Investment Thesis

Green Thumb Industries (OTCQX:GTBIF) is one of the largest US multi-state operators (MSO) in the cannabis industry. They have the best balance sheet among the MSOs with significant growth potential in states that have recently legalized recreational cannabis. Additionally, 2 major catalysts can serve as value unlocks and serve to rerate the multiple on GTBIF’s stock, which is near all-time-lows. Key risks include continued regulatory headwinds and price compression in cannabis prices.

Background & History

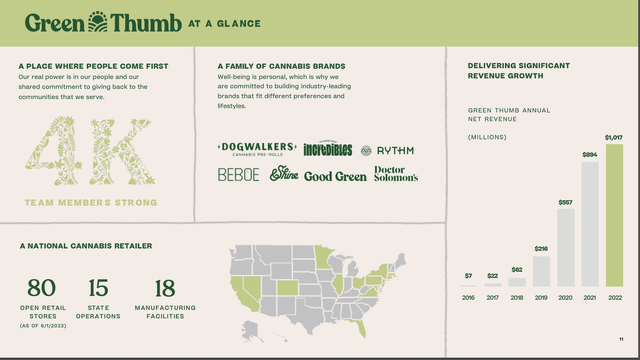

Established in 2014, Green thumb industries began as a small cannabis company in Illinois headed by current CEO Ben Kovler and former CEO Peter Kadens. While Kadens has since left the company, GTBIF has been able to grow massively since its humble beginnings. Ben Kovler retains significant ownership with a 7.8% stake in the company. GTBIF went public through a reverse merger with Bayswater Uranium Corporation (a shell company) in 2018 at a price of $7.90 per share. At that time GTBIF had 12 retail stores and 7 manufacturing facilities spread across 6 states. By the end of 2018 GTBIF had about $62 million in revenue.

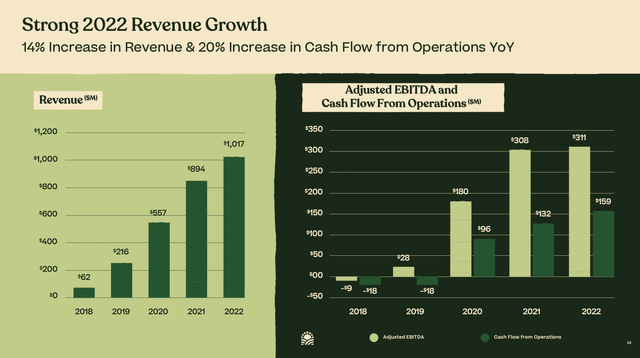

Fast forward to today and GTBIF has 80 retail stores and 18 manufacturing facilities spread across 15 states. GTBIF is vertically integrated with its own grow facilities, distribution, retail channels, and brands. Through a history of acquisition and organic growth, GTBIF has increased revenue almost 20x from $62 million in 2018 to over $1 billion today. Meanwhile its stock price is currently at $8.35 for a CAGR of just 1.11% 5 years after it has gone public. While the cumulative return has been low, the stock price has been incredibly volatile reaching a low of around $4.50 per share during the COVID crash and a peak of around $37 in February 2021 when exuberance about regulatory reform was at its peak. Is there opportunity here or is GTBIF doomed for continued stagnation?

GTBIF Operating History (GTBIF June 2023 Investor Presentation)

Growth & Operating History

As mentioned previously, GTBIF’s revenue growth since its IPO has been truly astounding. But revenue growth without profitability is value destructive as spending 2$ to get back 1$ is not beneficial to shareholders. Thus, the question to ask is has Green Thumb’s revenue growth been value destructive?

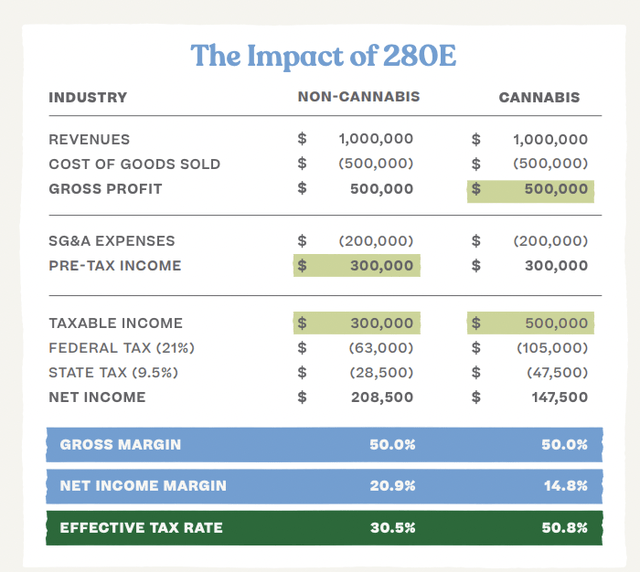

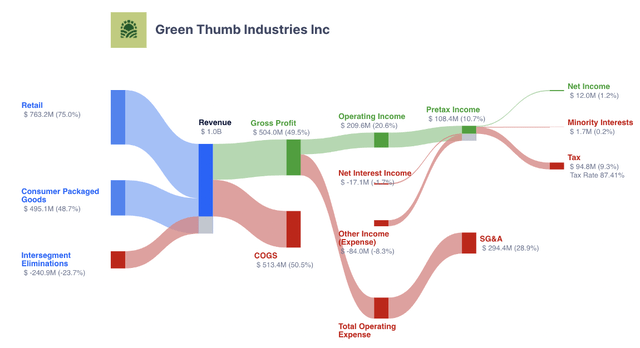

To look at this question, one should analyze 2 key operating metrics: Earnings per share (EPS) & operating cash flow per share (OCF/share). While earnings are the best proxy for profit generation, earnings have a few key issues that are especially salient in industries with extensive investment needs and/or high taxation. As it so happens, the cannabis industry features both. With high fixed asset investment, earnings are reduced as depreciation & amortization (D&A) rise. Taxation also reduces earnings and because cannabis is still federally illegal and as a schedule 1 substance, cannabis companies such as GTBIF are not allowed to deduct business expenses from their taxes. Thus they have to pay taxes on gross profit, which inflates their tax burdens to as high as 80%. An illustration of the tax burden is shown below.

280E Tax Burden (GTBIF 2022 Annual Report)

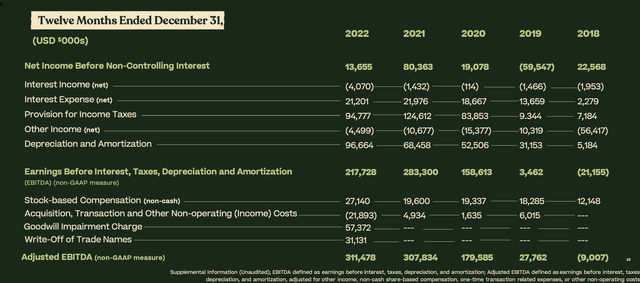

GTBIF’s extensive investment in building its retail & grow operation has resulted in about a 20x increase in D&A from $5 million in 2018 to $96 million today. If you add D&A, taxes, and interest back to earnings to create EBITDA, one can see how GTBIF has grown from $36 million in 2018 to $224 million today. However, shareholders have not benefited from this rise in EBITDA as the money has mostly been invested in assets and paid out as taxes to Uncle Sam, hence the D&A and T. OCF which adds back D&A, but still counts taxes an expense corroborates this growth as OCF has grown from -$18 million in 2018 to $159 million today.

To put this growth into context, one also has to look at the growth in share count over the 5 year period. From GTBIF’s 2018 annual report, diluted shares outstanding were 148 million and have grown to 238 million today. Since OCF was negative in 2018, I will use EBITDA/share as the metric to use and despite the increase in share count EBITDA/share has grown from about $0.24 per share in 2018 to about $0.94 per share. However, EBITDA, as I previously discussed, is an imperfect measure of growth as taxes, interest, and D&A are real expenses for the shareholder. Net income and EPS, which represent the actual profit that shareholders generate, has lagged EBITDA growth as seen below. So while the OCF picture looks good, the EPS picture is less clear. However, looking at EBITDA instead of EPS shows that GTBIF has been growing and investing in its business substantially while paying large taxes.

GTBIF June 2023 Investor Presentation

GTBIF Revenue Growth (GTBIF June 2023 Investor Presentation)

Can any of this change in the future? Will GTBIF’s large investments and high taxes ever abate? I will now discuss why I believe GTBIF’s large investment cycle is at its peak and free cash flow will soon start to appear in meaningful amounts as capex investing winds down. This will also help increase EPS in the future.

I will also discuss the 2 big catalysts that can propel GTBIF’s fundamentals and stock price and which form the backbone of the bull case for GTBIF and the cannabis industry writ large.

GTBIF Current Position and Peer Analysis

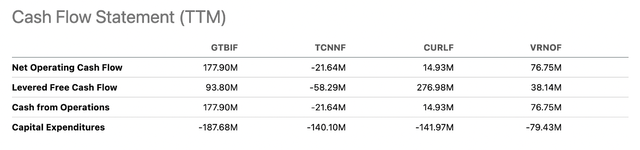

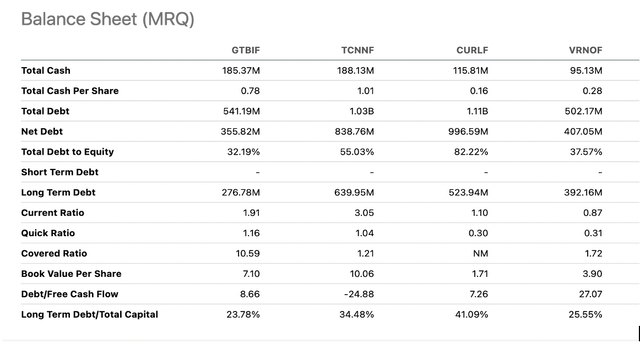

GTBIF is well positioned in regards to their balance sheet and cash flow profile compared to peers Curaleaf (OTCPK:CURLF), Trulieve (OTCQX:TCNNF), and Verano (OTCQX:VRNOF). They have the least debt to equity of their peers, with best in class cash flow generation.

US MSO Cash Flow (Seeking Alpha)

US MSO Balance Sheets (Seeking Alpha)

In addition to their strong balance sheet and cash flow, GTBIF seems to be nearing the end of their capital investment cycle. At their last earnings call, CEO Ben Kovler said the following:

So we expect about another $100 million for the rest of the year in CapEx into the business in the projects that we’ve talked about. No new news there, finishing those off. And we do not think 2024 looks like 2023, just as 2023 is less than 2022, it’s coming off on those big ones.

And so what do we do with that cap, that free cash flow that you articulated, again, out of a – basically like you said, a flat environment of $300 million is, one, CapEx, we have that funded, we have that well done. Two, we’re thinking about the debt. Yes, we have a low level of debt, but it’s something we’re talking about and thinking about. We have $250 million at 7% due in April of 2025, and then we look at what other things we could do with the cash, whether it’s M&A on our own equity, certainly looking at things in this environment that could be exciting as we look at a medium and long-term lens in the best interest of shareholders.

So it’s a fortunate spot that we’re in with that kind of powder to play with, given the balance sheet we have and the cash it produces. But it’s important that people understand the tax rate, which you obviously do, and then interest, because interest is real cashish out the window. So we like the situation, it produces cash, we have the projects well-funded, fully funded on the balance sheet today. The business produces the cash and then puts us in a position to wait for a few good things or a few good ideas to come along, which we’re excited about.

As GTBIF comes off their major spending cycle, they will have excess cash that can be used to benefit shareholders directly, either by buying back shares or through debt paydown. This should bode well for future returns.

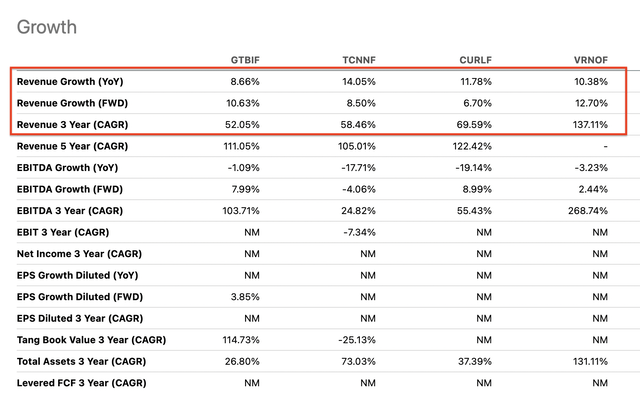

While it is important to mention, compared to peers, GTBIF’s recent growth has not been as strong as evidenced below. However, their conservative balance sheet and spending discipline are important in an industry like cannabis and so I prefer them compared to peers even if they may grow at a slower pace. And with key states like Maryland, Minnesota, Virginia, and Pennsylvania, I believe GTBIF is well-positioned for future growth. All of the states mentioned are either at the early stages of recreational use or may have recreational sales in the not-to-distant future.

Revenue Growth (Seeking Alpha)

The 2 Big Catalysts

1. SAFE Banking, Uplisting, and Institutional adoption

SAFE Banking is currently being debated in congress and this law would enhance financial institutions abilities to work with US MSOs including allowing people to purchase product with credit cards and allowing more banking access to the cannabis industry. Not only could this serve to decrease the cost of capital for the industry, but also it can potentially lead to uplisting to major stock exchanges such as NASDAQ or the NYSE. GTBIF along with many other US MSOs trades on the OTC exchange meaning that many institutions and even brokerage firms such as Vanguard, Robinhood, and Euroclear do not allow people to buy these stocks. This creates an inefficiency in price where demand may be artificially suppressed due to inaccessibility.

GTBIF is currently trading near all-time lows on a price to cash flow (P/CF ratio) basis and the inaccessibility of buyers may be partially to blame. Although quantifying the amount to which demand for these stocks would increase upon being listed on an official exchange is unclear, it is suspected to be significant. Only 9% of GTBIF’s shares are held by institutions.

GTBIF Price to Cash Flow (GuruFocus)

2. Rescheduling, Descheduling, and 280E tax removal

As mentioned previously cannabis is a schedule 1 drug, which means any business that is “plant-touching” has to abide by the 280E tax code, which states that businesses operating with schedule 1 substances may not claim business deductions. This results in massive tax bills for US MSOs. In fact, in the last 12 months GTBIF paid an astounding $95 million tax on $108 million of pretax income for a whopping 87% tax rate. If they were taxed at a normal rate, this tax would be closer to 20 million, which could increase their operating cash flow almost 50% and their EPS/net income 300-400%.

GTBIF Tax Burden (GuruFocus)

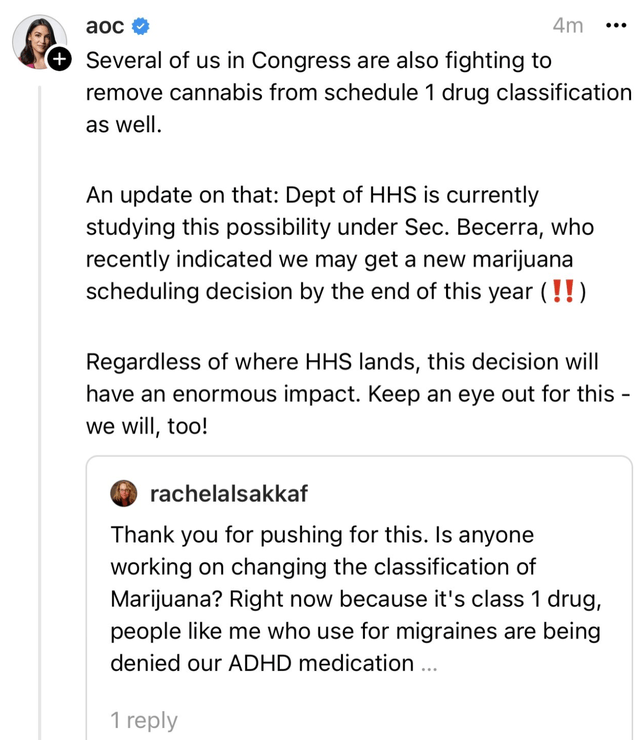

The main way to get rid of the 280E tax penalty is through removing cannabis from the schedule 1 substance registry which would require rescheduling or descheduling. The secretary of Health and Human Services, Xavier Becerra is currently reviewing cannabis status as a schedule 1 substance and a decision is due out by the end of the year. In fact, AOC recently posted to keep an eye out for the scheduling review, which could mean good things to come.

Alexandria-Ocasio Cortez Threads Post

Risks

There are several risks to my thesis. Continued regulatory inaction on SAFE Banking and/or rescheduling will continue to hamper GTBIF and other MSO stocks as the stock will continue to be inaccessible to buyers and the punishing tax rates will crimp earnings and cash flow.

Cannabis prices have also suffered from severe price compression over the past few years and MSOs struggle to pass these costs on to consumers because the black market, which does not have to pay high taxes can continue to undercut MSOs. A lack of enforcement on black market operations can hinder MSO growth and performance. Additionally, too many growing facilities and an oversupply of cannabis has contributed to this problem.

GTBIF also has considerable key man risk with CEO Ben Kovler owning a substantial amount of stock and his ability to execute and maintain a strong balance sheet in such a difficult industry has been remarkable.

GTBIF may also suffer from a lack of growth if no more states legalize and/or more competition enters the field. GTBIF’s revenue growth has been trending down for the past few years, with the most recent year exhibiting just 14% revenue growth.

Conclusion

GTBIF offers a great way to invest in the US cannabis industry with its peer-leading balance sheet, strong state footprint, and declining capex requirements. Although the past 5 years have not produced shareholder returns, I believe the next 5 years will be much more fruitful due to a combination of declining capex, growth from newer recreational states, and the potential for significant upside catalysts in SAFE Banking and rescheduling.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here