Investors of Biopharma leader Merck & Co., Inc. (NYSE:MRK) didn’t cheer the completion of its recent $10.8B acquisition of Prometheus Biosciences, which I first discussed in April. MRK has remained close to the lows in June, as its premium valuation needs to be carefully assessed.

The company expects to provide a more detailed outlook at its upcoming Q2 earnings release on August 1, discussing the near-term impact on its earnings drivers. According to the company’s prelim update, the acquisition is “expected to negatively impact earnings per share by approximately $0.25 in the first 12 months following the transaction’s close.”

As such, I believe the impact is likely not that significant, as Merck is expected to report an adjusted EPS of $7 based on the revised consensus estimates. Although it represents a 6.5% decline YoY, it’s not likely to be structural to Merck’s earnings growth. Accordingly, Merck’s adjusted EPS is projected to return to positive growth in FY24 with a 21.8% increase.

With Merck not facing an impending patent cliff on its well-diversified portfolio, Merck Bulls could argue that it justifies MRK’s premium valuation. Moreover, with Merck’s robust balance sheet boasting a net debt/forward EBITDA ratio of just 0.32x for FY23, the company has significant flexibility to capitalize on business development opportunities to expand its pipeline.

While Merck’s wide-moat business model is underpinned by its success in Keytruda, it also has a robust vaccines portfolio bolstering its competitive edge. With its industry-leading production scale, Merck is expected to continue delivering robust profitability and operating leverage.

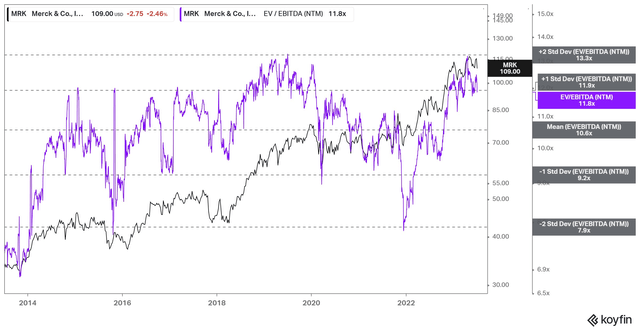

MRK forward EBITDA multiples trend (koyfin)

However, it’s also critical to consider whether the current valuation in MRK justifies the growth inflection that analysts anticipate next year. I assessed that while the company promulgated a negative impact on this year’s earnings due to its recent acquisition, investors weren’t unduly concerned.

Despite that, MRK last traded at a forward EBITDA multiple of nearly 12x, well above its 10Y average of 10.6x. On an adjusted P/E basis, MRK’s forward adjusted P/E of 15.8x is also well above its Pharma peers’ median of 11.5x (according to S&P Cap IQ data), suggesting no valuation dislocation despite the recent pullback.

Hence, I assessed that unless you have high-conviction in MRK’s thesis, I don’t view the current opportunity as particularly enticing from a risk/reward perspective.

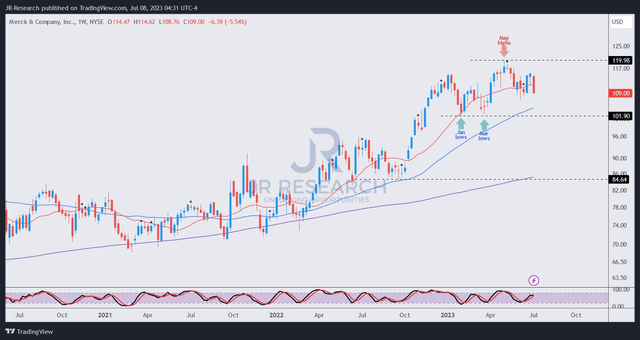

MRK price chart (weekly) (TradingView)

MRK’s price action suggests that the recent pullback is close to re-testing its June lows. However, the critical support zone to watch remains MRK’s $100 level, bolstered by dip buyers in January and March.

I see MRK’s May highs particularly troubling, indicating that holders weren’t willing to support a decisive breakout into higher levels, as MRK took out its all-time highs. As such, the lack of decisive breakout buying momentum indicates that perhaps the market was concerned about MRK’s relatively expensive valuation.

With that in mind, I urge investors to consider holding back adding more positions at the current levels, considering its relatively well-balanced risk/reward, without convincing technical buy triggers.

However, if MRK could retrace further toward the $100 region and hold its support zone robustly, it could open up another opportunity for dip buyers to add with more confidence considering an improved risk/reward profile.

Rating: Maintain Hold.

Important note: Investors are reminded to do their own due diligence and not rely on the information provided as financial advice. The rating is also not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have additional commentary to improve our thesis? Spotted a critical gap in our thesis? Saw something important that we didn’t? Agree or disagree? Comment below and let us know why, and help everyone in the community to learn better!

Read the full article here