The JPMorgan Ultra-Short Income ETF (NYSEARCA:JPST) is an income ETF that aims to bring investors a high yield while limiting risk. JPST invests in a variety of short-term bonds and has AUM of about $24B. Short-term bonds have grown in popularity now that short-term interest rates are higher. They now provide a high yield and have low volatility. JPST is no exception. It has a 30-day SEC yield of about 5.25%. While this is a high yield, it has some risk factors that make some other short-term ETFs a better choice. I rate JPST a Hold.

Holdings

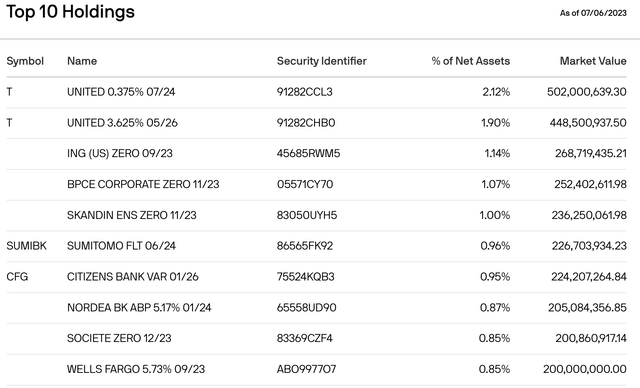

JPST has 658 holdings. Its top 10 holdings make up only a little under 12% of this ETF, making it well diversified.

JPST’s top 10 Holdings (jpmorgan.com)

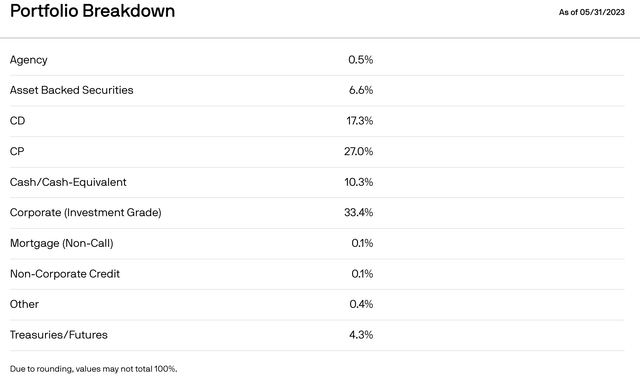

JPST holds a variety of different types of bonds. Its largest holding is investment-grade corporate bonds, making up about 33.5% of the fund, followed by CP at 27%.

JPST’s holdings by bond type (jpmorgan.com)

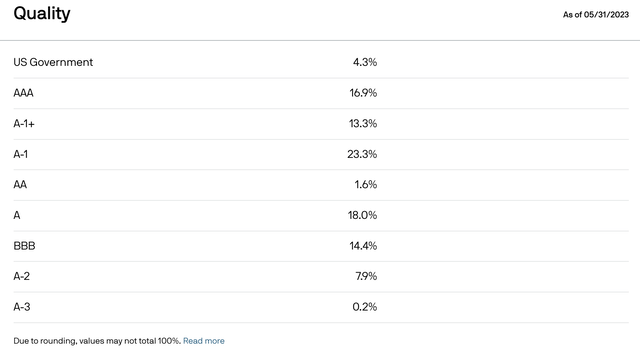

These bonds also have fairly high credit ratings. Its largest holding is in A-1 bonds, and it holds no non-investment grade bonds.

JPST’s holdings by credit rating (jpmorgan.com)

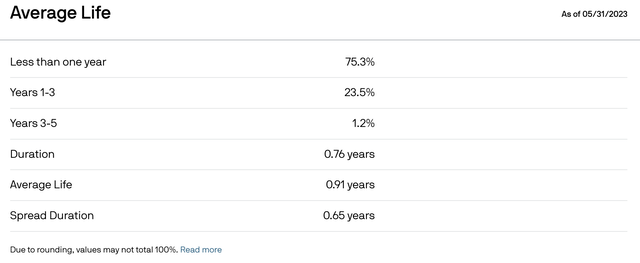

While JPST does hold ultra-short-term bonds, its name JPMorgan Ultra-Short Income ETF is potentially misleading. About a fourth of the ETF is in bonds with maturity dates over a year.

JPST’s holdings by maturity (jpmorgan.com)

Risk and volatility

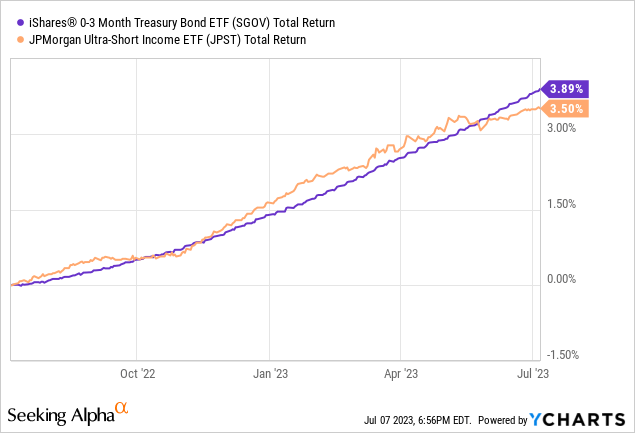

While JPST’s risk is low because it holds investment-grade short-term bonds, it has some risk due to its holdings of longer-term bonds relative to other ultra short-term bond ETFs, and the fact that it only holds about 4% in treasuries. SGOV is a popular 0-3 month treasury ETF that is extremely close to risk-free. SGOV isn’t subject to much price change because its holdings have essentially zero default risk and, because they are so short-term, have very little interest rate risk. The chart below shows SGOV’s and JPST’s total returns for the past year.

While both are fairly low in risk, it’s very clear that JPST has more risk than SGOV. Considering this, it’s reasonable to assume that JPST must have a much higher yield, and that’s why some investors find it more attractive than SGOV.

Yield comparison

JPST has a 30-day SEC yield of 5.24%. This is ever so slightly higher than SGOVs, which is 5.17%. In my opinion, getting 0.07% more in yield from JPST is not worth the risk. Adding longer-term bonds, corporates, and even some low credit-rated bonds gives a whopping 0.07% higher yield compared to 100% treasuries exhibiting practically no risk.

JPST’s advantages

While I think in the current economic climate, JPST isn’t the best option, it still has some advantages that can be profitable at certain times. Until very recently, US treasuries yielded practically nothing for a long period of time.

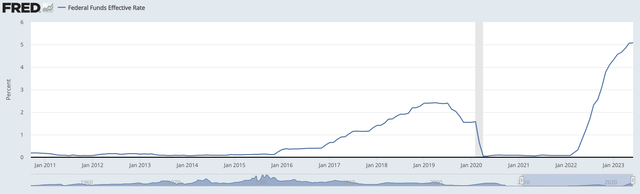

Federal Funds Effective Rate (fred.stlouisfed.org)

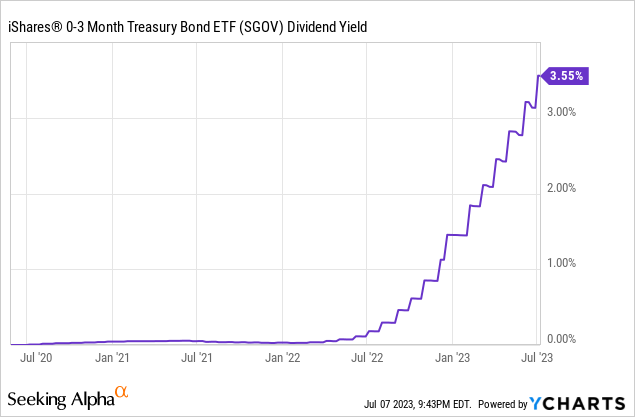

The chart above shows the Fed funds rate for a little over a decade. As it shows, it has been at practically zero for the majority of the time. Because SGOV’s yield is almost completely controlled by the Fed funds rate, SGOV yielded practically nothing. SGOV hasn’t been around for a decade, but as the chart below shows, its yield was near zero from about July 2020 until about March 2022. (The current yield is different than what was stated above because of different calculation methods, TTM vs 30-day SEC yield.)

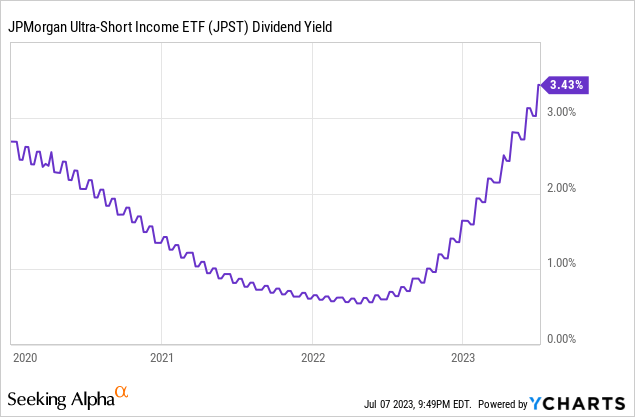

Because JPST has more risk, JPST’s yield isn’t nearly as dependent on the Fed funds rate as SGOV.

As the chart above shows, JPST’s yield is much higher than that of SGOV’s during the same time frame.

Fed Chairman Powell has told us to expect a couple of years before rate cuts start. This means there is no rush to move to JPST now. When the time for rate cuts draws nearer, this ETF should be reassessed.

Capital appreciation

The more interest rate risk a bond ETF has, the more capital appreciation potential it has. As every bond investor knows, as rates go up, the price goes down, and vice versa. So when rates get cut a couple of years from now, SGOV’s yield will go down and the price will only go up slightly, whereas when interest rates fall, JPST’s price will modestly appreciate. Again, while this is a valuable quality, it’s not likely to be profitable for years.

Conclusion

JPST offers exposure to short-term bonds. While this ETF has some valuable qualities, right now is not the time to buy. There are better high-yield ETFs that, unlike JPST, have practically zero risk, particularly SGOV. As we get closer to when rates will be cut, this ETF will be better than SGOV because it will offer some capital appreciation potential as well as a high yield. For now, I rate JPST a Hold.

Read the full article here