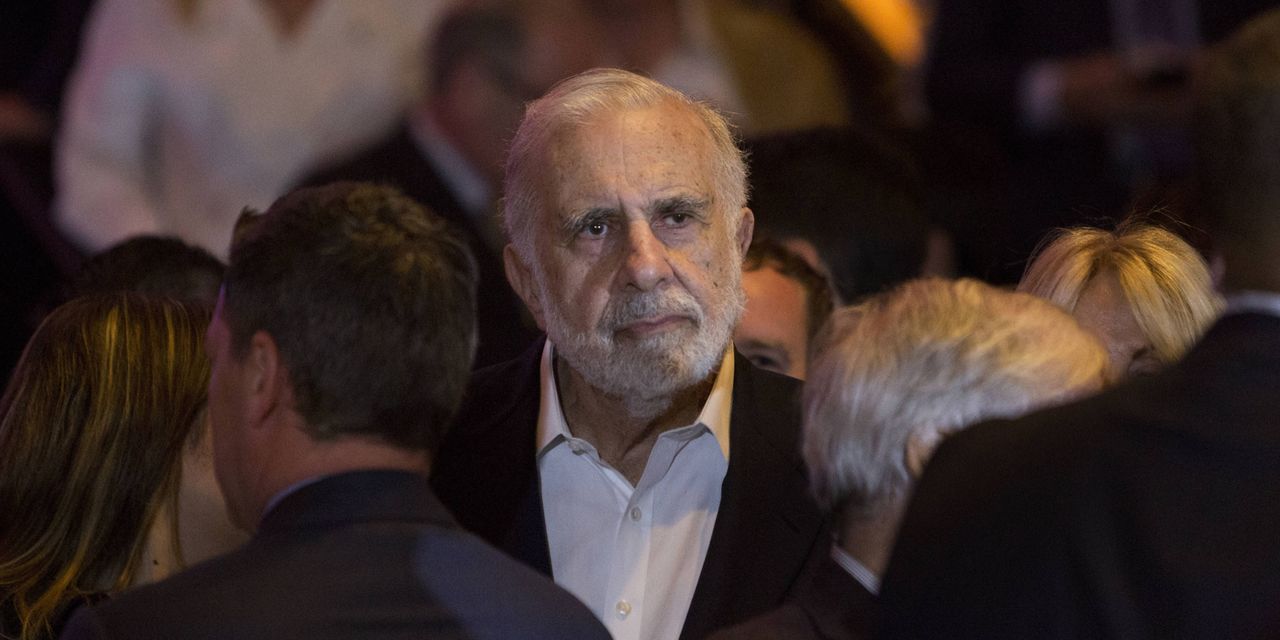

Shares in activist investor Carl Icahn’s publicly listed investment vehicle dived after short-seller Hindenburg Research released a critical report on the company.

Icahn Enterprises

(ticker: IEP) shares were down 13% Tuesday after the publication of the Hindenburg report.

Icahn Enterprises

is a holding company with stakes in businesses including

Xerox

(XRX), and it also owns some companies outright.

Hindenburg makes money by “shorting,” or betting against, the stocks it reports on. Hindenburg’s report questioned Icahn Enterprises’ policies on asset valuations and its dividend policy. Icahn Enterprises didn’t immediately respond to a request for comment from Barron’s.

Icahn is normally on the other side of corporate struggles, known for his activist campaigns to try to force changes at companies such as

Netflix

(NFLX).

Hindenburg’s report isn’t the only recent example of a prominent activist investor facing criticism over his own listed companies. Shareholder activist Nelson Peltz’s Trian Fund Management said last year that it would shut down a London-listed investment vehicle after a campaign by dissident investors.

Write to Adam Clark at [email protected]

Read the full article here