Investment Summary

The share price for Haynes International Inc (NASDAQ:HAYN) has been on a steady climb for the last 12 months, up around 55%. This hasn’t culminated in the valuation being too high however, it still sits below the sector’s average p/e of 13. The company focuses on developing and manufacturing nickel and cobalt-based alloys used for sheet, coil, and plate forms. The primary markets for the company are the United States and Europe but also sees demand from China.

The last report from the company was a real success and the order backlog reached a record high at $446 million, close to ⅔ of the entire market right now. Despite revenues growing rapidly, it hasn’t resulted in an alarming amount of share dilution, only increasing around 1.6% in the last 12 months. With strong growth prospects in several end markets, I think HAYN is a very appealing company to be invested in right now. The current price is at a good entry point and constitutes a buy in my opinion.

Overview Of Haynes

The company provides alloys with high-temperature resistance (HTA) and corrosion resistance (CRA). Their HTA products are utilized by equipment manufacturers in the aerospace market for jet engines, power generation for gas turbine engines, waste incineration, and industrial heating equipment. The company’s CRA products find application in various sectors, including chemical processing, power plant emissions control, and hazardous waste treatment.

Segment Results (Earnings Report)

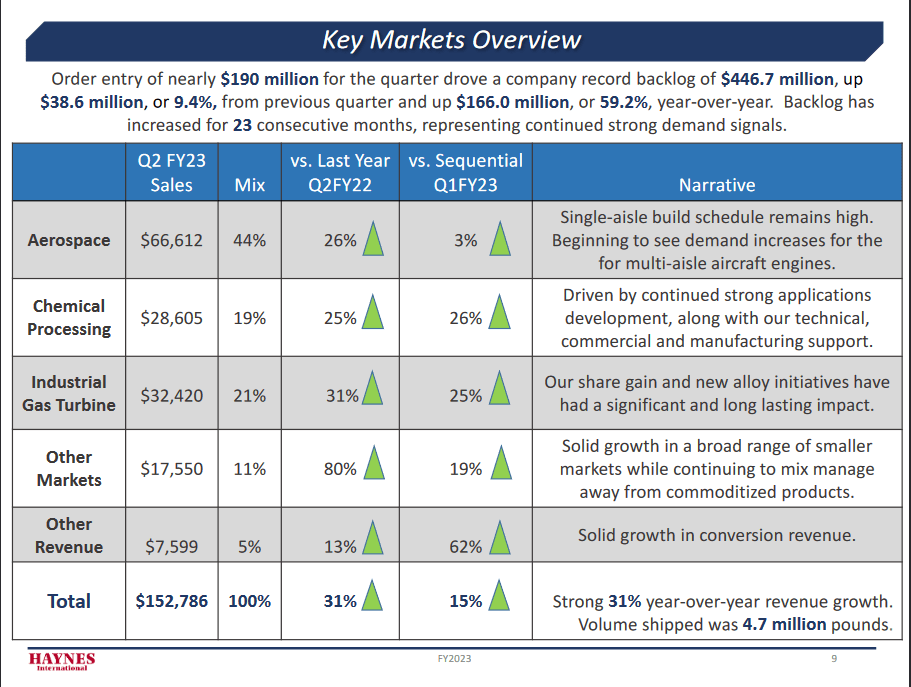

HAYN has several key markets that help drive revenue growth for the company. The largest one was aerospace which represented $66 million in sales last quarter, a 26% increase YoY. But HAYN is making moves to establish itself, like initiatives of new alloy in the Industrial Gas Turbine market.

One source of revenue that shouldn’t be forgotten is the “other markets” that HAYN is involved in. They state that new technologies like fuel cells and concentrated solar power. I think that this part of future financial reports will become very important to watch to get a sense of the potential of diversified applications of the products that HAYN offers. In all reality, it could become the largest and fastest-growing part of the business and eventually, it will branch out to its segments in my opinion. Just looking at the last report it experienced an 80% YoY increase in revenues, reaching $17 million or 11% of the total revenues.

Quarterly Result

The last report from Haynes was a success in my opinion as revenues grew by 59% YoY, reaching $190 million. The demand for their diversified products and services remained in very high demand and it resulted in HAYN reaching a record-breaking amount of backlog orders in the company’s history, valued at $446 million.

Income Statement (Earnings Report)

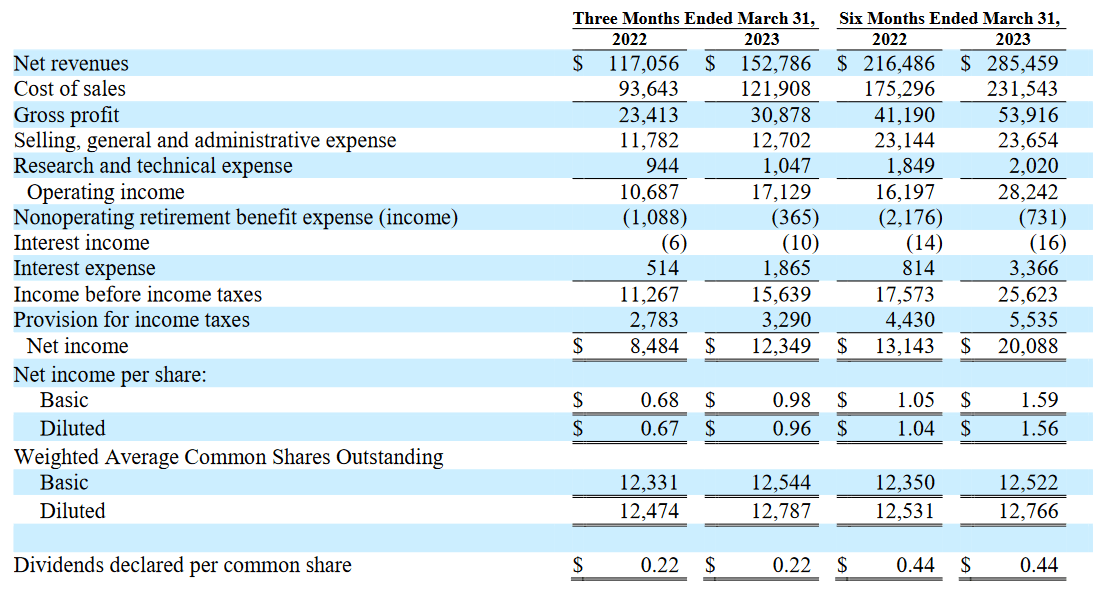

In a lot of cases with high-growth companies like this, it’s fueled by significant amounts of share dilution, but in the case of HAYN that doesn’t seem to be the case. The outstanding shares have only increased by around 1.6% YoY, which I don’t find worrying and fully anticipate with a company like this. The company does some stock-based compensation each year, and in 2022 that was valued at $3.6 million. This seems to be the primary cause for the increasing amount of shares, and I don’t necessarily view stock-based compensation as something worrying, as long as management isn’t selling vast amounts of shares, it just means they hold a bigger stake in the business which can be viewed as reassuring.

Some of the difficulties that HAYN did have for the quarter were materials costs, which did affect the margins and caused them to decrease on a yearly basis. However, these seem to be short-term headwinds and the increase in volumes shipped and utilization rate is helping offset some of these losses.

As for the full results of 2023, HAYN mentioned in the last report they see both revenues and earnings growing between 15% – 20% compared to 2022 results. This amount of growth does in my opinion justify the valuation right now and with HAYN even trading below the sector average it becomes more appealing.

Risks

I think one of the risks that are facing is high materials costs, but what is positive to see is this trend is starting to reverse somewhat. The price of nickel reached all-time highs in early 2022 but has been on a steady decline since.

Nichel Chart (tradingeconomics)

The last quarter’s difficulties with raw materials costs haven’t seemed to slow down the overall growth of the business, as the earnings outlook remained very good for 2023. But I think spikes in the price of materials will cause some inconsistent reports from HAYN and could result in a volatile share price. So far though, the share price has been on a steady climb upward but still sits below its 52-week high of $60 per share.

Financials

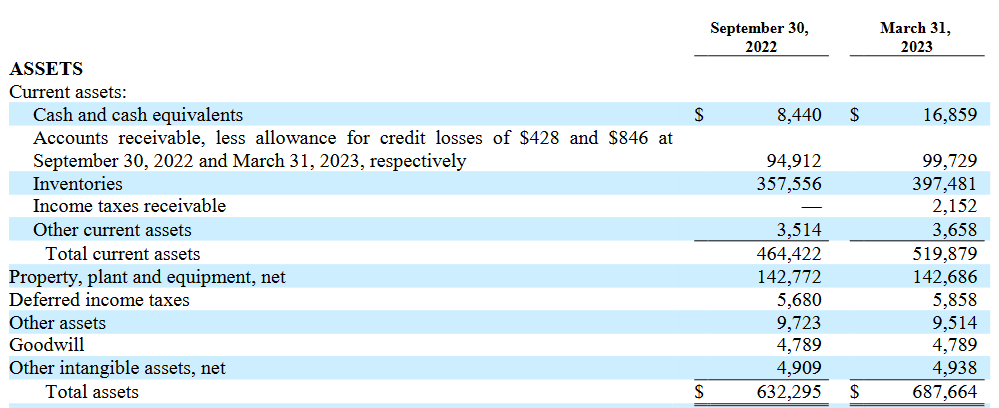

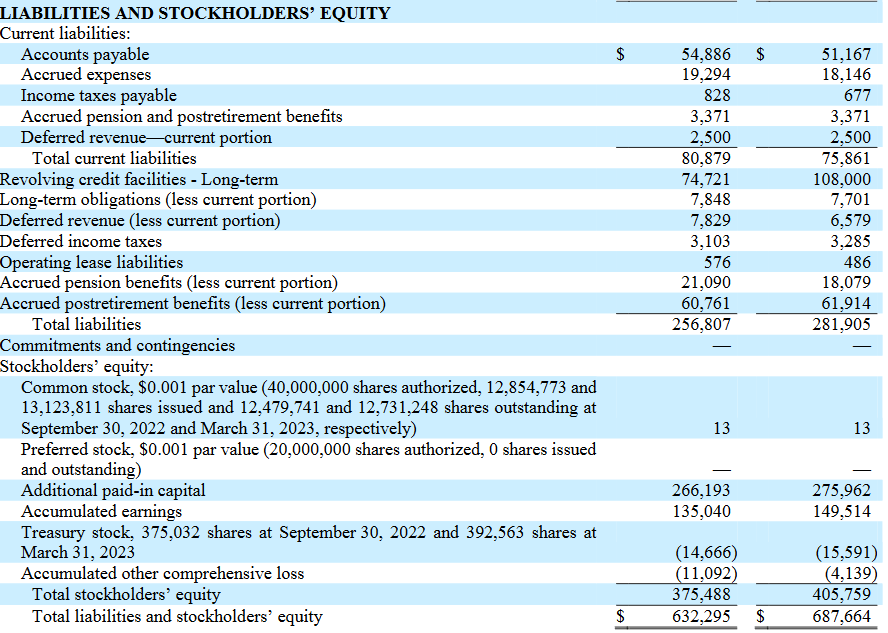

As far as financials go for HAYN they have done a fantastic job in my opinion in leveraging the growing demand and turning that into a better and more sturdy balance sheet. The cash position for example has risen by around 100% on a YoY basis and now is valued at $16.8 million.

Assets HAYN (Earnings Report) Liabilities HAYN (Earnings Report)

The rapid growth that HAYN has had so far has resulted in a significant amount of debt, fortunately, as they sit at just about $100 million right now. This seems very manageable when you compare the net debt/EBITDA which has a ratio of 1.1 right now, far below the preferred threshold of 3. Where some future challenges will be had is the negative cash flows for the business. This should be a major focus for the company in the coming years to improve, I know I want to see an improvement from the negative $91 million levered FCF they had in 2022. I think it’s possible as between 2019 and 2021 they had positive FCF, and now as they are scaling up it might take a hit, but once they start consolidating I think we will see quick progress.

Valuation & Wrap Up

In terms of valuation right now for HAYN, I think the FWD P/E of 12 looks like a great entry point. The share price has lifted somewhat from early June when it dipped to around $43. Despite being up around 14 – 16% since then I don’t think investors are overpaying for HAYN. It trades below the second average of 13x earnings.

Stock Price (Seeking Alpha)

With a dividend yield too of 1.73% as well and the only dilution of shares seemingly being from stock-based compensation, I don’t think investors are facing any worrying risks here. The balance sheet looks healthy and HAYN should be able to get back to positive FCF once again as the material costs are easing and volumes continue to grow. Right now I think Haynes is a buy for investors seeking exposure to a broad set of end markets, which also are growing at a fast rate.

Read the full article here