In Q2 2023, AST SpaceMobile (NASDAQ:ASTS) announced the successful achievement of both cellular connectivity and repeated 4G download speeds during the testing of its current satellite, BlueWalker 3. The Company’s stock price has accumulated more than 50% increase because of the milestone accomplishments, outperforming the NASDAQ Index in the same trading period. However, the gain was nearly erased single-handedly by the stock offering decision announced on 28th June 2023, which will bring in an additional $60 million of cash to support the manufacturing of the next 5 satellites.

Investment thesis

Based on a probability-weighted valuation of both the “Boom” and “Doom” scenarios, the long-term risk-reward ratio for the company is becoming increasingly attractive, especially in light of the recent equity financing announcement that caused a temporary decline in the stock price. The long-term forecast for ASTS remains bullish with more technological de-risking events unfold.

However, investors should be mindful of the stock’s volatility pattern, which is typically triggered by key milestone achievements leading to upward movements, followed by financing events that result in downward movements. The share price volatility pattern is not uncommon for the Company’s stock and is expected to persist over the next 1-2 years, since the Company is still in its early days of research and development.

An overall buy rating is assigned for long-term investors. But it is important to carefully consider entry points following the technological and corporate achievements, as explained in the end of the analysis.

A recap on AST SpaceMobile

AST SpaceMobile (“ASTS”) is a telecommunication company dedicated to building a cellular broadband network through its planned Low Earth Orbit (“LEO”) satellite constellation. The goal is to provide mobile connectivity to remote areas with limited internet access. The Company currently has one testing satellite on orbit and planning to launch 5 satellites in Q1 2024 (i.e., Block 1) and 20 more in late 2024 (i.e., Block 2).

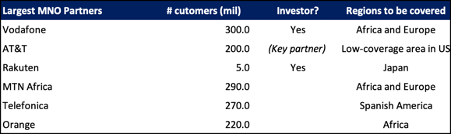

By partnering with major global mobile network operators (MNOs) through signed Memoranda of Understanding (MOUs), AST SpaceMobile aims to provide coverage to the areas with highest commercial potentials, targeting MNO markets with over 2 billion subscribers in the initial phase of the constellation, which includes 25 satellites.

AST SpaceMobile

The long-term view: Boom is more likely than doom

The successful deployment of BlueWalker 3, along with its expansive commercial communications array in low Earth orbit (LEO), has validated the feasibility of ASTS’s concept and technology. The Company claimed they “are confident in the architecture and do not foresee any major changes to the Block 1 satellites”. This reassurance has told us about the resources and efforts needed for the next phase of production will be similar to BlueWalker-3.

The immediate pivotal factor that will determine the target price of the Company is the success of its Block 1 and Block 2 satellites. The performance and viability of these satellites will determine whether ASTS can effectively operate on a larger scale with commercial success. Therefore, our financial analysis is focused on a 3-year forecast, which accounts for this critical milestone. anything beyond this timeframe is subject to uncertainties and therefore not representative.

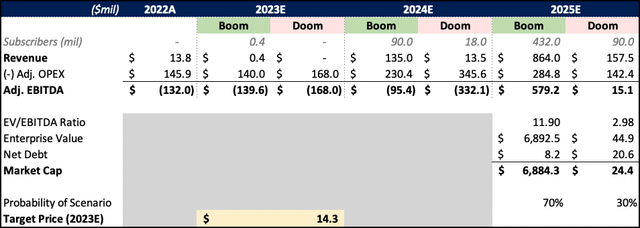

The financial model we utilized incorporates a probability-weighted valuation methodology, considering two distinct scenarios that may unfold for the company over the next 3 years:

“Boom Scenario”:

- Successful deployment of the 25 satellites with delivery that is on time, within budget and without error

- Increased monetization of the subscribers of its MNO partners and higher Revenue Per User once all 25 satellites are operational

- Higher valuation multiple as perceived by the market, since the Company has achieved a disruptive business model and technology

“Doom Scenario”:

- Delayed deployment of the planned satellite timeline for a year or longer, with higher CAPEX and production costs needed

- Revenue remains being generated from test and trial projects, without / with little commercial plan clients

- Conservative valuation multiple since the Company has not demonstrated its ability

Analyst’s Research; AST SpaceMobile

While it is a consensus that there will be little to no revenue for ASTS in FY2023, as the Company is laser-focused on delivering the 5 Block 1 satellites that can generate cash and revenue starting in FY2024 at the earliest, attention is primarily on managing cash burn in the short-term, which will be further discussed in the upcoming section.

On the other hand, the growth of revenue in both FY2024 and FY2025 will be determined solely by the Company’s ability to launch and operate its constellation, which in the current “Boom Scenario” it is assumed that by FY2025, approximately 20% of the subscribers from MNO partners such as Rakuten in Japan, Vodafone, or Orange in EMEA will be served across continents. This translates to potentially monetizing around 430 million subscribers out of the total 2 billion subscribers. However, if the satellites fail to cater to mass market customers, it is likely that the Company will be limited to engaging only in “trial projects” such as with FirstNet of AT&T, as reflected in the model.

The EV/EBITDA multiple used for calculating the market capitalization in FY2025 is based on the assumption that if AST SpaceMobile emerges as a successful disruptor in the telecommunications market, it would be valued at a minimum of 2 times higher than its peers, which normally has a EV/EBITDA multiple of 6 – 6.5 – but if not, in the “Doom Scenario,” where the company fails to prove its technological capabilities, the multiple would be significantly lower. Currently, the probability of the “Doom Scenario” is assumed to be 30%, but this is expected to decrease as more clarity will emerge and provide greater confidence in the Company’s prospects.

The short-term view: Gains are likely to be wiped out by adverse corporate events

We tend to target our fundraising efforts as we de-risk our business through the successful completion of milestones – Sean Wallace, Chief Financial Officer of AST SpaceMobile

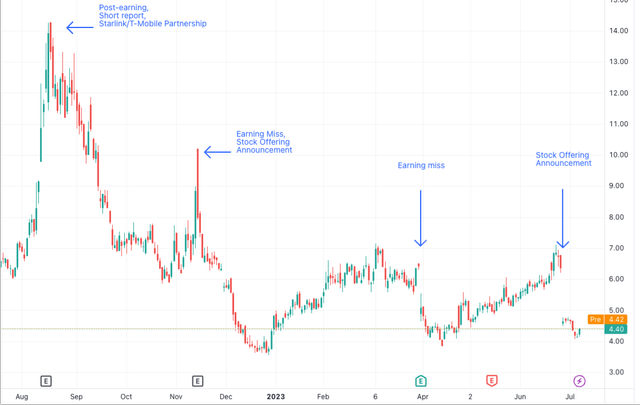

While the long-term prospects hold promises for investors, the short-term performance of the stock is plagued with volatility-triggering events, like missing earnings target or financing events, that overshadow investor optimism. This is exemplified by the management’s emphasis on fundraising efforts, which are said to typically occur after the successful completion of business or technological milestones when investor sentiment is the strongest.

From the graph below, it is evident that corporate and financing events have repeatedly offset stock gains throughout the past year. Although the 5 Block 1 satellites are expected to become commercially operational in 2024 and generate revenue from mobile network operator (MNO) partners, the company’s liquidity position remains a significant concern that will continue to impact the stock’s performance like before.

TradingView

For example, ASTS has recently made a strategic move to address its short-term cash needs through stock offering, raising an additional $60 million in cash. While this decision is intended to bolster the company’s financial position and provide the necessary resources to meet immediate requirements, it has resulted in a significant 30% decline in the share price.

Investors have always been aware that substantial funding the Company would be required to realize its ambitious business plan of providing global satellite-to-device coverage, which involves deploying over 110 satellites. Despite the significant capital expenditure of over $2 billion needed for BlueBird satellite manufacturing, ASTS currently only maintains a cash position sufficient to manufacture its next 5 to 10 satellites. To cover the launch of all 25 planned satellites by 2024, it is anticipated that at least two additional rounds of financing will be necessary.

Analyst’s Research; AST SpaceMobile

Investment comments: Exercise selectivity in entry timing to optimize long-term return

As ASTS continues to make progress in mitigating technological risks, it is crucial for new investors to closely monitor the unfolding of specific de-risking milestones. Adopting a phased investment approach and entering the market after these significant events occur can provide an advantageous position for long-term investors. These milestones, once achieved, are anticipated to act as share price catalysts:

- Timely execution of satellite production: ASTS has a record of experiencing delays, especially when they are working with cutting-edge technology which is the first satellite communication constellation directly connected with devices. The Company expects the 5 Block 1 satellites will be delivered by this year and launched by Q1 2024, while the 20 Block 2 will be launched in late 2024. Delays in meeting milestones and deployment targets could potentially impact investor sentiment and stock price, particularly when expectations have been priced in in the market.

- Proven commercial operation capacity: Despite the successful testing of the BlueWalker satellite, ASTS has not yet operated commercially to provide reliable and accessible services on a global scale. It will only be de-risked in Q1 2024 when the first set of five Block 1 satellites are tested and serving the mass market customers.

- Regulatory approval in key countries: For ASTS to operate in different markets, the Company needs to operate within certain permitted spectrum, which will require regulatory approval. In the US, ASTS and AT&T have announced a spectrum leasing agreement between two parties in May 2023. Regulatory approval in the US and other countries gives the Company license to operate and opportunity to realize its business potential.

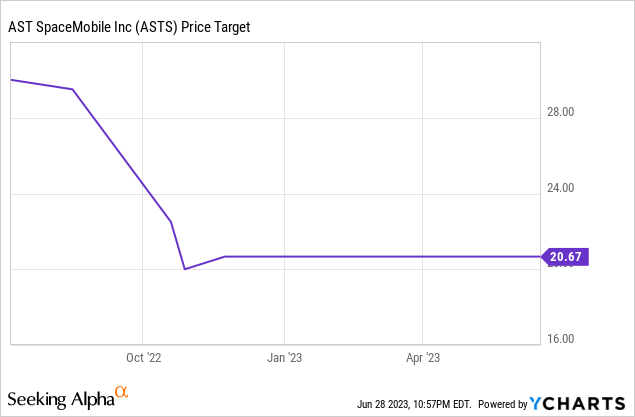

While the stock offers potential 4x – 5x upside, as indicated by both my analysis and analysts’ target price as shown below, it is crucial for investors to exercise caution and be mindful of factors that could disrupt the Company’s progress and share price. Key considerations include the availability of sufficient cash, the risk of technological failures in the next phase, regulatory challenges in navigating the satellite communication space, and competition from other players and partnerships in the industry.

Read the full article here