Dear readers/followers,

RWE (OTCPK:RWEOY) remains one of the largest energy companies on the planet – even if it’s only the second-largest in the country of Germany. It’s however also one of the 400 largest companies on the planet, with roots going back over 100 years. It was one of the first companies to gain independence from allied control in West Germany, went on to build the first nuclear power plant in the country, and has gone on a wide, European shopping spree to end up with one of the largest and most attractive legacy asset portfolios on the continent.

In this article, I intend to provide an update for the company and where I see things go during 2023-2025.

Let’s get going.

RWE – Plenty to like about energy/utility assets

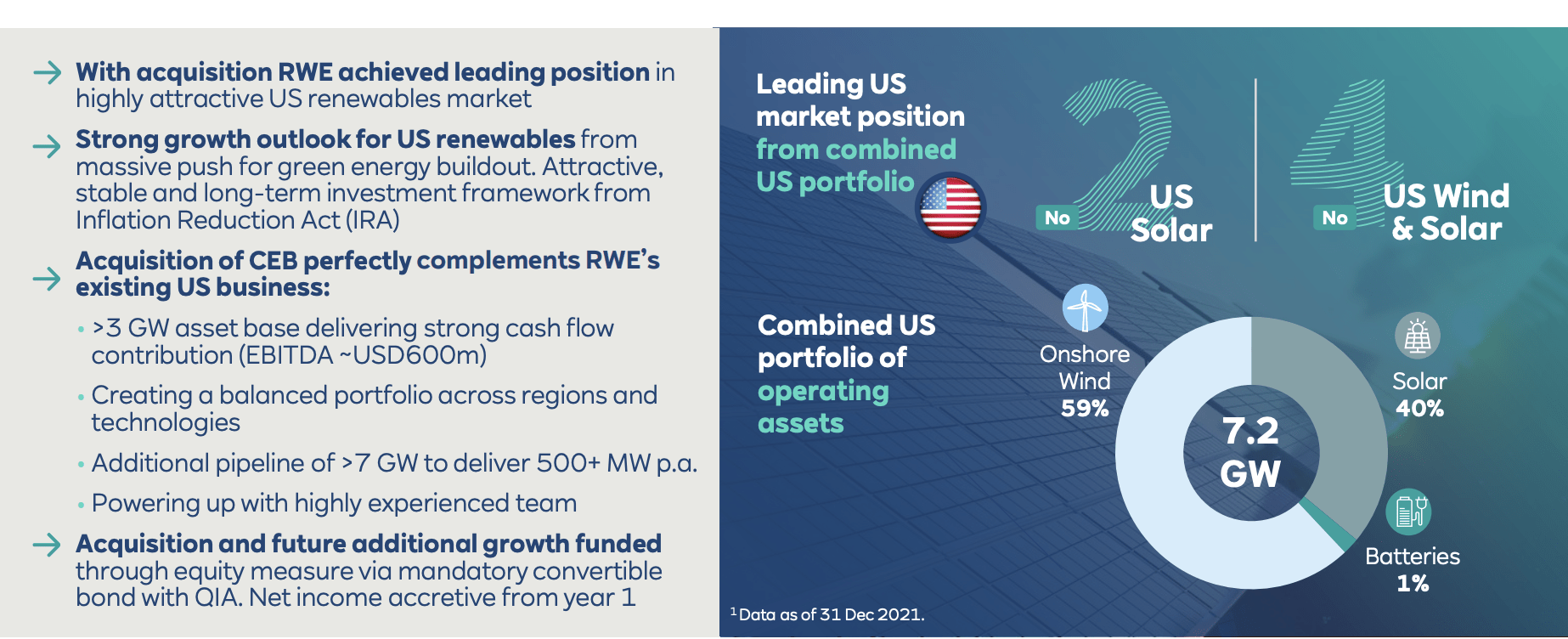

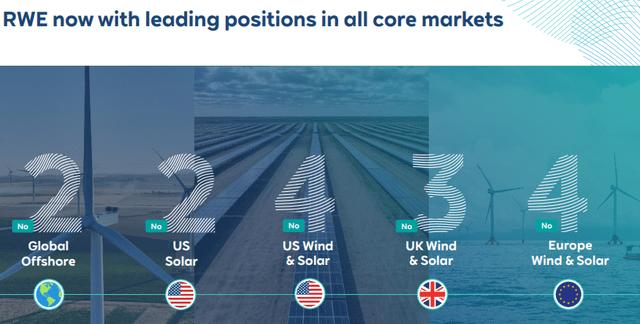

When I say “legacy”, I don’t want to give you the picture that the company doesn’t do renewables. I don’t think any one company could survive such a route in this market. What was once considered RWE, even by people with knowledge in the industry, is no longer what the company “is” today. The company has a very attractive set of renewable assets that seems to be growing year over year. What’s more, the company has already become a leader in US solar and Wind/Solar.

RWE IR (RWE IR)

The company, once the champion of coal, has pledged to leave the source behind within the next 7 years and already has one of the most attractive sets of sustainability ratings for any legacy asset company gone renewables on the market today.

Safety remains extremely high. What else would you call BBB+ investment grade, with a leverage target below 3.5x, which is currently already below 3x. The company has also adopted a dividend floor of 50-60% which based on current earnings trends puts the business at a yield of 2-3%.

The company isn’t the most attractively-valued utility or energy company out there. But then again, utilities aren’t as cheap as they were about a year back when I bought most of my Enel (OTCPK:ENLAY) or other stakes, which are currently up 35%+ including dividends.

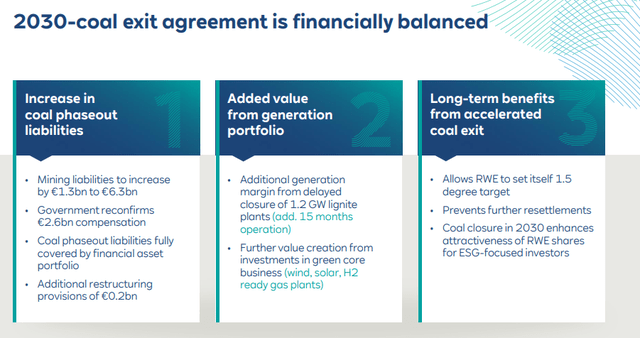

However, this lack of absolute undervaluation is understandable when viewing the company’s earnings improvements. RWE exceeded its financial targets in the 2022 fiscal despite all macro and challenges, coming in at a net income of €3.2B. The coal exit, which is most often spoken about, is actually in many ways ahead of schedule and is already balanced financially.

RWE IR (RWE IR)

The company has short-term measures to increase capacity, with the last of the 3.1 GW capacity going offline on the 31st of December 2029. The company has already delivered on several projects, strategic M&A’s, and pipeline additions to diversify operations ahead of these changes, resulting in market leadership across the world and specific markets.

RWE IR (RWE IR)

Its generation portfolio has been added to through complementing wind and solar assets, and due to carbon taxation and other measures, the resulting ESG-friendly portfolio will result in earnings growth as well as dividend growth. The company’s €1/share dividend is a floor for future years, so it should never dip below this level.

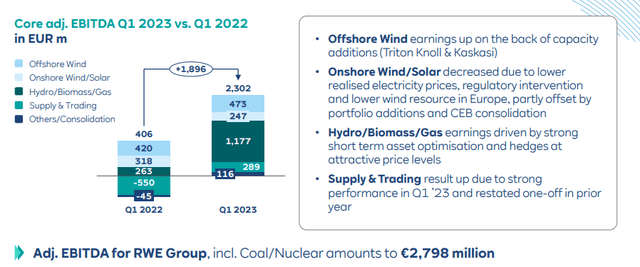

The company also confirmed the 2023E outlook, and delivered very solid 1Q23 numbers, with a very attractive mix that is no longer even as close to coal-heavy as it once was.

RWE IR (RWE IR)

RWE is, when you look closely at the company, surprisingly stable for the transition it’s going through and is continuing to go through in the next 7 years. Over the past 5 years, its share price development has been close to linear and growing at 23% per year or 143% over 5 years. This still trounces the S&P500 and other indices by a wide margin and makes me regret not investing much more, and sooner in the company. But it also means that the company is not necessarily all that attractively valued compared to opportunities available in other segments of the market.

RWE today is an Essen-based market-leading operator of green generation assets combined with a strong, attractive commercial platform. Its new exposure to its diversified and international markets with EBITDA coming from core businesses and less than a quarter from legacy is attractive – and no doubt why investment giant BlackRock (BLK) holds a large stake in the company.

The company’s maturities are extremely well-laddered, with nothing maturing before 2025, and most of it beyond 2028 – amply timed for the exit in coal, with the company’s borrowing costs likely to remain controlled due to its green status going forward. This is one of the few businesses where I do not necessarily view the Green focus as a negative because it results in actual, concrete advantages and fiscal improvements for the businesses.

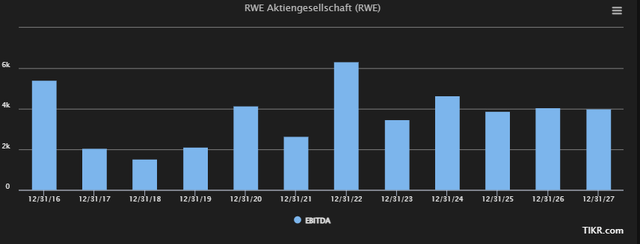

However, let me make one thing clear because it becomes relevant when we look at valuation. In the next 5-7 years, the company’s earnings profile will be volatile, and heavily impacted by the market for energy prices that we see. The company’s EBITDA will fluctuate, and anything close to 2022A levels will not be seen again for a very long time. So for those of you investing and hoping for a repeat of the 2022 performance, put that out of your mind. It’s unrealistic. 2022 EBITDA was at over €6B – I estimate that the company will be lucky, based on the downturn in power prices and volatility as well as changes and shutdowns, to reach an annualized EBITDA of over €4.4B – at least until 2026E. And most analysts following the company would agree with me on this point.

RWE EBITDA estimates (TIKR.com)

it’s a different RWE – but a better RWE to invest in the long term. But any sort of massive, triple-digit RoR is unlikely outside the bounds of massive utility premiumization. If we do see utility premiumization, I will be in the front row for massive returns given my 10% exposure to the sector in my portfolio – however, I view it as unlikely given the tepid earnings trends that most utilities and energy companies actually have over time.

Also, remember as a risk, RWE, given its broad exposure, has a very complex set of regulators from multiple nations and multiple regulatory bodies, with renewables alone in various countries under more than 5 different ones. This together with one of the most ambitious legacy plans that I am aware of, means that I am somewhat careful about when to “BUY” and when to “HOLD” this particular business.

The current forecasts for RWE are generally positive if we view them as outside of the 2022 paradigm, which set a massively positive precedent that I would be prepared to wager money upon so that it won’t be repeated. As RWE’s transformation has slowly gone toward more and more renewables and the plan is slowly being executed upon, we’re seeing more of a forecastable earnings and dividend nature, which is what we want to be seeing. Again, the company’s plan very much works – but we do need to give RWE time to actually realize it, and as they do, outperformance on the basis of EPS and dividends won’t be realistic – not unless we see a similar spike in pricing and trends as we saw in 2022.

RWE – Updated valuation

The update for RWE is relatively simple. The thesis hasn’t materially changed, but we have gathered some confidence and conviction in the overall long-term upside for the company – by long-term, I mean to 2030 and beyond. I don’t see any large-scale risks or impacts that could de-rail the path the company has taken. My previous PT for the company came to around €49/share – and I won’t be changing that in this article.

The update for RWE is relatively simple. The thesis hasn’t materially changed, but we have gathered some confidence and conviction in the overall long-term upside for the company – by long-term, I mean to 2030 and beyond. I don’t see any large-scale risks or impacts that could de-rail the path the company has taken. My previous PT for the company came to around €49/share – and I won’t be changing that in this article.

That means that RWE is still a “BUY” for me – but that “BUY” comes with a number of FYI notices – such as the one to not expect massive outperformance on a forward basis because of it being, frankly, unlikely in this environment.

S&P Global averages for RWE come to around €52.24/share from 19 analysts. Out of those 19, 18 are at a “BUY” or “Outperform” for the company in the longer term. That’s from a range at a €48/share low target, and a near-€60/share high target. I mostly agree with the general assessment made of the company here, though I view anything above €55/share to be somewhat too premium even for what the company offers here.

Even though other analysts don’t see a clear near-term upside based on earnings trends, I consider it far more likely that RWE will deliver stable results from the end of 2023E and upward – and this remains good enough for me to hold a positive thesis on the company.

However, meager yield and other regulatory risks inherent to the company in transformation are enough to make this far from the “best” sort of investment in the sector today. I do believe in the “BUY” – otherwise I wouldn’t be giving the rating. But I also caution you that your actual upside may be not as high as you might expect – and with the yield, this has the potential to push you below 10% per year, which is what I want to be getting whenever I put money to work.

The reason I invested in Enel above RWE, as well as other companies, is that the relative upside, despite what I view as similar levels of safety, is simply higher. Even if a company is a “BUY”, it still needs to outdo other potential investments to get my money.

And that, RWE does not necessarily do here either. It’s a great business with a good upside, but it’s not the “best” opportunity out there today.

Thesis

- RWE is among the class-leading renewable companies on earth, though with a still-existing legacy portfolio with exposure to lignite and other non-friendly (in environmental terms) fuel. The company is working to reduce this, and exit coal by 2030. It’s BBB+ rated, has a well-covered yield of over 2%, and is set, as I see it, to stabilize its earnings in the next couple of years.

- Because of this, I view RWE as a “BUY” with an appealing conservative PT of €49/share for the native – below even the analyst average, but still enough to interest potential investors.

- I own RWE here – and I intend to slowly build more as time passes and earnings come in.

Remember, I’m all about:

- Buying undervalued – even if that undervaluation is slight and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn’t go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside that is high enough, based on earnings growth or multiple expansion/reversion.

The company is not cheap here. Not based on the forecasts that the company currently does have – but it’s still good enough, based on a €49/share price target, to constitute a “BUY” for me here.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here