Investment Overview

One is based in San Diego, the other in Menlo Park, Calif. One has a market cap valuation (at the time of writing) of $29bn, the other $3.1bn. One earned revenues of $4.6bn last year, the other only $128m. One recorded a net loss of $(4.4bn) last year, the other $(314m). The former’s share price is -50% over the past three years, the latter’s +232%.

The two companies in question are the DNA sequencing pioneers Illumina (NASDAQ:ILMN) and Pacific Biosciences of California Inc. (NASDAQ:PACB), and back in 2020, they looked set to merge after Illumina agreed to pay $1.2bn to acquire Pac Bio. The regulatory approval process became protracted due to concerns about the anti-competitive nature of the deal, however, and the two parties agreed to terminate the deal, with Illumina paying Pac Bio a termination fee of $98m.

Since then, Pac Bio shares have risen by >200%, while Illumina stock has fallen by nearly half. Given last year’s losses, most investors may logically conclude that backing the momentum stock, Pac Bio, would be the right move if attempting to gain exposure to the genetic sequencing market – a sector with enormous potential.

It may not be quite that simple, however. As sophisticated and ground breaking as gene sequencing undoubtedly is, it’s a tricky product to sell.

Systems are expensive to acquire and operate, and because this is still an industry in its infancy, use cases are not as prevalent as you might expect. Customers – typically public and private laboratories, research organizations, and pharmaceutical companies – often overlook pure gene sequencing products due to budgetary constraints, and the “razor and blade” business model can easily come unstuck if products are not used regularly.

While a larger company like Illumina has successfully grown revenues from $1.8bn in 2014, to >$4.5bn in 2022, while recording net income of $726m, $826m, $1bn, $656m and $762m in the five years prior to 2022, PacBio has grown revenues from $61m, to $128m over the same period, whilst net income across the past 5 years to 2022 has been $(103m), $(84m), $29m, $(181m), and $(314m).

The list of smaller companies attempting to sell smaller, niche products into the life sciences / biological research industry, using the razor and blade model, that have fallen on hard times is lengthy – T2 Biosystems (TTOO) and Accelerate Diagnostics (AXDX) both developed promising systems for detecting bacterial infection, for example, but have seen their share prices decline by >90%.

Shares of NanoString Technologies (NSTG), a specialist in profiling of genes and proteins from tissue sample, are down 74% across the past year, Co-Diagnostics (CODX) by 80% Invitae Corporation (NVTA) shares by 86% across five years, and closest to home for Pac Bio, perhaps, Bionano Genomics stock – listed as a direct competitor in Pac Bio’s 2022 10-K submission (annual report), trades at a value of $0.6, with a market cap of $179m, having hit highs of >$13 in mid-2021.

Pac Bio is a larger company than any of those mentioned above, but its business model is similar and market dynamics similarly challenging. From Illumina’s perspective, the company is still dealing with the fallout from its controversial acquisition of cancer testing company Grail – a company it once owned – that has led to the resignation of its CEO, Francis deSouza and made it a target for activist investor Carl Icahn.

Both Illumina and Pac Bio provide investors with exposure to an industry that has transformative growth potential on the plus side, but is fraught with systemic risk and arguably an outdated business model on the negative side.

In this post I will dive a little deeper into the product suite, recent performance, and outlook for both companies, highlight where I think investors may benefit or lose out in relation to the business model, and conclude with my take on which represents the better investment opportunity at the present time.

Illumina – Overview and Recent Performance

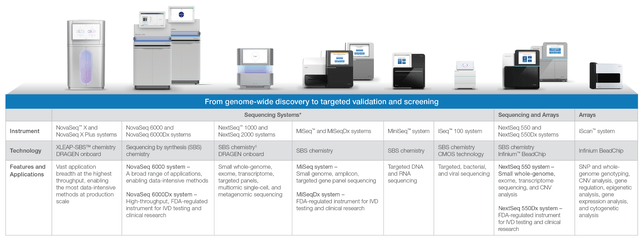

In its 2022 10-K submission (annual report), Illumina provides the below breakdown of its current product suite:

Illumina product suite (Illumina 10-K 2022)

The 10-K also states:

Most of our product sales consist of sequencing- and array-based instruments and consumables, which include reagents, flow cells, and library preparation, based on our proprietary technologies. We also perform various services for our customers.

In 2022, 2021, and 2020, instrument sales represented 16%, 17%, and 13%, respectively, of total revenue; consumable sales represented 70%, 71%, and 71%, respectively, of total revenue; and services represented 14%, 12%, and 16%, respectively, of total revenue.

What the above indicates is that Illumina is earning more from its consumables sales than its instrument sales, which I would interpret as a positive sign, showing that its products are not sat in laboratories gathering dust, but forming a key part of client’s research projects and drug development efforts.

In Q123, Illumina says it received >200 orders for its NovaSeq X device, and that it expects to make >330 shipments across the year. The company drove $1.09bn of revenues for the quarter – an 11% year-on-year decline – with non-GAAP net income of $13m, and earnings per share (“EPS”) of $0.08.

On the Q123 earnings call, Chief Financial Officer (“CFO”) Joydeep Goswami attributed the annual revenue decline to:

an expected year-over-year slowdown in COVID surveillance, COVID-related disruptions in China, the transition of some of our high-throughput customers to NovaSeq X, and customers managing constrained capital markets globally.

The company drove just $10m of cash flow from operations, but reported a cash position of ~$1.5bn, which puts the company on a financially stable footing. Guidance for FY23 was provided for 7-10% revenues growth, a non-GAAP operating margin of ~8%, and non-GAAP EPS of $1.25 – $1.5.

The profit margins remain narrow – forward price to earnings ratio is presently >130x at current share price of $183 – which speaks to the challenging nature of the business, but Illumina does have the size and scale to withstand trickier operating conditions, and a nascent, albeit controversial new business division it hopes will be transformative for the business – if it can hold onto it.

Illumina and Grail – A Match Made In Heaven, or Hell?

I wrote about Illumina’s imminent purchase of Grail all the way back in September 2020 for Seeking Alpha. It was an extraordinary story then (timeline can be found here), that has only gotten more so over the past three years. As I wrote in 2020:

Grail has developed an early detection test for multiple cancers, named Galleri. Galleri studies fragments of nucleic acid shed by cells into the bloodstream to detect the presence of cancerous tumor DNA (“ctDNA”). The company believes its test has the potential to detect nearly 70% of cancers resulting in death within five years at an earlier stage.

Grail was actually founded by Illumina, but the company opted to spin out the company in 2016, while retaining a 15% stake in the business. Realizing its mistake in letting such a valuable business go, Illumina moved to reacquire the company in late 2020 in a cash and stock deal worth $8bn, announcing in a press release that the Next Generation Sequencing (“NGS”) oncology testing market was anticipate to grow to $75bn by 2035.

Authorities in the US and EU objected to the deal, however, on anti-competitive grounds – just as they had the Illumina / Pac Bio merger. The US courts ruled in favor of Illumina against the Federal Trade Commission (“FTC”), but the EU blocked the takeover. Illumina took its case to a closed hearing with senior EU and antitrust authorities in February this year.

Then, in March this year, billionaire activist investor Carl Icahn, who owns ~1-2% of Illumina, attempted to claim three board seats at the company to ensure Illumina stopped pursuing the Grail deal, which was creating “a staggering amount of risk” at the company, the activist claimed, given the EU and US opposition.

Last month, Illumina’s CEO Francis deSouza stood down, with Charles Dadswell, senior vice president and general counsel, stepping in as interim chief executive. Icahn also successfully removed Chairman John Thompson, replacing him with Andrew Teno.

What will happen to the Grail deal? Apparently the company is about to receive a record fine from the EU for completing its deal without permission, rumored to be >$450m, or 10% of annual revenues. Illumina has also announced job cuts, and plans to leave its San Diego campus, in an effort to reduce annualised run rate expenses by $100m.

All of this mayhem helps to explain why Illumina’s share price has fallen from >$515 in late 2021, to just $182 at the time of writing. The uncertainty is hurting the company, although looked at another way, Illumina stock does not necessarily look cheap, trading at >6x 2022 revenues, at a time when profit margins are wafer thin.

Illumina’s longstanding problem has traditionally been viewed as a fairly limited set of product offerings focused on short read sequencing that could be challenged by upstarts like Pac Bio. The desire to acquire Pac Bio stemmed from the latter’s focus on Long Read technology, which is more versatile and less complex than short read – although it has not yet had much of an impact on the industry as a whole, which is primarily controlled by Illumina.

With an activist investor intent on shutting down the new business opportunity Illumina has been focused on since giving up on Pac Bio, it’s hard to see how Illumina grows – with no ~$75bn cancer testing market to address, you could even argue that Illumina stock has further to fall, perhaps to a price to sales ratio of ~5x, or a $22.5bn valuation, although my suspicion is any resolution of the company’s problems will be welcomed by shareholders and result in valuation growth in the short term.

It shouldn’t be forgotten that Illumina is the 800-pound gorilla of the DNA sequencing industry, more than twice the size of its next largest rival Qiagen (QGEN), a company that Thermo Fisher had planned to buy before a boom in revenues during the pandemic persuaded shareholders not to sell. Qiagen earned $2.1bn of revenues in 2022 – less than half what Illumina earned – and its share price has been stagnant for years. Can Pac Bio step up and take the fight to Illumina?

Pacific Bio – Overview and Recent Performance

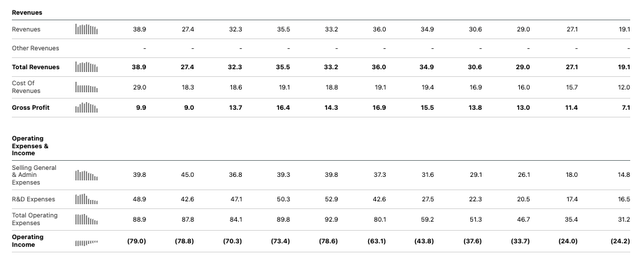

Pac Bio may have the long read technology, addressing what management believes is a $40bn addressable market (Source: Investor Presentation), but it does not as yet have the clients, and its growth is flat, as we can see below.

Pac Bio quarterly performance (Seeking Alpha)

The above quarterly earnings don’t inspire much confidence – if Pac Bio’s products are so impressive, why has it not been selling more of them? Luckily, like Illumina, Pac Bio has plenty of cash – $875m as of Q123 – so losses aren’t too much of a concern, although if the business keeps losing money at the current rate, its funding will be exhausted in two and a half years.

In November last year Pac Bio shared some targets during its investor day, which as its ambition to grow revenues at a 40-50% CAGR to 2026, or to >$500m, and to achieve positive cash flow by 2026 – about the same time its funding is set to run out, coincidentally.

Pac Bio is pinning its hopes on two new products – Revio, described in its 2022 10-K submission as a “a new long-read sequencing system designed to enable the use of HiFi sequencing for large studies in human genetics, cancer research, and agricultural genomics,” and Onso, “a short-read DNA sequencing system, designed to deliver industry-leading sensitivity and specificity for novel insights in oncology, disease research, and other applications.”

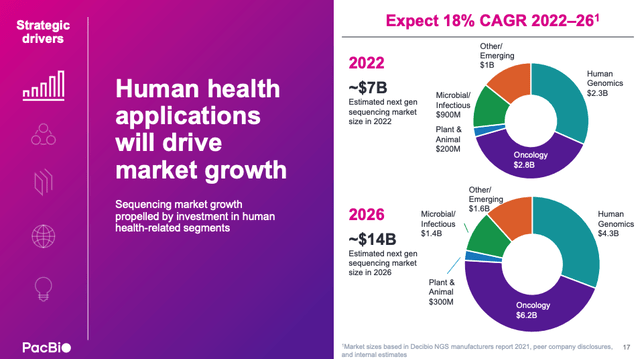

Pac Bio market growth opportunities (Investor Day presentation)

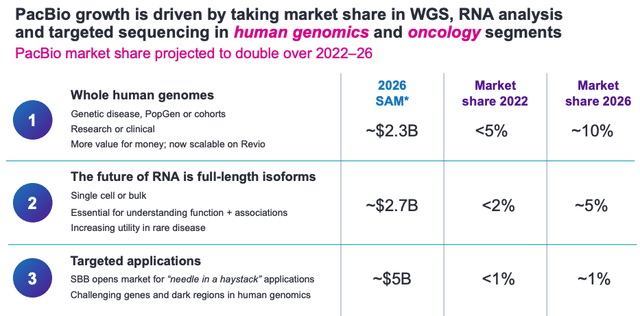

As we can see from the investor day slide above, Pac Bio’s core markets are human genomics and oncology, and the company’s strategy is to double its market share in the fields of whole human genomes and RNA analysis.

Pac Bio market share targets (Investor Day Presentation)

Pac Bio’s products seem to enjoy a good reputation – clients to have purchased new Revio systems include the likes of the Broad Institute and the Hudson Alpha Institute of technology, but the company’s goals remain the same – to build a large enough installed base that is used frequently enough to drive consumables revenues and lift revenues.

This razor and blade strategy still feels like Pac Bio’s Achilles heel – the company cannot use its products itself, it needs to persuade its clients to do so. The demand may simply not be there. Apparently, Pac Bio has >1,000 sequencers installed to date, but if these are made obsolete by the new products, revenues could end up shrinking before they start growing, and consumables revenues may shrink as well.

Apparently, Revio drives a higher revenue contribution than previous systems, but in order for Pac Bio’s business model to work, Revio will need to be a cutting edge product for the next decade or more, because the business cannot afford to keep dismantling its existing installed base and asking customers to pay for newer models.

Pac Bio – Solid Valuation Growth, But Too Much Reliance On “Jam Tomorrow”

Pac Bio’s share price rocketed to an all-time high of >$50 in 2021, presumably owing to the market’s expectation of a surge in product use and revenues as a result of the fight against the pandemic.

By July 2022, however, shares had sunk in value to <$4.5, likely a reaction to a series of disappointing earnings quarters. The two new product launches may be the contributing factors behind the company’s >135% increase in the share price across the last 12 months, and 54% gains year to date, perhaps also fuelled by Illumina’s struggles.

The $3.2bn current market cap valuation is 25x 2022 revenues, however, and although Q123 saw revenues 17% annually, to $38.9m, there’s no 2023 guidance, and management’s stated goal is to drive >$500m revenues for the first time in 2026. As such, in three years’ time, revenues may support a P/S ratio of ~6.5x, and marginal profitability – which doesn’t make an especially persuasive bull case relative to a lot of businesses whose growth in exponentially higher.

Pac Bio seems to have a great deal riding on Revio and Onso – if these systems do not sell well, the company’s valuation may suffer – remember, net losses in Q123 were >$88m.

Concluding Thoughts – The Upstart, or The 800-Pound Gorilla? Take Illumina Short Term, Pac Bio Long Term

To summarize my discussion above, Illumina has the market share, and even if it does not have the necessary long-term sequencing capabilities, its market share is seemingly unaffected, and its revenue generation is impressive, while its profitability is satisfactory.

Illumina’s M&A activities have been nothing short of disastrous for investors, however, with the Pac Bio pursuit failing and the GRAIL acquisition resulting in record fines and a battle for control of the company. GRAIL is the business that might have driven revenues and profitability to new levels, although it’s not guaranteed, and if the activist investor gets their way and the deal is scuppered, perhaps Illumina could start looking in-house for innovation instead of attempting to buy it in. That is, after all, how Grail was created in the first place.

While I do think Illumina stock has suffered as a result of the struggle in the boardroom, and I can see a share price spike arriving later this year or early next as these issues play themselves out – either the company emerges from the shadow of the Grail debacle, or wins the battle for control and keeps the technology – I still think a valuation of ~$30bn – $35bn is about right for Illumina, based on its ability to generate revenues over the next decade.

If I were buying the stock today, I would be looking for a rapid rise >$300 on the resolution of the Grail and boardroom disputes, and I’d be selling as soon as that target was achieved, owing to doubts about where the business can grow over the next decade.

On the other hand, if I were buying PacBio stock today I would be holding for the long term, as it could take several years for Revio and Onso to capture market share, and because I don’t find management’s forward guidance especially compelling. Longer term, however, there’s clearly room for Pac Bio to grow, and it seems the company has the products and cash to grow rather than shrink, as so many companies with a similar business model have done owing to a lack of client spending.

A final point – if I were a member of Pac Bio’s management team, I would be pushing for a sensational takeover of Grail once it is back outside of Illumina’s control again!

That would give Pac Bio the near-term revenue opportunity it craves, double the company’s size, and provide some genuine competition to the 800-pound gorilla, Illumina. I can’t imagine that will happen, but it might give the entire industry – which cannot seem to get an M&A deal over the line – a shot in the arm, and a competitive edge.

Read the full article here