I just finished my newest book, REITs For Dummies, and I can’t wait to get a copy of it in my hands (and yours too).

It took me over six months to write it, but in reality, it took me over thirty years…

30 years, you ask?

Yes, this is the amount of time that I’ve been investing in commercial real estate, starting with my first Advance Auto Parts (AAP) store in Laurens, South Carolina.

That one deal led to over $1 Billion in real estate deals in which I accumulated vast experience in property sectors such as net lease, shopping centers, warehouses, restaurants, office, apartments, and even golf.

As an investor, I’ve now experienced four recessions including…

- The Early 1990’s recession (8 months long)

- The Early 2000’s recession (8 months long)

- The Great Recession (18 months long)

- The COVID-19 Recession (2 months long)

During these four recessions, peak unemployment hit…

- The Early 1990’s Recession: 7.8% (June 1992)

- The Early 2000’s Recession: 6.3% (June 2003)

- The Great Recession: 10.0% (October 2009)

- The COVID-19 Recession: 14.7% (April 2020)

The average time frame between each recession was around 8.7 years.

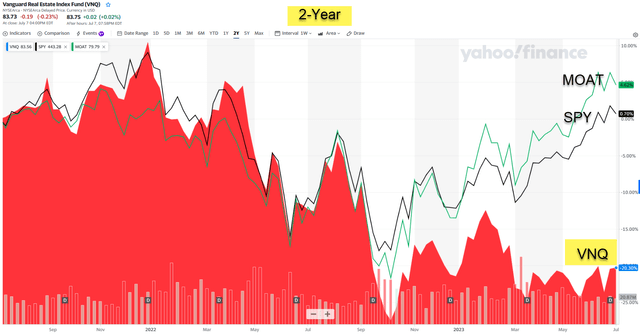

It’s been just over 3 years since the end of the Covid-19 recession and debate continues over whether we’re in a recession, as Mr. Market seems to believe that REITs have already priced in one.

Yahoo Finance

Against this backdrop, and while past performance is not an indicator of future results, it’s possible that the current downturn could present a similar pattern to recessionary precedent.

In short, REITs have performed remarkably well after periods of downturns.

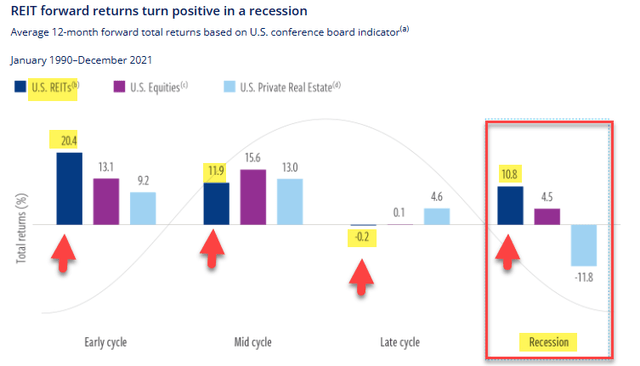

As per Cohen & Steers research, analyzing recessionary periods dating back to 1990 demonstrates that the best returns for REITs have been generated investing during the early cycle.

Cohen & Steers

As viewed above, investing in REITs during the recession has generated forward returns on average of 10.8% which is above long-term averages. The forward REIT return of 10.8% outperforms the returns of the equity market of 4.5%.

More so, this solid outperformance continues as we move into the early cycle.

Again, as viewed above, REITs see even stronger relative outperformance in early cycle recovery periods: 20.4% versus U.S. Equities of 13.1% and Private Real Estate of 9.2%.

What about interest rates?

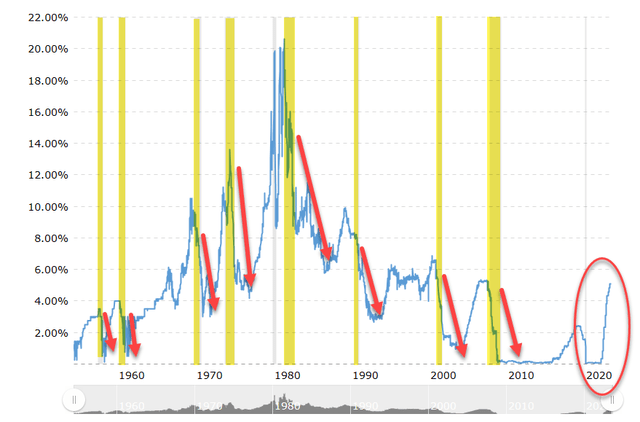

As a developer, I’ve witnessed rate hikes before.

I financed my first Advance Auto Parts store (in the early 90’s) with a bank loan in which the interest rate was around 8%. As you can see below, in all recessions (yellow line) going back to the 1950’s rates fell (blue line).

Federal Funds Rate – 62 Year Historical Chart

macrotrends.net

REITs have performed remarkably well when rate-hiking cycles have ended…

Not so fast…

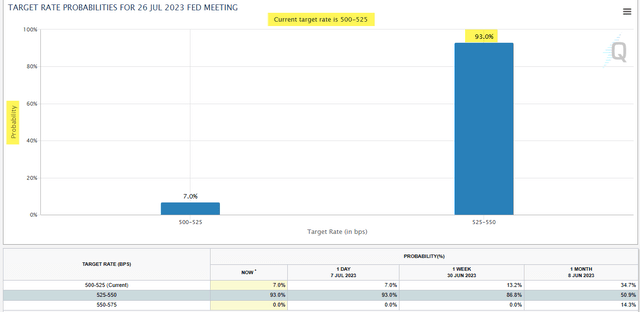

The Fed isn’t done yet as it continues to pursue its quantitative tightening program into July and talks of the need to keep moving its policy rate of interest upwards.

As of Friday, investors assigned a more than 92% chance that the Fed will raise rates in July, according to CME Group’s FedWatch tool, which calculates the probability using futures contract prices for rates in the short-term market targeted by the Fed.

CME Group’s FedWatch tool

Clearly REIT underperformance year-to-date is a result of the Fed pushing back the end of the rate-hiking cycle in hopes of cooling economic demand and lessen wage pressures. Chris Rupkey, the chief economist at FWDBONDS, said.

“The less than expected jobs data won’t scuttle the Fed’s plans for a rate hike on July 26. Bet on it.”

The Fed’s updated projections that were released following its June meeting showed it expected two more rate increases over the next year, more than penciled in during the spring. Investors are now pegging about 23% odds that rates will go as high as 5.5% to 5.75%.

Economic data remains strong, and many economists who have called for a recession are now in the uncomfortable position of pushing back the start date. One my favorite Barron’s writers, Andy Serwer, said it like this,

“There won’t be a recession this year. Not with all the help-wanted signs plastered on storefronts, and friends telling me they can’t find people to hire for their businesses. Not with some 2.5 million airline passengers a day filing through TSA checkpoints. Not with hotel room rates up 10% from pre-pandemic levels for most major U.S. cites. Not with the market cap up 14% year to date”

All these points hit home for me.

I’m trying to hire a few people to help run my U-Haul (UHAL) business and it’s slim pickings. I’ve been traveling across America (Chicago, NYC, West Palm, and SC) over the last few weeks and airports are packed.

My best barometer are the Uber drivers and they’re all upbeat.

So, why are REITs singing the blues?

Could CRE Be the Next Black SWAN?

In the same Barron’s article, Andy Serwer said, “some sort of exogenous bird could crash the economy” and of course he’s referring to a “black swan” event.

Many pundits believe it’s CRE, commercial real estate, and specifically recent banking headlines have created concerns that are weighing on REITs.

Specifically, there’s increased focus on tightening lending conditions, especially in the office sector.

However, contrary to common misconception, office exposure within the publicly listed REIT sector is less than 3.5% of the index’s market cap.

Furthermore, there is a view that CRE is a highly levered asset class.

In the case of REITs, this simply isn’t true.

On average, REITs have leverage less than 35%, and 86% of their debt is fixed (for an average term of around 6 years).

These attributes, which appear not to be well understood among the general investor population, help insulate REITs against looming market pressures as growth slows and lending conditions tighten.

In fact, the weaker hands – primarily private developers and small cap REITs – could become catalysts for the higher-quality names we’re recommending at iREIT© on Alpha.

As the saying goes, “cash is king” and we suspect that the pressure on highly leveraged landlords will provide an opportunity set for large cap REITs to continue to consolidate, demonstrate synergies via economy of scale.

So when should you buy?

At iREIT© on Alpha we will continue to research REITs, thru various market cycles, as our primary goal is to find income-oriented businesses with wide moats.

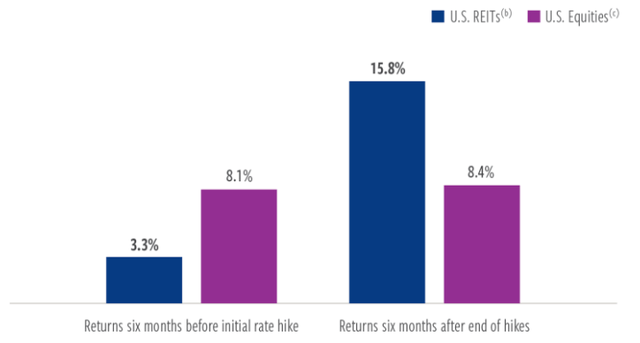

While we can’t predict when the rate cycle will end, we do know that when it does it will be a very good environment for REITs. In fact, U.S. REITs have historically produced returns above 15% over the six months following the end of a Fed hiking cycle.

March 31, 2023. Source: Cohen & Steers calculations, Bloomberg, and Federal Reserve

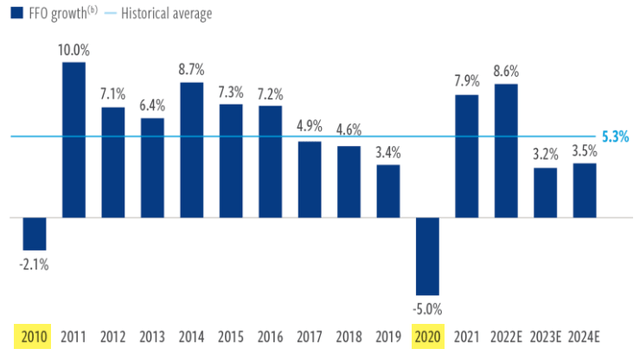

Importantly, REIT fundamentals remain strong, the sector generated same-store net operating income (NOI) growth of 7.2% in Q1-23, compared with the historical average since 2000 of 2.4%. As seen below, cash flow growth remains strong, which supports continued dividend growth.

March 31, 2023. Source: Cohen & Steers calculations, Bloomberg, and Federal Reserve

Where’s the cheese?

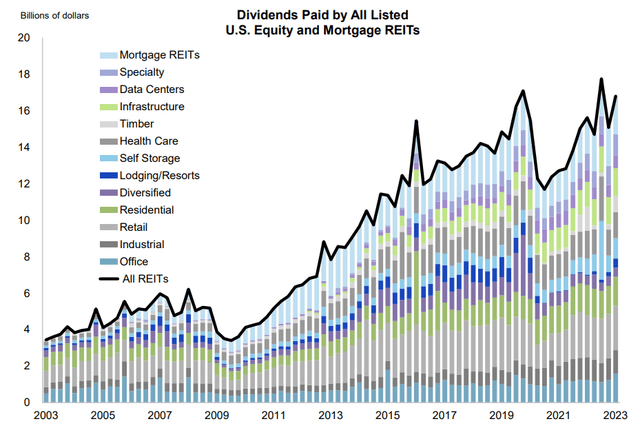

Most folks’ own REITs because of dividends.

Some investors own them because of their high yield (REITs must payout at least 90% of their taxable income in the form of dividends).

And some investors own then because of the predictable income.

Personally, I like both of these attributes.

Nareit

At iREIT© on Alpha, we consider dividend safety and reliability a big part of the value equation for REITs which is why we place heavy emphasis on the dividend in our iREIT© quality scoring model.

In fact, I recently decided to design and construct a new REIT portfolio for my mother which I recently shares with members at iREIT© on Alpha. In a few days I’ll publish the entire portfolio, but I always provide our valued members with our research a few days in advance.

In this article today, I decided to provide two of the picks within the “technology” sector…

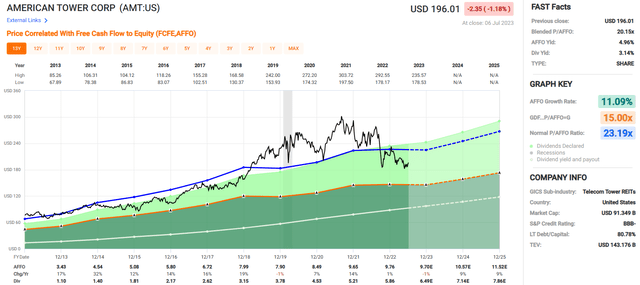

American Tower (AMT)

American Tower is a cell tower REIT that specializes in wireless communications real estate. Their portfolio has a global reach with over 181,000 international cell towers and approximately 43,000 cell towers located in the United States and Canada. In total they have approximately 226,000 communication sites that are located in 26 countries and across 6 continents.

In addition to cell towers, AMT has a portfolio of more than 1,700 distributed antenna system networks and 28 data centers. In addition to the communication sites they lease, AMT also provides services that include structural analysis, zoning and permitting, and construction management.

AMT has a BBB- credit rating and solid debt metrics with an interest coverage ratio of 7.13x and a net leverage ratio of 5.2x. Their debt has a weighted average term to maturity of 5.8 years and approximately 80% of their debt is fixed rate.

Over the last 10 years AMT has delivered an average AFFO growth rate of 11.09% and an average dividend growth rate of 20.70%. They pay a 3.14% dividend yield that is well covered with an AFFO payout ratio of 60.04%.

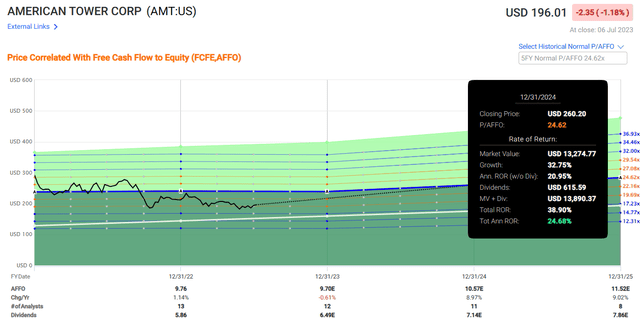

FAST Graphs

AMT trades at a P/AFFO of 20.15x which compares favorably to their normal AFFO multiple of 23.19x. They currently are trading in line with their net asset value with a P/NAV ratio of 0.97x. If AMT trades back to its normal 5-year AFFO multiple it would result in a total annual rate of return of 24.68% by the end of 2024.

At iREIT we rate American Tower a BUY.

FAST Graphs

Digital Realty Trust (DLR)

Digital Realty is a data center REIT and is one of the largest owners of data centers with more than 310 data centers that have over 214,000 cross connects and serve approximately 5,000 customers worldwide. They have a global presence with data centers located in the U.S., Latin America, Canada, Europe, Australia, Asia, and Africa.

In total their data centers are located in 25 countries and span across 6 continents. DLR’s data centers have a wide range of capabilities including co-location interconnection, enterprise hybrid solutions, and dedicated data halls to serve hyperscale customers. DLR’s customers include business enterprises, network service, IT and cloud providers.

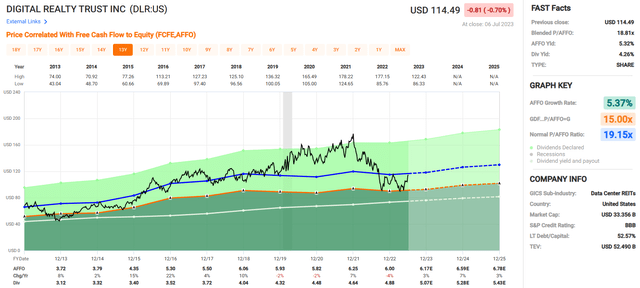

DLR is investment grade with a BBB credit rating and has sound debt metrics including a net debt to adjusted EBITDA of 7.1x, a long-term debt to capital ratio of 52.57%, and a fixed charge coverage ratio of 4.4x. They have had an average AFFO growth rate of 5.37% and an average dividend growth rate of 5.29% over the last 10 years and currently pay a 4.26% dividend yield that is covered with an AFFO payout ratio of 81.33%.

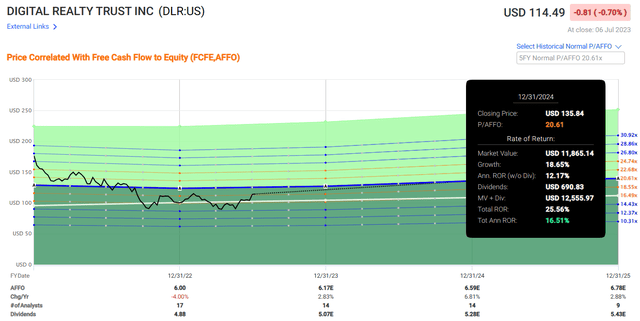

FAST Graphs

DLR currently trades at a P/AFFO of 18.81x which is a slight discount to their normal AFFO multiple of 19.15x. They are priced right in line with their net asset value with a P/NAV ratio of 0.99x. If DLR trades back to its normal 5-year AFFO multiple it would result in total annual rate of return of 16.51% by the end of 2024.

At iREIT we rate Digital Realty a BUY.

FAST Graphs

What a Great Mousetrap

As I explained at the outset, I’m extremely excited to get my hands on a copy of my new REITs For Dummies book, and I’m also planning to record a masterclass version for iREIT© members soon.

Given where we are in this cycle (rates for longer, recession maybe in 2024) I consider it a terrific time to begin focusing on the sector.

Our collective research (for me over 30 years of boots on the ground experience) suggests that for the most part, REITs are on solid ground to deliver strong performance over the next 12 months.

Although REITs have their own basket within S&P’s Global Industry Classification Standard (‘GICS’), Mr. Market is still unsure of the value they hold.

The fact that 150 million Americans (roughly 45% of American house- holds) are invested in REITs is a terrific sign and I’m happy to say that my family, including my mother, has invested heavily in the REIT mousetrap.

Now, riddle me this, how much cheese have you invested in the REIT mousetrap!

Read the full article here