Wells Fargo (NYSE:WFC) is not one of my favorite banks in the U.S. due to relatively weak fundamentals, and its operating performance is not expected to improve much in Q2 20223.

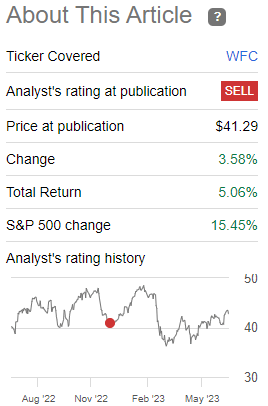

As I’ve analyzed in previous articles, Wells Fargo has not been one of my favorite plays among U.S. large banks, due to several fundamental issues that continue to negatively affect the bank’s performance. Since my last article, its total return has been only about 5%, being an underperformer compared to the S&P 500 index, as shown in the next graph.

Article performance (Seeking Alpha)

On the other hand, this performance has been more or less in line with the financial sector, and only slightly lower than Citigroup (C), the only U.S. large bank that I own in my personal portfolio. Given that Wells Fargo is going to report its Q2 earnings this week, in this article I update its investment case and make an earnings preview, to see if the bank now offers better long-term potential or if it remains a value trap.

Recent Events & Earnings Preview

While the Federal Reserve has been on a hiking pace over the past year, which theoretically is positive for banks and should be a support for higher share prices, Wells Fargo’s share price has been trading sideways for the past couple of years, showing that the bank has other issues that have been a headwind for its shares.

Share price (Bloomberg)

Wells Fargo is a bank with a business profile highly geared to retail and commercial banking, while its exposure to investment banking is not that great, thus its exposure to higher interest rates is quite significant. Indeed, during 2022, Wells Fargo’s net interest income amounted to $44.9 billion, representing some 61% of total revenues, compared to JPMorgan (JPM) that generates 51% of revenue from NII, or Goldman Sachs (GS) that only generates some 17% of total revenue from NII.

Wells Fargo’s NII increased by 20% YoY in 2022, while the bank’s total revenues decreased by 6% YoY, showing that higher interest rates were not enough to offset weakness in other areas. Indeed, loan origination was much lower which led to lower commissions, and trading gains were also softer, explaining the bank’s overall revenue decline.

Therefore, while rising interest rates would benefit Wells Fargo more than some of its direct competitors, weakness in other segments justifies why its share price performance has not been much different than compared to its peers in recent years.

In Q2, this trend is not expected to be much different, given that Wells Fargo’s NII is expected to be $12.9 billion, up by 26% YoY, due to rising rates. However, this represents a small quarterly decline, as the net interest margin is expected to contract from 3.20% in Q1 2023 to 3.06% in the most recent quarter. This happens due to higher cost of deposits, which usually have a large lag to rising rates, due to deposit betas being lower than asset sensitivity to higher rates.

Its total revenues are expected to be $20.1 billion in Q2, up by 16.9% YoY, but down 3.1% QoQ, as commission and trading income are expected to remain broadly soft and offset to a large extent the bank’s gains from higher rates.

On a more positive note, after several years of relatively high levels of expenses, in large part due to litigation issues, the bank seems to now be behind major hurdles, and its operating expenses are expected to be below $13 billion in the quarter. This represents a flat performance compared to the same quarter of last year, but a decline of 3% from the previous quarter.

Its cost-to-income ratio, a key measure of efficiency in the banking sector, is estimated to be around 64% (vs. 66% in Q1 and 65.5% in 2022), still a level that is above the average of its closest peers, but more acceptable when compared to the past few years (68% in 2021 and 77% in 2020). Nevertheless, assuming that the Federal Reserve is nearing the top of its current hiking pace and may, potentially, cut interest rates in 2024 or after, further improvements in its efficiency ratio should come mainly from cost-cutting, an area where Wells Fargo has a relatively weak track record.

Indeed, according to analyst’s estimates, Wells Fargo’s costs are not expected to drop much beyond the $13 billion mark over the coming quarters, thus its efficiency ratio is likely to remain above 63-65% over the next couple of years, a level that is not impressive and represents one of the bank’s main structural issues (poor efficiency).

While in the past its expenses were impacted by one-off litigation costs, which aren’t recurring by nature over the medium to long term, Wells Fargo’s efficiency is not good enough compared to its closest peers and this is not easy to fix, as a good part of its costs are sticky, being a major reason why I’ve been bearish on its stock over the past few years.

Furthermore, its operating performance has been constrained by the Fed’s $2 billion asset cap, which the bank expected since 2018 to be resolved in a relatively short period of time, putting severe limitations on the bank’s ability to grow its business. This is also a reason why Wells Fargo has not been able to reduce its cost-to-income ratio in recent years, as costs from regulation and others have increased in recent years, which has not been offset by higher recurring revenues.

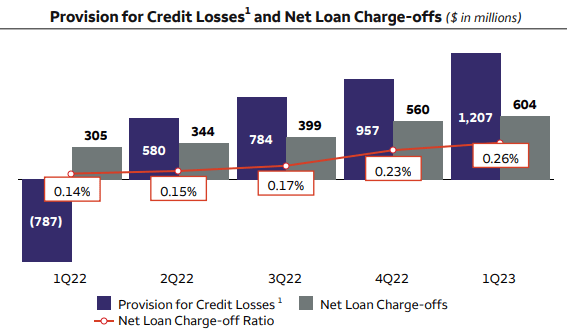

Regarding asset quality, despite the inflationary environment, higher interest rates, and an economic slowdown, credit quality has remained relatively strong in recent quarters, but the deteriorating trend is expected to somewhat accelerate in Q2.

Indeed, its loan-loss provisions are expected to be slightly below $1.5 billion, an increase of 23% QoQ and more than double compared to Q2 2022, but only represents a cost of risk ratio of 60 basis points (bps), still an acceptable level considering the challenging macroeconomic environment. Its net charge-offs are expected to be about $700 million, leading to total credit costs of about $2.2 billion in the quarter (vs. $1.8 billion in Q1), being a headwind for earnings growth.

Credit costs (Wells Fargo)

Taking into account that Wells Fargo’s revenues are expected to decline compared to the previous quarter and credit costs are expected to increase, which will not be offset by lower expenses, its net income should be about $4.4 billion (-6.4% QoQ) and its EPS is expected to be $1.16 (vs. $1.23 in Q1). Its return on equity (ROE) ratio, a key measure of profitability in the banking sector, is expected to be around 11%. This is an acceptable level and is above the bank’s cost of equity, even though it is considerably below the most profitable U.S. large banks, given that JPMorgan for instance is expected to report a ROE above 16% in Q2.

Regarding capital, its core tier 1 (CET1) ratio is expected to be around 10.8% at the end of June, comfortably above its capital requirement of 9.2%. The bank’s capital position is sound, something that was also visible in the recent stress test results even though its capital ratio declined to 8.2% in the adverse scenario, one of the biggest decreases among U.S. large banks. Nonetheless, this capital ratio was well above the minimum requirement, showing that the bank is well-capitalized and can therefore maintain its capital return policy to shareholders.

Indeed, following these stress test results, the bank expects its capital requirements to decrease a little bit in the coming months, allowing it to increase its quarterly dividend to $0.35 per share (vs. $0.30 currently). This means its annual dividend will increase to $1.40 per share, which at its current share price leads to a forward dividend yield of about 3.3%. This yield is not impressive and is below Citigroup for instance, not being therefore a major reason to buy its shares, in my opinion.

Conclusion

Even though Wells Fargo is a bank with significant exposure to rates, its recent operating performance has not been impressive and this is not likely to change much in Q2, as other headwinds offset the positive impact of increasing NII. Indeed, higher credit costs are one of the key items to watch, as credit quality is likely to deteriorate and negatively impact its bottom line. Wells Fargo continues to trade around book value, which seems fair, thus I’m upgrading to hold, but I don’t see much upside here and will remain on the sidelines on this bank for the time being.

Read the full article here