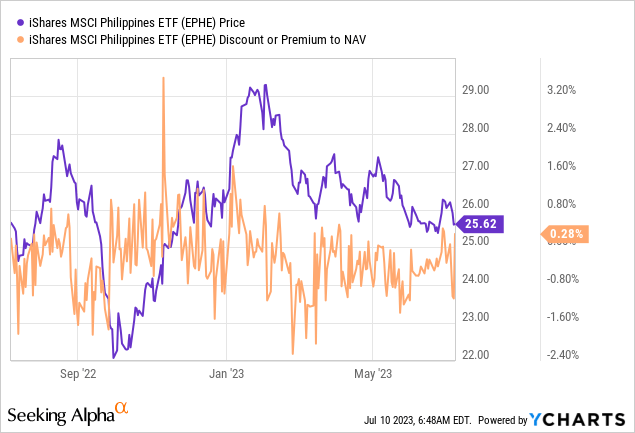

The iShares MSCI Philippines ETF (NYSEARCA:EPHE) has further declined since I last covered the name, as stickier-than-expected core inflation (the highest in the Southeast Asian region) and constant foreign net selling (foreign ownership now at multi-year lows) weighed on equity performance. With core inflation likely to worsen from here, as a 25% daily minimum wage hike kicks in and El Nino hits through the rest of the year, the Bangko Sentral (i.e., the Philippines central bank) may be forced to resume rate hikes. So even with the current EPHE portfolio valuation down to a seemingly cheap ~13x P/E (vs. a low-teens earnings growth outlook), equities could still see more downside ahead. The next BSP meeting in mid-August, the first post-leadership reshuffle, presents a potential catalyst.

Fund Overview – A Reasonably Priced Single-Country ETF for Philippine Exposure

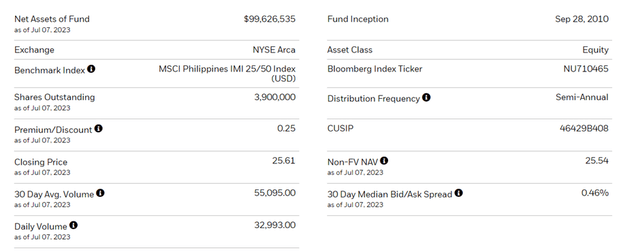

The NYSE-listed iShares MSCI Philippines ETF, which primarily tracks Philippine large-caps via the MSCI Philippines IMI 25/50 Index (USD terms), held ~$100m of net assets at the time of writing. Of note, the asset base is well below the prior ~$116m due to equity underperformance and investor outflows. The ~0.6% expense ratio remains unchanged, though, providing a reasonably priced vehicle for single-country Philippines exposure.

iShares

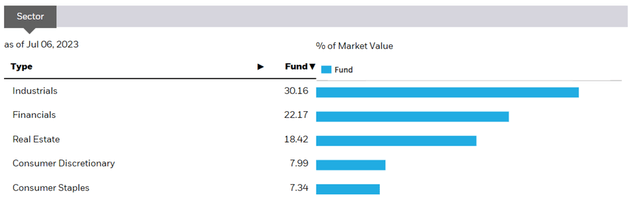

The EPHE portfolio is down to 37 holdings (38 previously), with the top-three sector allocations largely unchanged. Industrials (a proxy for Philippine conglomerates with diversified holdings across multiple sectors) remains the largest allocation at 30.2% (above the 29% prior), followed by Financials at 22.2% (unchanged) and Real Estate at 18.4% (down from ~20% prior). The rest of the top-five list runs below the 10% threshold, with Consumer Discretionary now the fourth-largest exposure at 8.0% (up from ~7% prior), replacing Consumer Staples at 7.3% (down from ~9% prior). While EPHE’s top five sectors make up an outsized ~86% of the total portfolio, the fund’s industrial exposure is mainly conglomerates with diversified sector exposure themselves, so EPHE is not as concentrated as it seems. The equity beta also remains quite low at 0.7 (vs. the S&P 500 (SPY)), so the fund screens favorably for its defensive qualities.

iShares

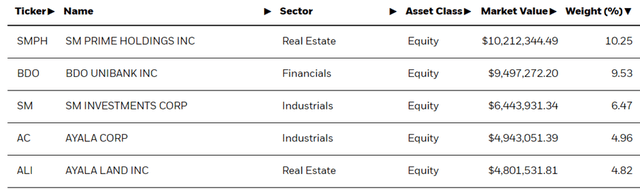

The EPHE single-stock profile is mostly unchanged as well, with the top holding still SM Investments’ property development arm SM Prime (OTC:SPHZF) at 10.3% (slightly down from ~11% prior). Domestic banking leader BDO Unibank (OTCPK:BDOUY) also remains the second-largest exposure at 9.5% (unchanged), followed by conglomerate SM Investments (OTCPK:SVTMF) at 6.5%. Rounding up the EPHE top five are major conglomerate Ayala Corporation (OTCPK:AYALY) and its real estate subsidiary Ayala Land (OTCPK:AYAAF). The portfolio has de-rated slightly to ~13x P/Earnings and 1.4x P/Book, but its discount to forward growth (low-teens consensus EPS growth estimates) isn’t wide by emerging market ETF standards.

iShares

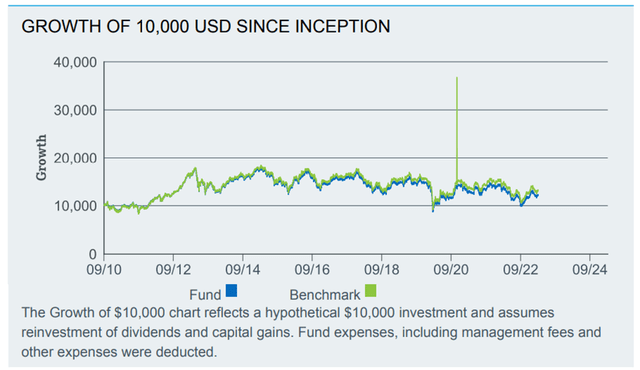

Fund Performance – Capital Return Track Record Worsens Following a Challenging Quarter

Following a subpar Q2, the ETF is down by 3.5% YTD and has compounded at +1.3% in market price and NAV terms since its inception in 2010. The near to mid-term performance figures don’t make for great reading either – over the last five and ten years, EPHE has delivered -1.9% and -2.1% total returns, respectively. In addition to the fundamental headwinds, the fund has also suffered from declining foreign participation (down to a multi-year low of ~20%) – a result of the country’s reduced weightings in benchmark equity indices, as well as lower liquidity levels vs comparable high-growth Asian equity markets.

iShares

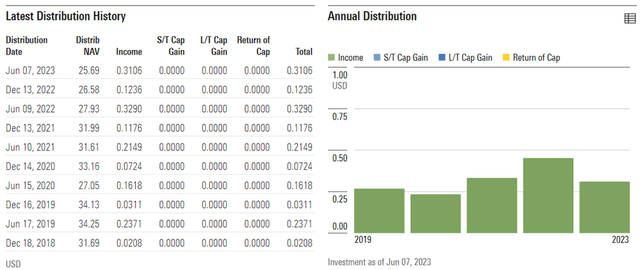

The semi-annual distribution yield is slightly higher at 1.8% on a trailing twelve-month basis (~1% 30-day SEC yield) following the YTD drawdown. Considering EPHE’s holdings in cash-generative banking and conglomerate names, however, the YoY payout growth is rather disappointing. Given management’s reluctance to prioritize shareholder returns over reinvestments (internal and via M&A), I would use EPHE primarily as a vehicle to ride the Philippines’ corporate earnings growth rather than as a defensive option.

Morningstar

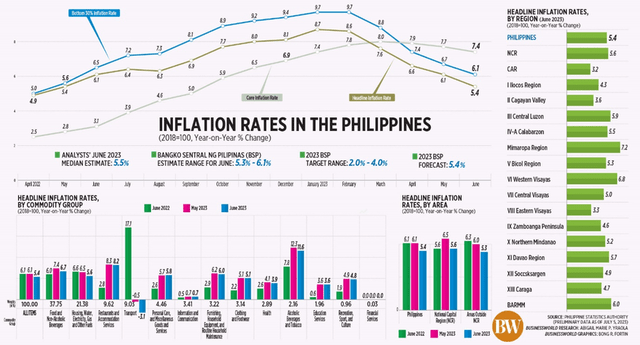

Elevated Inflationary Risks Remain

The biggest surprise out of the Philippines last month was core inflation, which remained the stickiest in the region at 7.4% YoY. While down from 7.7% previously, the key take here is that inflation remains well above the BSP’s 2-4% target range and, perhaps more importantly, above the benchmark policy rate at 6.25%. With the Philippines also not planning to roll out major subsidies (in contrast with its Southeast Asian neighbors) and a major minimum wage hike set to kick in soon, the central bank could well be forced out of its extended pause. Expect more policy clarity on the BSP inflation outlook once newly appointed Governor Eli Remolona takes charge at his first policy meeting next month.

BusinessWorld

An under-discussed tail risk to the Philippines investment case is the prospect of an El Niño event in the coming months. For context, El Niño refers to a climate pattern of lower rainfall and agricultural production, which typically results in a one-two punch of higher inflation and lower growth (i.e., stagflation). Depending on the length and severity of this episode, fiscal buffers such as price controls and subsidies may not be enough to tide the economy over, particularly in light of the current budget deficit (~7% of GDP). Hence, the risk of near-term monetary policy intervention is worth considering – either via more hikes or delayed rate cuts. At the current low-teens P/E, EPHE isn’t priced for tail risks, and thus, an unexpected reversion to monetary tightening poses significant downside to equity performance this year.

More Headwinds on the Horizon

Having seen the weightings in major Asia Pacific benchmarks cut in recent years, Philippine equities continue to suffer from declining foreign participation – ownership has now reached an all-time low, with no sign of easing up anytime soon. Alongside this technical overhang, core inflationary pressures, currently the highest in the region, also remain a key headwind for the consumer-focused economy. While the BSP has signaled a neutral policy stance, the upside inflation risks from the upcoming minimum wage hike and an El Nino episode in H2 mean more rate hikes could be on the horizon. The ~13x earnings valuation screens reasonably relative to the EPHE portfolio’s underlying earnings growth, but with no upside catalysts on the horizon, I remain cautious here.

Read the full article here