Introduction

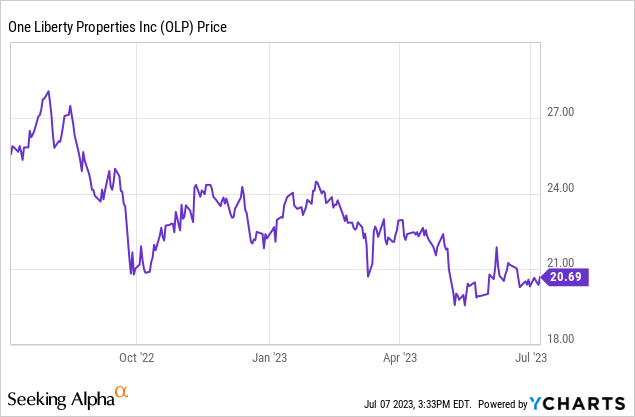

It has been three years since I last discussed One Liberty Properties (NYSE:OLP) and a lot has happened since. In my original article, which was published in the summer of 2020, I argued there was a potential 50% upside potential while the REIT paid a 10% dividend yield. And that target was effectively reached. Less than 18 months after the article, the share price was trading at twice the level it was at in August 2020 and the REIT continued to pay a quarterly dividend of $0.45.

As the REIT has been hit by the fears of higher interest rates and compressed earnings, the share price is now trading around the $20 mark, which is just 15% higher than three years ago, and I wanted to check up on the REIT to see if this is an opportunity to get back in.

OLP’s FFO and AFFO remain strong

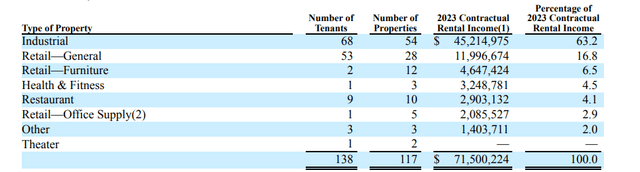

One Liberty still offers an attractive diversification, but it’s interesting and encouraging to see the weight of the industrial properties in the portfolio has continued to increase. The 49 industrial properties the REIT had a little while ago were further boosted to 54 properties, which now account for in excess of 63% of the rental income, as you can see below.

OLP Investor Relations

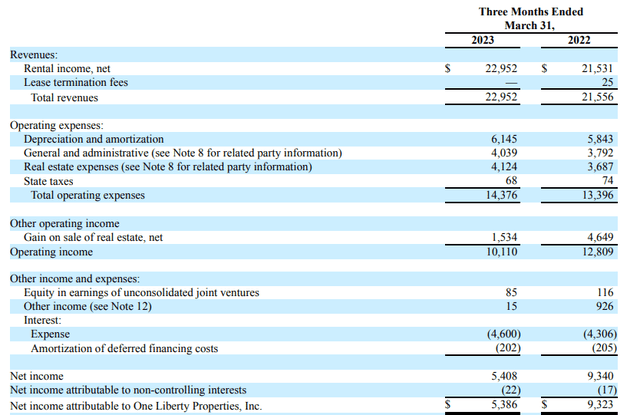

The REIT remains a pretty active trader in its assets, and this helps the REIT to secure the best possible performance for its unitholders. While the income statement is somewhat irrelevant for REIT investors, I still tend to like having a look at it, mainly to determine the Net Operating Income as well as seeing the evolution of the interest expenses.

OLP Investor Relations

As you can see above, One Liberty – as a net lease REIT – reported a total rental income of $23M and reported about $4.2M in real estate expenses and taxes. The net operating income on the asset level was approximately $18.75M, which represents about $75M on an annualized basis.

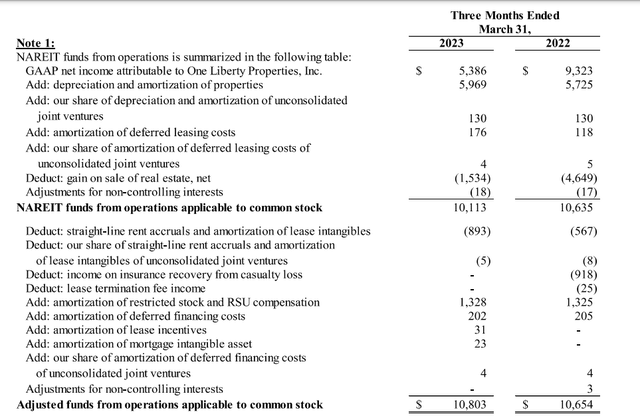

OLP Investor Relations

The net income of $5.4M obviously was the starting point of the FFO and AFFO calculations and as you can see above, the total FFO came in at $10.1M while the AFFO was a respectable $10.8M. That’s a small increase compared to the $10.65M in AFFO generated in the first quarter of 2022 despite having to deal with a higher net interest expense.

As there are currently 20.55M shares outstanding, the total AFFO/share came in at $0.525/share (the REIT reports the AFFO/share of $0.50 on a fully diluted basis, while I use the current share count).

Based on the current multiple of just 10 times the AFFO/share, One Liberty Properties appears to be pretty attractive and the current quarterly dividend of $0.45 per share remains fully covered.

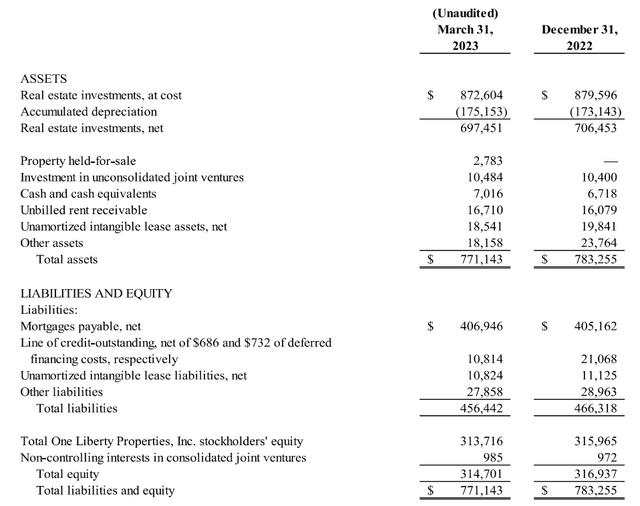

As of the end of Q1, One Liberty Properties had about $418M in gross debt and about $7M in cash and $2.8M in properties available for sale. On a pro forma basis, this means the net debt level was approximately $408M. While this means the debt ratio is almost 60% based on the book value of the assets of approximately $697M, let’s keep in mind this already includes about $175M in accumulated depreciation.

OLP Investor Relations

This means the LTV ratio based on the acquisition cost is a more respectable 46.7%. And considering the NOI in Q1 was $18.75M, and we can expect a full-year NOI of $75M (I’m expecting the NOI to come in higher but to err on the side of being cautious I will just use the annualized result from Q1), one could argue the fair value of the assets is even higher than the acquisition costs. Applying a cap rate of 6.75% on the industrial properties and 8% on the other assets, the market value of the assets would actually exceed $1B and come in at close to $1.05B, in which case the LTV ratio would drop below 40%.

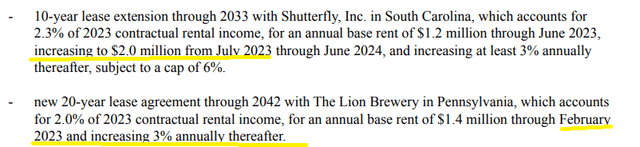

And again, I expect the full-year NOI to come in higher than the $75M I used. Some of the acquisitions and lease extensions will only come into play throughout this year. I have highlighted some elements below (sourced from the 2022 annual report):

OLP Investor Relations

OLP Investor Relations

These are just three examples, but this means an increase in the rental income of $1M on an annual basis. And as the direct operating expenses won’t be impacted, the vast majority of that additional million dollars will flow through to the FFO and AFFO.

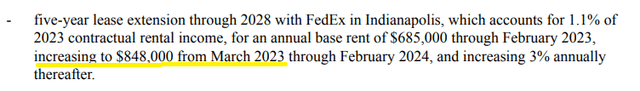

One element to keep an eye on are the leasing spreads OLP will be able to generate in 2023 and 2024 as it will have to renew about 14% of its annual rental income.

OLP Investor Relations

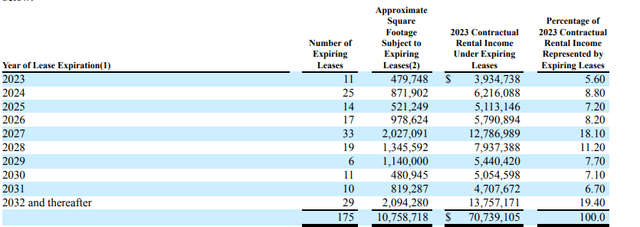

Do we need to be worried about the cost of debt?

So, OLP looks good from an earnings multiple perspective, while I’m not worried about the debt levels either. The one remaining question that needs to be answered is how well can and will the REIT deal with the increasing interest rates.

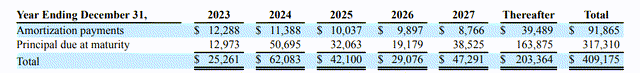

As of the end of 2022, the average remaining term of the mortgage debt (which represents almost 100% of the total debt outstanding) was 6.5 years, with an average interest rate of 4.10%. The image below shows that about half of the mortgage debt only matures after 2028 which means that the next few years I expect the interest rate increases to be very manageable.

OLP Investor Relations

An increase of 200bp would add $0.5M in interest expenses based on the 2023 principal payments, just $1.2M per year in 2024 and $0.85M in 2025. That’s $2.5M in additional interest expenses between now and the end of 2025. This means that an increase of the net operating income by 4% (less than 1.5% per year) would fully cover the increased interest expenses. Additionally, the cost of debt may be lower than what I’m using in my calculations. About 40% of the mortgage debt that has to be refinanced in 2024 already has a 4.70% interest rate, so we likely won’t see a 200bp mark-up on that refinancing.

Investment thesis

Applying a cap rate of 6.75% for industrial assets and 8% for the other assets, I estimate the fair value of the real estate assets to come in between $1B and $1.05B. This means the total equity value attributable to the shareholders of One Liberty is likely closer to $600M than to the $315M reported book value. At $600M, the NAV/share is approximately $29.25, and that’s approximately 40% higher than the current share price and this clearly shows the upside potential as I don’t think the cap rates I have used are excessive.

This means I think the 8.7% dividend is safe, as I anticipate the payout ratio will be lower than 90% this year. I also don’t expect the AFFO to be hit too hard by increasing interest expenses in the next 2.5 years, as anticipated NOI increases should be sufficient to fully compensate for the higher interest expenses.

I will be looking to re-initiate a long position in One Liberty Properties in the near future.

Read the full article here