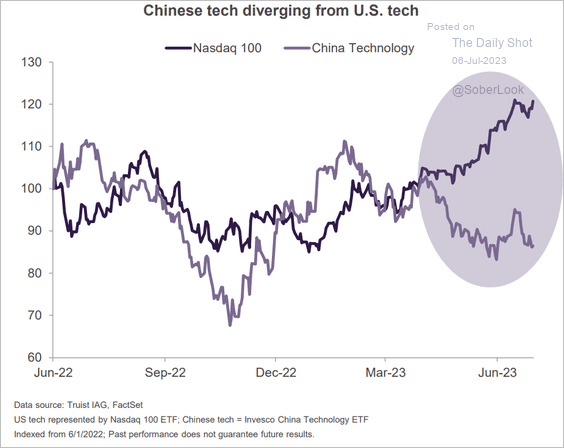

China’s reopening has not gone as the bulls would’ve liked. Just take a look at the China Technology sector compared to the Nasdaq 100 over the last year. The former is lower by about 10% while the latter is up by greater than 20%. Cyclical financials and technology companies domiciled in China have suffered first from draconian regulatory crackdowns by the nation’s government, then by a soft reopening post-COVID.

After that turmoil, I see some opportunities. One name, Lufax Holding (NYSE:LU) has a very low price-to-book ratio as a fintech stock with a clear downside level to trade off of ahead earnings next month.

China Tech Sells Off As US Tech Soars

The Daily Shot

According to Bank of America Global Research, LU is a leading technology-empowered personal financial services platform in China, mainly providing loans to small business owners & salaried workers, and tailored wealth management solutions to middle-class & affluent populations. Ping An Group holds a 39% stake in Lufax and senior management of Ping An Group & Lufax holds another 39%.

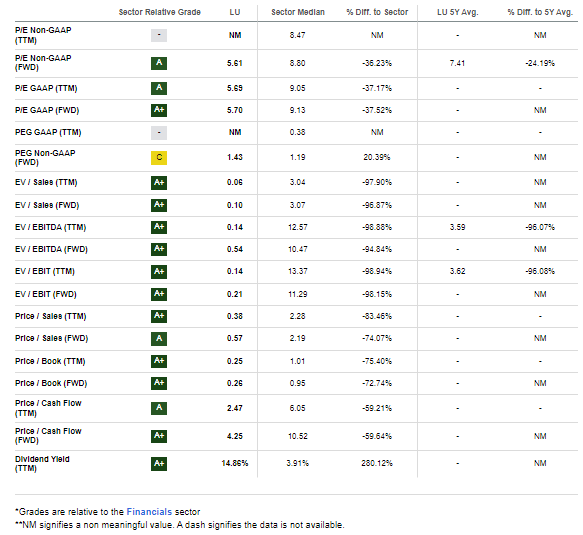

The China-based $3.4 billion market cap Consumer Finance industry company within the Financials sector trades at a low 5.7 trailing 12-month GAAP price-to-earnings ratio and pays a high 14.9% dividend yield, according to Seeking Alpha. Ahead of earnings in early August, the stock carries high implied volatility at 71% and a low short interest percentage of just 2.9%.

Back in May, Lufax reported operating EPS of $0.04 which was a $0.02 beat while revenue of $1.47 billion, a 46% year-on-year decline, missed by a significant $260 million. Shares fell in the days after that mixed report. Amid an 87% net profit plunge from a year ago, the sequential change was actually positive, and its management team offered up a somewhat rosy scenario of China’s economic recovery, which I take some issue with.

Still, declining charge-offs were a boon, but new loans fell 65% YoY for the fintech company. With earnings in a few weeks, keep your eye on LU’s risk-bearing ratio as well as its net margin. Loan loss reserves are something else to monitor as the economic situation in China remains uncertain. Overall, the company still possesses a differentiated competitive position servicing small and mid-sized companies through a mix of distribution channels. Better economic data out of China would certainly help shares in the second half.

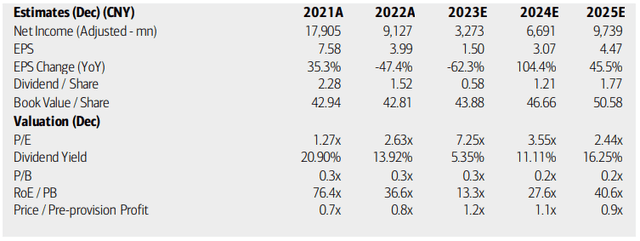

On valuation, analysts at BofA see earnings falling hard this year after 2022’s steep per-share fall-off. EPS is expected to bounce back in 2024, though, with further gains coming in 2025. Dividends, meanwhile, should come in much lower this year due to the firm’s variable dividend payout policy while its book value per share is steadier. So investors should take the currently high yield with a big grain of salt. In terms of the P/E ratios, they are exceptionally low (as are so many China companies, particularly Chinese financials). Its price-to-book ratio is almost alarmingly cheap, near 0.25.

Lufax: Earnings, Valuation, Dividend Yield Forecasts

BofA Global Research

LU has historically sold for 7.4 times prospective operating earnings per share, so today’s 5.6 multiple is indeed inexpensive. Moreover, the modest P/B ratio mentioned before contrasts to the sector median of 0.95 on a forward basis. If we assume a modest rise in the P/B ratio to just 0.4 (bypassing a P/E valuation due to very high EPS volatility and unclear profitability outlook), then the stock should trade near $2.25. I assert a below-market P/B is warranted given China’s weak re-opening which could pose problems for cyclical fintech players.

LU: Attractive Valuation Metrics, Low P/B

Seeking Alpha

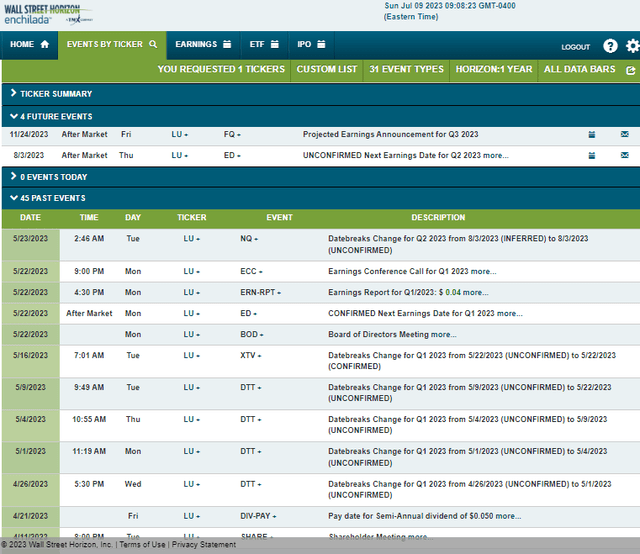

Looking ahead, corporate event data provided by Wall Street Horizon show an unconfirmed Q2 2023 earnings date of Thursday, August 3 AMC. No other volatility catalysts are expected, nor are corporate events slated.

Corporate Event Risk Calendar

Wall Street Horizon

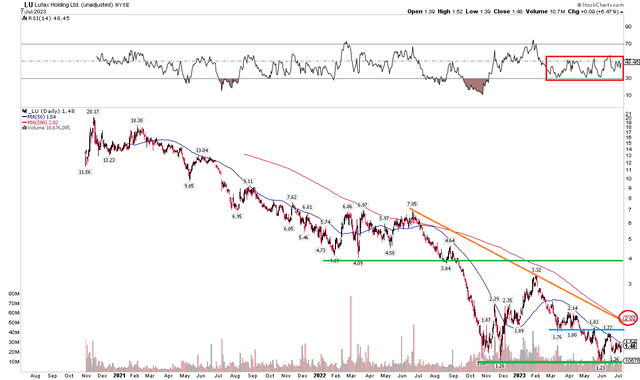

The Technical Take

LU has been an utter trainwreck after the initial weeks of going public in late 2020. It is an understatement to say that the bears have been in control. Notice in the chart below that the stock recently cratered to the low $1s. But I see reason for some hope. The $1.23 to $1.30 level has been successfully tested a few times now, so being long under $1.50 with a stop under, say, $1.20 is not a bad risk-reward play considering that I find the company undervalued.

I see resistance, though, at the $20 mark – that is where a downtrend resistance line as well as the long-term 200-day moving average both come into play. Further selling pressure may come in the high $3s – that’s the base from a trading range that endured from early late 2021 through the first half of last year. With the RSI momentum indicator holding in the bearish 20 to 60 zone, I would like to see that line turn above 60 to help support a possible price inflection. Finally, there may be near-term resistance in the $1.72 to $1.80 zone.

Overall, the long-term trend is down, but we could see a near-term bounce. From a risk management perspective, a stop loss under the all-time lows is prudent.

LU: Emerging Support After a Protracted Downtrend

Stockcharts.com

The Bottom Line

I have a buy rating on Lufax Holding stock. The company has gone through a tough stretch amid tight China lockdown measures and a tepid economic reopening. I see shares today as undervalued while the chart offers a few rays of hope for the bulls. Still, prudent risk management should be applied.

Read the full article here