Introduction

Meyer Burger (OTCPK:MYBRF) (OTCPK:MYRBY) is a Swiss company specialized in the production of solar panels which it sells to customers in Europe and the USA. The company has been finetuning a new process for the past 15 years and is now finally ready to start monetizing its technological know-how. The anticipated production this year will almost triple compared to last year and the production capacity will then almost quadruple again by the end of next year. This means the company will soon reach its critical mass and will likely soon be EBITDA and cash flow positive.

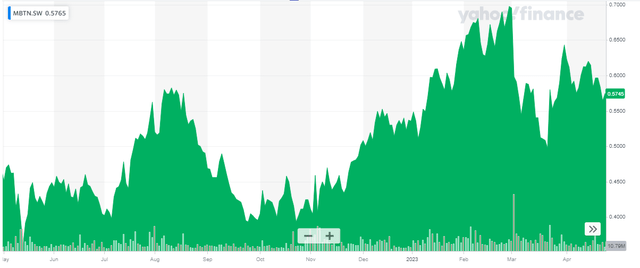

Yahoo Finance

Meyer Burger has its primary listing in Switzerland where it is trading with MBTN as its ticker symbol. While the company is a penny stock with a current share price of 0.58 CHF it most definitely is not a nano-cap. After a recent 250M CHF capital raise, the company currently has about 3.6 billion shares outstanding resulting in a current market capitalization of 2.1B CHF. That’s approximately 1.86B USD. The average daily volume in Switzerland is 27 million shares per day.

Why Meyer Burger has a competitive advantage over its peers

About three years ago, Meyer Burger started to look into the production of solar panels using the heterojunction/Smartwave technology which was developed by the company for about a decade until it decided to apply the technology in the solar panel industry. While the company’s most recently launched product is a solar roof tile (which isn’t new as Tesla (TSLA) has been producing shingles for a while now) which will be commercialized later this year, the main reason for the company’s existence is the fact it has been able to drastically increase the energy yield per module area (which basically means the panels produced by Meyer Burger produce more electricity per square meter).

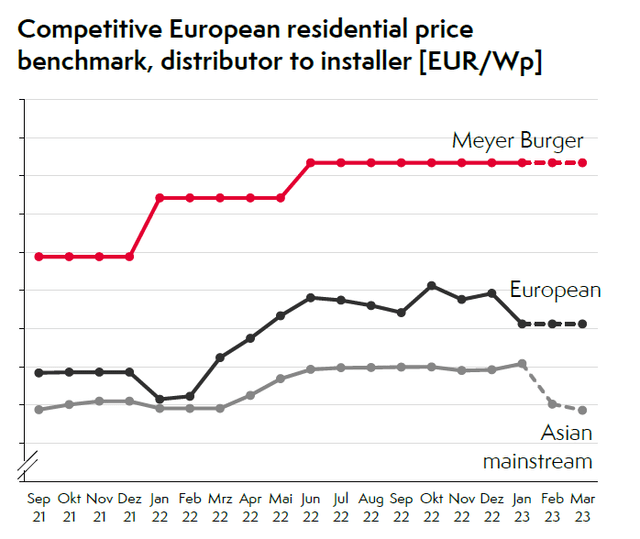

Meyer Burger Investor Relations

This has allowed the company to position itself in the premium segment of the market, a segment that it is starting to dominate after for instance Panasonic and LG Electronics announced their retreat from the module market. This basically means Meyer Burger is in an excellent position to rapidly gain market share in this premium segment. The image above shows the recent pricing power experienced by Meyer. While most of its competitors have had to reduce prices from Q4 2022 on, Meyer Burger was able to keep its prices stable although it has indicated it will slightly reduce its prices later this year in an attempt to first maintain and later grow their market share in the solar panel market.

The so-called ‘glass-glass’ product beats the existing ‘glass-foil’ products on the market as Meyer Burger’s product offers better longevity and lower degradation statistics compared to the standard products. The glass-glass product will be the sole focus of Meyer Burger going forward and a new product platform which will be online from 2024 on will solely focus on using glass as a back sheet.

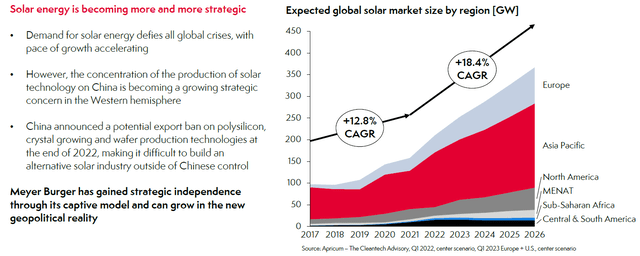

The energy crisis in Europe has caused consumers to rethink their power needs and more importantly, people have started to wonder how they can increase their self-sufficiency level when it comes to their own power supply. We saw a massive increase in the demand for solar panels in 2022 and the worldwide demand will continue to grow at a double digit rate.

Meyer Burger Investor Relations

Seeing how the demand is anticipated to increase pretty aggressively in Europe over the next few years, Meyer Burger is in an enviable position and ready to fire on all cylinders as it recently completed an expansion to increase its production capacity.

As part of its expansion plans, the company has recently announced it is entering the Australian market for solar panels. It plans to exhibit at the upcoming Sydney conference (where it has also secured a speaking slot) and hopefully Burger Meyer can lock in some initial orders at that conference and fill its order book ahead of the rapid production capacity expansion.

2022 was just the start and the company should turn profitable soon

I can be pretty brief about 2022 as the company was just gradually ramping up its production. This means the FY 2022 results do not reflect Burger Meyer’s operational and financial performance. During the year, the company produced approximately 321 MW of modules but it only recorded about 250MW in sales mainly due to accounting rules as a shipment can only be recorded as revenue once the buyer has received the shipment. Considering a substantial portion of the panels was shipped to the USA, the transit period was pretty long and the revenue of the panels shipped in 2022 but only delivered in 2023 will be added to the 2023 revenue.

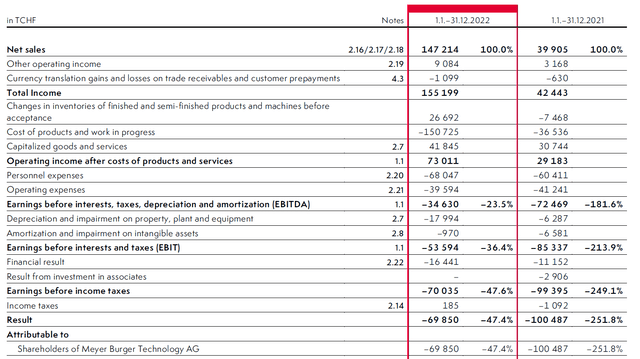

The total reported revenue for FY 2022 came in at 147M CHF and the company added an additional 9.1M CHF in ‘other income’ to the revenue (this was mainly related to the release of a provision for bad debt and the revenue generated by the company restaurant and the company kindergarten). As you can see below, the company did report a positive operating income but the EBITDA was still negative after deducting the G&A expenses.

Meyer Burger Investor Relations

There was a clear improvement though as the EBITDA result of minus 34.6M CHF was a sharp improvement compared to the negative 72.5M CHF in FY 2021. And the financial result will improve this year as the company no longer has to deal with capacity constraints (it couldn’t produce the solar modules fast enough to keep up with demand). A second production line was started in September 2022 and the company should see the full benefit this year.

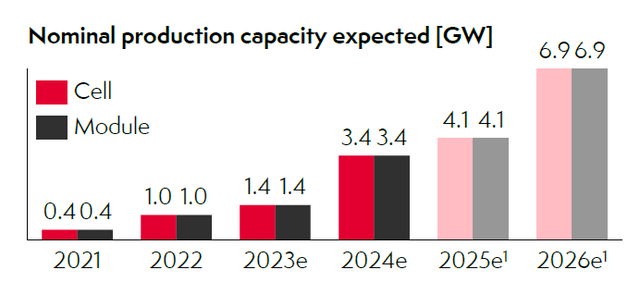

We know the company produced about 321 MW of capacity, but it has very aggressive growth plans for this year as this is the first full year the expanded production capacity which was completed in 2022 will start to contribute to the results. During 2023, Meyer Burger anticipates to produce and sell about 800MW of capacity. Great, but that still is just a stepping stone for the company to realize its longer term projections. The image below shows how optimistic Meyer Burger is as it anticipates its production facilities to be able to have a production capacity of 3.4 GW per year by the end of 2024 which should further increase towards 6.9 GW by the end of 2026. If Meyer Burger can indeed pull this off, it would be able to twenty-fold its production in just 4-5 years time. Needless to say this will have a very positive impact on the company’s financial performance as well.

For 2023, Meyer Burger is anticipating a ‘positive EBITDA’ which is a good start, but we will only really start to see the positive impact of additional expansion investments in 2024. Looking at the consensus estimates, analysts are projecting an EBITDA of 126M CHF and 241M CHF for 2024 and 2025 respectively.

Meyer Burger Investor Relations

This obviously means the total capex level will remain high, and Meyer Burger tapped the market for a 250M CHF capital raise in the fourth quarter of last year. A total of 927M new shares were issued at an issue price of 0.27 CHF per share. While that was a discount to the share price at that point, Meyer Burger played it fair and completed the capital raise through a rights issue which means existing shareholders were able to participate in the financing.

Investment thesis

Meyer Burger is a ‘new kid on the block’ in the solar industry but the rapid revenue growth indicates the company’s products are quite popular. It couldn’t keep up with demand in 2022 and it will be interesting to see if this year’s entire production will be sold out right away as well as that would make the company’s aggressive growth plans more credible.

As of the end of 2022, Meyer Burger had almost 300M CHF in cash and a net cash position of in excess of 70M CHF. About 143M CHF of the gross debt consists of a 3.5% convertible bond maturing in 2027, but that bond is currently slightly ‘in the money’ (as the average conversion price is 0.5868 EUR (approximately 0.57 CHF). As the proof of concept has now been delivered, I expect Meyer Burger to sign new credit facility agreements with its banks and that could be an important catalyst. Additional debt funding may not be necessary (but it would be nice to have the flexibility) as Meyer Burger expects a large portion of its capex programs to be funded by the deposits from new long-term offtake contracts (starting in 2025) which would for sure be the cheapest source of capital. Additionally, Meyer Burger has applied to the EU Innovation Fund to seek funding in the ‘three digit million range’ to further expand its production capacity in Europe. It expects to hear back from the EU Innovation Fund this summer.

I currently have no position in Meyer Burger but I am following the stock closely.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here