Written by Nick Ackerman, co-produced by Stanford Chemist. This article was originally published to members of the CEF/ETF Income Laboratory on June 25th, 2023.

Eaton Vance Tax-Managed Global Buy-Write Opportunities Fund (NYSE:ETW) continues to trade at a wide discount since cutting their distribution last year. This is similar to the other Eaton Vance funds and makes them particularly attractive now. Historically speaking, some of the best opportunities in closed-end funds come after distribution cuts when a fund traded at relatively narrower discounts or premiums.

As a quick reminder, the distribution cuts were simply based on adjusting payouts to a more sustainable and reasonable level. Eaton Vance tends to be pretty quick to adjust as needed, and this was simply in line with what EV has done historically when markets start to perform poorly.

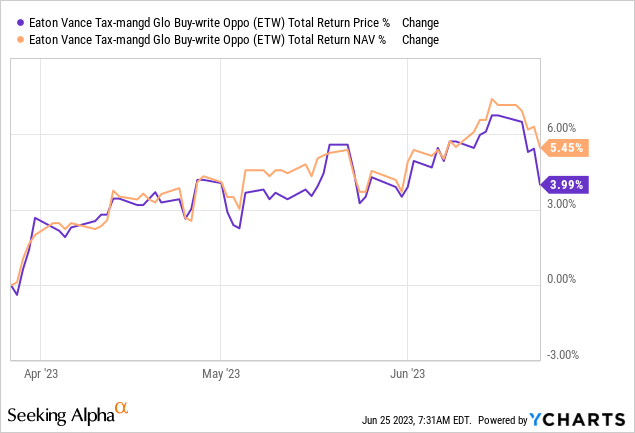

Since our last update, it would appear that the fund’s NAV performance has been better than its share price performance. What that means for investors is that the discount would have widened even further. In this case, going from an attractive ~6.5% discount to around a ~9.25% discount today.

YCharts

Besides being attractively valued, the fund’s options writing strategy can be beneficial at this time over leveraged funds. Since the fund doesn’t utilize any borrowings, they don’t have to deal with the headwinds of leverage costs rising substantially in the last year. In fact, writing calls on indexes can be a bit of a defensive strategy.

The Basics

- 1-Year Z-score: -1.24

- Discount: -9.23%

- Distribution Yield: 8.67%

- Expense Ratio: 1.11%

- Leverage: N/A

- Managed Assets: $958.2 million

- Structure: Perpetual

ETW will “invest in a diversified portfolio of common stocks and write call options on one or more U.S. and foreign indices on a substantial portion of the value of its common stock portfolio to seek to generate current earnings from the option premium.”

The tax-managed focus comes in with the “fund evaluating returns on an after-tax basis and seeks to minimize and defer federal income taxes incurred by shareholders in connection with their investment in the Fund.” The investment policy is designed to achieve its main objective; “to provide current income and gains, with a secondary objective of capital appreciation.”

The fund is a fair size, and with a daily average trading volume of around 250k shares, that should provide enough liquidity for most retail investors. The fund’s expense ratio is fairly competitive in the CEF space. With no leverage in the form of borrowings or preferred offerings, there are no leverage costs to worry about with this fund. That can make it ideal now that the Fed has ramped up rates to ~5% and is expected to do at least a couple more rate hikes this year.

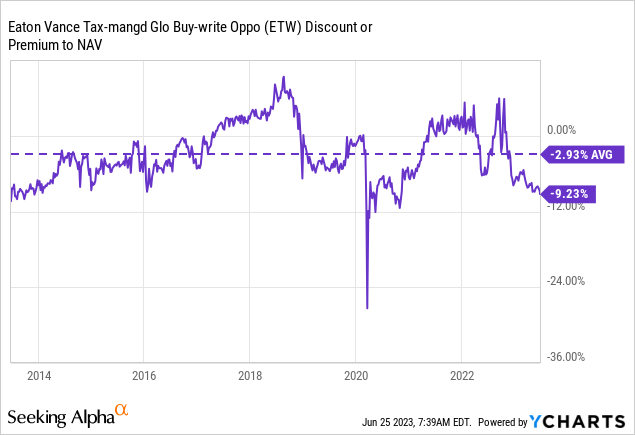

Performance – Discount Widening

Since our last update, the discount has continued to widen. While the fund’s discount was attractive previously, it’s even more attractive at this time. Over the last decade, the fund has traded at discounts that are materially more narrow than the current level. That alone could provide some potential upside from here relative to other diversified global CEF counterparts.

YCharts

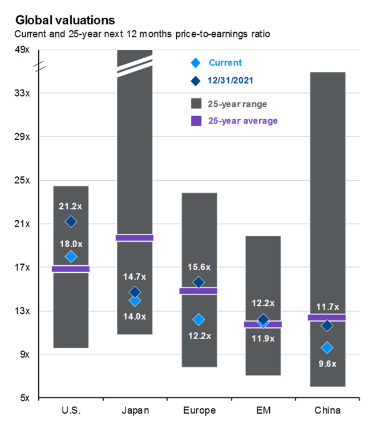

The case for global investments continues to be that they are relatively cheaper than U.S. investments. The S&P 500 Index has had a good year thanks to the magnificent 7, which has been pushing valuations even higher in 2023 for the U.S. To be fair, ETW has exposure to several of these mega-cap growth names, and they’ve certainly benefited from this exposure.

Thanks to JPMorgan, they’ve put together several charts that can help put international investments into some context relative to U.S. equities. This data is as of May 31st, 2023.

Global Valuations of Equity Markets (JPMorgan)

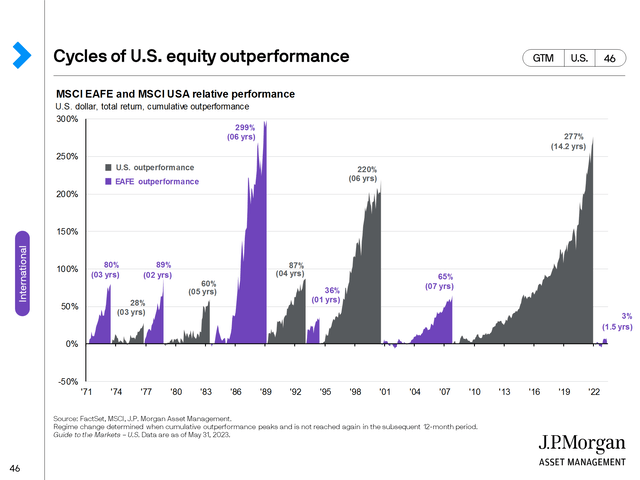

Global investments have been starting to show some promise, too, even as the valuations remain more attractive around the globe and outside of the U.S. Historically speaking, the last run for U.S. outperformance over international equities had been an abnormally long period. That outperformance could continue and reverse the more recent trends where global investments are outperforming.

Said another way, just because U.S. stocks have outperformed for a long time, it doesn’t mean they can’t continue to do so. It isn’t as if they have to take turns; there are a million other factors to consider. The reason for highlighting this is to say that diversification into global investments has paid off in the past. When and if the latest trend continues isn’t guaranteed, but it shows that it does happen.

U.S. Vs. International Equity Performance (JPMorgan)

The call-writing strategy that ETW utilizes can limit the upside, which is something that should be considered. Theoretically, as they write against indexes, there is a chance for unlimited losses. These losses are indirectly essentially ‘covered’ through the portfolio’s underlying holdings that mirror the indexes they write against.

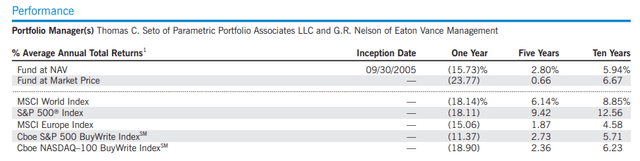

In order to provide some context of performance, the fund provides a benchmark performance against CBOE S&P 500 BuyWrite Index and the CBOE Nasdaq 100 BuyWrite Index. When comparing against the proper indexes, ETW has put up fairly competitive results while providing a substantial monthly distribution stream to income investors.

The data is from their annual report for the period ending December 31st, 2022. Still, it can provide us some context of the track record that ETW has. In 2023, ETW has been performing quite well, so the results would be even higher at this time.

ETW Annualized Performance (Eaton Vance)

While the upside can be limited in a raging bull market with the options strategy, some downside can also be offset. This can also be beneficial in a flat market, as options premium would continue to roll in, creating capital gains when there would otherwise be a lack of gains realized from the underlying portfolio.

Distribution – Attractive Rate

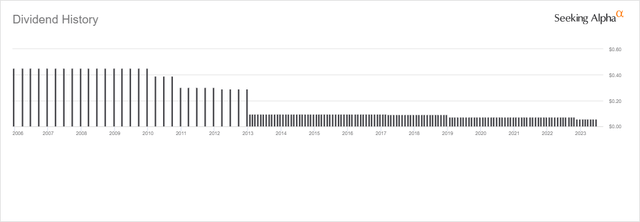

As equities performed poorly last year, as we can see from the results shared above, the fund ended up cutting its distribution. This would have been to bring down the distribution rate that became unsustainable, and by doing that, the fund would have limited the erosion in the underlying fund. This isn’t the first distribution cut in the fund’s history.

ETW Distribution History (Eaton Vance)

It probably won’t be the last, either. Closed-end funds are simply wrappers of assets that payout the majority of their income and capital gains to investors. In fact, most of the time, it is over what the fund is actually generating. That leaves little room for error as they aren’t like a C-corp operation where they retain cash to grow their underlying business or have a cash balance that they can rely on in a black swan event.

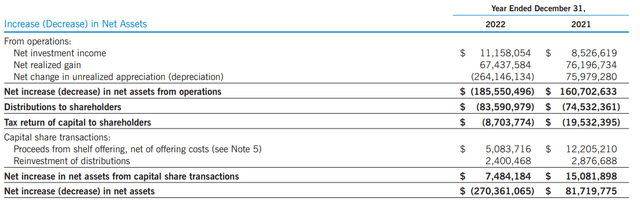

For ETW, we can see that the fund’s net investment income increased in the prior year. However, it still meant that most of the distribution would require capital gains to fund the payout to investors. NII coverage came to around 15% for the last year.

ETW Annual Report (Eaton Vance)

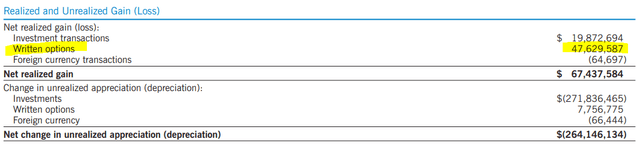

Of the $67.438 million in realized gains listed for 2022, a sizeable portion of that was driven by the fund’s options writing strategy. Of course, the overall unrealized losses overwhelmed the portfolio and resulted in NAV declines for the year. However, had it not been for the options premiums received, losses would have been even worse.

ETW Realized/Unrealized Gains/Losses (ETW Annual Report)

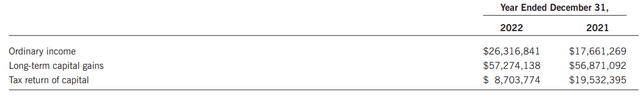

For tax purposes, the distributions get classified as a bit of everything, including ordinary income, long-term capital gains and return of capital.

ETW Distribution Tax Classification (Eaton Vance)

The EV index writing funds can generate return of capital distributions even in good years where the fund is covering its distribution. This can be the case because when the underlying portfolio is rising, it’s likely that the index writing strategy is generating losses. Those losses are then realized since they come with an expiration date.

However, they can choose not to realize gains in the underlying portfolio. That can create a situation where the fund, in some years, has realized losses but unrealized gains enough to provide positive NAV performance. At the same time, since the fund wouldn’t have technically realized enough to cover the distribution for tax purposes, the distribution can be classified as ROC.

Eaton Vance provides a longer discussion on the topic for those still having difficulty understanding ROC distributions. This can be one of the more difficult-to-understand topics of investing.

Of course, there can be destructive ROC too. That would have technically been what most of last year was, as the fund’s NAV declined.

ETW’s Portfolio

For the most part, ETW’s portfolio turnover is fairly low. This is due to the strategy of being tax-managed and how that works with writing index calls. Last year the fund’s portfolio turnover was 12%. That was actually on the high end of the last 5 years where turnover had previously been as low as 2% and only as high as 7% previously.

Still, this means fairly limited changes in the underlying portfolio overall. That keeps the portfolio fairly predictable for investors, which can be helpful as CEFs aren’t necessarily the most transparent regarding what they hold. They are actively managed, and most only update monthly, but some are only even quarterly on what their portfolios are doing.

The fund’s options strategy is writing calls against nearly 100% of the portfolio. With the latest fact sheet, they show that they were 98% overwritten. The average days to expiration were 16, and they write at-the-money options with the % out of the money at 1.8%. While they are an actively managed fund, their options strategy is pretty consistent with limited deviation. So in that sense, it’s similar to their underlying portfolio. They’re actively managed, but for the most part, you aren’t going to see too many surprises.

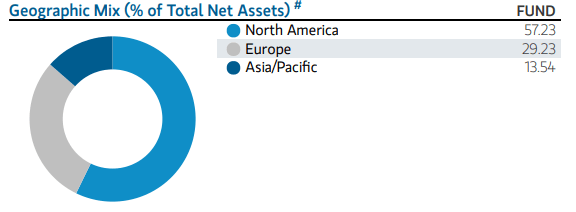

As a global fund, they still hold a meaningful allocation to North American exposure which U.S. investments will presumably dominate that category. This is fairly standard for global funds. These weights are also pretty consistent with what we’ve seen in prior updates, which is absolutely to be expected with the limited turnover.

ETW Geographic Allocation (Eaton Vance)

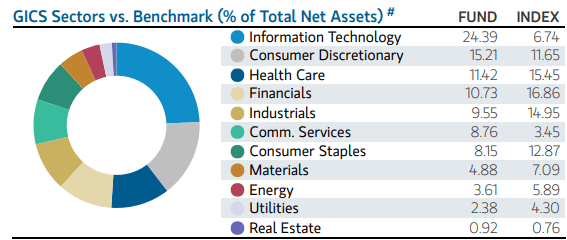

In terms of portfolio weighting, the fund has favored tech. This isn’t that unusual, as tech exposure dominates the most popular indexes. The fund benchmarks against the S&P 500 but also the MSCI Europe Index. In looking at the fund’s sector weights against its benchmark, it would appear that they’ve chosen to apply only MSCI Europe as the benchmark. This appears to be the case because otherwise, the tech allocation would be higher if it was mixing in characteristics of the S&P 500.

ETW Sector Allocation (Eaton Vance)

The S&P 500 Index has become dominated by tech, which now represents nearly 29% of the index. That makes ETW’s tech exposure closer to what we would see in the S&P 500.

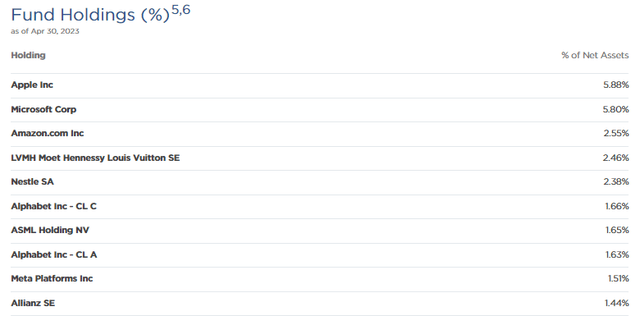

The top ten represent around 27% of the fund’s assets, and they list 300 total positions. We see the usual suspects of the mega-cap growth names in the top holdings, including Apple (AAPL), Microsoft (MSFT) and Amazon (AMZN) being the largest weightings in the fund. In smaller allocations, they hold both classes of Alphabet (GOOG) and (GOOGL) while also carrying some exposure to Meta Platforms (META). This is 5 of the 7 magnificent 7.

ETW Top Ten Holdings (Eaton Vance)

Keeping weighting to these names is important for the fund’s strategy when writing calls. This is because when they are writing calls against indexes, the returns of the underlying portfolio need to match up loosely with that of which they are writing against. A mismatch could potentially see the fund’s underlying portfolio declining, and if simultaneously the S&P 500 is rising, then both sleeves of their portfolio strategy would be generating losses.

By holding these names, if the S&P 500 rises, then ETW’s underlying portfolio should also rise to offset those losses generated in the options. Conversely, if the index is falling, ETW’s portfolio will generally be falling too but offset to some degree by the option premiums collected by writing calls against the indexes. Those options contracts would look to expire worthless, and they’d pocket the entire premium.

Besides writing options against the S&P 500 Index, ETW is quite diverse and writes options against the Dow Jones Euro Stoxx 50 Index, FTSE 100 Index, the Nasdaq 100 Index and the Nikkei 225 Index. The top holdings here don’t represent every index listed, but we do have a few European names. Those include LVMH Moet Hennessy Louis Vuitton SE (OTCPK:LVMHF), Nestle (OTCPK:NSRGY) and ASML Holding (ASML) – which are included in the MSCI Europe Index as top holdings. Allianz SE (OTCPK:ALIZF) is also a European holding, So that would keep the index writing against European indexes hedged with some of those names.

Conclusion

ETW provides exposure to global assets while also utilizing a call-writing strategy. That can benefit the fund as it’s a slightly defensive strategy and can provide capital gains during times of flat markets. In rapidly rising markets, it can limit the upside. Also making ETW particularly attractive at this time is the fund’s substantial discount relative to its historical level. That could provide added upside potential if or when the discount narrows. With no leverage in the form of borrowings or preferred offerings, this CEF has been in a position where it hasn’t had to deal with rising costs. That could be seen as another benefit during this interest rate hiking cycle.

Read the full article here