Amid stiff competition in a generally saturated market, American oral care giant Colgate-Palmolive (NYSE:CL) has delivered marginal growth over the past several years. A strategy focused on premiumization, as well growth prospects in emerging markets notably India may not be enough to meaningfully move the needle for the USD 18 billion behemoth. Pet Nutrition is fast-growing but as a relatively small business, may contribute to low- or mid-single digit growth overall.

Saturated market, stiff competition

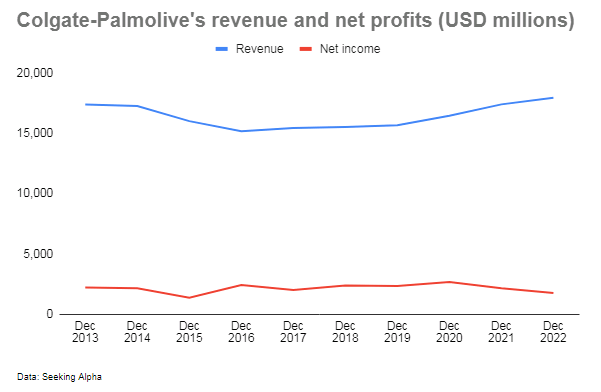

Colgate’s revenues and earnings have barely grown over the past decade.

Author

While part of this may have to do with the vagaries of foreign currency fluctuations (notably from emerging markets which account for 45% of sales), part of it may also be due to fundamental changes in the company’s bread-and-butter business; CL’s Oral Care segment, which accounts for more than 40% of sales, appears to be seeing a slow but consistent market share erosion with CL’s global toothpaste and toothbrush market share dropping from 44% and 33% respectively in 2017, to 41% and 32% in 2019, and currently sits at 40% and 31% as of Q1 2023.

Management has highlighted premiumization as a strategic area of focus; however, it remains to be seen if this could sufficiently jumpstart the company’s anemic top-line and bottom-line growth. Inflation, although moderating, remains elevated, so consumers may be looking for cheaper alternatives to daily essentials such as private label products rather than premium offerings.

Moreover, CL’s premiumization strategy is not new; the company has had a line of premium oral care products for years such as Colgate Natural Extracts and Colgate Enamel Strength, but that has not translated into exciting financial performance. The company’s premiumization focus this time is on opportunities in the whitening segment which according to the company remains underpenetrated and for which demand is on the rise. The effort may help defend market share but remains to be seen whether it could offset any potential overall market share erosion due to a relatively smaller presence in faster-growing toothpaste segments such as sensitive toothpastes which at a mid-single digit growth rate according to research reports is growing faster than the whitening segment and the overall toothpaste market in general, both of which are expected to grow in the low single digits. Sensitive toothpaste market leader Sensodyne’s (HLN) middle single digit revenue growth in 2022, appears to be better than Colgate’s Oral Care segment which reported net sales growth of less than 1% the same year (Colgate doesn’t break down Oral Care segment sales).

India a bright spot in emerging markets, but may not be enough to move the needle annually

Brazil, Latin America’s biggest economy likely has limited opportunities with the country being the highest consumers of toothpaste on a per capita basis. China’s toothpaste market has reached a fair degree of penetration (see below). That leaves India, with its one billion plus population, rapidly expanding economy, and low toothpaste consumption as one of the few remaining markets with significant growth prospects in terms of both volume and price.

Oral Care accounts for about 95% of CL’s India business which generated revenues of roughly USD 620 million in FY2022. Per capita toothpaste consumption in India is low, at an estimated 100-200 grams per person, compared with 300 grams for China. As usage increases along with urbanization and rising incomes, India’s toothpaste consumption could nearly double, a positive for Colgate, a market leader in India’s oral care space.

Premiumization is also an area of strategic focus for CL in the country where a booming beauty and personal care market could drive demand for whitening toothpaste. CL is well positioned to capitalize on this opportunity which could further support its India business although again, it remains to be seen if it could arrest sliding market share; CP’s market share in India has dropped to 50% from 55% a few years ago, partly driven by the rise of the natural toothpaste segment which Colgate lost out to local rivals like Dabur, and pioneer naturals-focused brand Patanjali which is backed by famed yogi Baba Ramdev. Patanjali’s ambition to ramp up advertising of its toothpaste products could present a rocky road ahead for Colgate in India. Nevertheless, even if Colgate manages to defend its market share and its India business triples over the coming years driven by a combination of volume growth and pricing, that would make India account for about 10% of CL’s net sales from about 4% currently, a meaningful figure overall but not likely to generate meaningful growth on an annualized basis for the oral care giant.

Colgate is reportedly looking at non-oral care segments to drive growth, such as personal care products under their Palmolive brand, but the naturals story is unfolding in India’s beauty and personal care market as well, and latecomer Palmolive does not appear to have a positioning comparable to natural, toxin-free personal care brands like Mamaearth (a homegrown startup that reached unicorn status less than a decade since its founding).

Pet Nutrition segment could support growth but minimal impact

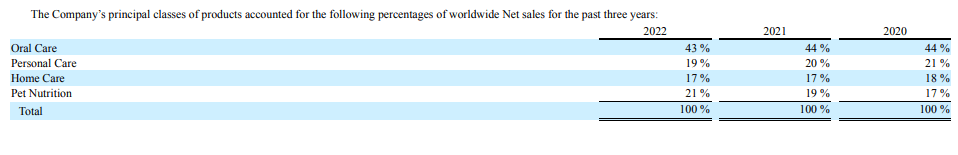

With double digit top line growth and a segment profit margin of 23% (which could recover to previous levels of around 27% as inflation moderates and pricing actions gradually catch up to cost increases), Pet Nutrition is CL’s only meaningful growth driver but the segment is relatively small accounting for just about a fifth of sales so there is little likelihood this segment could help CL deliver exciting overall growth. CL expects net sales growth of 3%-6% in FY 2023 including the benefit of pet food acquisitions and a low single digit negative from foreign currency.

Colgate-Palmolive 10-K, FY 2022

Conclusion

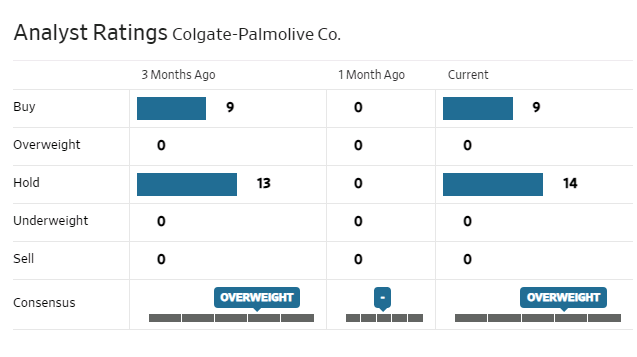

Colgate-Palmolive has a moderate buy analyst consensus rating.

WSJ

CL’s valuation does not appear overly expensive, with a forward P/E of nearly 25 (comparable to rival P&G) though not a bargain either. With low growth prospects, the stock may offer limited upside at current prices and could be viewed as a hold.

|

Colgate-Palmolive |

P&G (PG) |

Unilever (UL) |

|

|

Forward P/E |

24.5 |

25.3 |

17.6 |

|

Levered free cash flow (USD billions) |

1.44 |

11.41 |

8 |

|

Market cap (USD billions) |

62.7 |

350.7 |

128.7 |

|

Dividend yield % |

2.5% |

2.5% |

3.7% |

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here