Summary

This is an update to my previous coverage for Burlington Stores (NYSE:BURL). Previously, I recommended buy rating because of the potential of a beat and raise narrative for FY23 as the guidance seems conservative.

For this update, I recommend a buy rating for Burlington as I expect it to see positive tailwinds in the near term, which should boost earnings growth.

Business description

Burlington Stores, the third largest American off-price apparel and home fashion retail firm with 927 stores as of the end of fiscal 2022, offers a wide selection of products from more than 5,000 brands at everyday low prices that are up to 60% lower than those offered by traditional retailers. The company’s goal is to make shopping feel more like a treasure hunt by constantly rotating its selection of goods and providing basic services.

Industry

The US apparel market is large and growing, with a TAM of $343 billion expected in FY23 and projected to grow to $371 billion in FY27. TJX, Ross, and Burlington are the three major players in the industry, with a combined market share in the low teens. Scale is important in this industry due to the importance of offering a large collection of SKUs while maintaining a strong balance sheet to last through economic cycles. As a result, I am optimistic about BURL’s market position.

Thesis updates

In 1Q23, BURL’s comp growth was only 4%, or 200 bps below the guidance of 5 to 7% growth, due to the effects of the weather and lower tax refunds. Nonetheless, I believe the business is about to see near-term tailwinds; management reported a strong performance in March, which was offset by lower tax refunds in April and cooler weather in the weeks before Easter. I think this is a positive turn of events because it will encourage people to make more frugal purchases, which is good for BURL. Stores in lower and moderate income regions have historically driven performance, but management has noted a new trend in which stores in higher income demographics are outperforming the rest of the chain. This indicates a downgrade in quality to me. So, I think that, even with a shaky macro backdrop, BURL’s total comp could be supported by trade-down benefits to off-price.

Financial analysis

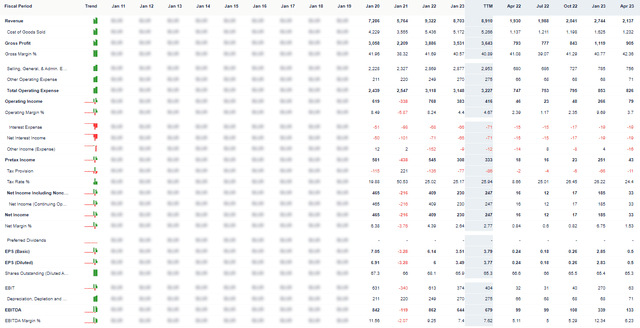

Gurufocus

BURL, as one might expect, is a very stable business that has consistently posted positive revenue growth since 2012 for an entire decade until covid happened. This demonstrates BURL’s stability and ability to grow in tandem with the industry. As BURL begins to reap the benefits of trade down, I expect near-term growth to be higher than the historical rate of msd to hsd rates. In the long run, growth should return to historical levels.

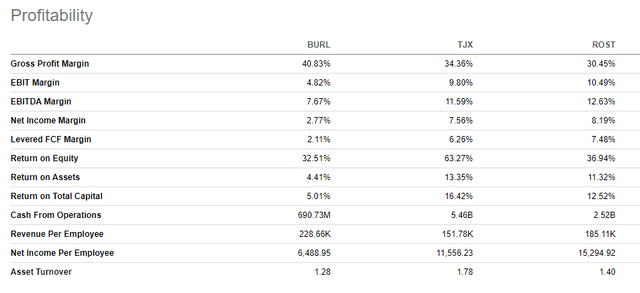

Given the high fixed costs embedded in this business, I expect the near-term high growth to be positive for EBIT margin due to the high incremental margin. Based on BURL history, we could see EBIT margins rising to 7/8%, as they did in FY17/18.

As previously stated, maintaining a strong balance sheet is critical given the business’s large fixed cost base (operating stores, leases, employees, inventory, working capital, and so on). BURL’s balance sheet is strong in my opinion, with $530 million in cash and $4.6 billion in debt. The debt level may appear high, but it is not a concern because $3.3 billion of the $4.6 billion is operating lease. The actual net debt after adjustments is around $800 million, which is less than 1x LTM EBITDA.

Valuation

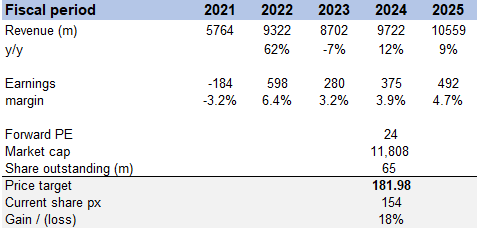

Author’s model

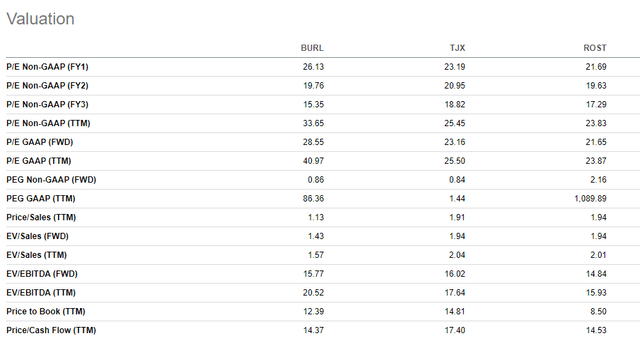

I expect BURL to grow revenue at higher than historical rates at 12% and 9% in FY24/25 as it benefits from the trade down movement, which will boost margins due to the high operating leverage. Given BURL positive earnings growth outlook in the near-term, and its higher margin profile vs peers, I believe it should be trade a premium to peers.

SeekingAlpha SeekingAlpha

Risk

My projections may be too optimistic if consumer spending drops more sharply than I anticipate, as this would cause sales trends to slow even further.

Conclusion

In conclusion, BURL , a leading off-price apparel and home fashion retailer, has a strong market position in the growing US apparel industry. Despite a slight comp growth miss in 1Q23, I believe the company is poised for near-term tailwinds with positive indicators in March and potential trade-down benefits. Near-term growth should outpace historical rates, benefiting EBIT margins, and the balance sheet remains strong with manageable net debt. However, the risk of a sharper decline in consumer spending should be considered. Overall, I remain optimistic about the company’s prospects.

Read the full article here