Dear readers/followers,

With the market taking a slight, interesting turn to the negative in this week, we’ve seen some companies drop down, and it’s time to highlight some businesses that at this time offer significant upside to any sort of conservative, realistic forward valuation. In specific, it’s time to highlight one business that I feel offers investors a very appealing mix of valuation, upside, and sector-competitive yield.

I’ve covered this company before, but I feel it’s high time for an update on the business here – and show you why I recently bought some more shares when the company dropped below that €25/share level for the native FRE ticker.

Let’s get going here.

Reviewing Fresenius for 2H23 – a lot to like.

Fresenius (OTCPK:FSNUF) hasn’t been the easiest sort of investment to go for of late. The company has been underperforming for a long time – but I believe the potential upside to crystallize more and more in 2024-2025E.

The company is a large German healthcare company out of Bad Homburg in Hesse, with a history going back over 100 years and a focus on its current business areas that goes back at least over 50 years, when the company began with its dialysis services. Today, the company’s focus and services are centered around dialysis services for hospitals and inpatient/outpatient medical care, and the focus is growing and expanding to other attractive areas, and away from dialysis (though we’re not there just yet).

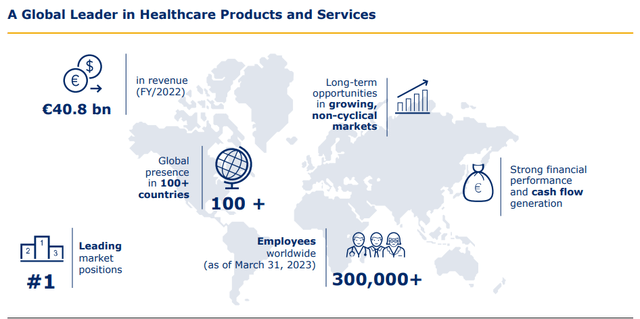

What is attractive about Fresenius is, among other things that the company is a market leader with a global presence in over 100 countries, over €35B worth of sales, and in excess of 300,000 employees across the world. In many of its areas, Fresenius holds a #1 market position, allowing the company a decent moat for its products and services.

There are clear catalysts for upward momentum for Fresenius.

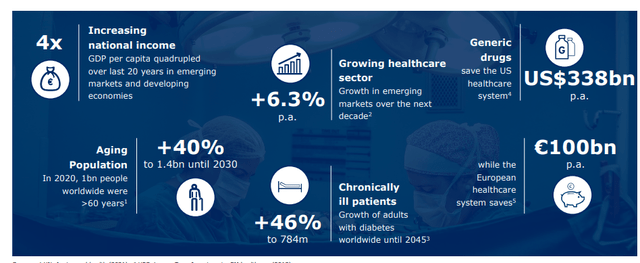

Fresenius IR (Fresenius IR)

Fundamentals remain on par for a positive thesis for Fresenius. These catalysts included a combined increase in overall national income (GDP per capita), together with an aging population, higher amounts of chronic illnesses, a growing healthcare sector, and the increased importance of generic drugs and cost-saving initiatives. It goes without saying that all of these trends work in favor of the company being one of the primary winners in the market of the future, provided that they manage to provide value and efficiency going forward.

Fresenius IR (Fresenius IR)

Looking at the valuation, it’s unfortunately also clear that Fresenius hasn’t really been able to do this. The company has underperformed for several years, due to difficulties in cost control, macro, and frankly, management of the company which hasn’t been great for some time.

However, Fresenius remains a key player in the sector – and the company now has better management with a new focus, that is set to get things “in line” with what I would consider to be better expectations. The company calls this its RESET program, which in essence means a much-simplified structure and better resource allocation.

It also includes the Intention to deconsolidate Fresenius Medical Care by changing the legal form of FMC to a German Stock Corporation (“Aktiengesellschaft”) in simplified governance, and instead focus on Operating Companies Fresenius Kabi and Fresenius Helios (to which I say “finally”). Active portfolio management is the best strategy here for Fresenius, for sure.

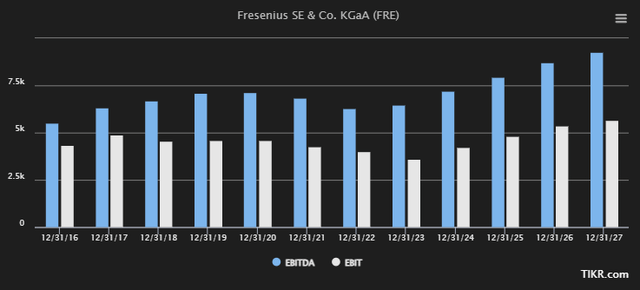

These ambitions are set to bring about €1B worth of structural productivity improvements, which goes some way to explain the expectations we see for the company as we move forward. Take a look at these EBITDA and EBIT trends and forecasts, which agree with my assessment of 2023 being the sort of “trough” year for the company.

Fresenius Forecast (TIKR.com)

Once this trough year is over, we’re likely to see the improvements. And because I consider these improvements both likely and inevitable, provided that management is on track and keeps its eyes on the ball, this makes the share price or how low the price goes a non-issue – because my conviction is high that it will go up again.

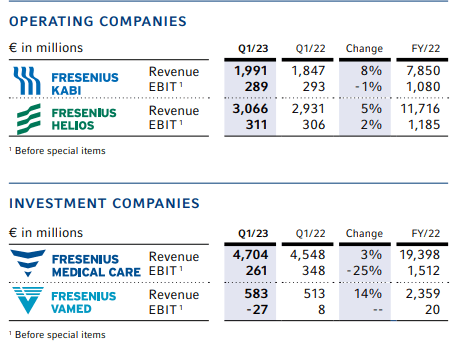

Fresenius today is a two-tier play on the company’s operating companies and investment companies – which are split as follows.

Fresenius IR (Fresenius IR)

The company’s sales are about 46/38 in Europe/NA, with about 10% APAC and 6% LATAM/other. So it’s mostly a play on EU/NA, with sales of about 30% helios, 19% Kabi, 46% medcare, and 5% Vamed – though this is changing. The company’s new operating structure means really moving away from the traditional “German” way of doing things and putting this company into a position of competitiveness on a global scale.

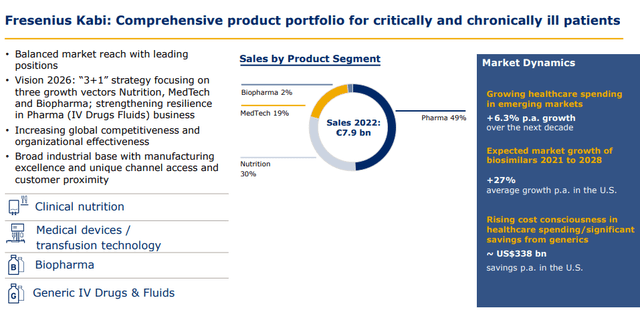

While MedCare is the segment that gets the most international and market attention, instead want to pull your attention to Kabi and Helios. Kabi with its attractive nearly €8B worth of 2022A sales with 49% pharma and 30% nutrition…

Fresenius IR (Fresenius IR)

…and Helios, driving towards leadership in both German and Spanish private hospitals, targeting a €123B market in Germany alone that is set to grow significantly – and that’s just in one country. MedCare will continue to be the primary segment for the company going forward. How could it be different with the segment being the world’s leading provider of dialysis products and services treating ~343,000 patients1 in ~4,060 clinics? But the segment does have some issues and needs to work on profitability before things can be viewed as “okay”.

The company’s dividend can be characterized as conservative – with a 24-30% payout ratio that currently puts that dividend at 3.73% – but on the global market, this is a great dividend given what the company offers, and it certainly has me investing more in the company.

What’s going to happen to Fresenius going forward is that the company will deliver its ReVitalize program now that ReSet is finished – and this is likely to bring about yet more positive changes in the form of accelerated performance and cost savings.

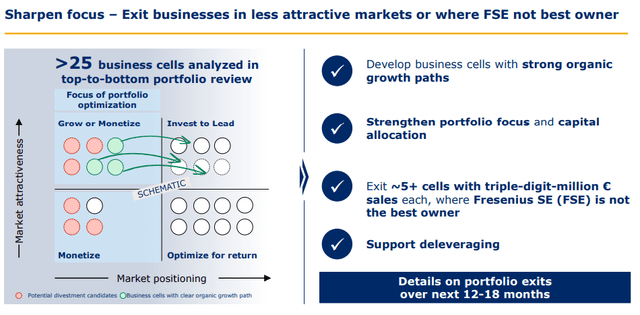

The company is also finally leaving unattractive markets behind – a great decision, though it took too long a time, because this is what has held the company from delevering effectively, and has kept the company at BBB.

Fresenius IR (Fresenius IR)

The company has finally realized, and is moving steps in ways that other companies have already delivered – many of them over 10 years ago.

Still, it’s a good move and I believe the combination of steps we’re seeing the company both planning and taking here is what will ultimately result in the substantially improved performance Fresenius is forecasted to see here.

Fresenius Valuation – The upside is most certainly there

From a valuation perspective, the picture we have is currently the following.

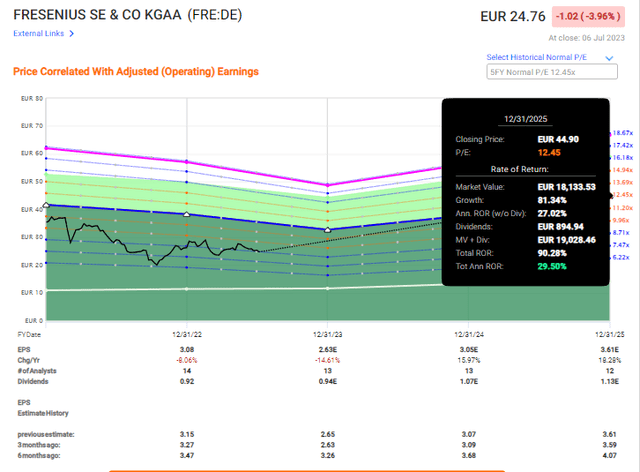

F.A.S.T graphs Fresenius Upside (F.A.S.T graphs)

Fresenius has a 90% upside based only on a 12.45x forward valuation – and that is conservative if you have any conviction to that 15-18% 2024-2025E growth rate – which I happen to have.

It’s important at this point to be clear about the fact that Fresenius actually mostly hits analyst targets on a longer-term basis. If we look at the 2-year trends, Fresenius hits 92% of the time, with only an 8% negative miss ratio. That is enough for me to have some fairly strong convictions, especially when considering that there hasn’t been a double-digit miss above 13% in more than 10 years.

That Fresenius has had troubles is not in dispute. They have.

That these troubles have been caused by management is also not in dispute. There is a lot of that – and there are a lot of other things that management has unfortunately also screwed up.

However, to consider that Fresenius isn’t able to turn this around would be completely wrong, in my view.

The company’s common shares currently trade hands at less than €25/share. The current company analyst PT comes to around €37/share, denoting a 47%+ upside. That is why out of 16 analysts following Fresenius, 13 are either at “BUY” or “Outperform”, and this forms the basis of my thesis as to why this company is a “BUY”.

It’s, simply put, too cheap for what it offers. I have 2% in my private portfolio, and 1% in my corporate portfolio, and my plan is to increase that allocation going forward for as long as the total allocation percentage stays below 3.5% or until I run out of funds, or until the company goes above €35-€37. Or, and this usually goes without saying, but if something fundamental was to change.

I want to be clear to you that what I’ve shown you here is the minimum target that I consider to be relevant for Fresenius. The company, over the longer term, has really been able to show considerably more appeal, leading to much higher standard valuations – as high as 17-18x P/E on a 20-year basis. The respective upside at this valuation if we see a reversal is closer to 160% total RoR until 2025E. So that 90% RoR, that’s conservative as I see it.

You need only look at variables like P/S values, projected future FC, book values and even extremely conservatively considered DCF valuations to find that the current valuation, or any long-term valuation below €35-€40/share simply makes no sense. That’s including the horrible rates of margin declines we’ve seen from the company over the past few years – even including those, the company is severely underappreciated here. Now, the company does need to “prove” its turnaround here – but that’s where I think over the past 6 months, it has done ample to showcase its turnaround is progressing, and I expect more positive news during the remainder of this year.

With that in mind, this brings me to my thesis for Fresenius, which currently is as follows.

Thesis

- Fresenius is a significantly undervalued German healthcare market leader with appealing vectors and segments available for investors today. I believe the company has massive appeal from a very fundamental point of view, and that long-term investors can look forward to nearly triple-digit rates of return going forward.

- The company is in the midst of a turnaround, but with the first parts of the turnaround delivered, I now consider the company poised to deliver the next ones as well, starting with a vastly improved and modernized operating structure.

- Conservatively, I expect a 90% RoR in the next 3 years, and I put my price target for Fresenius for 2023 at least at €35/share – and I don’t believe this to even be close to what the company could be capable of if we see a full reversal.

Remember, I’m all about :1. Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

2. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

3. If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

4. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

This means that the company fulfills every investment criteria I put forth, which makes this business a “BUY” for me at an attractive price.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here