Delta Air Lines (NYSE:DAL), one of the leading airlines in the United States, is poised to potentially exceed earnings expectations this week. Several factors contribute to this optimistic outlook, including a surge in daily flights, a rebound in passenger numbers, government initiatives to address staffing shortages, and a solid financial foundation. Let’s explore these factors in detail and present a compelling case for Delta Air Lines’ potential to outperform market expectations.

Record-Breaking Daily Flights and Rebounding Demand

The recent surge in daily flights represents a remarkable milestone for the aviation industry. FlightRadar24, a flight tracking website, reported that a record-breaking 134,386 flights were operated in a single day on Thursday, July 6th. This figure, which excludes various unmeasured flights, signifies the highest number of tracked flights since the website’s inception. The tremendous demand for flights suggests a strong recovery in the aviation sector and bodes well for DAL stock.

flightradar24

Although the COVID-19 pandemic hindered air travel growth by approximately 15-20%, recent data reveals that this week’s flight volume could have been 15% higher without the pandemic’s impact. The pent-up demand for travel, coupled with eased travel restrictions and increased vaccination rates, has led to a significant rebound in passenger numbers. Furthermore, June 30 witnessed the busiest day in U.S. airports since December 2019, with 2,883,595 passengers passing through TSA checkpoints. This resurgence in passenger numbers indicates a promising trend for Delta Air Lines and other airlines.

Addressing FAA Staffing Shortages

The Federal Aviation Administration (FAA) currently faces significant staffing shortages among federal air traffic controllers. The shortage has prompted the FAA to request certain airlines in specific regions to reduce the number of flights this summer. To alleviate the strain, the FAA has allowed airlines to drop their minimum flight requirements by 10% during the peak summer travel period. This relief aims to mitigate the effects of air traffic controller staffing shortfalls, particularly in areas like the New York City metropolitan area.

The FAA acknowledges the urgency of addressing this crisis and plans to shift radar operations from Newark to Philadelphia in September. Additionally, President Biden’s proposed budget includes a 17% funding increase to enhance FAA facilities and systems, as well as the hiring of 1,800 new air traffic controllers in fiscal year 2024. While these measures will take time to fully address the staffing issue, they demonstrate a commitment to improving air traffic control infrastructure and services.

Financial Performance and Market Expectations

Delta Air Lines’ pre-pandemic revenue figures highlight its solid financial footing. In 2019, the company generated $43,030 million in revenue, with revenue per share of $72.21 and a gross profit of $13,186 million. For the current trailing twelve months, the company reported revenue of $44,692 million, revenue per share of $84.56, and a gross profit of $11,285 million. These figures indicate Delta Air Lines’ has fully recovered from the pandemic and were able to navigate those difficult times without diluting shareholder’s value.

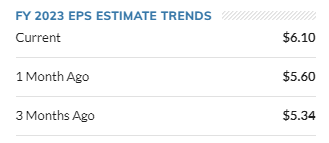

Among 16 analysts’ forecasts, an average earnings per share of $2.36 is expected with revenue of $14.44 billion. The high EPS estimate is $2.5, while the low estimate stands at $2.1. Furthermore, the high revenue estimate reaches $15.15 billion, with the low estimate at $14.16 billion. This range of estimates suggests a positive outlook for Delta Air Lines’ financial performance as the expectation is a ~64% increase over last years $1.44 EPS and earnings estimates for the year have steadily been going up.

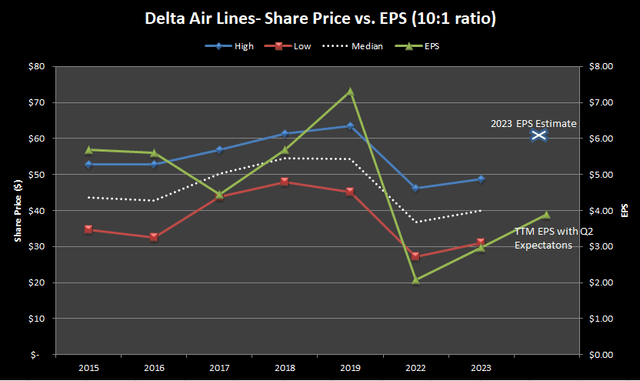

Marketwatch Yahoo Finance and Marketwatch Data Plotted in Excel

Comparing historical values on Delta can be challenging with all of the outliers from the pandemic. I plotted the share price range by year with EPS (on a 10:1 scale) and removed 2020 and 2021 and use trailing twelve months for 2023. While it appears price is overextended with shares trading above earnings on the scaled chart, an earnings expectation hit or even a mild miss would still put current price at a ~12 PE ratio which is still a good value for a long term buy by historical norms especially with full year estimates extending well past current the current trading range. The boom cycle could just be getting underway as evidenced by the record flights, the full year EPS estimates rising, and the U.S. airports hitting levels not seen since December 2019 along with strong grades across all factors.

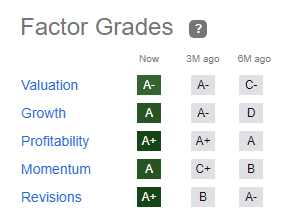

Seeking Alpha Ratings

Delta may have also tipped its hand to a blowout earnings report by announcing on June 15th that it would be reinstating its dividend. The dividend, set at $0.10 per share, will be paid on August 7 to shareholders of record as of July 17. Delta follows in the footsteps of Southwest Airlines, which became the first major U.S. airline to reinstate its dividend in December 2020. The decision to resume dividends reflects Delta’s progress on its three-year financial plan, which includes over $10 billion in debt repayment over the past two years. This move aligns with Delta’s optimistic forecast of higher-than-expected profits for the quarter ending in June, driven by strong summer travel demand. It is worth noting that as part of the government assistance received during the pandemic, airlines were previously prohibited from paying dividends or buying back stock.

Trade Idea

While I do expect a beat from Delta and consider it a good long term buy, shares are overbought by most technical indicators and anything less than stellar could lead to a selloff in the short term which is why my options play for this earnings report entails very little to no risk for a downside move.

TradingView

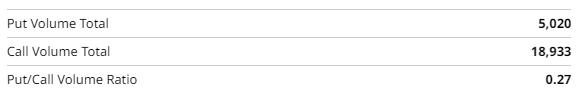

A factor to consider before trading options is a stock like Delta does not have the options volume of the indices and this can lead to some hidden fees when navigating wider bid-ask spreads. The call volume greatly exceeds the put volume so I believe a short call condor with a tilt to the bullish side could be a good play.

BarChart

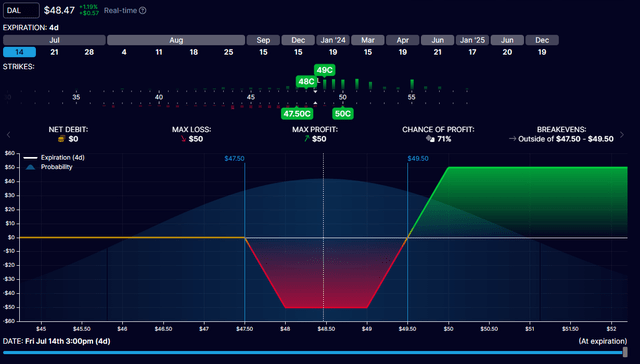

Short Call Condor

Buy to Open $49 Call and $48 Call July 14th expiration

Sell to Open $47.50 Call and $50 Call July 14th expiration

OptionStrat

Typically, tight inverse short call condors would have a less favorable risk to reward ratio if the long and short positions have the same width. By reducing the width of one of the short legs by 50 cents, it increases the risk-reward to a theoretical 1:1 at the expense of no profit potential to the downside. However, the $50 profit for one set will not be achievable in reality since all 4 legs will be deep in the money reducing their volume and widening their bid-ask spread. Still, a very favorable trade in my opinion as share price only needs to move +3% to achieve a possible 70-80% profit against risk when factoring in bid-ask spread or down 2% by expiration to result in no loss or very minimal depending on the order fill.

Delta Air Lines is well-positioned to surpass market expectations this week due to several favorable factors. The record-breaking number of daily flights, resurgence in passenger numbers, government initiatives to address staffing shortages, and a solid financial foundation provide a compelling case for the company’s potential for success. As the aviation industry recovers, Delta Air Lines stands as a resilient and adaptable player, ready to capitalize on increasing demand for air travel.

Read the full article here