Novo Nordisk (NVO) is a global healthcare company based in Denmark, primarily engaged in the discovery, development, manufacturing, and marketing of pharmaceutical products. The company’s main focus is on diabetes care, but it also offers a broad portfolio of biopharmaceutical therapies for haemophilia, growth hormone therapy, hormone replacement therapy, and a rapidly growing Anti-Obesity Medication (AOM) division. I believe a lot of this growth is priced in to the Novo Nordisk but there is still upside despite that and I list it as a Buy.

Novo Nordisk

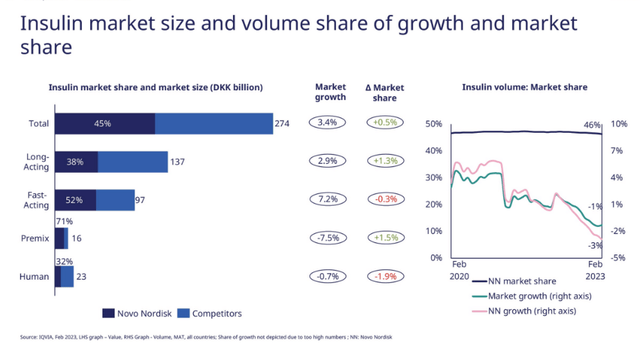

Controlling roughly 45% of the $40 Billion insulin market Novo Nordisk is a giant in the industry. With slowing to moderately declining market growth in insulin Novo Nordisk was at a bit of a disadvantage until it’s recent GLP-1 breakthrough products: Ozempic, Rybelsus and Wegovy. This semaglutide molecule that Nova Nordisk owns not only helps control diabetes but also has the added benefit of weight loss at higher does. Below is a breakdown of the different does of semaglutide across their various product lines as well the delivery mechanism.

- Ozempic® (semaglutide injection): This medication is used for the treatment of type 2 diabetes. It’s an injectable form of semaglutide that is usually started at a dose of 0.25 mg per week for 4 weeks, then increased to 0.5 mg per week. If additional blood sugar control is needed, the dose can be increased to 1.0 mg per week. List Price: $935 per pen

- Rybelsus® (semaglutide tablets): This is an oral form of semaglutide used to improve blood sugar control in adults with type 2 diabetes. The initial dose is typically 3 mg once daily for 30 days, then increased to 7 mg once daily. If necessary, the dose can be increased to 14 mg once daily. List Price: $935/Package

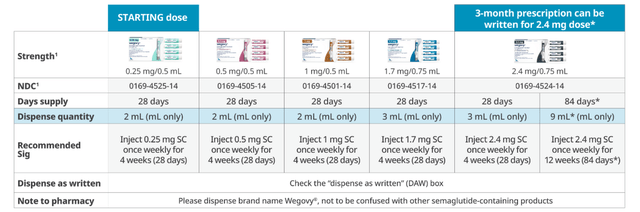

- Wegovy® (semaglutide injection): This is a higher dose injectable form of semaglutide that is used for weight management in adults who are overweight or obese. It’s started at a dose of 0.25 mg per week for 4 weeks, then increased in a stepwise manner until it reaches a dose of 2.4 mg per week. List Price: $1349/Package

As can be seen the doses for diabetes management injectable are 1.0mg per week and for Wegovy is in the 2.4mg per week with stepwise doses highlighted in the image below.

Novo Nordisk

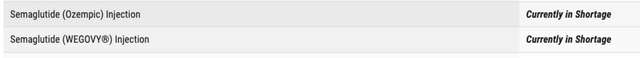

In early May of this year Novo Nordisk published an article describing the supply constraints associated with Wegovy:

While we are actively producing and shipping all dose strengths of Wegovy® and have taken significant measures to increase capacity, we will only be able to supply limited quantities of 0.25 mg, 0.5 mg, and 1 mg dose strengths to wholesalers for distribution to retail pharmacies which will not meet anticipated patient demand. We anticipate that many patients will have difficulty filling Wegovy® prescriptions at these doses through September. …

We do not currently anticipate supply interruptions of the 1.7 mg and 2.4 mg dose strengths of Wegovy®.

These constraints are also highlighted on the FDA’s website.

FDA

Novo Nordisk and the FDA indirectly outline that due to supply chain issues there is a roughly 5 month disruption in the ability of prescriptions of Ozempic and Wegovy to be filled. I anticipate that this September date is based around the FDA’s final approvals of the massive Novo Nordisk site in Clayton, North Carolina. Based off of their website:

Fermentation and Recovery process was submitted to the FDA for approval in May 2023.”

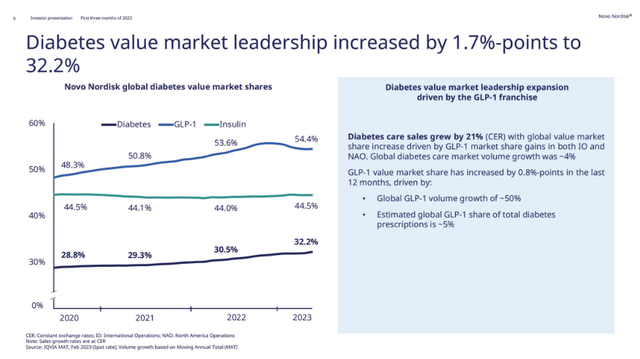

With a roughly 4-month turnaround time, this puts production approval for roughly September. The opening of this site will be massive for the API (active pharmaceutical ingredient) Semaglutide that is used in their entire GLP-1 portfolio of products. This site will not only alleviate the shortage but will also allow the market to expand for these drugs. Novo currently has a dominate market share of GLP-1 treatments. Most of this market share is focused on treating diabetes and not on treating obesity. I believe as more Semaglutide production comes online in North Carolina that Novo Nordisk will be able to focus more on the production of the semaglutide intensive obesity treatment Wegovy.

Novo Nordisk

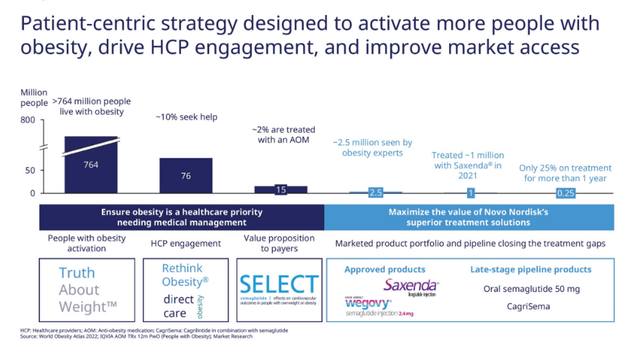

Based off of Novo’s figures Worldwide 764 Million+ people live with obesity with only 10% seeking help and ~2% being treated with AOM’s. Through a combination of marketing and normalization of medication to treat obesity this customer conversion and market will expand dramatically. I think one of the greatest networks effects of this product is going to be the “skinny Jimmy.” Once someone within a potential customers sphere of people dramatically loses weight people will ask what happened. When people reply with AOM’s such as Wegovy it turns an advertising expense in to a revenue stream.

AOM Treatment Pipeline (Novo Nordisk)

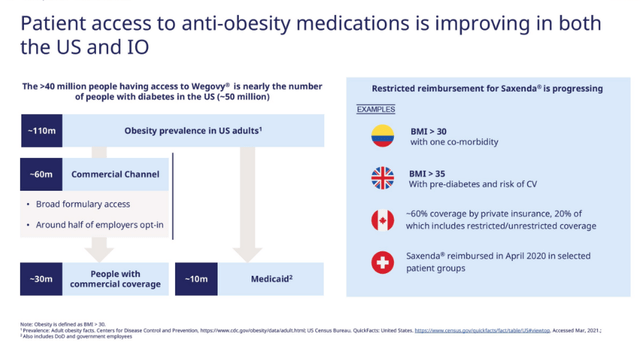

Wegovy is one of the first AOM’s to work effectively and have this level of success on patients. The market for Wegovy is massive and I believe as the second order effects of weight loss factor into insurance companies model’s that more insurance companies will not only cover Wegovy expenses but may even reward some customers for using it. I believe obesity will slowly be treated similar to smoking and insurance premiums will increased for obese patients. While this will require a law change in the US the chances of this happening are non-zero.

Novo Nordisk

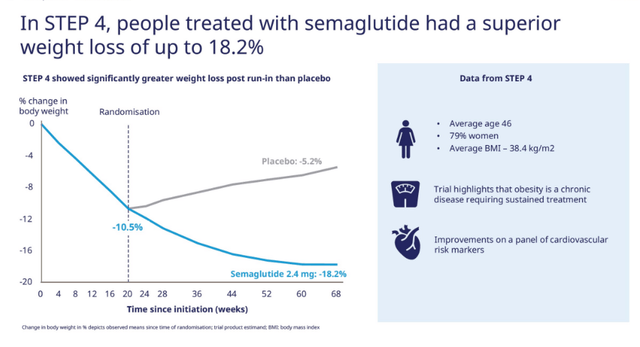

Another important aspect of the opportunity from Wegovy and their other GLP-1 drugs is that for the affects to continue the pharmaceuticals must be taken weekly otherwise there is a reverse in trend of weight loss and diabetes. This means that once a patient is on Wegovy they will likely stay on it or a similar drug to maintain the weight-loss. Which is highlighted in the image below. Also I believe the “stickiness” of Wegovy comes from the side effects of GLP-1’s being most severe early in the use of the product. Switching products likely will trigger those side effects again and even if there are cheaper alternatives customers are likely to stay with Wegovy and other Novo Nordisk GLP-1 treatments.

Weight change after stopping Wegovy (Novo Nordisk)

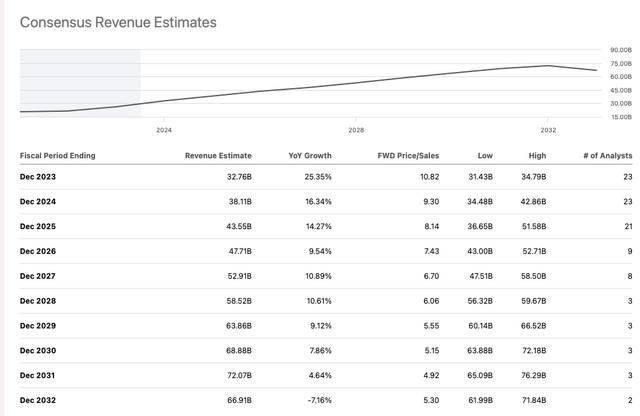

Revenue Growth Expectations:

Found on Seeking Alpha’s Earnings estimates page below is table of estimated YoY growth in Revenue.

Seeking Alpha

$5 Billion in revenue increase per year for the next 5 years will likely come from a variety of avenues but I believe it’s safe to assume the high growth rate from their Diabetes and Obesity Care will continue to frontline this growth rather than increases in the insulin market. With diabetes care having a list price of $935/month and Obesity Care having a list price of $1349 / month and with a rough assumption of a 25% weighted average discount rate to list price we can begin to estimate what customer growth will support this $5 Billion revenue increase. Obviously this is a very rough estimate and assumes a 2:1 ratio of diabetes care products being sold relative to obesity care. The average customer based off of these assumption generates $805 in revenue/month -> ~$9,657/ Year. To reach the analyst estimated growth rate of roughly $5B per year this works out to adding about 500,000 customers per year or 125k per quarter from now until 2032. All of this is also assumed to be done while maintaining those high list prices despite potential government interference and rising competition.

Novo Nordisk

I believe that this is more than doable for the business and I believe the maturity of Novo Nordisk will allow them to not only meet those target but likely exceed them as long as production can keep up with demand. The demand for these products is and will continue to be immense due to the strength and appeal of its portfolio of solutions.

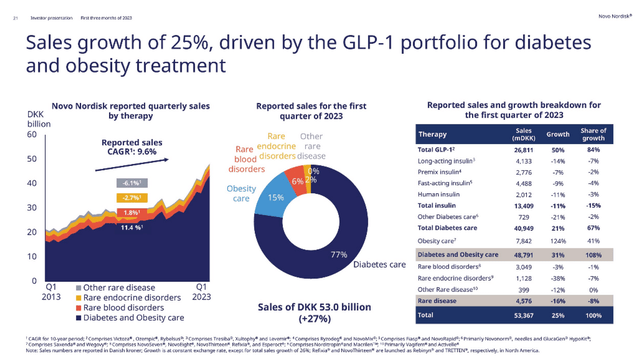

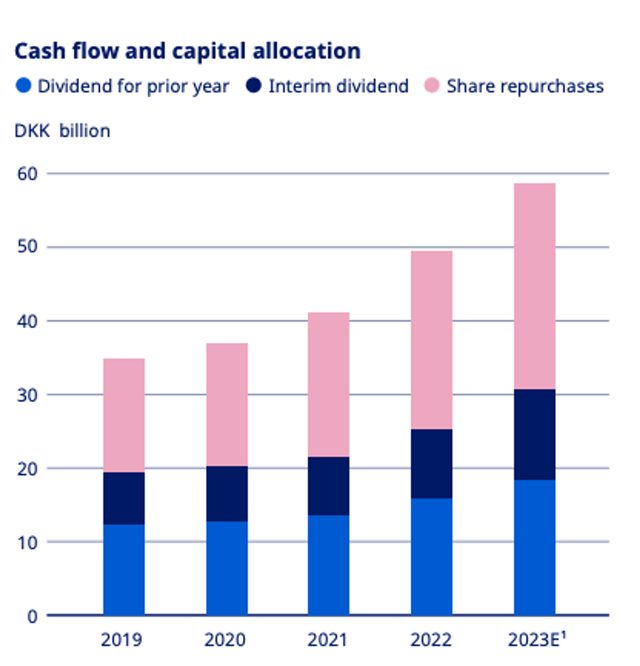

Not often do we see companies of Novo Nordisk’s size have growth of 25%+ YoY for revenue. Usually those type of revenue increases are reserved for smaller sub-$10 Billion market cap companies. The advantage of a mature company having this level of growth is that the timeline of these large revenue increases passing on to investors drop dramatically. Novo Nordisk has a history of not only dividend increases but also of the more tax-efficient stock buy backs.

Novo Nordisk

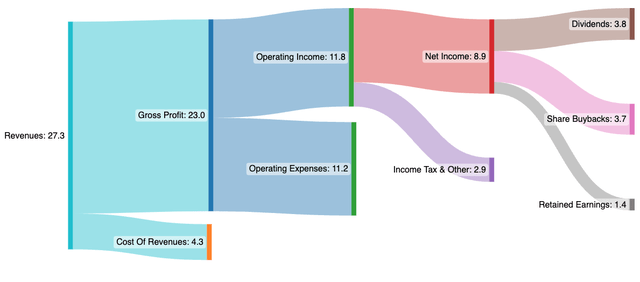

To highlight the capital return efficiency of Novo Nordisk I present the following for 2022 all numbers are in Billions:

Author

An incredibly high 27% of revenues were transferred to investors through Dividends and Stock Buybacks. This has been management’s style for at least last decade or so with about 1% of shares being purchased back every year. We can assume the trend will continue throughout the high growth over the next couple of years. Which should reward stockholders in the near term.

Valuation

Currently, Novo Nordisk has a Mkt. Cap / Revenue of about 13x and does about $27 Billion of revenue a year and has a market cap of around $350 Billion. At the current valuation Novo Nordisk will need to grow into this price but at the current growth rate this is very doable. With The North Carolina plant coming online later this year we will likely see stepwise changes in revenue that exceed analyst expectations for next year’s revenue.

In the short term there may be some turbulence in the August 10th earnings due to supply constrained growth issues. I anticipate them to offset this with an announcement stating that the North Carolina plant will be begin full production. This turbulence may possibly present a catalyst to acquire shares or potentially take advantage of increase volatility through options selling. Despite the short term turbulence I believe coupled with the high operating leverage and high return to investors marks this stock as a buy at current levels despite relatively high valuations.

Risks

As with all pharmaceutical companies there are regulatory risks as well as recall risks of the products. I believe both of these risks to be minimal due to the heavy regulation by the FDA and because their portfolio has many competitors that should properly enable free market dynamics and limit oversight.

I believe the largest risks to Novo Nordisk come from their near peer emerging competitor Eli Lilly’s (LLY). Mounjaro is similar to Ozempic and Rybelsus in the fact that it is used to treat Type 2 Diabetes and has the added benefit of weight loss. While Mounjaro isn’t FDA approved for weight loss it currently being reviewed for approval. In addition to Mounjaro Eli Lilly is working on Surmount a drug designed specifically for weight-management. While not approved yet it is in development and will likely be some level of competitor in a few years. Novo Nordisk’s first mover at scale advantage puts them in a market maker position which will allow them to dominate the AOM market for years to come.

Conclusion:

In conclusion, Novo Nordisk, with its robust product portfolio, proven track record, and dominant market share, seems well-positioned to drive significant growth over the next several years. The company’s growing focus on its Anti-Obesity Medication (AOM) division and novel GLP-1 therapies present substantial opportunities for expansion. Particularly, the semaglutide-based medications – Ozempic, Rybelsus, and Wegovy – have significant potential, especially if the supply constraints can be resolved with the expected production increase from the new Clayton, North Carolina plant.

The current supply constraints and any potential short-term disruption due to their upcoming earnings announcement may present an attractive buying opportunity for investors. With a growing global prevalence of obesity and type 2 diabetes, there’s a huge potential market for these drugs. The second order effects of weight loss, the ‘stickiness’ of these medications, and the potential changes in insurance premiums also bode well for the company’s future growth.

While the valuation of Novo Nordisk might seem high, considering its substantial projected growth and its history of rewarding shareholders through dividends and buybacks, the stock could still present a promising investment. However, one must be cautious about regulatory risks and competitive pressures, especially from potential new market entrants like Eli Lilly’s Mounjaro and Surmount.

Therefore, despite its high valuation and the competitive risks, Novo Nordisk could be a solid ‘buy’ for investors looking for a strong player in the pharmaceutical sector with a substantial growth runway and a history of returning capital to shareholders.

Read the full article here