Piedmont Office Realty Trust (NYSE:PDM) is an office REIT primarily based in the Sunbelt region. They own and operate 51 high quality class A office buildings totalling 16.7 million square feet. These are located in cities like Atlanta, Boston, New York, Dallas, and Minneapolis. While they still own buildings outside of the Sunbelt region they are gradually rotating from these places and anticipate to make new investments mainly in Atlanta, Dallas, and Orlando. As with any office REIT the stock has been performing badly over the recent months and quarters mostly due to the work from home trend. Although, the stock price has been increasing in the last month or so.

Their leasing has been pretty good with the occupancy standing at 86.1% which, while not ideal, is not bad for an office REIT and it is actually quite standard these days when compared to peers. I would not fear it even though it decreased slightly from last year’s occupancy of 86.7%.

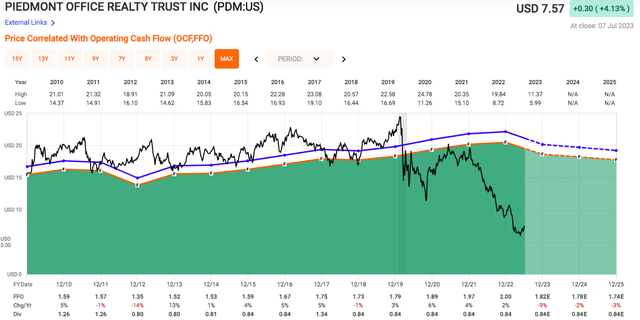

The FFO per share stands at $0.46 per quarter ($1.96 in the last year). In the last quarter PDM incurred a net loss of $1.3 million which is a huge shift compared to the first quarter of last year when the net income was $59.9 million. The guidance provided by the PDM states that their FFO per share will be between $1.80 and $1.90 so a little decrease from this year. Moreover, they expect a net income/(loss) between ($1 million) and $1 million so again, not too far off from this year. Worse results are for the most part a consequence of higher interest expense driven by higher rates.

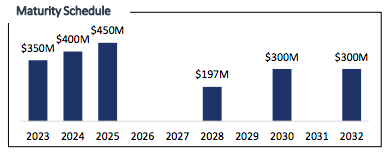

The company is BBB rated by S&P and Baa2 rated by Moody’s suggesting their balance sheet should be stable so let’s take a closer look. They have an outstanding debt of $2.2 billion, 81.2% of the debt is fixed and the weighted average stated interest rate is 4.13%. $600 million is available under a line of credit and $170 million in cash. One big downside is their maturity schedule because more than half of their total debt will mature in the next three years. Still, I don’t see this as threatening to the company as they do have money on their credit line but they will probably have to refinance which will likely drive interest expense even higher.

PDM

The annual dividend per share is $0.84 which is a 11.09% yield. The payout ratio is only 42% of the FFO so the dividend is well covered.

Now for the valuation. Piedmont, much like other office REITs right now, is really cheap. The P/FFO currently stands at 3.97x with a historical average of 11.08x so the company is trading at a major discount here. Similar to Brandywine Realty Trust (BDN) with a P/FFO of 3.71x. But much cheaper than Highwoods Properties (HIW) which trades at 6.37x.

I don’t expect the company to return to its historical average, however, it is likely it will reach the level of HIW and their P/FFO of around 6x, which is still pretty conservative, but it would still mean a 50% upside.

As with any investment there are risks to consider. Here are a few that I consider as the major ones.

1. Tenants not renewing their leases because of work from home. This would of course be problematic for the company and they would have trouble generating a sufficient amount of capital.

2. Not being able to refinance debt. Since their maturities are quite big, this would put the company under a lot of pressure and they would have problems paying the maturities.

3. Higher interest rates for longer, which would take away a large part of the company’s capital.

All things considered, PDM has a well distributed portfolio and most importantly high quality class A buildings which I think is a major advantage in the office sector as they are getting more popular than older ones. Their balance sheet looks pretty stable and the dividend is really high. Additionally, the stock is really cheap. With that, I think Piedmont is a strong enough company to survive the current situation in the office sector and I rate it as a Buy here.

FastGraphs

Read the full article here