These 3 are smaller than the competition, make no mistake they bring a lot to the table

I used the words revenge of the mini-mes to underscore that while these challengers are smaller, they will take share in their respective competitive niches.

I want to focus on three stocks whose narratives changed for legitimate reasons. Some companies desperate for investor dollars will change the name and symbol of a company to attract traders or naive investors to a popular trend. We will certainly see companies looking to tie themselves to generative AI without a legit reason. I am not going to focus on that, it is still “caveat emptor” – “let the buyer beware” in the stock market, and I wouldn’t have it any other way. All I advise is to keep away from some faddish trends. Try to identify sustainable narratives and look for the underappreciated quality name.

The important point I want to make here is that legit companies, after years of preparation or none, can become part of a big trend.

An example I won’t expand on here is when Pfizer (PFE) was confronted with what to do about Covid, it invested in BioNTech (BNTX). In an instant, it had a new narrative in producing a vaccine for CV-19. Let me leave the example of quick change right here. I am sure there were all kinds of work involved to decide to invest and get rights to distribution. All I want to point out is that seemingly instantaneously, PFE was at the forefront and made billions. The stock did well as well, though not so well lately. What I want to talk about is an enduring change that came about practically under the radar but embodied foresight, planning, investment, and execution. It required strong leadership to have buy-in in the strategy years away from the goal. The key point is, If you have your eyes open you can catch the turn and create long-term capital appreciation, and some fast money too.

Let’s start with the first “mini-me”: Advanced Micro Devices (AMD)

First, I want to say there is no insult meant for AMD or their brilliant CEO Lisa Su. They brought Intel (INTC) to its knees, with fast-iterating innovation, and discounted pricing. I just wanted to find a way to encapsulate and convey why I see these stocks appreciating. What we have are fast followers to the leader(s) in each market space, that is competing with a much larger competitor. They are innovating, and providing unique services, and in some cases lower prices to punch above their size. For Lisa Su, this was a familiar playbook, she was already focused on data center computing and already competed with NVDA in producing GPU. So, what is different now, Ms. Su recognized that the next frontier was large language model AI. She poured resources into redesigning their chips to compete with NVDA, not only chips but also software. In the debut of her AI strategy, she had software partners showing that they had tools to build AI applications but also demonstrated compatibility with NVDA software. In recent comparisons, AMD GPUs were 80% as fast as NVDA. No doubt AMD will make up the 20% lag with a 40% discount, or 30% as she did with INTC. Also, AMD has been making claims of lower power consumption, I would expect that to be part of her tactics here to compete on TCO as well.

Finally, let’s make something very clear, no one in the tech world wants a monopoly on what has been compared to the invention of electrical power, or the entire productivity of the internet itself. They want AMD to succeed, and If they can provide almost as good at a big discount, all the better. So, the question will be, can AMD do to NVDA, what it did to INTC? That is the wrong question, there is plenty of room for both, and possibly another competitor right now. These two will be slugging it out, competing to bring the best for the least. That is what is so great about competition. So, is AMD smaller by market cap, yes, is it competing only on price? Absolutely not, AMD has a lot of innovation, and a large variety of chips for the data center, while NVDA has just the GPU and their software tools that have become the standard. I would also say that Lisa Su and the CEO of NVDA Jensen Huang are evenly matched. They can both prosper, except I believe AMD has a lot of catching up to do in stock price. Even if it goes to its previous high, it will be very rewarding. I invested in the stock long term and am long options at the $115 strike. The 52-week high for AMD is $132, so that is a nice 15% gain. As a long-term investor, I have my starter position and I plan to add to it over time. I expect AMD to go higher, as more traders and investors buy into the strategy. If AMD falls further this week, I will roll down my calls to a lower strike. I will give AMD a short leash, if it falls enough, I will close out my trade and wait for AMD to settle lower before resetting my Call. I know there is an upside in further recognition of AMD’s AI offering.

Next is Oracle (ORCL), apologies to Larry Ellison, and his very able CEO/President Safra Catz

ORCL is no one’s clone, they have been savvy players in enterprise software for decades. They are valued at $300B in market cap. Safra Catz has been building up to being a real player in Cloud services, notably picking up TikTok as a customer for their US product. In their last earnings conference, it was revealed that they were growing their cloud business by 50%, better than AWS, Azure, and GCS. These are all $Trillion market cap companies. They have a backlog of $2B in services orders for ‘23, even more notable is their close relationship with NVDA. Let me quote the Founder and Chief Technology Officer Larry Ellison; “Oracle’s Gen2 Cloud has quickly become the No. 1 choice for running Generative AI workloads. Why? Because Oracle has the highest performance, lowest cost GPU cluster technology in the world. Nvidia themselves are using our clusters, including one with more than 4,000 GPUs, for their AI infrastructure.” Notice he is also using cost + innovation to lure customers. Perhaps this is a feature of many of the strivers that are going after the establishment. I have had a long-term investment in ORCL for a number of years. Ever since they announced that they were using AI/ML to automate all database administration functions for large enterprise databases, I was a buyer. I have been trading ORCL ever since their fantastic AI announcement. I bought back into ORCL at the $115 strike as well. I have been adding calls at this level. If it breaks $110, I will likely start adding calls at the $110 strike and roll down my $115 calls to that level as well.

That leaves us with Rivian (RIVN), and there is no doubt who they are emulating

It’s obvious that the CEO of RIVN is not mimicking Musk’s approach to tweeting, memes, or smoking a J with Joe Rogan. Frankly, I had to look up his name while writing this article, and I am very glad about that. RIVN has gone 8 sessions in a row and is up 14% just on Friday. RJ Scaringe CEO of RIVN has this truck manufacturer executing and hitting their unit goals. Their pickup is the number one selling EV pickup truck in the USA. Ford has not been able to manufacture their F-150 Lightening at scale so far. I saw their SUV. It is very nice looking, a good fitment, and it presents itself well as a luxury SUV. Why all this excitement? As soon as I heard that they announced that they will meet their goal of delivering 50,000 trucks, I bought the stock first at 19, and at 20, and I bought call options, several tranches as a matter of fact. This was early last week. Why was 50,000 such a magic number? I remember when Tesla Motors had a goal of 50k units. The struggle they had to ramp up, once they got over that hurdle, things began to coalesce, and I see the same here. Is RIVN truly a mini-me? They started with a pickup and a delivery van exclusively for Amazon (AMZN) for now. They already added an SUV, I think this was a better approach than Musk’s evolution of models. Trucks are hotter than cars, the Tesla Model-Y is clearly their bestseller. So, no RIVN is not a knockoff of TSLA. They seek to grow rapidly with a better product mix. In fact, that is what all three companies are striving to do, build a better, faster, cheaper, and more targeted product than their bigger rivals. That’s why I called this article Revenge of the Mini-Mes. They are innovators and trailblazers in their own right – two are decades old and not new to the rough-and-tumble competition in technology. As for RIVN, I credit them with the great deal that they closed with AMZN before they built a single vehicle, that says a lot about the RIVN team.

That is why I think there is plenty of stock appreciation in all 3 of these names in the next few years. One word of caution about RIVN, I have no idea whether this current jag will run up past $30 and beyond or come down to $19-20 and spend some time consolidating. I expect a lot of traders who sold TSLA too early or never got in, to find a way to get into this name at some point. That said, I will be a bit cautious about my current level of options. I would likely close them out on any sign of weakness and wait for the name to settle. I am not selling my equity, though.

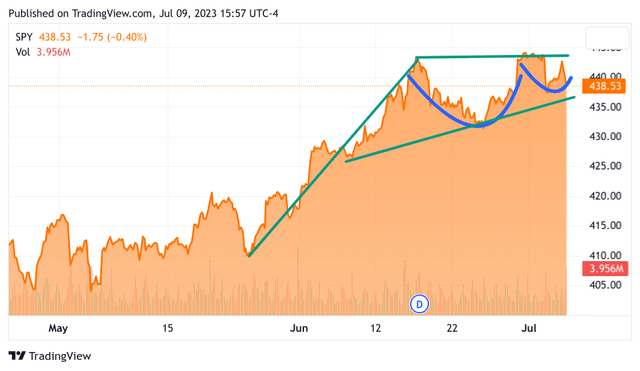

I can’t write my weekly article without a word about the climate for stocks. I expected a strong July, but the Fed rained on that parade with the Fed minutes. A number of voting members wanted to raise last month, in addition to 2 more this year. So, when the ADP employment number totted up to nearly a half-million, there were plenty of market participants heading for the exits. The BLS number on Friday went in the opposite direction and showed a much lower-than-expected number. At first, there was a rally but then, it dawned on participants, “Wait a minute, sharply falling employment means there could be a recession!” Down came the indexes. I think we are going to have a bit more sideways action, but the good news is the rally is intact. So whether it’s one or two more ¼ point hikes, stocks should be moving higher. Check out the chart I created for the Group Mind Investing Community this weekend.

TradingView

Here is a 3-month chart of the S&P 500 ETF (SPY) the SPY closely matches the movement of the SPX. I drew in the leftmost green diagonal lines, showing that the index ran sharply higher at a 45-degree slant. We had a rapid rise starting in late May. The other 2 green lines that are beginning to converge outline a rising pennant (bullish). I took a bit of artistic license in drawing a cup-and-handle within the pennant (also bullish), but to my eye, it seems to be forming. So yes, this chart confirms that the rally is still in operation. The pennant could turn into some sideways consolidation, which wouldn’t be terrible either. We’ve come a long way and this week could add some turbulence. We have a bit of a throwback to 2021 with perhaps a little tribulation for the CPI, and PPI economic numbers. I think the CPI and PPI will prove to be positive. I think we challenge 4500, and if earnings come in better than expected (as I expect) we could go way higher.

Read the full article here