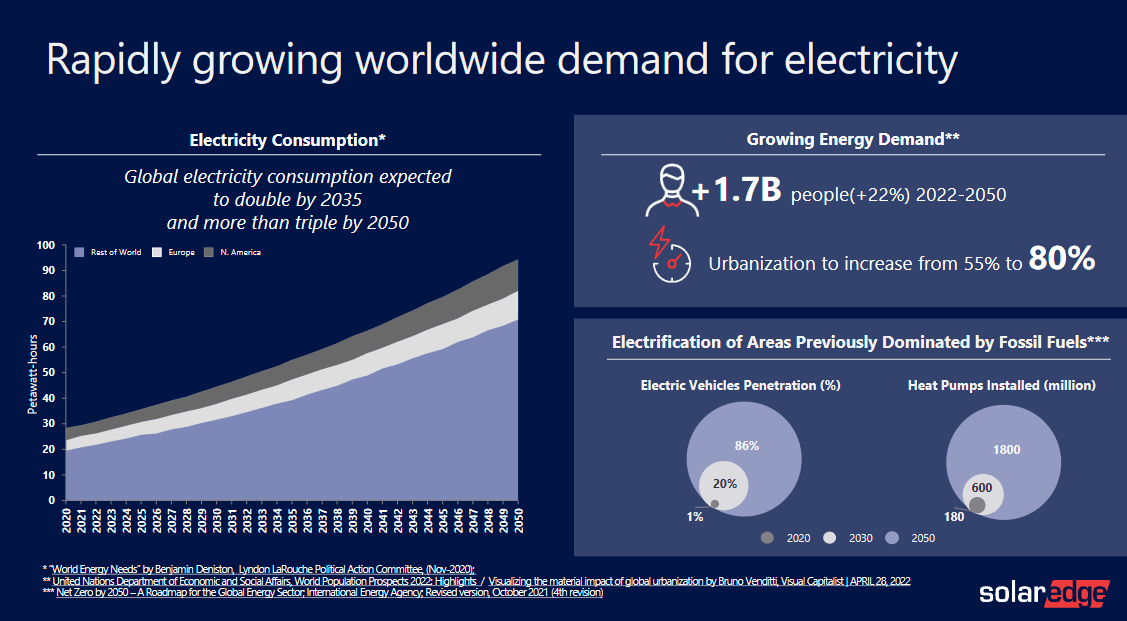

Market Growth (Investor Presentation)

Expectations that global electricity consumption will have tripled by 2050 suggest that SEDG has a massive runway still of growth and demand. I don’t think solar will be the majority of energy generated by then, the phase-out of “traditional” sources like gas and oil will still play an important role in 2050 most likely. What many investors find intriguing about the solar market is that it remains largely underpenetrated.

Earnings Highlights

Looking at the last earnings results from SEDG it’s hard to not see it as a success if I’m being honest. The revenues came in at $943 million and the expectation for Q2 in FY2023 is that revenues could top over $1 billion, which would be a first in the company’s history. Back in Q2 FY2022 the gross margins took a hit and landed at 25.1% and looking at the historical results for gross margins they have been trending down.

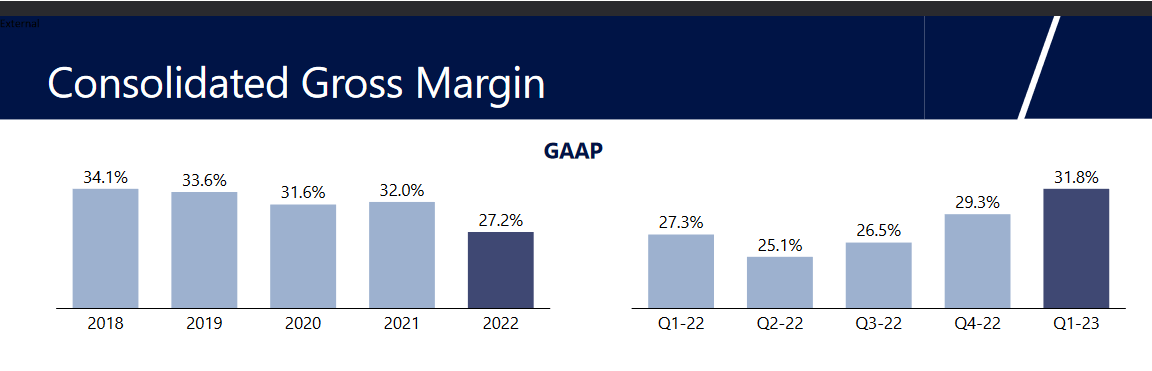

Margin History (Earnings Presentation)

But the last quarter was a sign that SEDG could see this trend reversing as they can pass down costs on to customers seeing as demand is still strong. But also that inflated costs for SEDG are stabilizing and margin volatility will be less likely in the future. As Q2 is expected to post a QoQ growth in revenues from the company’s guidance which they provided in the Q1 report, the same seems to be true for the gross margins, which are estimated to be between 32 – 35%. A beat on this would be a catalyst for the stock price in my opinion, and cause for the downtrend the company has had the last few months to reverse. A significant difference this quarter compared to Q1 FY2022 is that SEDG did generate $21 million in financial income, which helped the bottom line immensely. The net income grew from $33 million to over $138 million, a massive leap that puts SEDG at a better valuation to start a position.

Risks

The primary risk with investing in the solar space right now I think is a recession. If people see their budgets get even smaller then investing in solar is likely not on the table. Besides that, some people might argue that the technology of solar is growing so fast that simply holding off a few years might see you get more value for your money. That could halter some growth perhaps, but demand seems to remain strong.

Looking at risks facing investors regarding the internals of SEDG, they have been diluting shares consistently over the last few years. In most cases, I do dismiss this if the company can grow the top and bottom line at a significant rate, which SEDG has done. The shares outstanding have increased by just over 4% YoY between 2018 and 2022. Comparing that to what I mentioned earlier that revenues grew by 35% YoY during that time seems to be a forgiving factor for this dilution.

Valuation

Currently, the valuation of SEDG seems too good to pass up based on the forecasted growth the company has for itself. The renewable sector and especially a lot of solar companies saw their valuations skyrocket as the hype around them grew. The 5-year average p/e for SEDG sits at 39 currently, which it trades 38% below right now. I think this highlights some of the more realistic multiples that have been applied to the industry after the hype. For a company that is growing earnings rapidly, I think a multiple around 25 and under is where I will be looking to buy. Estimates suggest that SEDG will be growing over 15% in terms of EPS in the coming several years. I think investors should view SEDG as a decently valued company right now that offers solid potential returns.

Final Words

Having exposure to the solar sector or renewables in general I think should be on most investors’ minds if they seek a diversified portfolio. It seems the sector has fallen a little out of favor as AI and semiconductors still dominate most of the news right now. But that opens up an opportunity to get in at very good price levels for a long-term position. In my opinion, the growth potential that SEDG offers compared to its FWD p/e of 23 seems like a positive risk/rewards ratio.

The second quarter of 2023 will set the tone for the remaining part of the year as both revenues and margins are expected to rise. That makes SEDG even more attractive in terms of valuation. As for me, I would be happy with paying a 25x earnings multiple for the company if they continue with their momentum, which equates to anything under $275 per share. In conclusion, this means that right now I view SEDG stock as a buy.

Read the full article here