Since debuting on the public markets in Q2 of 2017, the JPMorgan Ultra-Short Income ETF (NYSEARCA:JPST) has grown to become a popular way for investors to generate income inside of their portfolios while maintaining low volatility of their invested principal.

Now – just six years later – the JPST exchange-traded fund’s (“ETF’s”) assets under management have grown to over $24 billion in size.

However, I’d argue there’s an even better ETF out there for investors looking to generate a healthy yield while simultaneously prioritizing a lack of principal volatility – statistically speaking.

Introducing the Neos Enhanced Income Cash Alternative ETF (NYSEARCA:CSHI).

CSHI’s Objective

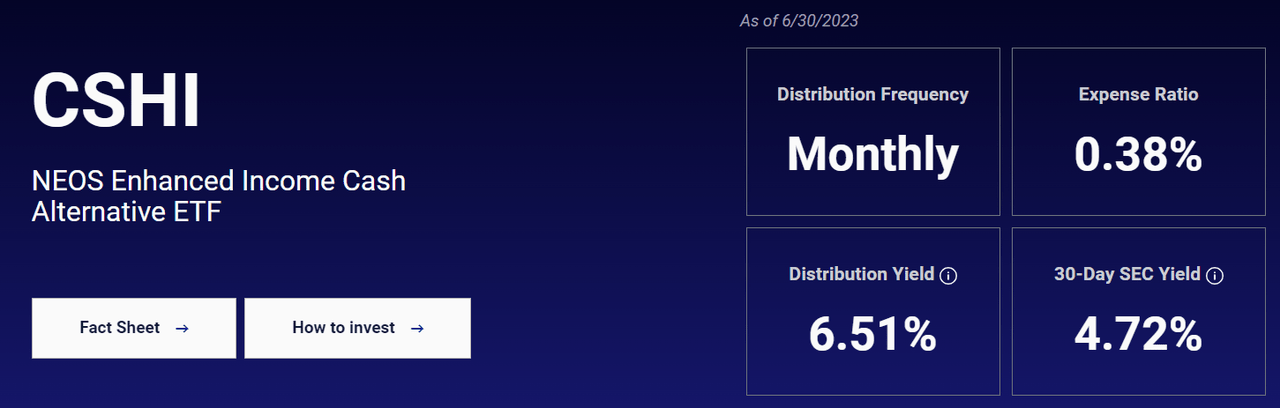

Here’s a look at CSHI’s investment objective based on the issuer’s website:

“The NEOS Enhanced Income Cash Alternative ETF seeks to generate monthly income in a tax efficient manner.

CSHI is an actively-managed exchange-traded fund that seeks to achieve its investment objective by … obtaining exposure to the performance of US short-term treasury bills, typically less than 90 days in duration, and selling S&P 500 Index put options to generate income … beyond what is received from the underlying investments.”

In plain English, by holding short-term Treasuries and leveraging a put option strategy, CSHI is able to generate a healthy 6.51% distribution yield (as of 6/30/23).

Now before you question why JPST is being compared to an ETF with a put option strategy – let’s break down CSHI’s investment objective step-by-step and decide which ETF belongs inside of a risk-averse, income-focused investor’s portfolio.

The Breakdown

“An ETF that seeks to generate monthly income…”

According to the CSHI Prospectus…

“CSHI is an actively-managed exchange-traded fund that seeks to achieve its investment objective by … obtaining exposure to the performance of US short-term treasury bills, typically less than 90 days in duration, and selling S&P 500 Index put options to generate income … beyond what is received from the underlying investments.”

The above statement means two things:

- As a shareholder in CSHI, you’re receiving the normally scheduled interest owed to you as an investor in short-term U.S. Government T-bills.

- And you’re also receiving monthly cash distributions paid for by the premiums that are generated by this Fund’s put option strategy on the S&P 500 Index (SP500).

Just so we’re all on the same page about their put option strategy, let’s quickly walk through how this strategy generates income for the fund.

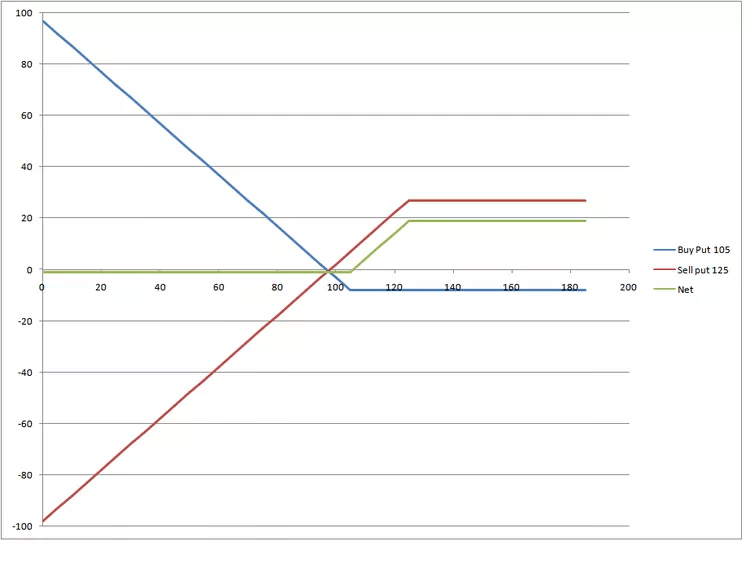

According to Investopedia, a “bull put spread” consists of two put options. First, an investor buys one put option and pays the corresponding premium. At the same time, the investor sells a second put option with a strike price that is higher than the one they purchased, receiving a premium for that sale.

Considering the second put option (the one the investor sells) has a strike price higher than the first put option (the one the investor purchases) – the premium received from their second put option is higher than the premium paid to purchase the first put option – allowing the investor to generate premium income while mitigating downside risk.

Bull Put Spread (Investopedia)

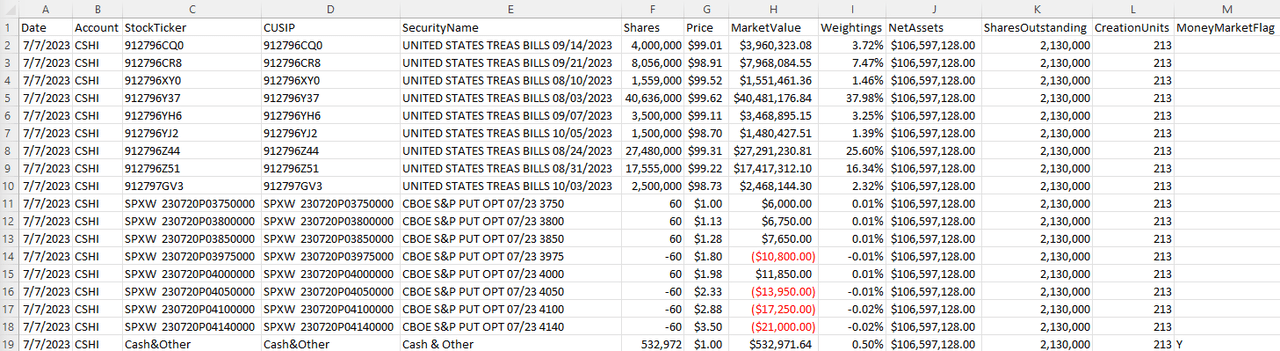

In the case of CSHI, we can see from their holdings (as of 7/7/23) that their fund managers are buying put options on the S&P 500 Index with a strike price about 13% below the current price of the S&P 500 Index (4,424 at time of writing) – while simultaneously selling put option contracts about 10% below the current price of the S&P 500 Index.

CSHI Holdings (7/7/23) (CSHI Website)

It’s important to note these put option contracts have expiration dates roughly two weeks out from the time of purchase.

This means across the 240 S&P 500 Index put option contracts that CSHI’s fund managers sold – they collected $63,000 in premium. Of this $63,000 in premium collected, they spent $32,250 purchasing 240 S&P 500 Index put option contracts – allowing them to profit $30,750 in the form of premium.

Assuming they roll these option contracts on a weekly basis and the profit from the difference in premium remains roughly the same, they’re looking at about $1,600,000 in potential profit to distribute annually to their investors – or about $0.75 per share in additional annual distributions.

This ~1.5% yield ($0.75/$50.11) in additional distributions is on top of the roughly ~5.2% annual yield generated by the fund’s exposure to short-term T-Bills. Together, this allows the CSHI ETF to boast a healthy 6.51% annual distribution yield.

CSHI Snapshot (CSHI Website)

Year-to-date, CSHI has paid $1.52 per share to their investors and is on track to pay roughly $3.26 per share throughout the entirety of 2023. This $3.26 figure equates to the 6.51% annual distribution yield shown above.

But, what happens if the value of the S&P 500 Index falls -10% over just a few trading days – causing the Fund to be on the hook for paying out the purchasers of their put option contracts?

Before we answer that question, I think it’s important to understand just how many times throughout history the S&P 500 Index has declined by -10% or more in a single trading week.

According to data provided by Yahoo Finance, the answer is 10 times.

Think about that for a second – the S&P 500 Index has had 4,986 trading weeks since 1927. Only 10 of those 4,986 trading weeks have resulted in a decline of -10% or more from the index – that figure represents only 0.2% of the total trading weeks since 1927.

Keep that statistic in mind now as we answer this question.

According to the Fund’s most recent holdings data (as of 7/7/23), they begin to be “on the hook” after the S&P 500 Index declines to 4,140 – or 6.5% below market close on July 7th, 2023. The Fund is “on the hook” all the way until the S&P 500 Index declines to 4,000 – during which the put contracts they purchased would kick in and begin to offset further losses.

Assuming we experience some sort of black swan event where the S&P 500 Index declines by double-digit percentage points in one week’s time, the Fund’s NAV could decline enough to wipe out several months of premium income. However, I don’t foresee this event happening – statistically speaking.

The additional ~1.5% yield, for me, demonstrates enough risk-to-reward to justify the ETF in my own portfolio. For those of you who are completely turned off by the minute possibility of this statistical anomaly actually happening, perhaps JPST is a better ETF to hold inside of your portfolios.

However, it’s important to note that CSHI’s sole underlying income-generating investment is short-term U.S. Treasuries – backed by the full faith and credit of the U.S. Government.

JPST’s underlying income-generating investments include corporate bonds, commercial paper, and various asset-backed securities – with 60.4% of their holdings (as of 5/31/23) being corporate bonds and commercial paper.

I’d argue the odds of seeing a double-digit, one-week decline in the S&P 500 Index (0.2%) is less common than the odds of corporate bonds or commercial paper being defaulted on – especially since 40% of their holdings’ credit quality is either A, A-2, A-3 or BBB.

“…in a tax efficient manner…”

Now that we’re all on the same page as to how this fund generates income for its shareholders, let’s further delve into how it achieves this in a tax-efficient way.

Unlike JPST – CSHI takes advantage of the tax efficiencies afforded to Section 1256 contracts by the Internal Revenue Code. Essentially, Section 1256 contracts allow income distributed to CSHI shareholders to instead be taxed as both long-term and short-term capital gains – compared to just short-term capital gains when assets get turned over inside of JPST.

“For Section 1256 contracts, the tax on the gain or loss is treated as if 60% of contracts were held as long-term investments and 40% as short-term investments.” – Investopedia

The Fund also mentions in their prospectus their intention to take advantage of tax loss harvesting opportunities on the S&P 500 put options and/or equity positions.

“In addition, the Fund may seek to take advantage of tax loss harvesting opportunities by taking investment losses from certain equity and/or option positions to offset realized taxable gains of equities and/or options.

Opportunistically, the Fund may seek to take advantage of tax loss harvesting opportunities on the SPX put options.”

Finally, it’s also important to mention that interest income generated through Treasury Bills is exempt from both state and local taxes. If you’re a California, New York, or Oregon-based investor – this might be a very important consideration.

Because CSHI utilizes these strategies, shareholders can expect less of a tax burden on their gains when Uncle Sam comes knocking in April.

Investor Takeaway

The JPMorgan Ultra-Short Income ETF is a fine product that deserves its rightful place inside of risk-averse, income-focused investors’ portfolios. However, I’d argue the Neos Enhanced Income Cash Alternative ETF is superior to JPST given its higher monthly distribution, tax efficiency, and statistical probability of outperformance.

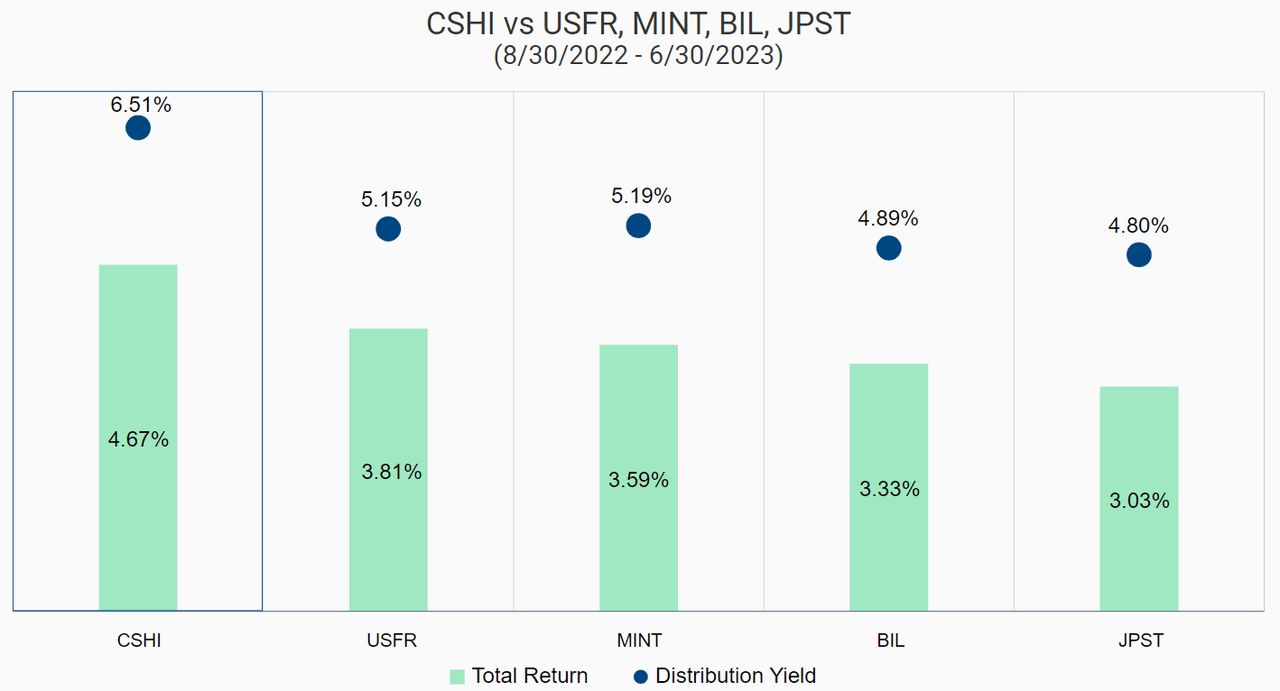

When compared to JPST since inception, it seems to have outperformed on every measure (see image below). And year-to-date, CSHI’s share price has outperformed JPST’s by +0.55% – while having also paid their shareholders +$0.43 more per share in dividends.

CSHI Comparison (CSHI Website)

As an income investor myself, I’m surprised more investors don’t know about the obvious benefits of choosing the Neos Enhanced Income Cash Alternative ETF over the JPMorgan Ultra-Short Income ETF – given its healthy outperformance thus far in 2023 and since its inception in August 2022.

Read the full article here