Lately, I have turned bullish on utilities and infrastructure investments due to the relative valuations of the utility sector compared to the market.

This article examines the pros and cons of the MainStay CBRE Global Infrastructure Megatrends Term Fund (NYSE:MEGI), a high yielding infrastructure fund.

On the positive side, the MEGI fund is paying an attractive 9.6% forward yield and is trading at a 16% discount to NAV with a portfolio of liquid public equities. However, on the negative side, the fund’s performance since inception have been subpar and the fund is managed by a relatively unknown manager.

Overall, for me, I believe the cons outweigh the pros. Until the MEGI fund can show signs of outperforming peers, there is no reason to get involved even if the distribution yield looks attractive.

However, for contrarian income oriented investors, MEGI’s high distribution yield and discounted portfolio could make it an interesting investment.

Fund Overview

The MainStay CBRE Global Infrastructure Megatrends Term Fund is a vanilla closed-end fund (“CEF”) that aims to provide high current income to investors. What sets the MEGI fund apart is the fund’s emphasis on the investment megatrends of Decarbonization, Digital Transformation and Asset Modernization. The MEGI fund also has a 12 year fixed term, although with termination in 2033, it is not relevant at this point in time.

The MEGI fund began operations on October 27, 2021 and currently has $883 million in net assets as of March 31, 2023. The MEGI fund uses leverage to enhance returns and as of March 31, the MEGI fund has 25% leverage. The MEGI fund charges a net expense ratio of 1.92%, fairly standard for similar CEFs.

CBRE Investment Management

Although the MEGI fund is offered by New York Life Investments, the fund is actually managed by CBRE Investment Management, a ‘real assets’ investment manager with $150 billion in assets under management. However, to my knowledge, CBRE is more associated with commercial real estate services (CBRE stands for the commercial broker Coldwell Banker Richard Ellis), and is not particularly well known for managing public equities.

Portfolio Holdings

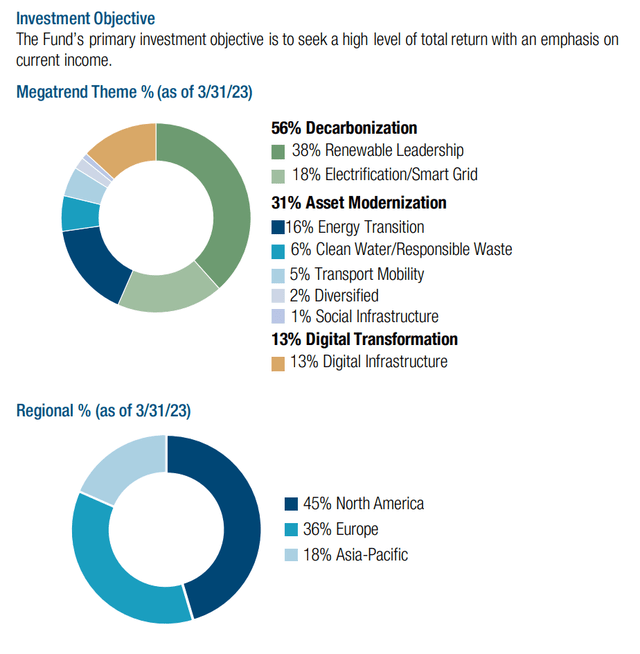

Figure 1 shows the fund’s sector allocation according to the ‘megathemes’, as of March 31, 2023. 56% of the fund is invested in the Decarbonization theme, 31% is invested in Asset Modernization, and 13% is invested in Digital Transformation.

Figure 1 – MEGI megatheme allocation (newyorklifeinvestments.com)

Although the MEGI fund is marketed as investing in megathemes, I have some reservations regarding the classification of some of its investments. For example, Figure 2 shows the top 10 holdings of the MEGI fund as of March 31, 2023.

Figure 2 – MEGI top 10 holdings (newyorklifeinvestments.com)

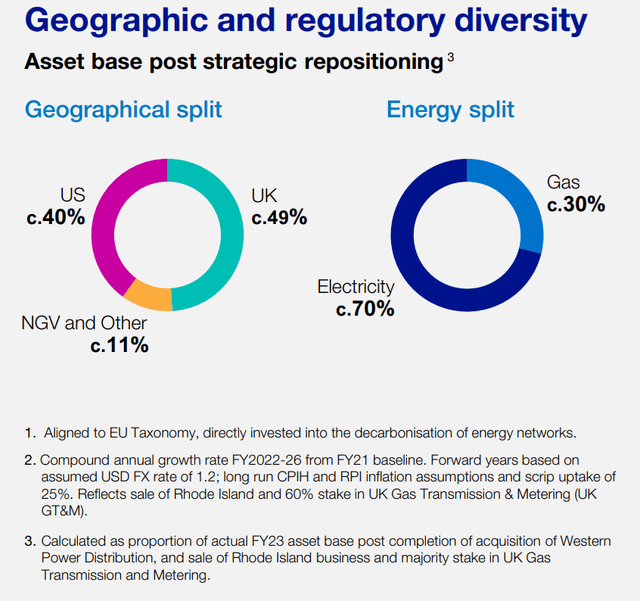

National Grid plc (NGG) is the 2nd largest holding of the MEGI fund and is classified as part of the ‘Decarbonization’ theme. NGG is a large legacy electricity and gas transmission and distribution utility based in the UK and US. Like all utilities, NGG is busy modernizing its assets, but it is a bit of a stretch to classify National Grid as a ‘Decarbonization / Electrification & Smart Grid’ play compared to other companies within its sector (Figure 3).

Figure 3 – NGG overview (NGG investor presentation)

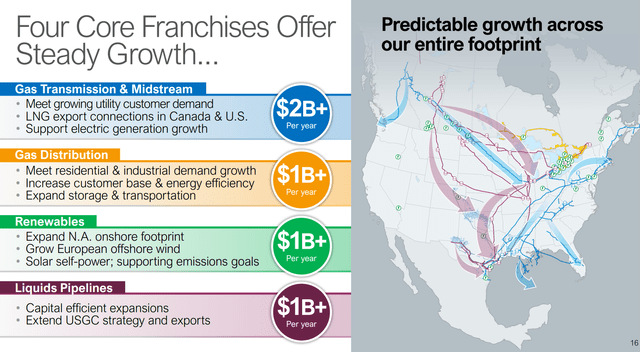

Similarly, Enbridge Inc. (ENB), the 3rd largest holding of the fund, is classified as part of the ‘Asset Modernization’ theme. However, Enbridge has one of the largest legacy oil and natural gas pipeline systems in North America that contributes more than 80% of the company’s earnings, so again, it is a stretch to classify Enbridge as an ‘Asset Modernization / Energy Transition’ play (Figure 4).

Figure 4 – ENB overview (ENB investor presentation)

Returns

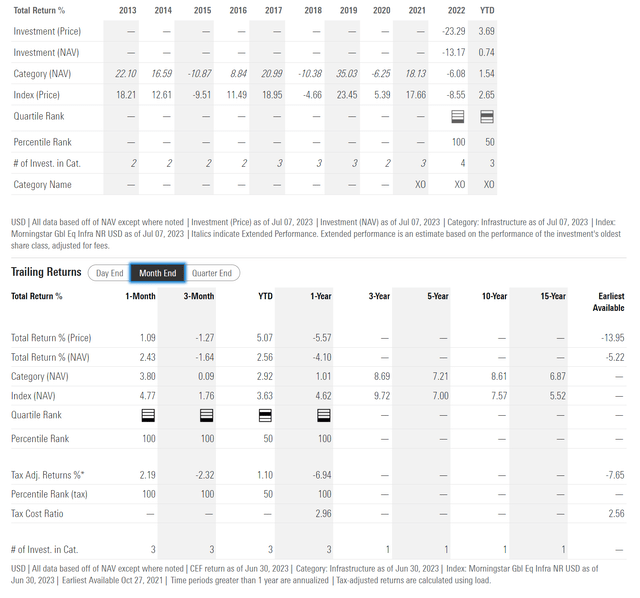

As the MEGI fund only began operations in October 2021, there is not a lot of historical performance to analyze. Overall, the MEGI fund’s start has been less than stellar, as it lost 13.2% in 2022 and is only up 2.6% YTD to June 30, 2023 (Figure 5).

Figure 5 – MEGI historical returns (morningstar.com)

Distribution & Yield

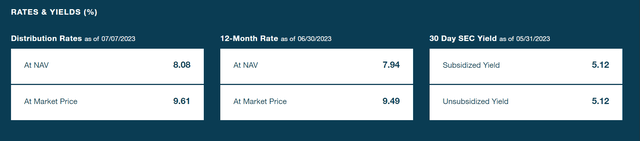

Despite poor investment performance, the MEGI fund has stuck to its high current income promise and is paying a high distribution yield to its investors. The $0.1083 / month distribution, which has been set since inception, currently annualizes to a 9.6% forward yield on market price and 8.1% distribution yield on NAV (Figure 6).

Figure 6 – MEGI is paying a 9.6% forward yield (newyorklifeinvestments.com)

MEGI Trades At Steep Discount

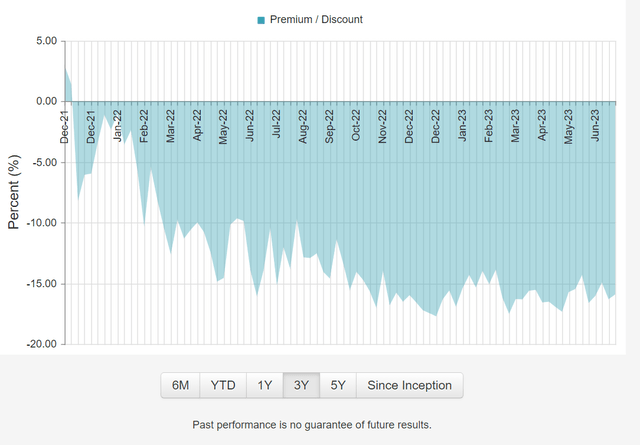

The MEGI fund’s poor performance since inception have caused investors to run for the exits, with the MEGI fund trading at a steep 16% discount to NAV.

Figure 7 – MEGI trades at a 16% discount to NAV (cefconnect.com)

MEGI vs. UTF & BUI

Since my current favourite utilities and infrastructure funds are the Cohen & Steers Infrastructure Fund (UTF) and the BlackRock Utilities, Infrastructure & Power Opportunities Trust (BUI), how does the MEGI fund compare to these 2 peers?

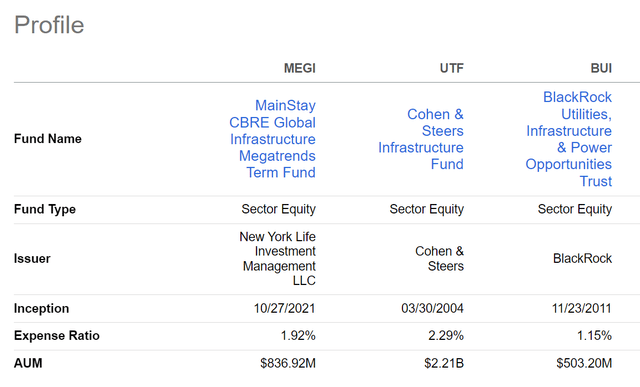

First, on fund structure, the MEGI fund is more expensive than the BUI fund, but less expensive than UTF. All 3 funds have considerable assets under management, so liquidity should not be an issue (Figure 8).

Figure 8 – MEGI vs. UTF and BUI structure (Seeking Alpha)

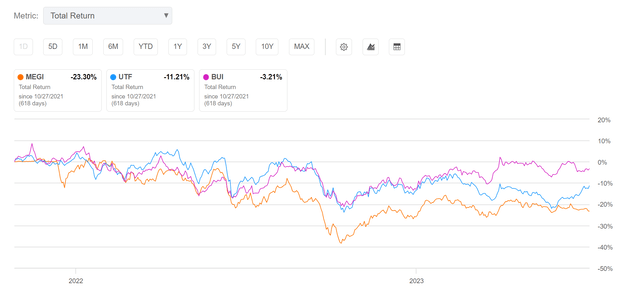

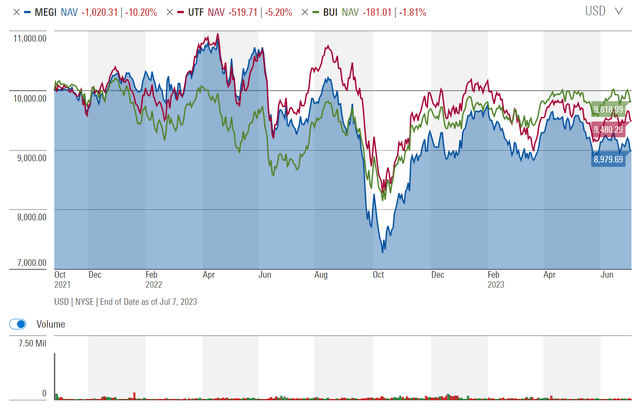

In terms of market performance, the MEGI fund has underperformed UTF and BUI by a mile, with total returns of -23.3% since inception compared to -11.2% for UTF and -3.2% for BUI (Figure 9).

Figure 9 – MEGI has massively underperformed on market price (Seeking Alpha)

Interestingly, NAV returns for the MEGI fund is not as bad, as the MEGI fund has only lost 10.2% of NAV since inception compared to -5.2% for UTF and -1.8% for BUI (Figure 10).

Figure 10 – But NAV returns is not as bad as market price (morningstar.com)

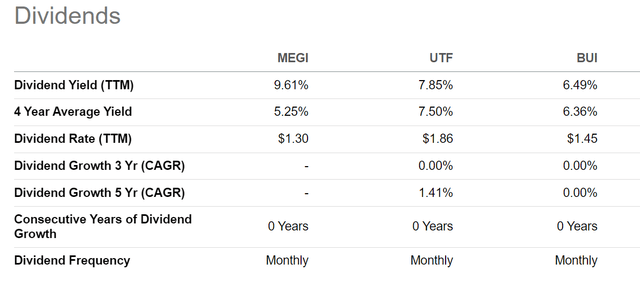

Finally, comparing the distribution yields of the 3 funds, the MEGI fund currently has the highest distribution yield at 9.6% on market price compared to 7.9% for UTF and 6.5% for BUI (Figure 11). On NAV, the yields are 8.1% for MEGI, 8.0% for UTF and 6.4% for BUI.

Figure 11 – MEGI has highest distribution yield out of the 3 peers (Seeking Alpha)

While MEGI’s performance has lagged peers, I believe the fund’s steep 16% discount to NAV may be a little too steep since MEGI’s portfolio holds liquid common and preferred shares of utilities and other infrastructure companies.

Part of the issue may be the relatively unknown manager, CBRE Investment Management. As I mentioned at the beginning of this article, CBRE is more associated with commercial real estate brokerage and services, and is not well known for managing public equities. Investors in the MEGI fund may have lost confidence that the CBRE team can turn around performance for the fund.

Conclusion

The MainStay CBRE Global Infrastructure Megatrends Term Fund is a high yielding infrastructure fund marketed as capitalizing on the investment megatrends of Decarbonization, Asset Modernization, and Digital Transformation. I have some reservations regarding the thematic classifications, as many holdings appear to be simply utilities and infrastructure companies with some exposure to the megathemes.

The MEGI fund is currently paying an attractive 9.6% distribution yield, although on NAV, the yield is only 8.1%.

Returns for the MEGI fund has been poor, with -5.2% average annual loss since inception. Poor returns combined with a relatively unknown manager have caused the fund to trade at a steep 16% discount to NAV.

For me personally, I would not invest in the MEGI fund, as the manager is not known for public equities investments and performance since inception have been subpar. However, for income oriented investors with a contrarian bent, MEGI’s high distribution yield and discounted portfolio could make it as an attractive mean reversion trade.

Read the full article here