Company Snapshot

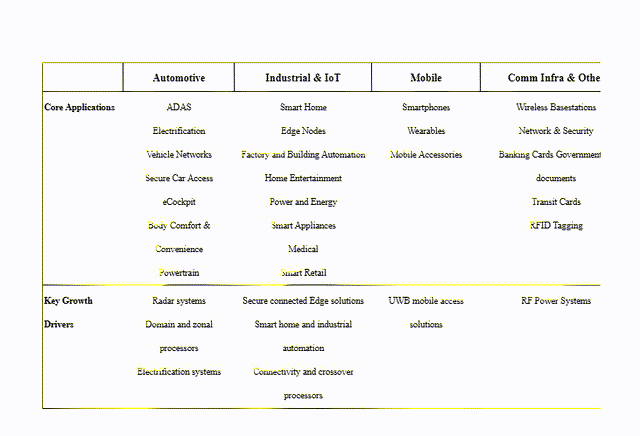

NXP Semiconductors (NASDAQ:NXPI) is a Dutch-based semiconductor entity whose product portfolio is used in four key end-markets- Automotive, Industrial & Internet of Things, Mobile, and Communication Services (see image below)

Annual report

NXPI utilizes both the OEM and distributors channels to sell its products; incidentally, within the former, it enjoys long-standing relationships with some of the most notable OEMs around such as Apple, Bosch, Harman Auto, Hyundai, Samsung, etc.

Well-Poised To Benefit From Developing Trends In The Auto Market

Even though NXPI offers exposure to a range of end markets, we believe ongoing developments in the auto market are what make this an intriguing play. For context, not only does the auto segment account for NXPI’s largest chunk of revenues (52% of group revenue last year, and 58% in Q1), it is also its fastest-growing segment (25% YoY growth in FY22, followed by 17% YoY growth in Q1).

Prima facie, when one thinks of the auto segment, one would be inclined to only look at production forecasts of autos every other year (this is expected to increase at a modest pace Y-o-Y). However, what’s often forgotten is also the growing electrification of the vehicle mix, the influx of ADAS (Advanced driver safety and assistance), and thus the concomitant penetration of semiconductor-related content within these vehicles (expected to surge by 5x from levels seen a few years back).

Intel

Currently, it is believed there are over 800 chips (with a chip value of $550/car) in a vehicle today; this will likely surge to 1100 chips ($920/car) by 2027.

An entity such as NXPI looks well poised to ride this wave, as it has built a reputation across different pockets within the auto space, particularly in the domain of automotive radars where it is believed to be the global market leader (Source: Yole). With increasingly stringent NCAP safety thresholds, demands for NXP’s radar-sensing technologies should grow.

One aspect that’s also particularly underappreciated is fuel economy-related applications such as Battery Management Systems (BMS) which NXPI specializes in. With Chinese OEMs developing ample clout in the EV market, we think BMS will become more commonplace, raising the profile of NXPI in the market.

Slowing FCF Dynamics And Declining Margin Profile Are Not Ideal

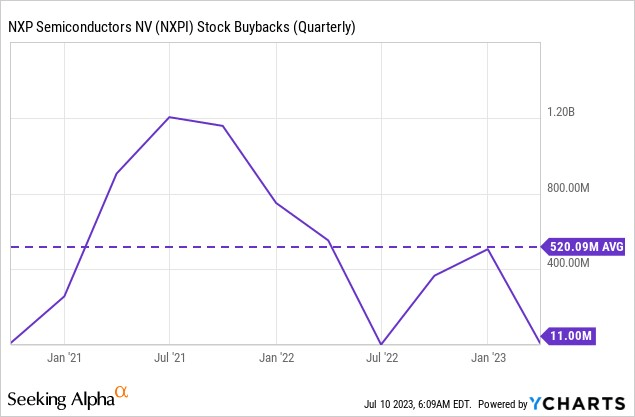

Besides NXPI’s core competence in the semiconductor space, investors also benefit from the company’s generosity as a shareholder return play. Whilst the dividend does not appear to be at risk, it looks like recent FCF dynamics have put a spanner in the works of the buyback angle.

YCharts

NXPI has traditionally spent over $500m per quarter on buying back its stock, and at the end of last year, NXPI had pending buyback ammunition of $2.48bn that could be deployed. However, in Q1, management only spent a miserly sum of $11m, and whilst they suggested they may do more in Q2, we don’t believe they are in a position to get it back to the historic level of buybacks per quarter.

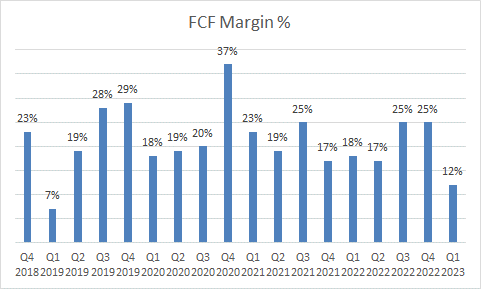

Coming back to the FCF position, note that typically NXPI used to convert at least one-fourth of its sales to FCF, but recently these conversion levels have collapsed with the FCF margin slumping to just 12%.

NXPI Investor Relations

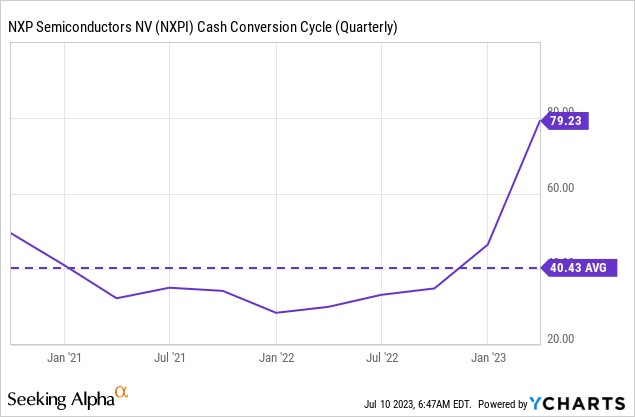

Much of this is on account of sub-par working capital dynamics that have weighed heavily on the operating cash flow position. Earlier cash tied up with working capital would be limited to only 40 days, but right now the cash conversion cycle is almost double that at nearly 80 days!

YCharts

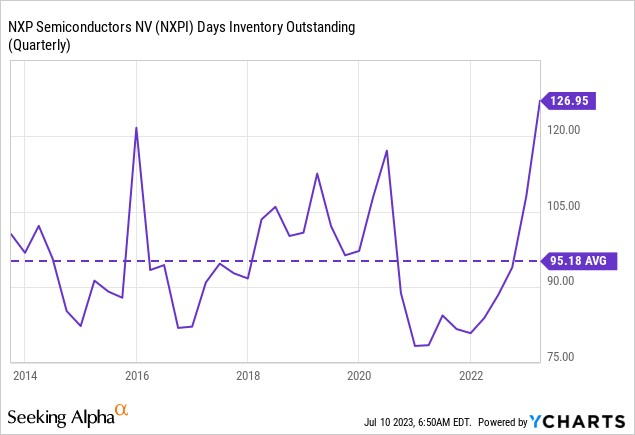

These pressures are primarily coming from the inventory front as the company reorients its inventory strategy. Earlier NXPI would inundate the channel inventory levels, and go easy on the inventory carried on their balance sheet, but recently the roles have reversed with, channel inventory standing at just 1.6 months. As a result, they are carrying an inordinately high level of inventory on their balance sheet with the inventory days at 10-year highs (over the last two quarters, inventories have been sucking out $200m of cash flow per quarter, the biggest drain on OCF).

YCharts

Management plans to lift the level of channel inventory only if they see a higher probability of sell-throughs, and they shot down the prospect of hitting channel inventory of over 2x, this year at least. As a result, we don’t expect any meaningful improvement on the operating cash flow front.

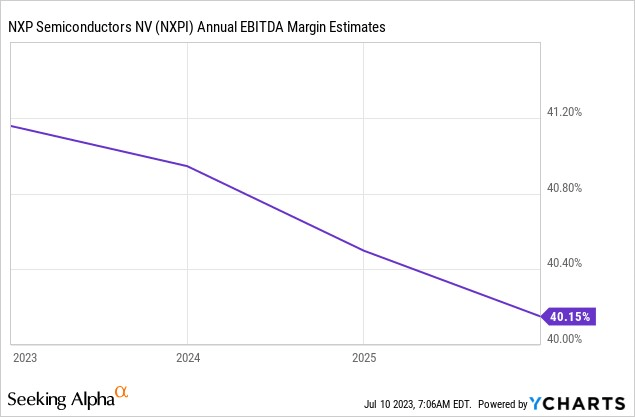

Investors also need to consider that currently, NXPI’s portfolio is benefitting from some pricing uplifts (as supply constraints linger and higher input costs get passed on to clients), but at some stage when the supply-demand position normalizes, this pricing lever is going to lose its luster (NXPI management believes they could then witness small single-digit price erosion annually). Clearly, margins are bound to be impacted, even as this translates to a lower flow through to the operating cash flow level. For context, consensus estimates show that NXPI’s margins will drop every single year through FY25, totaling 130bps in aggregate.

YCharts

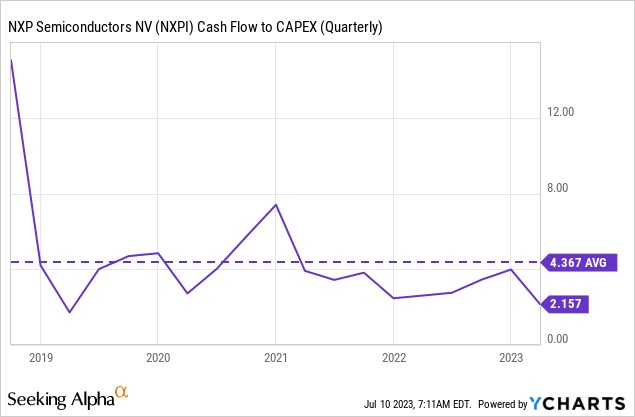

All in all, when your operating cash flow is not solid enough, there is lesser elbow room to cover your CAPEX requirements. Earlier, NXPI’s operating cash flows were covering its CAPEX requirements by over 4x, now it is half of that.

YCharts

Closing Thoughts – Technical And Valuation Narratives

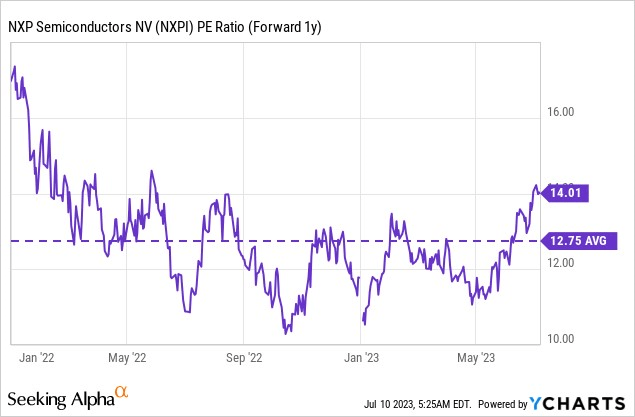

All in all, in light of some of the concerns we’ve covered in the previous section, it is questionable if investors should even be paying a premium valuation to pursue NXPI at this juncture.

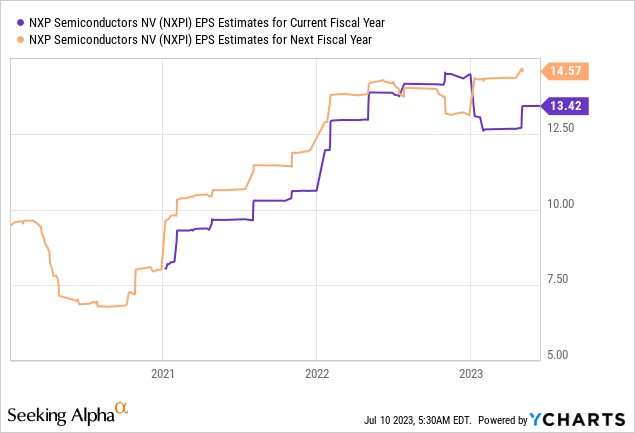

Even though NXPI management expects a pickup in H2 over H1, note that the expected EPS for FY23 will likely only come in at $13.42, implying an annual decline of-7% for the year. Granted, NXPI will more than makeup for the decline next year, with an expected EPS of $14.57 in FY24, but the net effect is a 2-year earnings CAGR of less than 1%.

YCharts

When you’re only getting just 1% earnings growth over the next two years, a forward P/E of 14x (based on FY24 estimates) comes across as very pricey, more so when it also represents a 10% premium over the stock’s long-term average.

YCharts

Even on the charts, there appears to be limited incentive to go long. The chart below shed some perspective on NXPI’s price imprints over a weekly basis; we can see that since 2022 the stock has been chopping around within the range of $140-$200/$204.

Investing

Within this broad range, since making an intermediate bottom in October, the stock has been trending up in the shape of an ascending channel (two black lines). At current price levels of $204, the stock is already close to the peak of its trading range, and not too far from hitting the upper boundary of the channel. We suspect a pullback closer to the $180 level would represent a better risk-reward than what we see currently.

YCharts

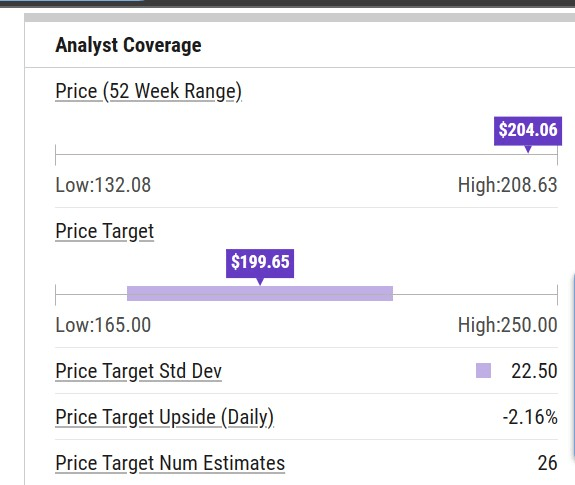

Investors would also be interested to note that currently the stock is trading above the average sell-side analyst price target of $200 (the average of 26 analysts), and it would probably take a monumental outlook for H2, for earnings to be revised upwards, and consequently the target.

Stockcharts

The chart above also suggests that investors fishing for suitable rotational opportunities within the autonomous and EV vehicle value chain are unlikely to plump for NXPI, as its relative strength ratio versus its peers from this space is trading well above the mid-point of the range.

Read the full article here