Introduction

I always like to start my articles, when I can, by reviewing any previous coverage I’ve had of a stock. In Fidelity National Financial’s (NYSE:FNF) case, I published the only “Sell” article in the history of Seeking Alpha on April 1st, 2022 titled “Understanding The Downside Danger For Fidelity National Financial Stock” where I tried my best to warn investors about the recession risks for the stock.

Understanding which businesses are cyclical and which are not is an essential skill that retail investors need to learn if they want to avoid deep drawdowns and value traps. I’ve found historical earnings patterns to be the most efficient and accurate way to determine business cyclicality. FNF has been deeply cyclical in the past and is therefore likely to be deeply cyclical in the future. With the Federal Reserve aggressively hiking rates, mortgage rates hitting highs not seen in years, and the 2-year/10-year yield curve recently inverting, investors should at least start getting cautious regarding the next bear market and/or recession. (In other words, we are likely closer to the top of the cycle than we are to the bottom.) This is a time to lighten up cyclical positions in most cases and if I was an owner of Fidelity National Financial, I would be taking profits around these levels and finding something more defensive to invest in.

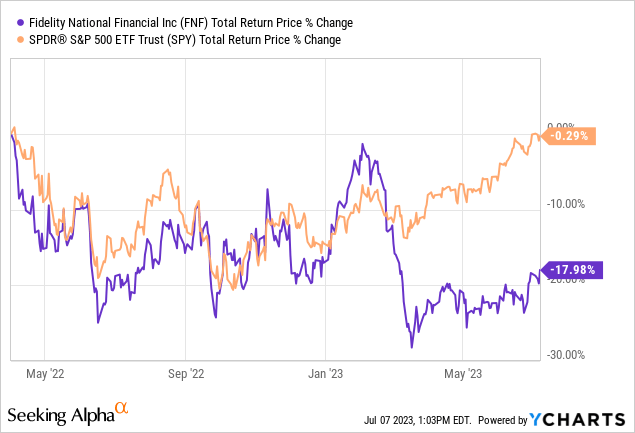

Since that article, here is how FNF has performed:

The total return of FNF, including dividends, is about -18%, while the S&P 500 (SPY) has been roughly flat.

The bearish thesis for FNF is starting to play out, but it has actually remained more resilient than I would have expected. I suspect that some investors are hanging onto the stock for a fairly high dividend yield of around 5%. In this article, I’ll share why I think hanging onto the stock for the dividend is unwise unless one takes the risk of recession completely off the table.

Understanding Earnings Cyclicality

Understanding a business’s earnings cyclicality is the key to understanding the potential danger investors face during down cycles. The worst mistake an investor can make with deeply cyclical businesses is assuming there won’t be earnings declines when there has been evidence of them in the past. While the past isn’t a perfect guide to the future, it is usually a decent guide that can keep an investor out of a lot of trouble. I judge a business to be “deeply cyclical” if they have experienced earnings declines deeper than -50% in the past, so the first thing I check with every stock is its earnings cyclicality.

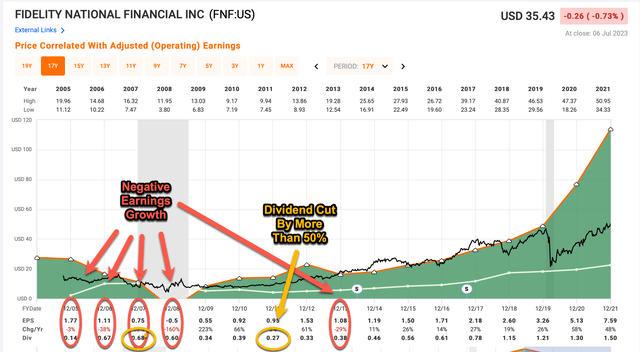

FAST Graphs

The FAST Graph above shows that FNF’s historical earnings growth has a history of being deeply cyclical, even going fully negative and causing earnings losses in 2008. It also has earnings that correspond to activity in the housing market, which started to decline in 2006, well before the actual recession that started two years later in 2008. Over time, earnings did recover, but not before suffering very big losses. Additionally, the dividend was cut by more than -50% during this period, so if there is a recession again, investors should not assume the current 5% dividend yield will be “safe”. It might be, but I wouldn’t count on it. Also, the stock price fell from peak to trough about -80% during the 2008 recession. That huge drawdown is a lot of risk to take for a 5% dividend yield.

The Current Downcycle

Now let’s move the current earnings downcycle for FNF.

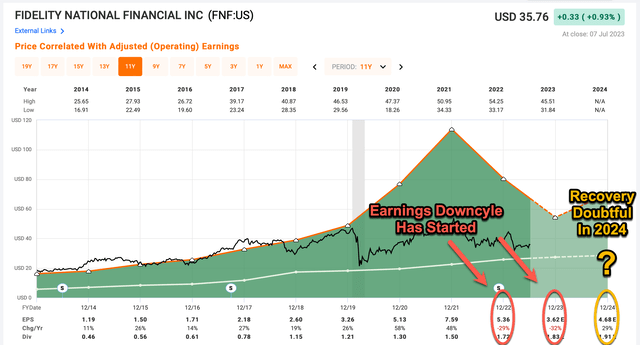

FAST Graphs

One of the reasons I felt compelled to warn investors about this stock last year was that it was clear to me nobody was considering the downside risk to earnings. Leading into my “Sell” article there had been 14 “Strong Buy” articles in a row published on Seeking Alpha. I’m not sure I’ve ever seen such an obscure stock with so much bullishness around it. At that time, analysts expected $6.32 per share in earnings for 2022, and they ultimately came in at $5.36. This year, analysts had expected $6.42 at the time of my previous article and now they expect only about half that, at $3.42 per share. It’s very likely the expected earnings next year from analysts miss again, so, as an investor, I would ignore the current expectations.

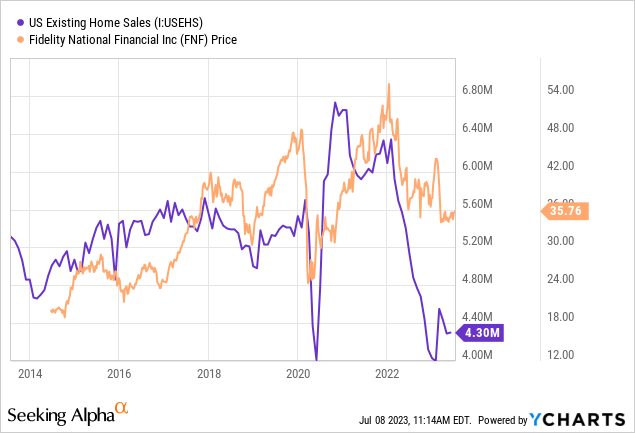

Most of the time investors benefit from using the simplest metrics to guide their investing decisions. Narratives, on the other hand, are often used more as excuses as a means to prop up stock prices or muddy the waters so true earnings are harder to ascertain. Investors are almost always better served by examining history, and then using a few basic metrics to understand a business’s earnings. In FNF’s case, US existing home sales usually are very predictive of where earnings, and therefore the stock price, will go.

In the graph above I plot US existing home sales along with FNF’s stock price. The last time US existing home sales were this low for a considerable period of time was in 2012 and FNF’s stock price traded around $10 per share. If that were to happen again, we would see about an -80% drawdown in the stock price just as we did back in 2009. That’s about a -65% to -70% from where the stock trades right now, so that is the current downside risk to the stock during a recession unless potentially lower interest rates in the future spur a pick up in home sales (which is possible, but the timing would have to just right, so not probable).

Once we got through the announcement of all the initial financial numbers during the last conference call, in the last paragraph, we get a better look-through into what management actually thinks about the near-term outlook.

Following our record level of share repurchases in 2022 at a total cost of $549 million, we prudently moderated our repurchase volume in the first quarter to preserve financial flexibility, as we navigate the challenging market and extended blackout period due to the year-end close cycle. We continue to view our current annual common dividend of approximately $500 million as sustainable. The dividend is reviewed quarterly and expected to increase overtime, subject to cash flows, alternative uses of capital and market conditions.

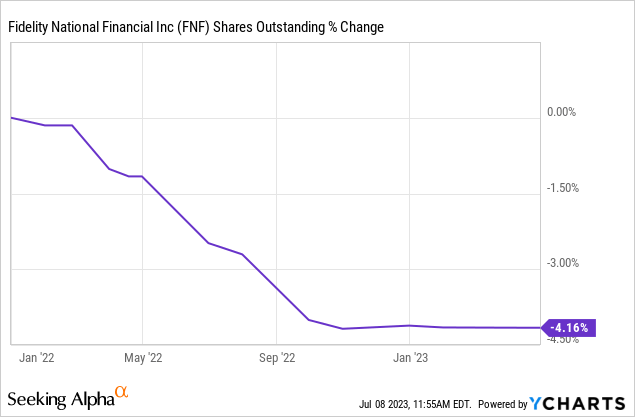

The proper translation of this is they are in capital preservation mode. Already, buybacks have essentially stopped even though the stock price is generally lower than when they were making record purchases last year.

Usually, businesses are much more flexible when it comes to cutting share buybacks than they are when it comes to cutting dividends. But we are now at the stage where the reduction of buybacks has already occurred. Also, a field staff reduction of more than 25% has already occurred as well.

In light of the steep decline in mortgage volumes as compared to the prior year and given the low inventory coming out of the fourth quarter, we continue to monitor expenses closely and reduced our field staff by an additional 2% in the first quarter. This is after a 26% reduction of field staff, net of acquisitions in 2022, one of the largest reductions in our history.

So, FNF is in preservation mode right now. The dividend is being paid, but they make it clear the dividend is reviewed quarterly, and I think they are getting to the point where if additional capital preservation is needed, the dividend may need to be cut at some point within the next year or two.

Some Thoughts On F&G (FG)

As I noted in the comment section of my previous article, I mostly consider recent M&A as negative when evaluating any potential stock purchase. My experience has been that only 1 time in 10 does M&A help medium-term stock performance. I also like to use history as my primary guide for earnings cyclicality and often M&A is used to muddy the waters on what is actually happening with a business, creating more complex accounting and room for earnings adjustments. Add to this, a spinoff, and it just muddies the waters more.

If one is generous, perhaps FG can make FNF about 20% less cyclical than it would have been otherwise. But when I looked at a group of FG peers and their earnings histories, the earnings were very unpredictable. I think it’s impossible for investors to know the earnings risk of FG and how much it might reduce earnings cyclicality for FNF. But even if we are generous, FNF remains a deeply cyclical business, and we can see that via management’s cautiousness regarding cost reductions and basically stopping buybacks.

Additionally, it’s worth noting that if management had been super bullish, as many investors were last year regarding all this M&A activity, then management would have been buying stock. Instead, they have sold about $13 million dollars’ worth of stock in the past 2 years and haven’t made a single purchase that I can see. One would think that if FG was ultra-transformational, someone would be buying the stock.

Conclusion

Every now and then I run across a stock that looks very obviously dangerous to me, but that nearly everyone is bullish about. That was the case with FNF last year. Whether I think anyone will listen or not, I feel an ethical obligation to at least share my reasoning with investors so they are aware of risks they might not have thought about. A lot of these dangers remain with FNF stock even though it is down about -20% since last year’s article. The main thing I want to warn investors about this time around is the safety of the 5% dividend yield. While it’s not yet in danger of being cut, I certainly wouldn’t consider it “safe” during an extended downcycle or recession. Most importantly, I don’t think there is any reason for an investor seeking yield to risk a -65% drawdown in the stock price and dividend cut when they can simply buy a short-duration treasury ETF like iShares Treasury Floating Rate Bond ETF (TFLO), which currently has an SEC 30-day yield of about 5.2%, and essentially has no downside risk.

There always seem to be a few people who think I’m just generally hating a business when I write a “Sell” article on the stock. That’s not usually the case. In fact, I think under $19 per share, a good case could be made for buying FNF, but we aren’t close to that price, yet.

Read the full article here