The CROX Investment Thesis Remains Excellent, Despite The Rally Thus Far

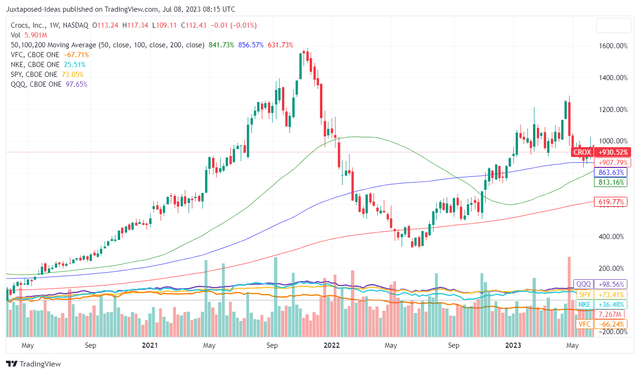

CROX 3Y Stock Return

Trading View

Crocs, Inc. (NASDAQ:CROX) has delivered outstanding returns of +930.52% since the worst of the pandemic, despite the drastic correction in 2022.

This is against its consumer discretionary peers’ performance thus far, such as Nike (NKE) at +36.48%/ V.F. Corp’s (VFC) at -66.24% and the wider market, such as the SPY at +73.41% and the QQQ at +98.56%.

Most importantly, all of these gains are attributed to its stock returns, since CROX does not pay a dividend. This cadence suggests two important things, in our opinion.

One, its long-term shareholders have continued to lend immense support to the stock, sustaining its gains thus far. Secondly, the management team led by the CEO Andrew Rees, has also renewed its branding and refocused its offerings since 2017, delivering excellent results again and again, naturally explaining the first point.

For example, CROX has managed to expand its top-line to $884.17M by the latest quarter, with the Crocs brand delivering +22% YoY growth and HEYDUDE a +15% YoY growth.

With HEYDUDE generating an annualized revenue contribution of $941.6M (+104.8% YoY) and approximate gross profit of $467.03M (+296.8% YoY) by the latest quarter, based on the step-up in the GAAP gross margin from 25.6% to 49.6%, it appears that the $2.5B price tag is not that hefty after all.

This proves that the highly competent CROX management has been able to fold the new acquisition into its current offerings, while unlocking expanded margins.

Given these developments, investors are probably not surprised by the raised FY2023 guidance, with revenues of $4B (+12.6% YoY) and EPS of $11.45 (+4.8% YoY) at the midpoint, especially since the management expects HEYDUDE gross margins to improve nearer to Crocs’ 55.8% in the near term.

In addition, thanks to the $589.85M of FCF generated over the last twelve months [LTM], we are confident of CROX’s guidance of gross leverage of under 2x by the end of the year and long-term target of below 1x, with $600M of its long-term debts already repaid over the LTM.

For now, its sales may have decelerated to +12.1% YoY in the North America market, thanks to the tougher YoY comparison, elevated interest rate environment, and tightened discretionary spending.

However, we believe CROX’s outperformance internationally at +31.8% YoY in the latest quarter, especially in China and Australia, may well balance the temporary headwind, with Asia Pacific now comprising 21.5% (+3.7 points QoQ/ +4 YoY) of Crocs revenues in the latest quarter.

Most importantly, demand in China appears to be accelerating, with the management reporting a two-year growth rate of +95% ex-currency in the latest earnings call, suggesting its long runway for growth in the country.

As a result of these early promising results, we believe CROX’s H2’23 performance may exceed expectations, though FQ2’23 margins may be temporarily impacted by the seasonally higher SG&A and marketing spend. Investors may want to temper their expectations a little.

So, Is CROX Stock A Buy, Sell, or Hold?

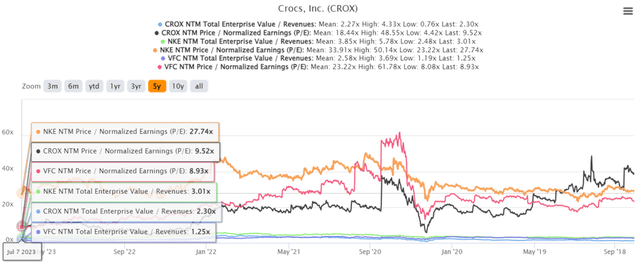

CROX 5Y EV/Revenue and P/E Valuations

S&P Capital IQ

For now, CROX’s valuations continue to be moderated, with NTM EV/ Revenues of 2.30x and NTM P/E of 9.52x, trading below its 5Y mean of 2.27x and 18.44x, respectively. The same has been observed with VFC’s valuations and, to a much smaller degree, with NKE.

Perhaps this is due to the market analysts’ decelerating top and bottom line projection at a CAGR of +10.4% and +9.3% through FY2025, respectively, compared to its normalized levels of +28.3% and +132.2% between FY2017 and FY2022.

However, we believe the pessimism embedded in CROX’s valuations are overly done, since the management has been able to drastically expand its profit margins by two-fold between FY2019 and FY2022.

Given its steady gross margins of 53.9% (+0.8 points QoQ/ +4.7 YoY) in the latest quarter, we are convinced about the management’s pricing strategy as well, despite the growing inventory level of $476.11M (inline QoQ/ +16.8% YoY), compared to the FY2019 levels of 50.1% and $172.03M, respectively.

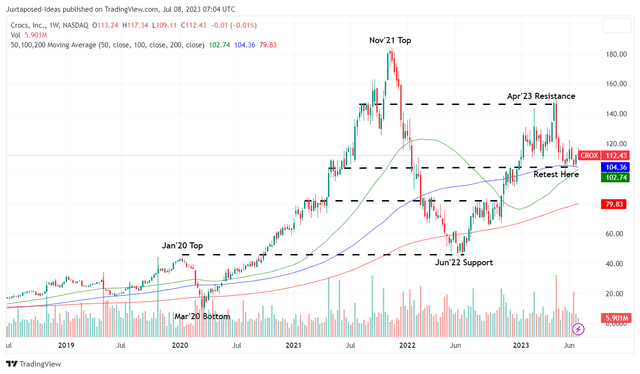

CROX 5Y Stock Price

Trading View

With CROX remaining well-supported here, we are cautiously rating the stock as a Buy. There is a decent margin of safety to our price target of $135.66 as well, based on its NTM P/E 9.52x and the market analysts’ FY2025 adj EPS projection of $14.25.

Long-term shareholders may also want to be patient, since we believe an upward rerating in its P/E valuations to the previous normalized levels of 17x is entirely possible, nearer to its consumer discretionary peers, once the macroeconomic outlook lifts and the Fed pivots.

This number suggests a long-term price target of $242.25, implying an ambitious upside potential of +115% from current levels. This correction is only temporal.

Read the full article here