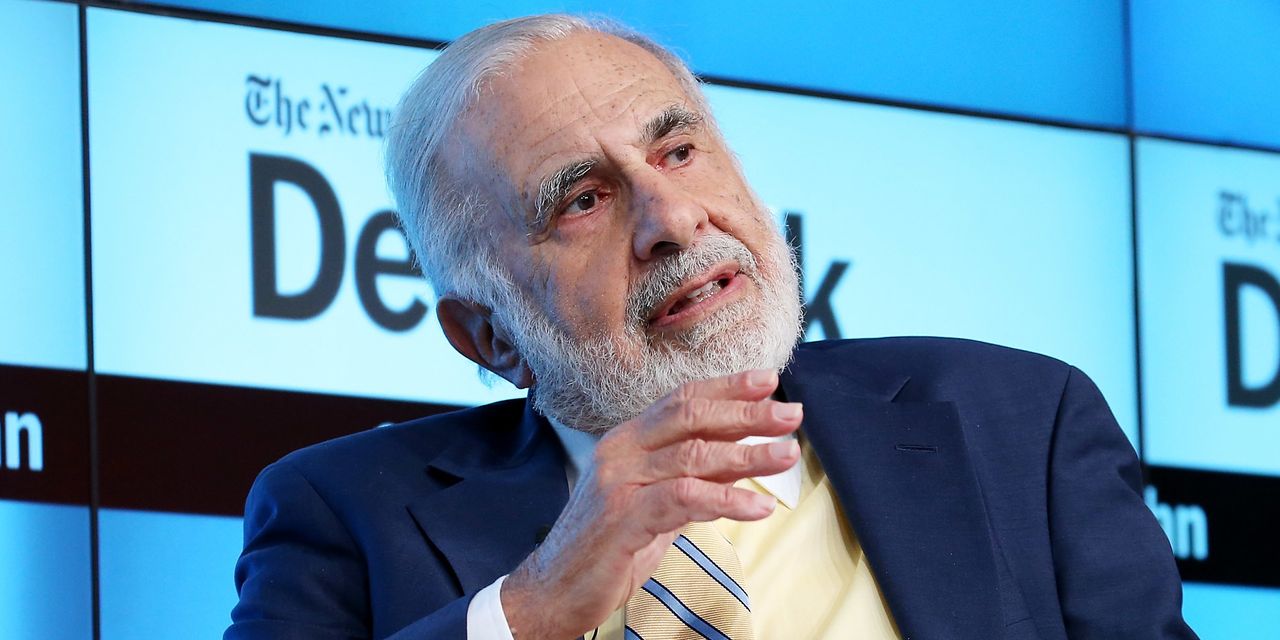

Carl Icahn, the 87-year-old billionaire activist investor, may have just fought off an activist attack on his own company.

Icahn Enterprises

(ticker: IEP) has been under pressure from Hindenburg Research, the group that separately went after India’s

Adani Group

earlier this year. As of Friday’s close, shares of Icahn Enterprises are down 43% since Jan. 1.

However, the stock surged more than 13% at Monday’s open after The Wall Street Journal reported that Icahn had renegotiated loans with banks that remove some of the risks at the company highlighted by Hindenburg. The company confirmed the story in a Securities and Exchange Commission filing just before the market opened.

The Hindenburg campaign against Icahn alleged the company was holding assets at inflation prices and was vulnerable because Carl Icahn had borrowed against the value of the shares in the company he founded.

Icahn and the banks agreed to untie the personal loans from the trading price of Icahn Enterprises shares. Icahn will repay the loans over three years and is secured by additional shares in the company, the SEC filing showed.

Icahn owns about 85% of Icahn Enterprises, and about 60% of his shares were pledged as collateral for personal loans, The Wall Street Journal said. Icahn has about $3.7 billion in loans but hasn’t liquidated other investments to satisfy margin calls, the Journal reported.

Icahn Enterprises didn’t immediately respond to a request for additional comment from Barron’s early on Monday.

Write to Brian Swint at [email protected]

Read the full article here